Form 8809 Extension

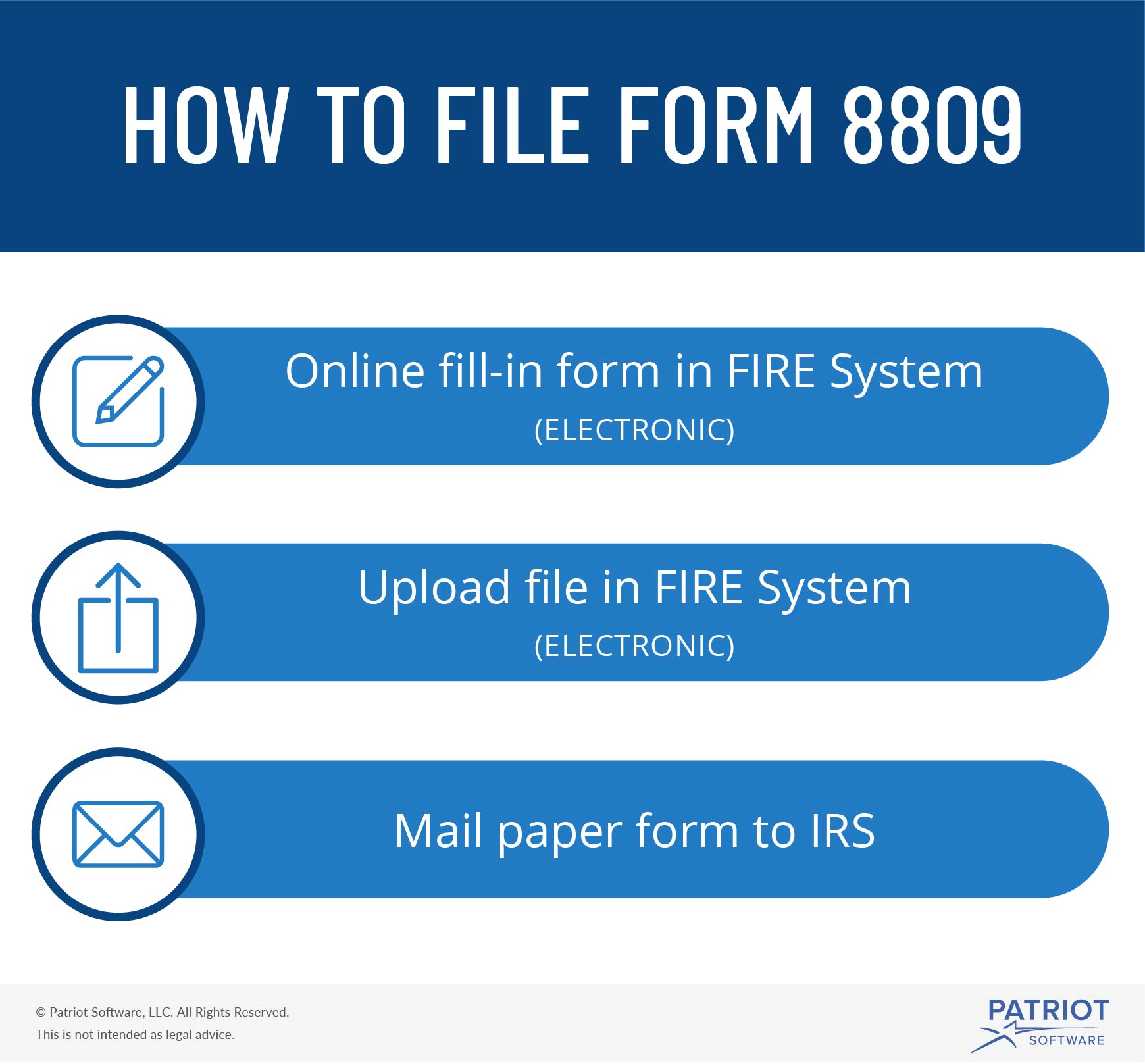

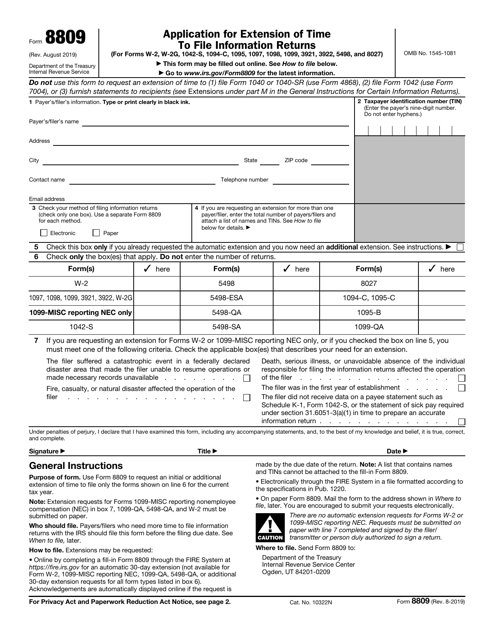

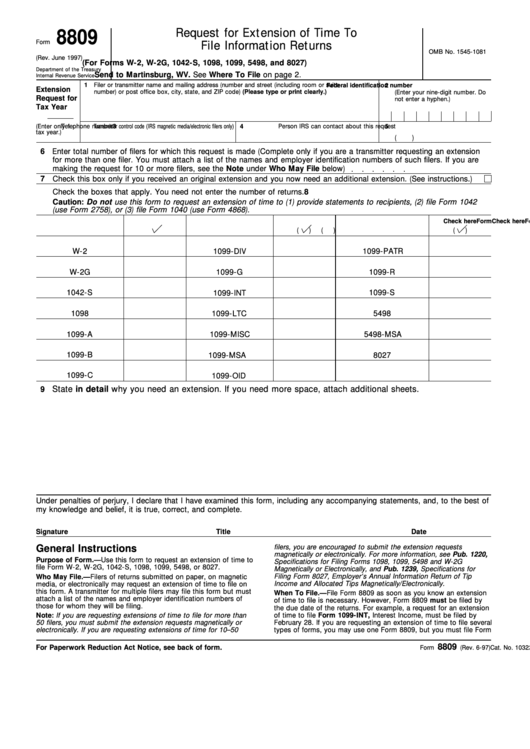

Form 8809 Extension - Web internal revenue service (irs) form 8809, “application for extension of time to file information returns,” is a form used by businesses and individuals to request an. Web use form 8809 to request an extension of time to file any of the following forms: Web file form 8809 as soon as you know an extension of time to file is necessary, but not before january 1 of the year in which the return is due. Fields with an * are required. And form 8809, application for extension of time to file. Web form 8809, application for extension of time to file information returns, is a form used by corporations and individuals to request an extension of the due date for filing federal tax. You may complete more than one form 8809 to. Form 8809 must be filed by the. Web extension of time to file both forms 1099 and 5498, you must file form 8809 by february 28 (march 31 if you file electronically). Web report error it appears you don't have a pdf plugin for this browser.

It is used by businesses and individuals to request a filing deadline extension for common. File information return extension online & get irs status. A tcc is required to upload a file for extension of. Web extension of time to file both forms 1099 and 5498, you must file form 8809 by february 28 (march 31 if you file electronically). Enter tax payer details step 2: You may complete more than one form 8809 to. Web report error it appears you don't have a pdf plugin for this browser. Web internal revenue service (irs) form 8809, “application for extension of time to file information returns,” is a form used by businesses and individuals to request an. Choose the information tax forms for which you need an extension step 3: Web extension of time to file both forms 1098 and 5498, you must file form 8809 by february 28 (march 31 if you file electronically).

Form 8809 must be filed by the. Web file form 8809 as soon as you know an extension of time to file is necessary, but not before january 1 of the year in which the return is due. File information return extension online & get irs status. Web internal revenue service (irs) form 8809, “application for extension of time to file information returns,” is a form used by businesses and individuals to request an. The type of form for which the extension is filed. Fields with an * are required. Web form 8809 is the irs’s application for extension of time to file information returns. Choose the information tax forms for which you need an extension step 3: Web extension of time to file both forms 1099 and 5498, you must file form 8809 by february 28 (march 31 if you file electronically). Tax payer details such as name tin address 2.

Need a Filing Extension for W2s and 1099s? File Form 8809

A tcc is required to upload a file for extension of. Form 8809 must be filed by the. Enter tax payer details step 2: Web extension of time to file both forms 1098 and 5498, you must file form 8809 by february 28 (march 31 if you file electronically). The type of form for which the extension is filed.

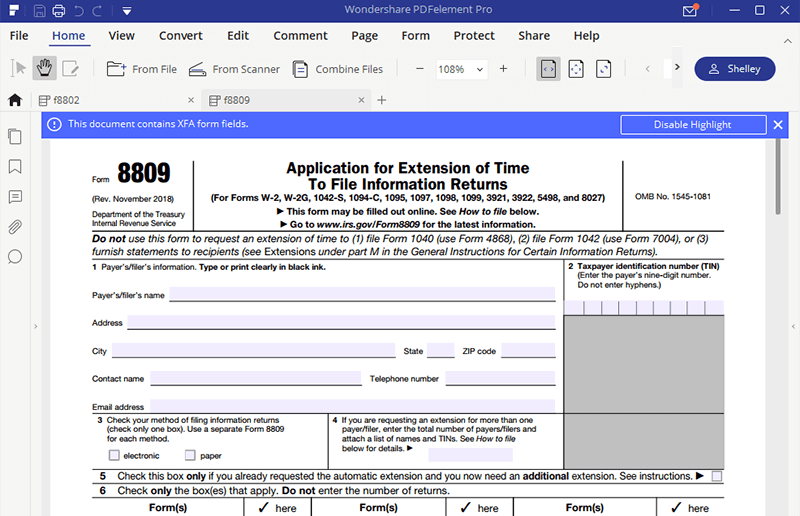

IRS Form 8809 Download Fillable PDF or Fill Online Application for

Web what information is required to file extension form 8809? The type of form for which the extension is filed. You may complete more than one form 8809 to. Transmit your form to the irs get started today. A tcc is required to upload a file for extension of.

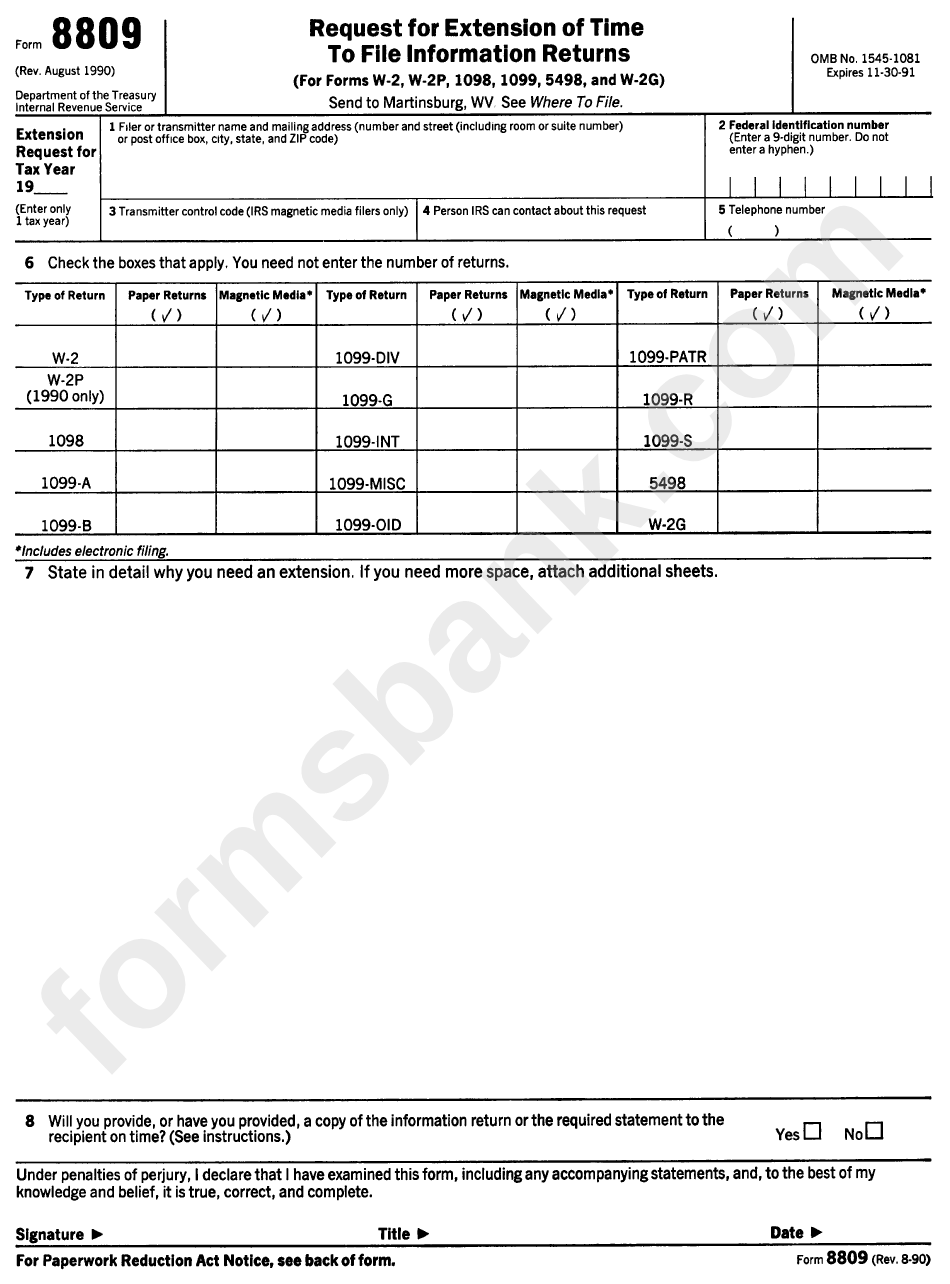

Form 8809 Request For Extension Of Time To File Information Returns

Web use form 8809 to request an extension of time to file any of the following forms: Web extension of time to file both forms 1098 and 5498, you must file form 8809 by february 28 (march 31 if you file electronically). And form 8809, application for extension of time to file. It is used by businesses and individuals to.

SSA POMS RM 01105.037 Exhibit 3 Form 8809 (Request for

Web form 8809, application for extension of time to file information returns use form 8809 to request an initial or additional extension of time to file only the forms. Web information about form 8809, application for extension of time to file information returns, including recent updates, related forms and instructions on. A tcc is required to upload a file for.

You’re Not Ready for the ACA Efile Deadline, What Are Your Options

You may complete more than one form 8809 to. Web form 8809, application for extension of time to file information returns use form 8809 to request an initial or additional extension of time to file only the forms. Web extension of time to file both forms 1099 and 5498, you must file form 8809 by february 28 (march 31 if.

Form 8809 Request For Extension Of Time To File Information Returns

Web information about form 8809, application for extension of time to file information returns, including recent updates, related forms and instructions on. You may complete more than one form 8809 to. File information return extension online & get irs status. It is used by businesses and individuals to request a filing deadline extension for common. Web what information is required.

Form 8809 Application for Extension of Time to File Information

Tax payer details such as name tin address 2. Web report error it appears you don't have a pdf plugin for this browser. You may complete more than one form 8809 to. Enter tax payer details step 2: Choose the information tax forms for which you need an extension step 3:

Need a Filing Extension for W2s and 1099s? File Form 8809

It is used by businesses and individuals to request a filing deadline extension for common. Web form 8809 is a tax form that allows taxpayers to request additional time for filing specific information returns such as 1099, w2, or aca forms. Web file form 8809 as soon as you know an extension of time to file is necessary, but not.

Tax Extension Form Extend Tax Due Date if You Need

Web file form 8809 as soon as you know an extension of time to file is necessary, but not before january 1 of the year in which the return is due. Form 8809 must be filed by the. Web form 8809, application for extension of time to file information returns use form 8809 to request an initial or additional extension.

What You Need To Know Before You File A Form 8809… Blog TaxBandits

File information return extension online & get irs status. Fields with an * are required. A tcc is required to upload a file for extension of. Web form 8809 is the irs’s application for extension of time to file information returns. Web extension of time to file both forms 1098 and 5498, you must file form 8809 by february 28.

Web Extension Of Time To File Both Forms 1098 And 5498, You Must File Form 8809 By February 28 (March 31 If You File Electronically).

Tax payer details such as name tin address 2. Web information about form 8809, application for extension of time to file information returns, including recent updates, related forms and instructions on. And form 8809, application for extension of time to file. Web form 8809, application for extension of time to file information returns use form 8809 to request an initial or additional extension of time to file only the forms.

Web File Form 8809 As Soon As You Know An Extension Of Time To File Is Necessary, But Not Before January 1 Of The Year In Which The Return Is Due.

Form 8809 must be filed by the. You may complete more than one form 8809 to. Web extension of time to file both forms 1099 and 5498, you must file form 8809 by february 28 (march 31 if you file electronically). Web report error it appears you don't have a pdf plugin for this browser.

Web Internal Revenue Service (Irs) Form 8809, “Application For Extension Of Time To File Information Returns,” Is A Form Used By Businesses And Individuals To Request An.

You may complete more than one form 8809 to. Web what information is required to file extension form 8809? Enter tax payer details step 2: Fields with an * are required.

The Type Of Form For Which The Extension Is Filed.

Web form 8809, application for extension of time to file information returns, is a form used by corporations and individuals to request an extension of the due date for filing federal tax. Choose the information tax forms for which you need an extension step 3: Transmit your form to the irs get started today. Web form 8809 is the irs’s application for extension of time to file information returns.