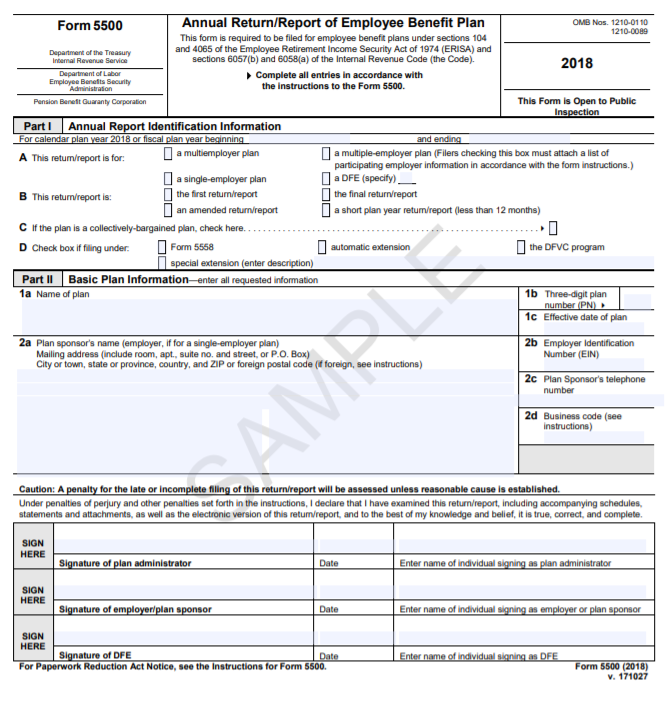

Form 5500 Instructions 2022

Form 5500 Instructions 2022 - Web form 5500, line 2d. Web paper forms for filing. Experience (e.g., termination, mortality, and retirement) is in line with valuation assumptions, Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating 2% shareholder of an s corporation, as defined in irc §1372(b), as a partner). The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans. Completed forms are submitted via the internet to efast2 for processing. Or use approved software, if available. The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align with the language in the clarified generally accepted. (failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.) Erisa refers to the employee retirement income security act of 1974.

Experience (e.g., termination, mortality, and retirement) is in line with valuation assumptions, See the instructions to the form. Erisa refers to the employee retirement income security act of 1974. (failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.) Web form 5500, line 2d. Web this projection shows expected benefit payments for active participants, terminated vested participants, and retired participants and beneficiaries receiving payments determined assuming: Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating 2% shareholder of an s corporation, as defined in irc §1372(b), as a partner). The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans. Completed forms are submitted via the internet to efast2 for processing. Web paper forms for filing.

Or use approved software, if available. Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating 2% shareholder of an s corporation, as defined in irc §1372(b), as a partner). See the instructions to the form. Experience (e.g., termination, mortality, and retirement) is in line with valuation assumptions, (failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.) The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align with the language in the clarified generally accepted. The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans. Erisa refers to the employee retirement income security act of 1974. Web form 5500, line 2d. Web paper forms for filing.

Form 5500 Is Due by July 31 for Calendar Year Plans

Web this projection shows expected benefit payments for active participants, terminated vested participants, and retired participants and beneficiaries receiving payments determined assuming: Or use approved software, if available. Web form 5500, line 2d. Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating 2% shareholder of an s corporation,.

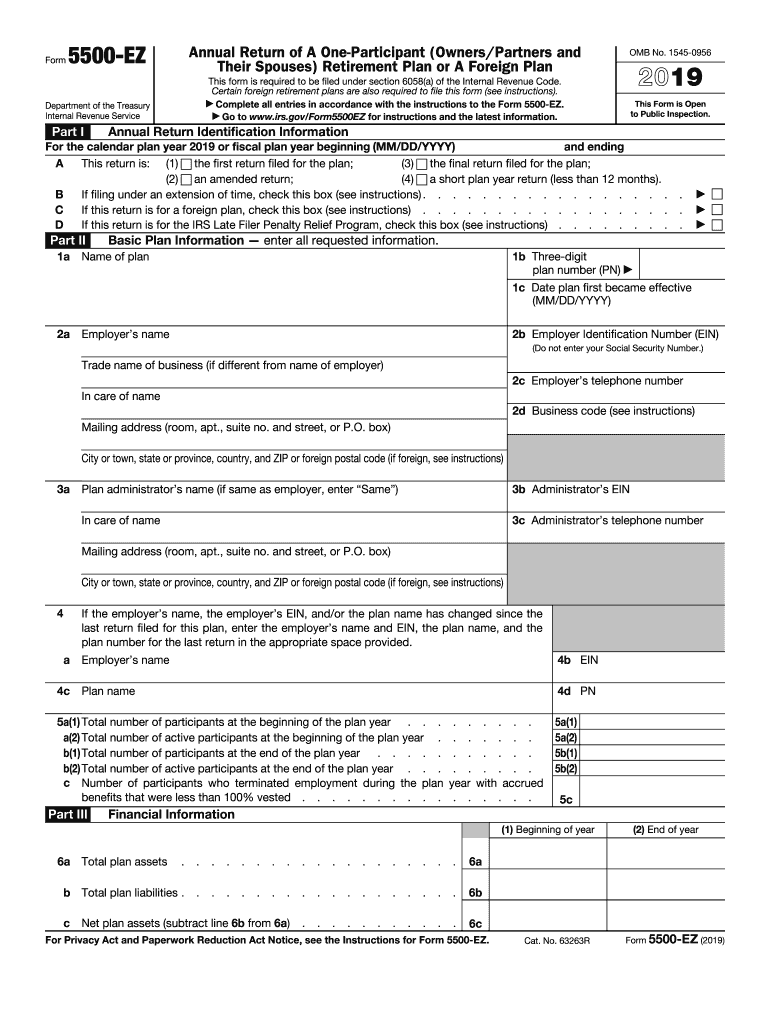

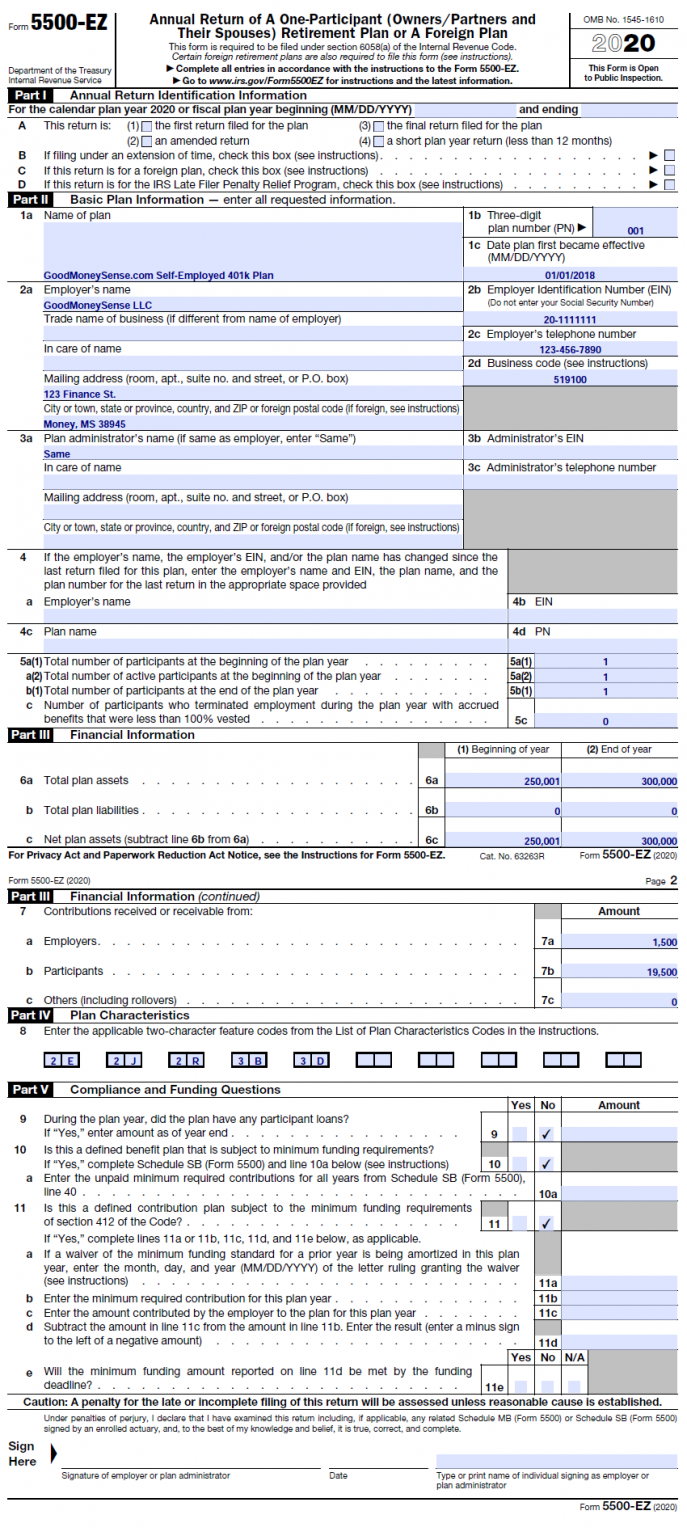

How to File Form 5500EZ Solo 401k

See the instructions to the form. Web form 5500, line 2d. Erisa refers to the employee retirement income security act of 1974. The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans. The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align.

Dol form 5500 Instructions Inspirational 25 6 1 Statute Of Limitations

Web this projection shows expected benefit payments for active participants, terminated vested participants, and retired participants and beneficiaries receiving payments determined assuming: The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans. Web form 5500, line 2d. Or use approved software, if available. Erisa refers to.

2019 Form IRS 5500EZ Fill Online, Printable, Fillable, Blank pdfFiller

Erisa refers to the employee retirement income security act of 1974. (failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.) Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating 2% shareholder of an s corporation, as defined in irc.

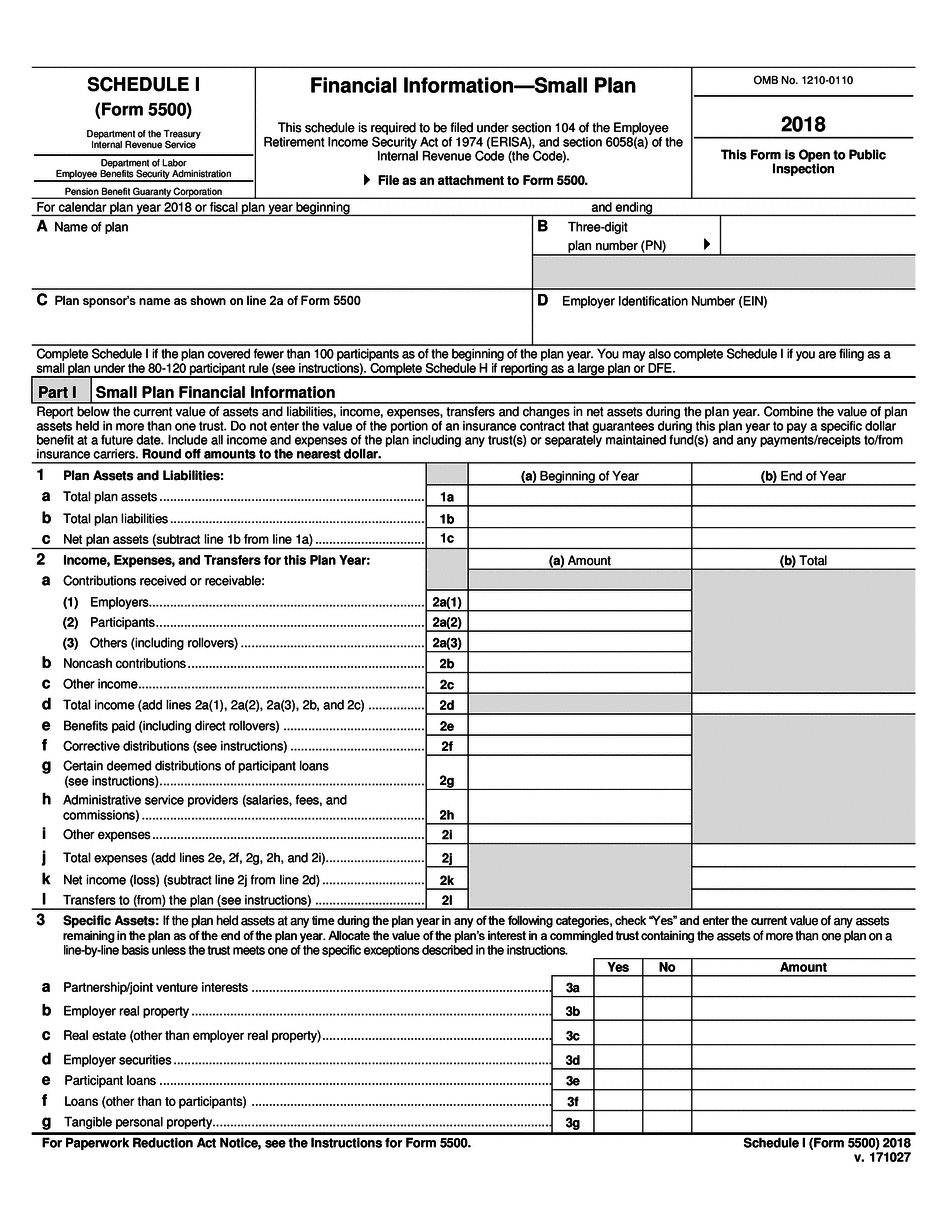

5500 Instructions 2018 Fillable and Editable PDF Template

Web this projection shows expected benefit payments for active participants, terminated vested participants, and retired participants and beneficiaries receiving payments determined assuming: Web form 5500, line 2d. The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align with the language in the clarified generally accepted. (failure to enter a valid receipt confirmation code will subject the.

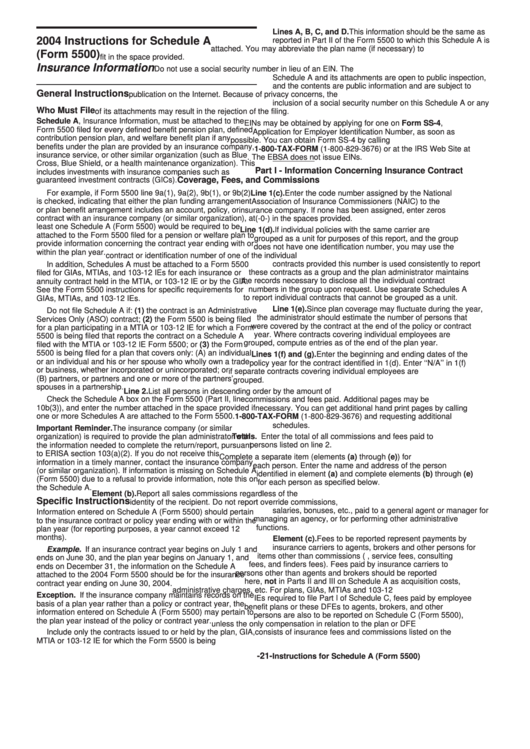

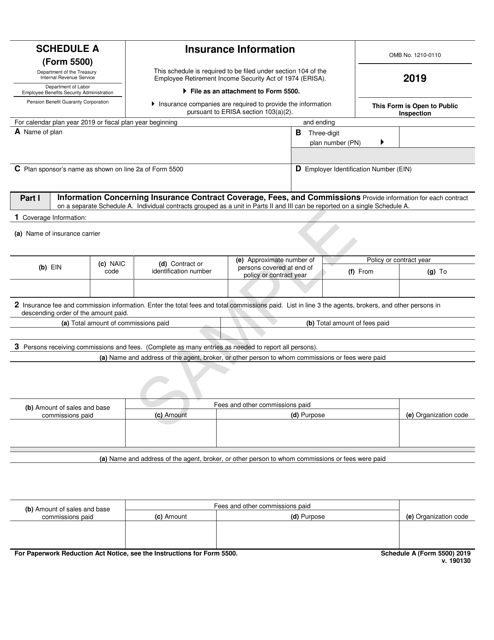

Form 5500 Schedule A Instructions Insurance Information 2004

(failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.) Experience (e.g., termination, mortality, and retirement) is in line with valuation assumptions, The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align with the language in the clarified generally accepted. Erisa refers to the employee retirement income security.

Form 5500 Fill Out and Sign Printable PDF Template signNow

The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align with the language in the clarified generally accepted. See the instructions to the form. Erisa refers to the employee retirement income security act of 1974. Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating.

2019 2020 IRS Instructions 5500EZ Fill Out Digital PDF Sample

Experience (e.g., termination, mortality, and retirement) is in line with valuation assumptions, See the instructions to the form. Web form 5500, line 2d. The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans. Erisa refers to the employee retirement income security act of 1974.

How To File The Form 5500EZ For Your Solo 401k in 2021 Good Money Sense

Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating 2% shareholder of an s corporation, as defined in irc §1372(b), as a partner). Web this projection shows expected benefit payments for active participants, terminated vested participants, and retired participants and beneficiaries receiving payments determined assuming: See the instructions.

IRS Form 5500 Schedule A Download Fillable PDF or Fill Online Insurance

The instructions to line 2d of the form 5500 have been clarified on how to report the plan sponsor’s business code for multiemployer plans. See the instructions to the form. Or use approved software, if available. (failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.) Completed forms are submitted via the.

The Instructions To Line 2D Of The Form 5500 Have Been Clarified On How To Report The Plan Sponsor’s Business Code For Multiemployer Plans.

Completed forms are submitted via the internet to efast2 for processing. Erisa refers to the employee retirement income security act of 1974. See the instructions to the form. Web form 5500, line 2d.

Or Use Approved Software, If Available.

Web paper forms for filing. Web this projection shows expected benefit payments for active participants, terminated vested participants, and retired participants and beneficiaries receiving payments determined assuming: Web a pension benefit plan for a partnership that covers only the partners or the partners and the partners' spouses (treating 2% shareholder of an s corporation, as defined in irc §1372(b), as a partner). (failure to enter a valid receipt confirmation code will subject the form 5500 filing to rejection as incomplete.)

Experience (E.g., Termination, Mortality, And Retirement) Is In Line With Valuation Assumptions,

The instructions for line 3a(1), 3a(2), 3a(3) and 3a(4) have been revised to align with the language in the clarified generally accepted.