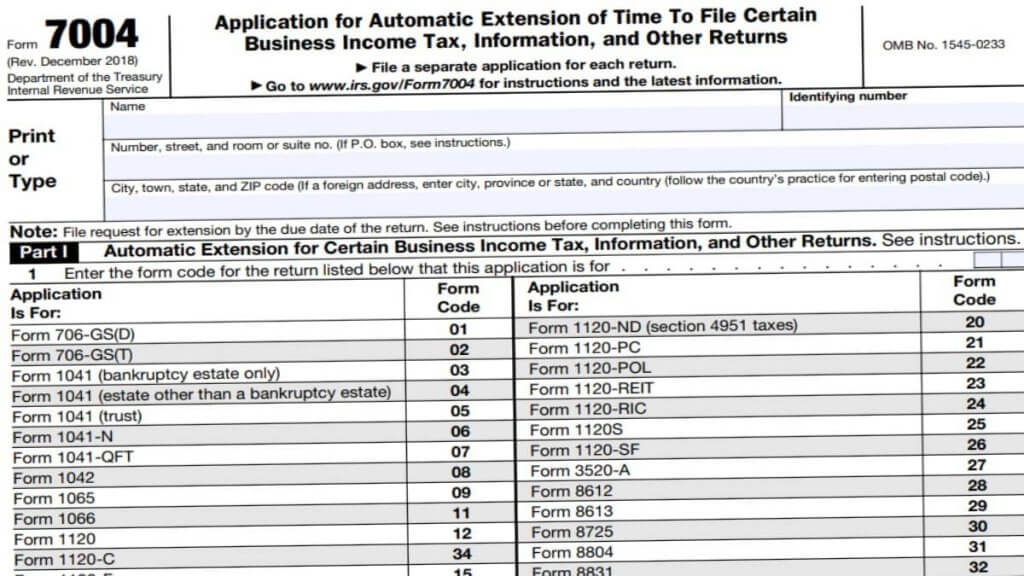

Form 7004 Filing Instructions

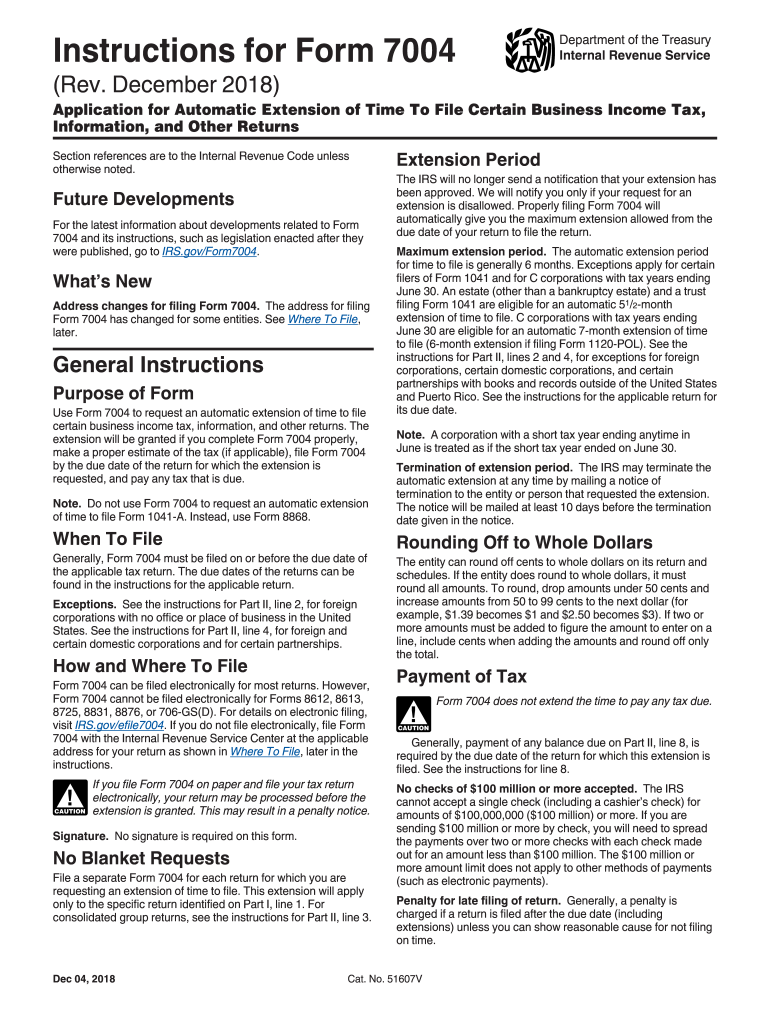

Form 7004 Filing Instructions - Web irs form 7004 instructions are used by various types of businesses to complete the form that extends the filing deadline on their taxes. But those who choose to mail their 7004 tax form should understand. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. Web the 7004 form is an irs document used by businesses to request an automatic extension for filing their tax returns. Web form 7004 is used to request an automatic extension to file the certain returns. There are three different parts to this tax. By the tax filing due date (april 15th for most businesses) who needs to file: General instructions purpose of form use form. Web the forms for which form 7004 is used to request an extension of time to file. With your return open, select search and enter extend;

But those who choose to mail their 7004 tax form should understand. Web the purpose of form 7004: Web generally, form 7004 must be filed on or before the due date of extensions) unless you can show reasonable cause for not filing the applicable tax return. Web the 7004 form is an irs document used by businesses to request an automatic extension for filing their tax returns. Web address changes for filing form 7004. Web form 7004 is used to request an automatic extension to file the certain returns. See the form 7004 instructions for a list of the exceptions. Web to file a business tax extension, use form 7004, “application for automatic extension of time to file certain business income tax, information, and other. Web the forms for which form 7004 is used to request an extension of time to file. Select the appropriate form from the table below to determine.

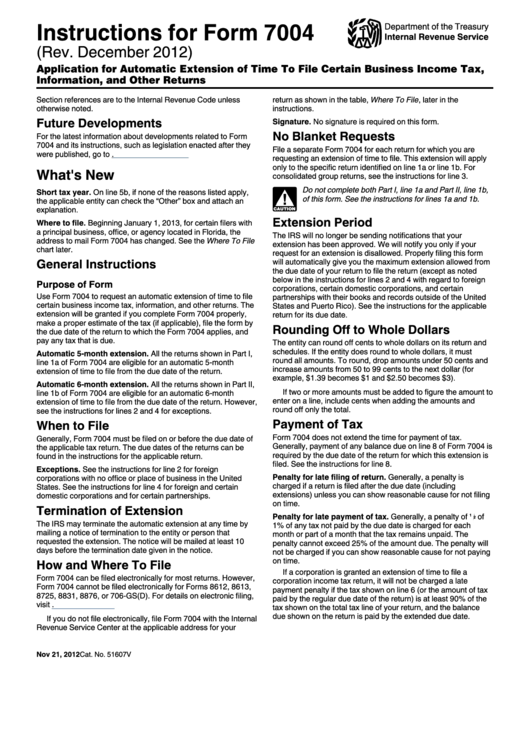

Web file extensions in lacerte; With your return open, select search and enter extend; Web you can file an irs form 7004 electronically for most returns. See where to file, later. Web use the chart to determine where to file form 7004 based on the tax form you complete. Web address changes for filing form 7004. Web generally, form 7004 must be filed on or before the due date of extensions) unless you can show reasonable cause for not filing the applicable tax return. See the form 7004 instructions for a list of the exceptions. Web to file a business tax extension, use form 7004, “application for automatic extension of time to file certain business income tax, information, and other. Extension form and filing instructions for forms 7004, 4868, 8868 are not printing in lacerte;

Form 7004 Where To Sign Fill Out and Sign Printable PDF Template

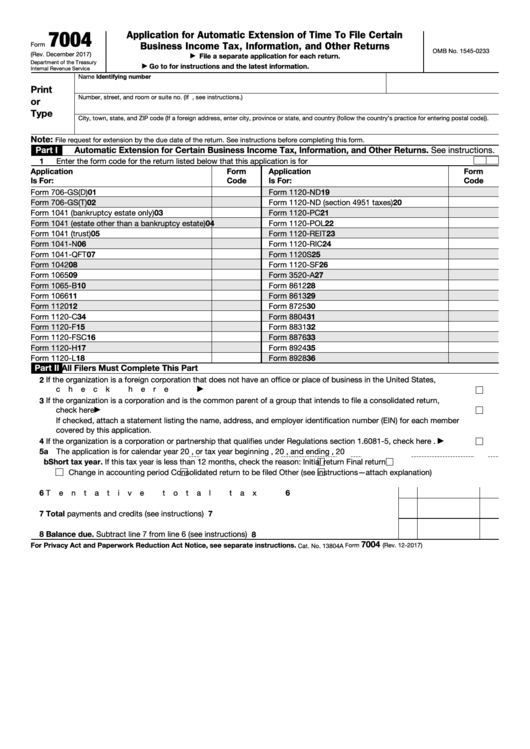

Web the forms for which form 7004 is used to request an extension of time to file. Web all types of businesses are required to file income tax returns with the irs annually to disclose financial information. There are three different parts to this tax. Web use the chart to determine where to file form 7004 based on the tax.

Tax extension form 7004

See where to file, later. Web address changes for filing form 7004. Web generally, form 7004 must be filed on or before the due date of extensions) unless you can show reasonable cause for not filing the applicable tax return. Filers requesting an extension will enter (in the box located at the top of part i) the form code. Web.

Free Fillable Irs Form 7004 Printable Forms Free Online

Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. With your return open, select search and enter extend; See the form 7004 instructions for a list of the exceptions. Web all types of businesses are required to file income tax returns with.

How To File Your Extension Form 7004? Blog ExpressExtension

There are three different parts to this tax. Web generally, form 7004 must be filed on or before the due date of extensions) unless you can show reasonable cause for not filing the applicable tax return. Web address changes for filing form 7004. Web to file a business tax extension, use form 7004, “application for automatic extension of time to.

Business Tax Extension 7004 Form 2021

General instructions purpose of form use form. Web follow these steps to print a 7004 in turbotax business: But those who choose to mail their 7004 tax form should understand. Filers requesting an extension will enter (in the box located at the top of part i) the form code. Web irs form 7004 instructions are used by various types of.

Instructions For Form 7004 (Rev. December 2012) printable pdf download

Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. General instructions purpose of form use form. Web file extensions in lacerte; Web use the chart to determine where to file form 7004 based on the tax form you complete. Web you can.

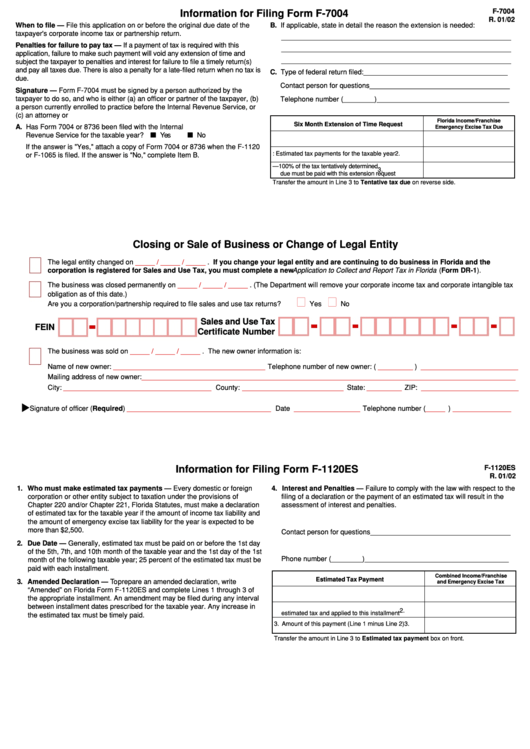

Form F7004 Closing Or Sale Of Business Or Change Of Legal Entity

Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. Web the purpose of form 7004: Filers requesting an extension will enter (in the box located at the top of part i) the form code. Web all types of businesses are required to.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

Web you can file an irs form 7004 electronically for most returns. With your return open, select search and enter extend; Web file extensions in lacerte; See where to file, later. But those who choose to mail their 7004 tax form should understand.

Tax filing mistakes to avoid when filing IRS extension Forms 4868 and

By the tax filing due date (april 15th for most businesses) who needs to file: The address for filing form 7004 has changed for some entities. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions, fully updated for tax year 2022. General instructions purpose of form.

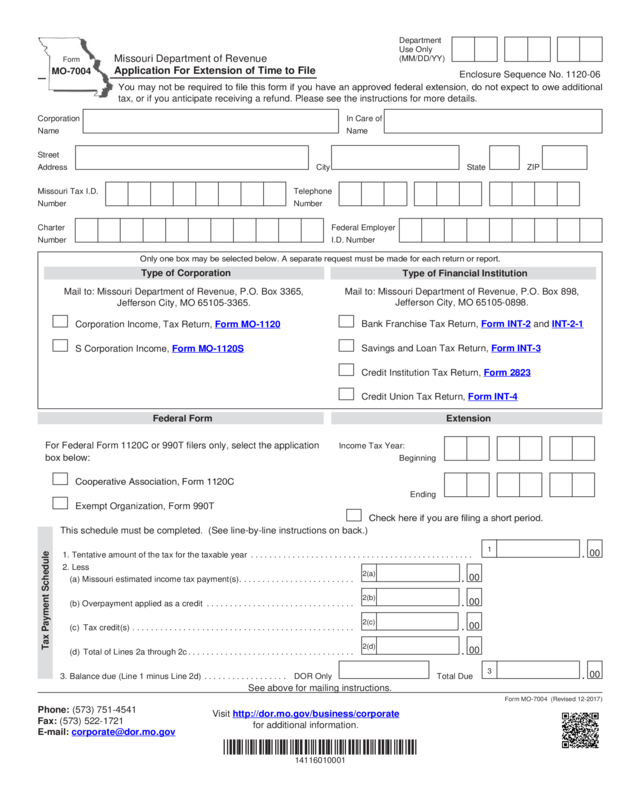

Form Mo7004 Application For Extension Of Time To File Edit, Fill

Web get 📝 irs form 7004 for the 2022 tax year ☑️ use the handy fillable 7004 form to apply for a time extension online ☑️ print out the blank template and fill in with our instructions. Web we last updated the irs automatic business extension instructions in february 2023, so this is the latest version of form 7004 instructions,.

Requests For A Tax Filing Extension.

Web the 7004 form is an irs document used by businesses to request an automatic extension for filing their tax returns. See where to file, later. With your return open, select search and enter extend; Web follow these steps to print a 7004 in turbotax business:

Web The Purpose Of Form 7004:

Web generally, form 7004 must be filed on or before the due date of extensions) unless you can show reasonable cause for not filing the applicable tax return. Extension form and filing instructions for forms 7004, 4868, 8868 are not printing in lacerte; Web the forms for which form 7004 is used to request an extension of time to file. General instructions purpose of form use form.

Our Website Is Dedicated To Providing.

See the form 7004 instructions for a list of the exceptions. Web all types of businesses are required to file income tax returns with the irs annually to disclose financial information. Select the appropriate form from the table below to determine. Web use the chart to determine where to file form 7004 based on the tax form you complete.

Web Irs Form 7004 Instructions Are Used By Various Types Of Businesses To Complete The Form That Extends The Filing Deadline On Their Taxes.

There are three different parts to this tax. Web to file a business tax extension, use form 7004, “application for automatic extension of time to file certain business income tax, information, and other. Web address changes for filing form 7004. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more.