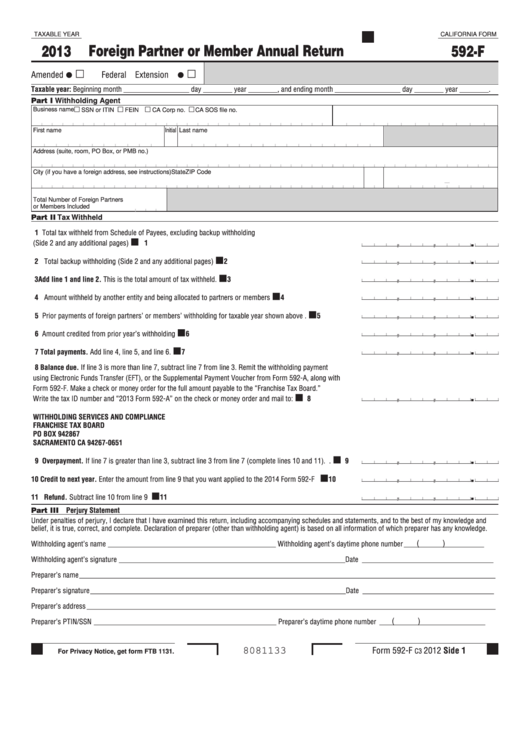

Form 592 F

Form 592 F - • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592, resident and nonresident withholding statement. Enter the beginning and ending dates for the. The first four payment vouchers are submitted with each of the four withholding payments throughout the year. Items of income that are subject to withholding are payments to independent contractors, recipients of. Web filling out this form requires you to provide your withholding agent's information, the amount of tax withheld, and each schedule of payees from that taxable year. Business name ssn or itin fein ca corp no. This form is for income earned in tax year. Due date form 592 is a return that is filed quarterly. First name initial last name ssn or itin.

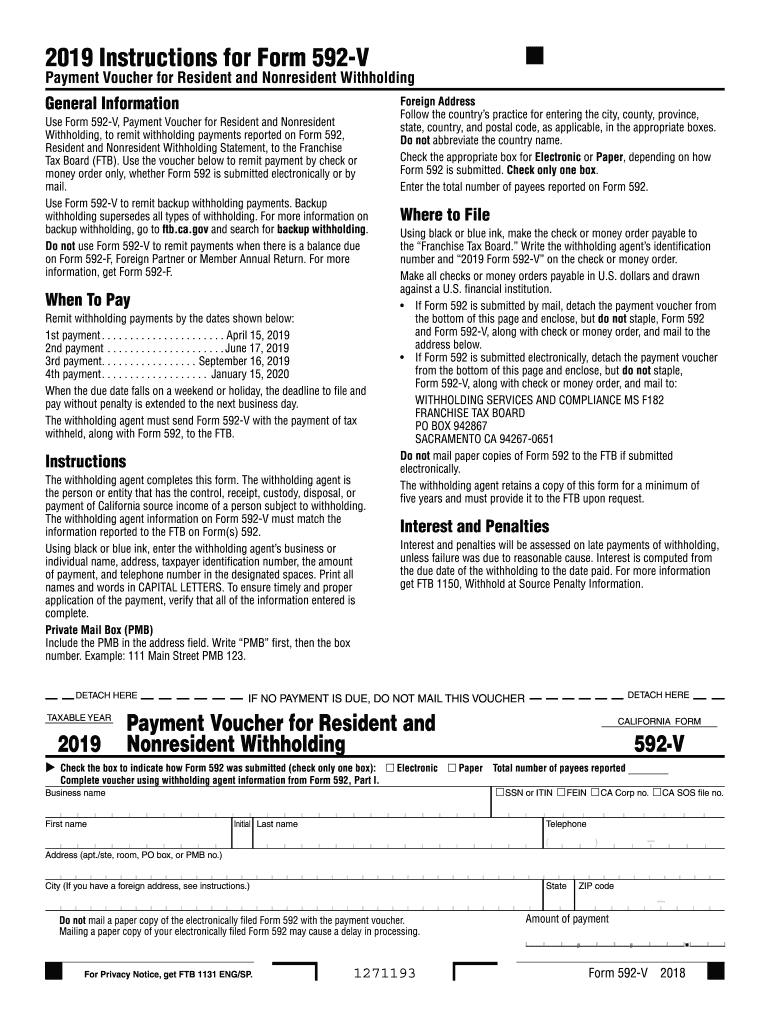

Business name ssn or itin fein ca corp no. _____ withholding agent tin:_____ business name fein ca corp no. Web filling out this form requires you to provide your withholding agent's information, the amount of tax withheld, and each schedule of payees from that taxable year. Compute the amount of resident and. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592, resident and nonresident withholding statement. Form 592 includes a schedule of payees section, on side 2, that. The first four payment vouchers are submitted with each of the four withholding payments throughout the year. Enter the beginning and ending dates for the. First name initial last name ssn or itin. Web use form 592‑v, payment voucher for resident and nonresident withholding, to remit withholding payments reported on form 592.

The first four payment vouchers are submitted with each of the four withholding payments throughout the year. First name initial last name ssn or itin. This form is for income earned in tax year. Enter the beginning and ending dates for the. Web file form 592 to report withholding on domestic nonresident individuals. Business name ssn or itin fein ca corp no. Compute the amount of resident and. Form 592 includes a schedule of payees section, on side 2, that. _____ withholding agent tin:_____ business name fein ca corp no. Web use form 592‑v, payment voucher for resident and nonresident withholding, to remit withholding payments reported on form 592.

2021 Form CA FTB 592F Fill Online, Printable, Fillable, Blank pdfFiller

Enter the beginning and ending dates for the. Web use form 592‑v, payment voucher for resident and nonresident withholding, to remit withholding payments reported on form 592. Compute the amount of resident and. Web tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Due date form 592 is a return that is.

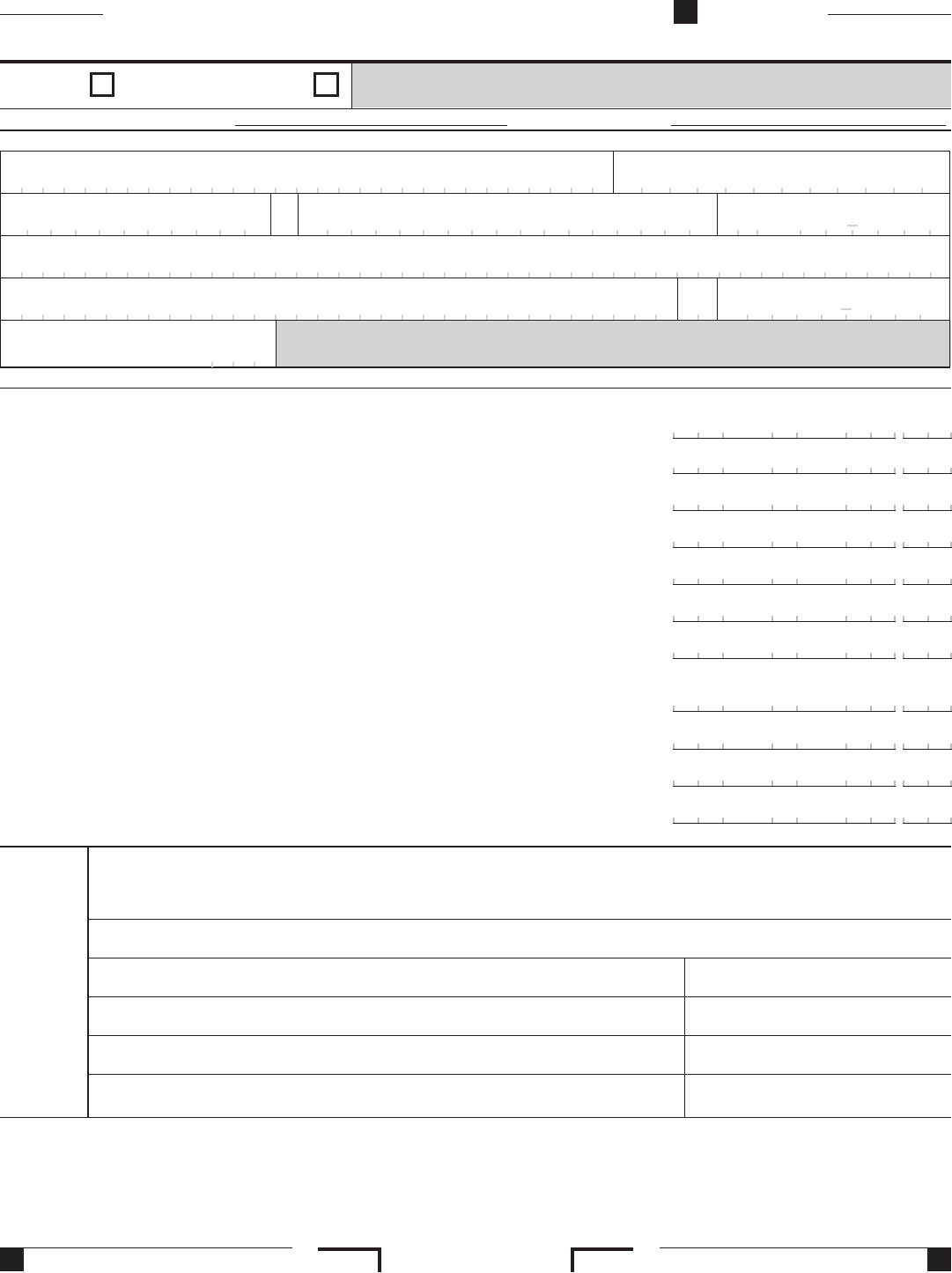

Fillable California Form 592F Foreign Partner Or Member Annual

Compute the amount of resident and. You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale. The first four payment vouchers are submitted with each of the four withholding payments throughout the year. Form 592 includes a schedule of payees section, on side 2, that. Web use form 592‑v, payment voucher for.

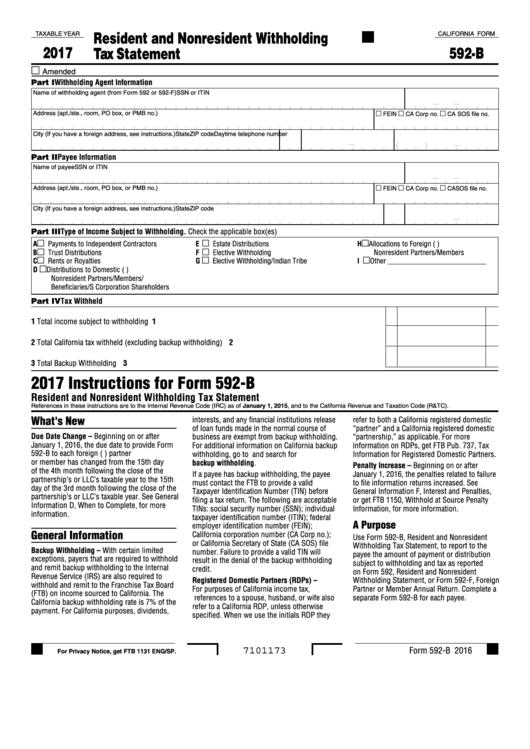

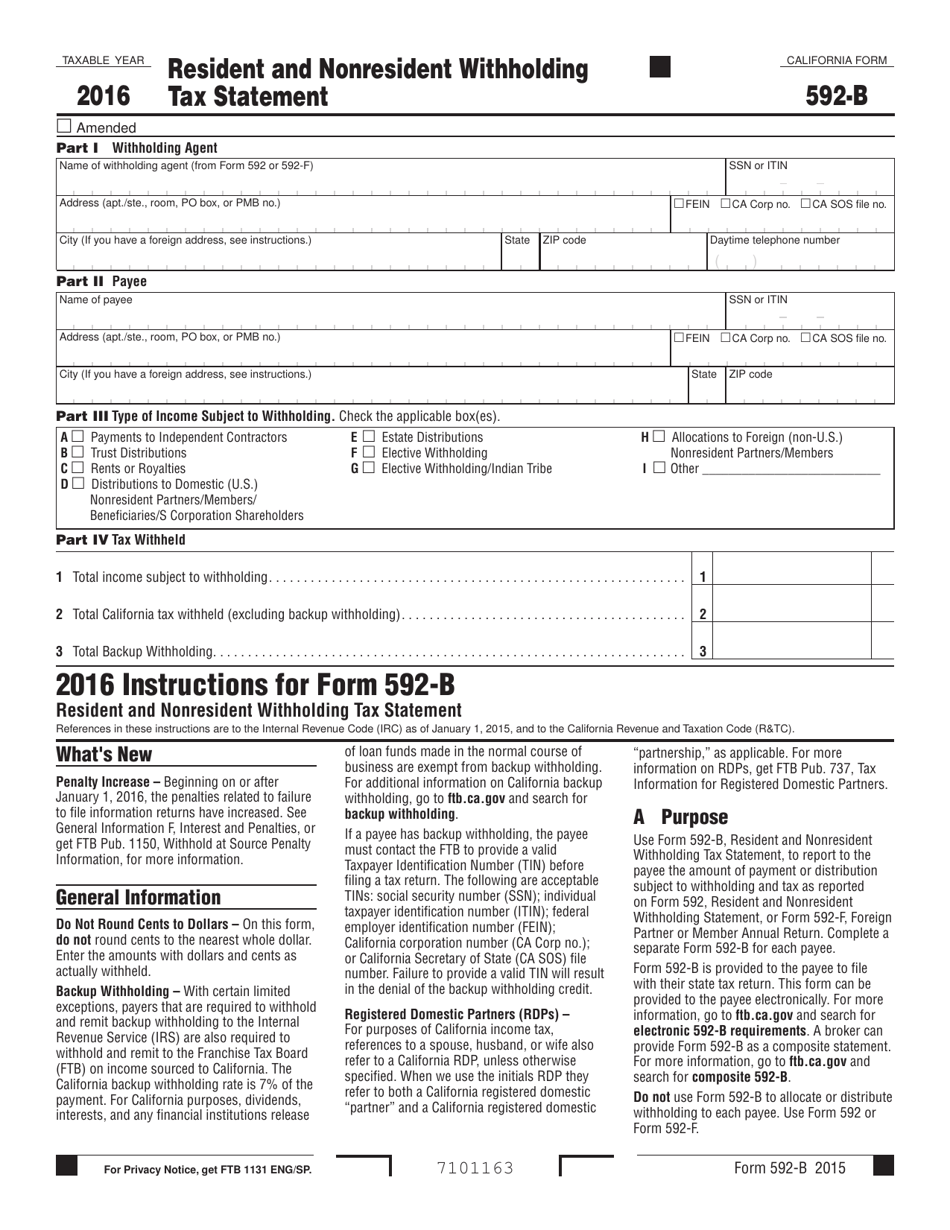

Fillable California Form 592B Resident And Nonresident Withholding

The first four payment vouchers are submitted with each of the four withholding payments throughout the year. Due date form 592 is a return that is filed quarterly. Web use form 592‑v, payment voucher for resident and nonresident withholding, to remit withholding payments reported on form 592. Web form 592 2020 withholding agent name: • april 18, 2022 june 15,.

Ftb Form 592 V 2019 Fill Out and Sign Printable PDF Template signNow

• april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Business name ssn or itin fein ca corp no. Enter the beginning and ending dates for the. Web file form 592 to report withholding on domestic nonresident individuals. Web use form 592‑v, payment voucher for resident and nonresident withholding, to remit withholding payments reported on form 592.

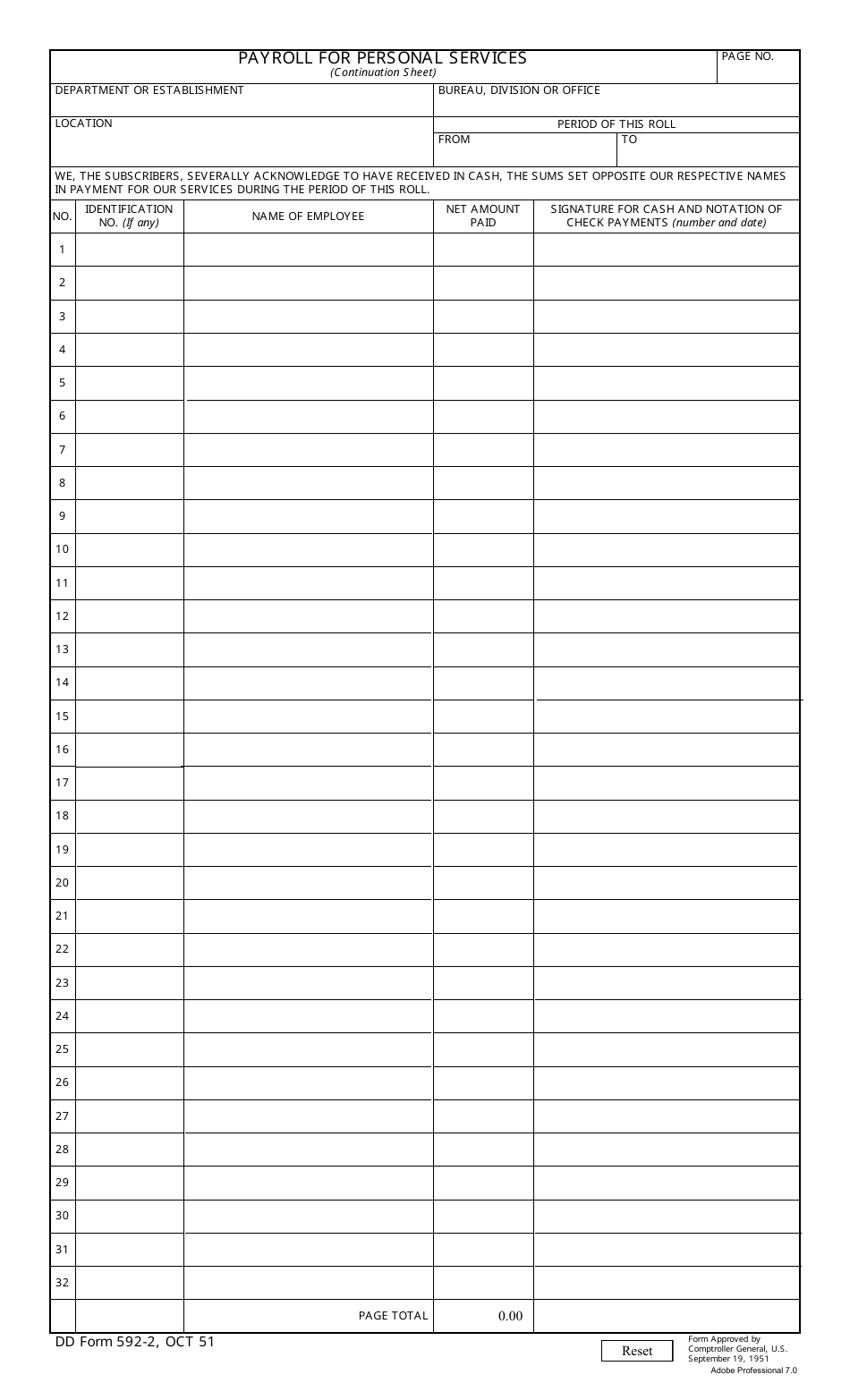

DD Form 5922 Download Fillable PDF or Fill Online Payroll for Personal

Web form 592 2020 withholding agent name: First name initial last name ssn or itin. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592, resident and nonresident withholding statement. The first four payment vouchers are submitted with each of the four withholding payments throughout the year. Web file form 592 to report.

Form 592B Download Fillable PDF or Fill Online Resident and

You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale. Web form 592 2020 withholding agent name: Form 592 includes a schedule of payees section, on side 2, that. Business name ssn or itin fein ca corp no. The first four payment vouchers are submitted with each of the four withholding payments.

Form 592B Franchise Tax Board Edit, Fill, Sign Online Handypdf

Web tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Web filling out this form requires you to provide your withholding agent's information, the amount of tax withheld, and each schedule of payees from that taxable year. Enter the beginning and ending dates for the. _____ withholding agent tin:_____ business name fein.

2017 Form 592F Foreign Partner Or Member Annual Return Edit, Fill

This form is for income earned in tax year. Items of income that are subject to withholding are payments to independent contractors, recipients of. Enter the beginning and ending dates for the. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Compute the amount of resident and.

2017 Form 592F Foreign Partner Or Member Annual Return Edit, Fill

First name initial last name ssn or itin. Enter the beginning and ending dates for the. Compute the amount of resident and. Web tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Web use form 592‑v, payment voucher for resident and nonresident withholding, to remit withholding payments reported on form 592.

2011 Form CA FTB 592A Fill Online, Printable, Fillable, Blank pdfFiller

Web tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Enter the beginning and ending dates for the. Web filling out this form requires you to provide your withholding agent's information, the amount of tax withheld, and each schedule of payees from that taxable year. Web file form 592 to report withholding.

Web Filling Out This Form Requires You To Provide Your Withholding Agent's Information, The Amount Of Tax Withheld, And Each Schedule Of Payees From That Taxable Year.

Business name ssn or itin fein ca corp no. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. First name initial last name ssn or itin. Form 592 includes a schedule of payees section, on side 2, that.

Web Tax Withheld On California Source Income Is Reported To The Franchise Tax Board (Ftb) Using Form 592.

Web form 592 2020 withholding agent name: The first four payment vouchers are submitted with each of the four withholding payments throughout the year. Compute the amount of resident and. Due date form 592 is a return that is filed quarterly.

Enter The Beginning And Ending Dates For The.

You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale. _____ withholding agent tin:_____ business name fein ca corp no. Web file form 592 to report withholding on domestic nonresident individuals. This form is for income earned in tax year.

Tax Withheld On California Source Income Is Reported To The Franchise Tax Board (Ftb) Using Form 592, Resident And Nonresident Withholding Statement.

Web use form 592‑v, payment voucher for resident and nonresident withholding, to remit withholding payments reported on form 592. Items of income that are subject to withholding are payments to independent contractors, recipients of.