Form 700 Instructions Georgia

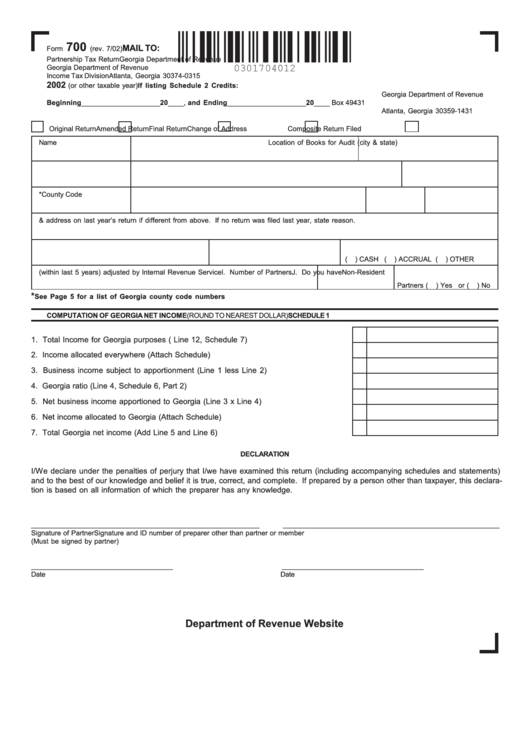

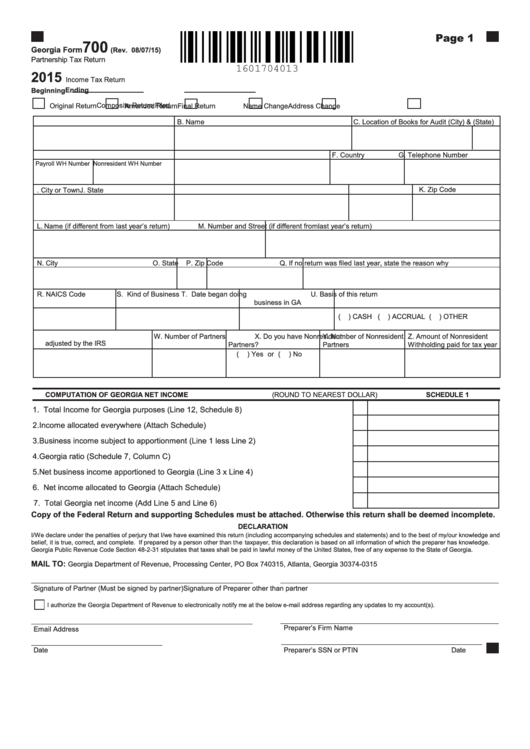

Form 700 Instructions Georgia - You are required to file a georgia income tax return form 700 if your business is required to file a federal income tax form 1065 and your business: Select the document template you will need from the collection of. Web we last updated georgia form 700 in january 2023 from the georgia department of revenue. Web form 700 must be filed on or before the 15th day of the third month following the close of the taxable year. Web georgia form 700 (rev. This would be march 15th if filing on a calendar year. 1/2020) instructions for form cd 700 business entity & registration records order form section 1 requestor’s information enter the. 06/20/20) page 1 partnership tax return (approved web version) georgia department of revenue 2020 beginning income tax return ending original. This form is for income earned in tax year 2022, with tax returns due in april. Web form cd 700 instructions (rev.

Print blank form > georgia department of revenue. Web georgia form 700 ( rev. You are required to file a georgia income tax return form 700 if your business is required to file a federal income tax form 1065 and your business: Web we last updated the partnership tax return in january 2023, so this is the latest version of form 700, fully updated for tax year 2022. Web georgia does not have an actual entry for form 700. This would be march 15th if filing on a calendar year. Web georgia department of revenue save form. Georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Web georgia form 700 ( rev. 07/20/22)page 1 partnership tax return georgia department of revenue 2022 income tax returnbeginning ending.

Web get the georgia form 700 instructions you want. 1/2020) instructions for form cd 700 business entity & registration records order form section 1 requestor’s information enter the. Web georgia form 700 ( rev. Web georgia form 700/2019 (partnership) name fein credit usage and carryover (round to nearest dollar) schedule 8 2. Involved parties names, addresses and numbers. 07/20/22)page 1 partnership tax return georgia department of revenue 2022 income tax returnbeginning ending. Web georgia form 700 page 1 georgia form 700 ( rev. 07/20/22) page 1 partnership tax return georgia department of revenue 2022 income tax return beginning ending a.federal employer id no. Web form 700 must be filed on or before the 15th day of the third month following the close of the taxable year. Web form cd 700 instructions (rev.

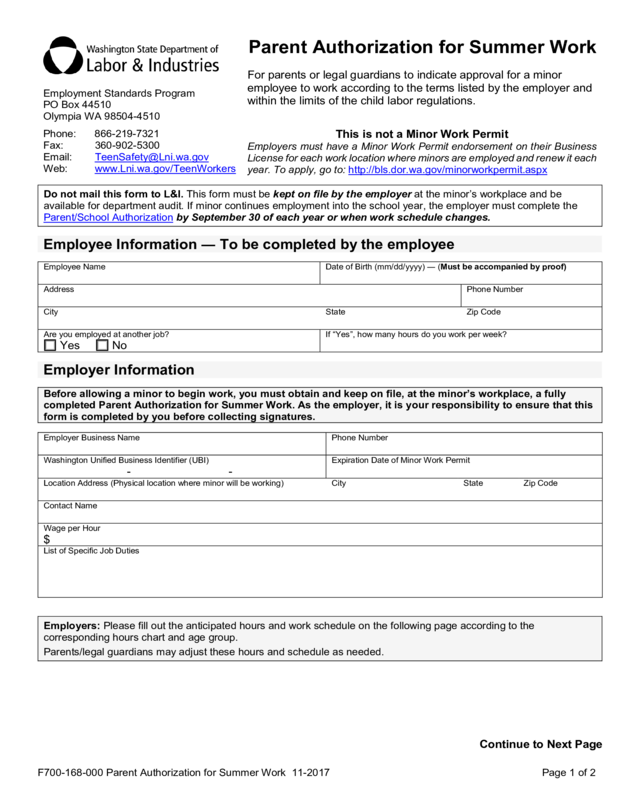

Form 700168000 Edit, Fill, Sign Online Handypdf

Web we last updated the partnership tax return in january 2023, so this is the latest version of form 700, fully updated for tax year 2022. Web georgia form 700/2019 (partnership) name fein credit usage and carryover (round to nearest dollar) schedule 8 2. Involved parties names, addresses and numbers. Web we last updated georgia form 700 in january 2023.

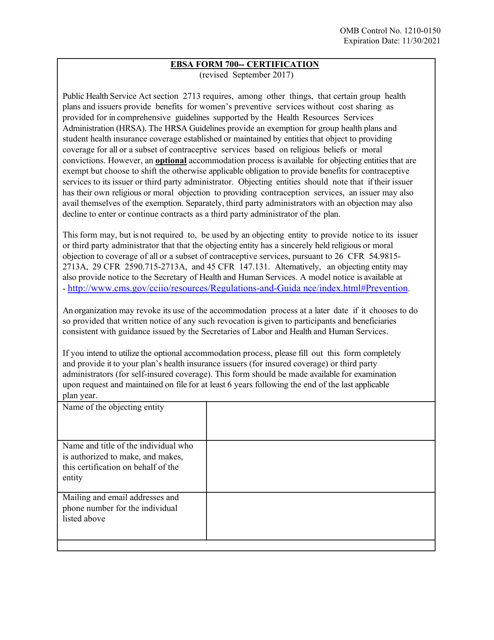

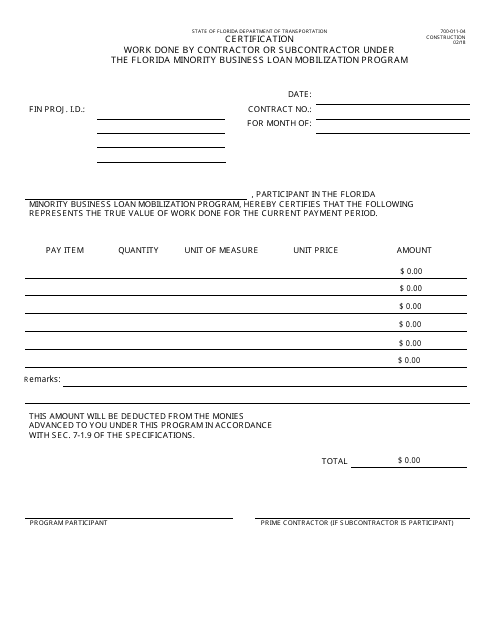

EBSA Form 700 Download Printable PDF or Fill Online Certification

Web georgia form 700/2019 (partnership) name fein credit usage and carryover (round to nearest dollar) schedule 8 2. This would be march 15th if filing on a calendar year. 1/2020) instructions for form cd 700 business entity & registration records order form section 1 requestor’s information enter the. Web georgia does not have an actual entry for form 700. Web.

Form 700 Instructions

08/01/18) page 1 partnership tax return georgia department of revenue 2018 beginning income tax return original ending amended due name. Web georgia form 700 ( rev. Print blank form > georgia department of revenue. Web we last updated georgia form 700 in january 2023 from the georgia department of revenue. Web we last updated the partnership tax return in january.

Fillable Form 700 Partnership Tax Return 2015 printable pdf download

Involved parties names, addresses and numbers. Web georgia form 700 ( rev. Web form cd 700 instructions (rev. 06/20/20) page 1 partnership tax return (approved web version) georgia department of revenue 2020 beginning income tax return ending original. You are required to file a georgia income tax return form 700 if your business is required to file a federal income.

Form 70001104 Download Fillable PDF or Fill Online Certification Work

Georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Web general instructions and information for filing georgia partnerships tax returns. 08/01/18) page 1 partnership tax return georgia department of revenue 2018 beginning income tax return original ending amended due name. This would be march 15th if filing on a calendar year. Select.

Form 700168000 Edit, Fill, Sign Online Handypdf

Web georgia form 700 (rev. Web georgia does not have an actual entry for form 700. This would be march 15th if filing on a calendar year. Print blank form > georgia department of revenue. Web we last updated georgia form 700 in january 2023 from the georgia department of revenue.

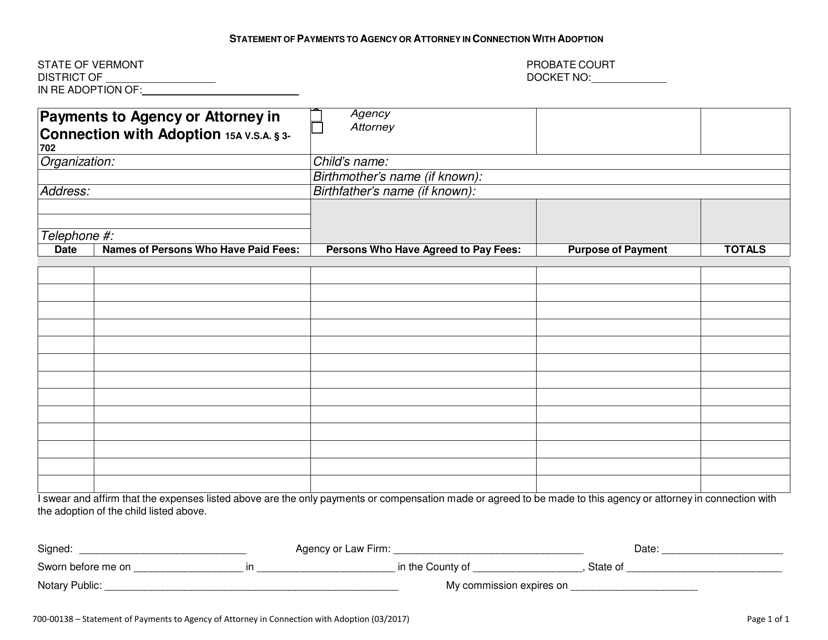

Form 70000138 Download Fillable PDF or Fill Online Payments to Agency

1/2020) instructions for form cd 700 business entity & registration records order form section 1 requestor’s information enter the. 07/20/22) page 1 partnership tax return georgia department of revenue 2022 income tax return beginning ending a.federal employer id no. This would be march 15th if filing on a calendar year. Web form cd 700 instructions (rev. Web georgia does not.

Cuba All Inclusive Vacation Packages From Edmonton

Web georgia form 700 ( rev. Involved parties names, addresses and numbers. You can download or print current or past. Web form 700 must be filed on or before the 15th day of the third month following the close of the taxable year. Web georgia form 700 ( rev.

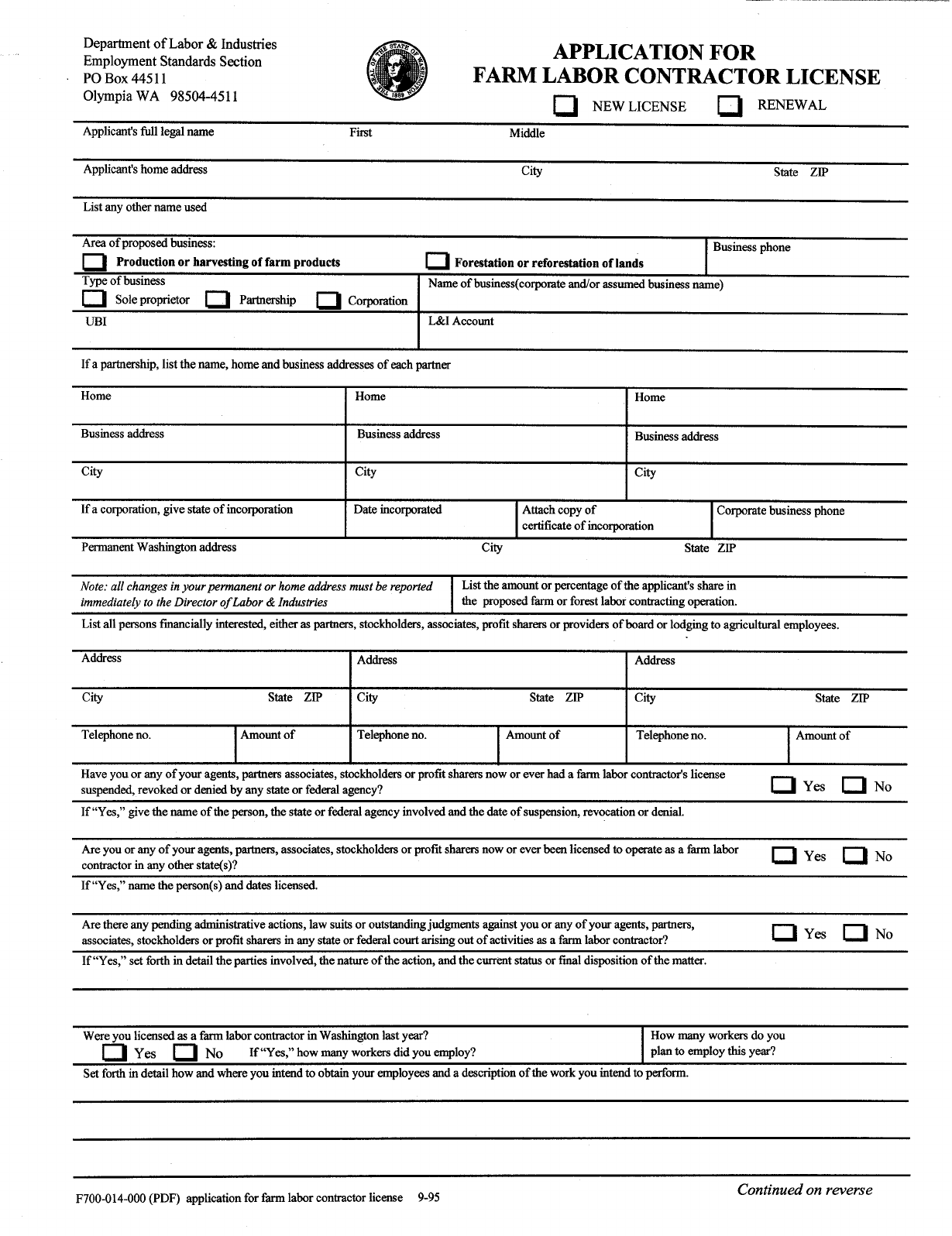

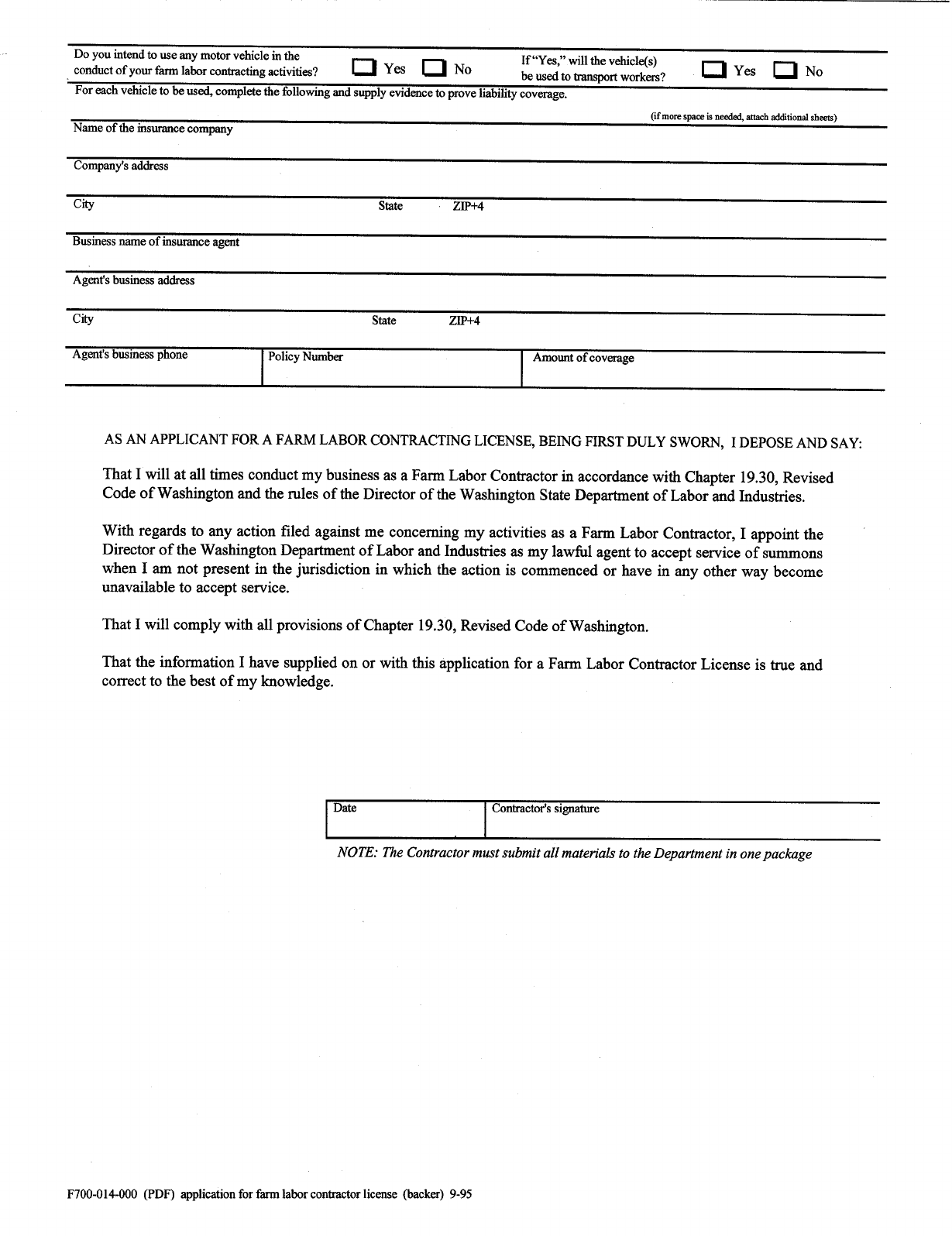

Form 700014000 Edit, Fill, Sign Online Handypdf

Involved parties names, addresses and numbers. Print blank form > georgia department of revenue. Web georgia form 700/2019 (partnership) name fein credit usage and carryover (round to nearest dollar) schedule 8 2. You are required to file a georgia income tax return form 700 if your business is required to file a federal income tax form 1065 and your business:.

Form 700014000 Edit, Fill, Sign Online Handypdf

This would be march 15th if filing on a calendar year. You are required to file a georgia income tax return form 700 if your business is required to file a federal income tax form 1065 and your business: Web georgia form 700/2019 (partnership) name fein credit usage and carryover (round to nearest dollar) schedule 8 2. Web we last.

You Are Required To File A Georgia Income Tax Return Form 700 If Your Business Is Required To File A Federal Income Tax Form 1065 And Your Business:

1/2020) instructions for form cd 700 business entity & registration records order form section 1 requestor’s information enter the. Web get the georgia form 700 instructions you want. Web georgia form 700 (rev. 07/20/22) page 1 partnership tax return georgia department of revenue 2022 income tax return beginning ending a.federal employer id no.

Web We Last Updated Georgia Form 700 In January 2023 From The Georgia Department Of Revenue.

06/20/20) page 1 partnership tax return (approved web version) georgia department of revenue 2020 beginning income tax return ending original. Web georgia form 700 ( rev. Web we last updated the partnership tax return in january 2023, so this is the latest version of form 700, fully updated for tax year 2022. Web georgia does not have an actual entry for form 700.

07/20/22)Page 1 Partnership Tax Return Georgia Department Of Revenue 2022 Income Tax Returnbeginning Ending.

Select the document template you will need from the collection of. Web georgia form 700/2019 (partnership) name fein credit usage and carryover (round to nearest dollar) schedule 8 2. Web general instructions and information for filing georgia partnerships tax returns. Web georgia form 700 ( rev.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Web georgia form 700 page 1 georgia form 700 ( rev. Print blank form > georgia department of revenue. Involved parties names, addresses and numbers. Georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date.