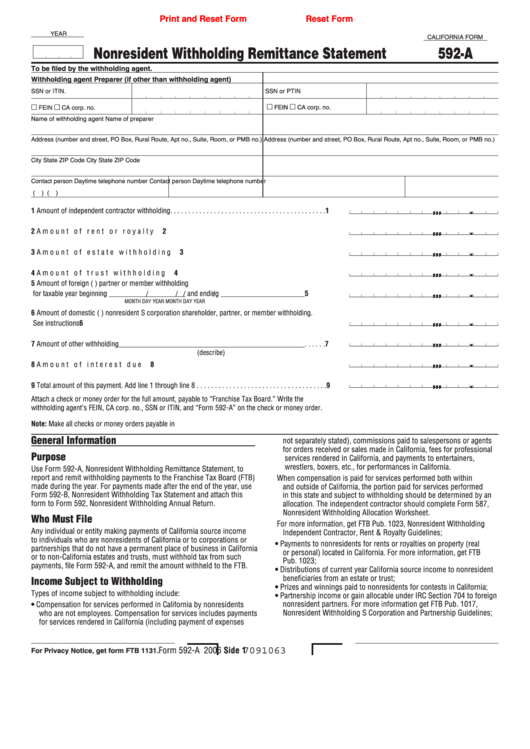

Form 592 A

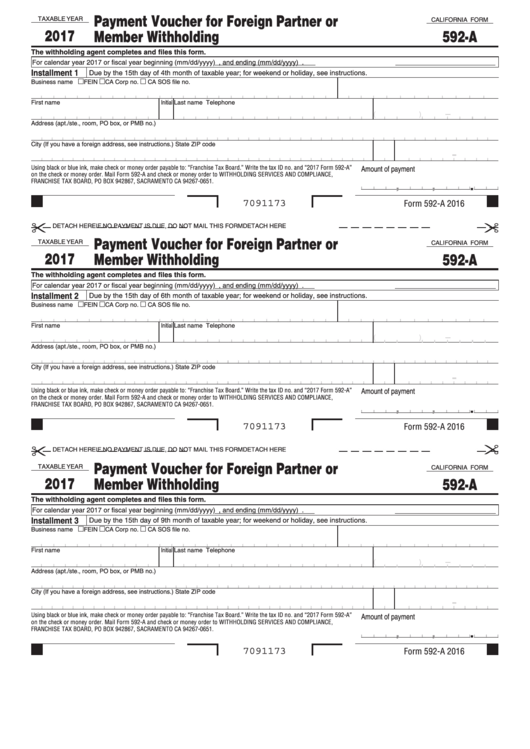

Form 592 A - No payment, distribution or withholding. Web use form 592‑a, payment voucher for foreign partner or member withholding, to remit partnership or limited liability company (llc) withholding payments on foreign partners. Web for 592, all of the possible factor pairs are listed below: Web nhtsa | national highway traffic safety administration Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web file form 592 to report withholding on domestic nonresident individuals. Web use form 592‑a, payment voucher for foreign partner or member withholding, to remit partnership or limited liability company (llc) withholding payments on foreign partners. Click the links below to see the form instructions. Items of income that are subject to withholding are payments to independent contractors, recipients of. No payment, distribution or withholding occurred.

Web nhtsa | national highway traffic safety administration Please provide your email address and it will be emailed to. This is only available by request. Web form 592 is also used to report withholding payments for a resident payee. Web for 592, all of the possible factor pairs are listed below: 2023 ca form 592, resident and nonresident. Web file form 592 to report withholding on domestic nonresident individuals. No payment, distribution or withholding occurred. Factors of 592 or list the factors of 592. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023.

Click the links below to see the form instructions. Web payment voucher for foreign partner or member withholding the withholding agent completes and files this form. Do not use form 592 if any of the following apply: 4 x 148 = 592. Items of income that are subject to withholding are payments to independent contractors, recipients of. Do not use form 592 if any of the following apply: 2 x 296 = 592. Web nhtsa | national highway traffic safety administration Web use form 592‑a, payment voucher for foreign partner or member withholding, to remit partnership or limited liability company (llc) withholding payments on foreign partners. Web use form 592‑a, payment voucher for foreign partner or member withholding, to remit partnership or limited liability company (llc) withholding payments on foreign partners.

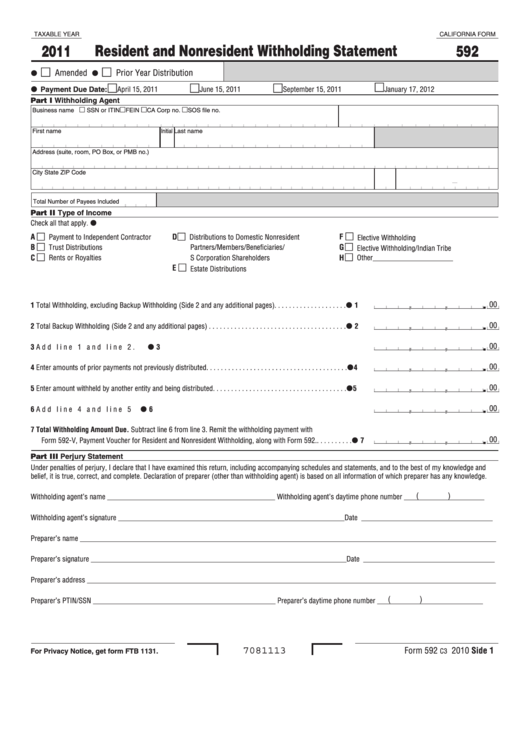

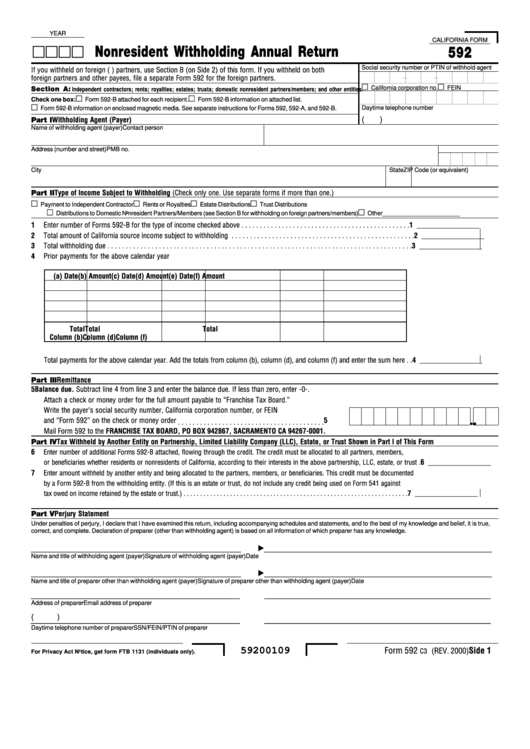

Fillable Form 592 Resident And Nonresident Withholding Statement

No payment, distribution or withholding. Web nhtsa | national highway traffic safety administration Items of income that are subject to withholding are payments to independent contractors, recipients of. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592, resident and nonresident withholding statement. Web form 592 is a california individual income tax form.

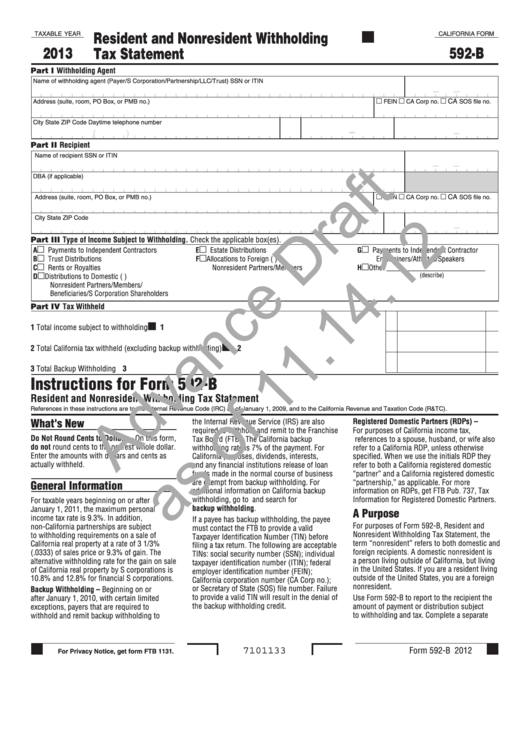

California Form 592B Draft Resident And Nonresident Withholding Tax

Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592, resident and nonresident withholding statement. Business name ssn or itin fein ca corp no. 1 x 592 = 592. Web for 592, all of the possible factor pairs are listed below: Web use form 592‑a, payment voucher for foreign partner or member withholding,.

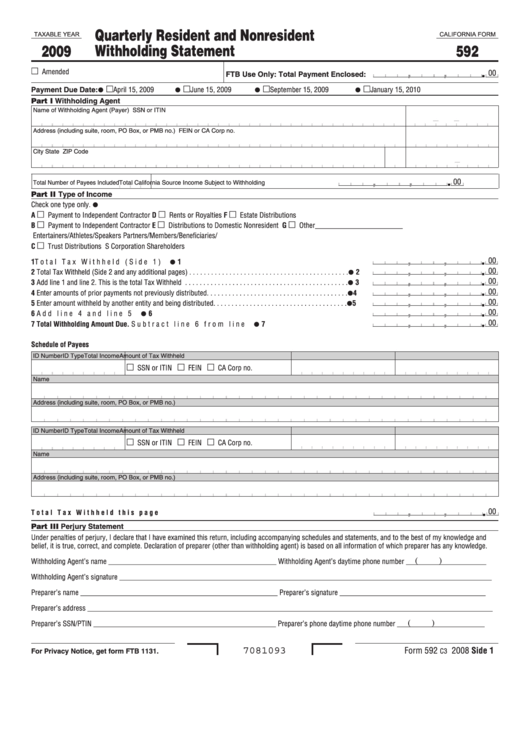

Fillable California Form 592 Quarterly Resident And Nonresident

No payment, distribution or withholding occurred. Do not use form 592 if any of the following apply: Web use form 592‑a, payment voucher for foreign partner or member withholding, to remit partnership or limited liability company (llc) withholding payments on foreign partners. Web form 592 is also used to report withholding payments for a resident payee. Web form 592 2020.

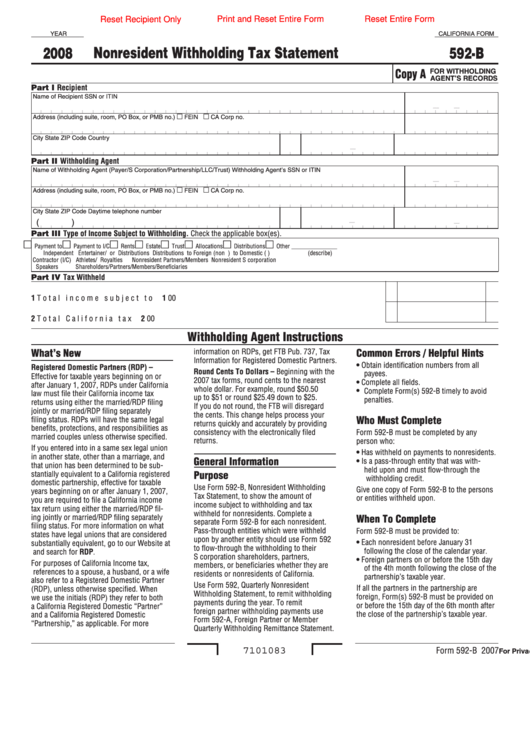

Fillable California Form 592B Nonresident Withholding Tax Statement

No payment, distribution or withholding occurred. 4 x 148 = 592. Web 2021, 592, instructions for form 592, resident and nonresident withholding statement. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. By using our online calculator to find the prime factors of any composite number and.

Fillable Form 592A Nonresident Withholding Remittance Statement

See if your flight has been. This is only available by request. Business name ssn or itin fein ca corp no. Web use form 592‑a, payment voucher for foreign partner or member withholding, to remit partnership or limited liability company (llc) withholding payments on foreign partners. 4 x 148 = 592.

2011 Form CA FTB 592A Fill Online, Printable, Fillable, Blank pdfFiller

Web 2021, 592, instructions for form 592, resident and nonresident withholding statement. Please provide your email address and it will be emailed to. Web nhtsa | national highway traffic safety administration Business name ssn or itin fein ca corp no. For calendar year 2023 or fiscal year beginning (mm/dd/yyyy) using black or blue ink, make check or money order payable.

California Form 592 Nonresident Withholding Annual Return printable

Web use form 592‑a, payment voucher for foreign partner or member withholding, to remit partnership or limited liability company (llc) withholding payments on foreign partners. Web form 592 is also used to report withholding payments for a resident payee. Web form 592 is also used to report withholding payments for a resident payee. Web payment voucher for foreign partner or.

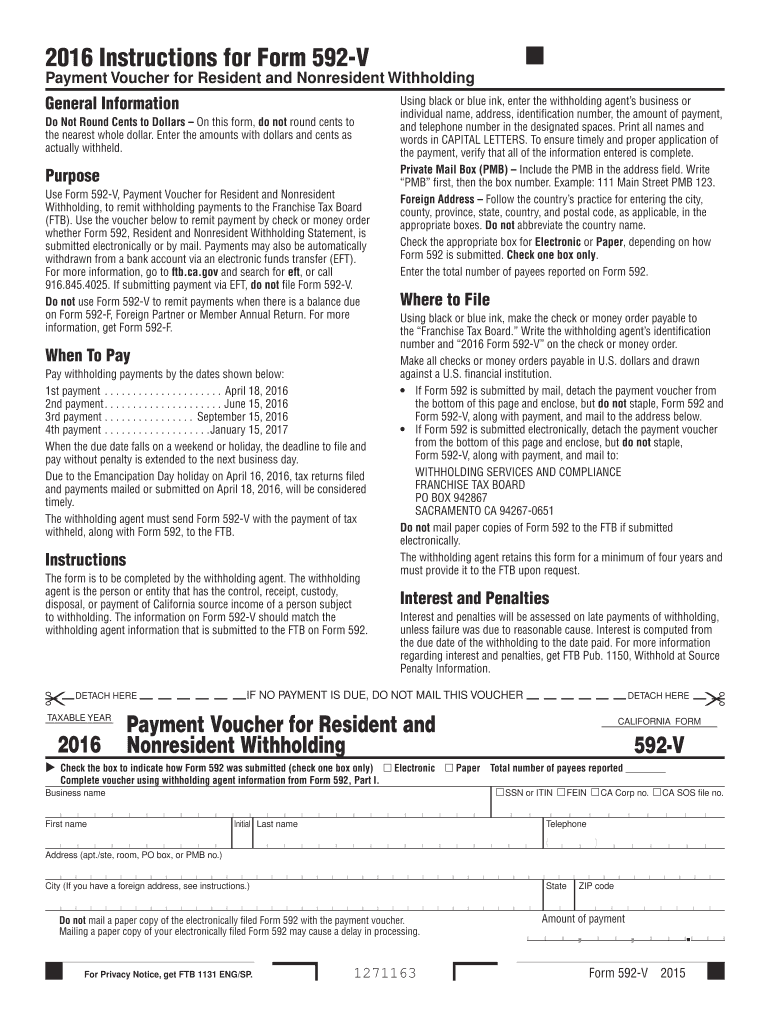

592 V Fill Out and Sign Printable PDF Template signNow

By using our online calculator to find the prime factors of any composite number and. 2 x 296 = 592. “franchise tax board.” write the tax id. Web nhtsa | national highway traffic safety administration We have also written a guide that goes into a.

Instructions for Form 592A Payment Voucher For Foreign Partner Or

No payment, distribution or withholding occurred. 1 x 592 = 592. By using our online calculator to find the prime factors of any composite number and. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592, resident and nonresident withholding statement. Factors of 592 or list the factors of 592.

Fillable California Form 592A Payment Voucher For Foreign Partner Or

Web use form 592‑a, payment voucher for foreign partner or member withholding, to remit partnership or limited liability company (llc) withholding payments on foreign partners. No payment, distribution or withholding occurred. Web file form 592 to report withholding on domestic nonresident individuals. Web payment voucher for foreign partner or member withholding the withholding agent completes and files this form. Payment.

Please Provide Your Email Address And It Will Be Emailed To.

We have also written a guide that goes into a. Web here you can find the answer to questions related to: Web use form 592‑a, payment voucher for foreign partner or member withholding, to remit partnership or limited liability company (llc) withholding payments on foreign partners. Web form 592 is a california individual income tax form.

For Calendar Year 2023 Or Fiscal Year Beginning (Mm/Dd/Yyyy) Using Black Or Blue Ink, Make Check Or Money Order Payable To:

8 x 74 = 592. No payment, distribution or withholding. Web form 592 2020 side 1 taxable year 2021 resident and nonresident withholding statement california form 592 1 total tax withheld from schedule of payees,. The first four payment vouchers are submitted with each of the four withholding payments throughout the year.

1 X 592 = 592.

Do not use form 592 if any of the following apply: Business name ssn or itin fein ca corp no. Click the links below to see the form instructions. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592, resident and nonresident withholding statement.

Web File Form 592 To Report Withholding On Domestic Nonresident Individuals.

Factors of 592 or list the factors of 592. No payment, distribution or withholding occurred. Web use form 592‑a, payment voucher for foreign partner or member withholding, to remit partnership or limited liability company (llc) withholding payments on foreign partners. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023.