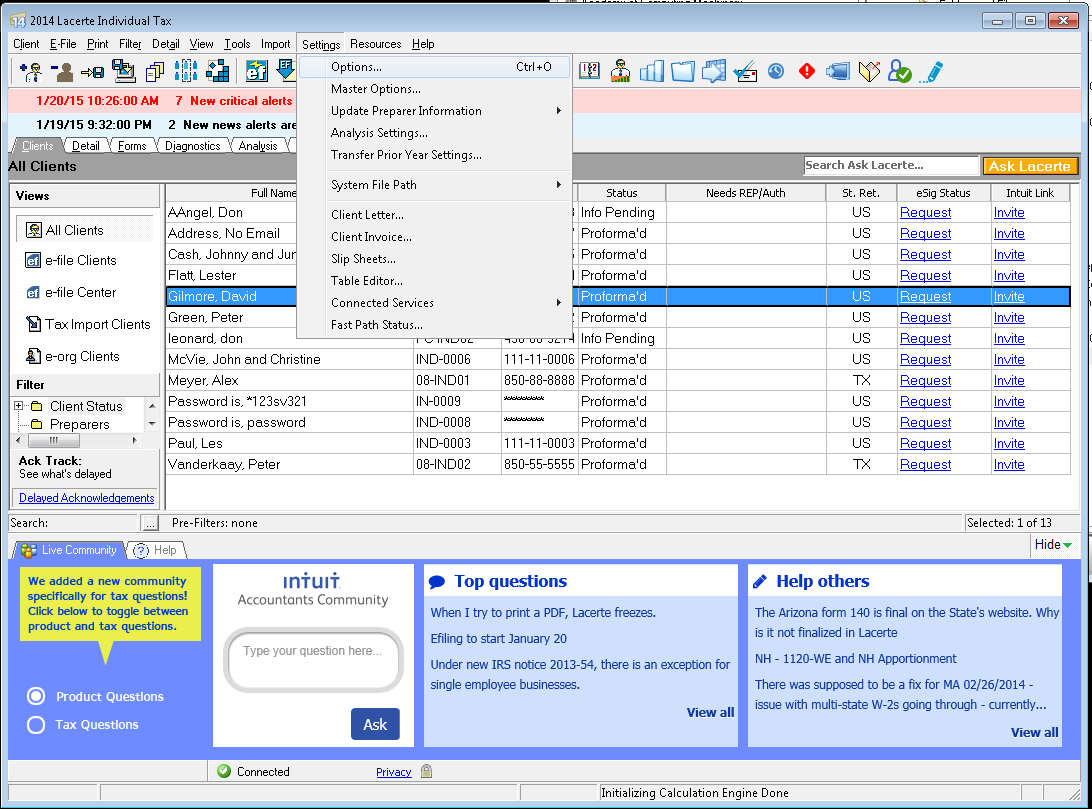

Form 5498 Lacerte

Form 5498 Lacerte - I understand that this amount doesn't need to be reported or included if no distribution occurred. The irs requires companies that maintain any individual retirement arrangement (ira) to file a form 5498, including a deemed ira under section 408 (q) in the tax year. Web solved•by intuit•1377•updated 1 year ago. The taxpayer isn't required to attach this form to their tax return. Web proseries doesn't have a 5498 worksheet. Web form 5498 is an informational form. The taxpayer isn't required to attach form 5498 to their tax return. For taxpayers, form 5498 is informational only. The taxpayer isn't required to attach form 5498 to their tax return. The irs requires the form be filed by companies that maintain an individual retirement arrangement (ira) during the tax year.

Web solved•by intuit•1377•updated 1 year ago. Web you use the 5498 to confirm that the client (and their broker) did in fact put their stated to you amount into the type of account as they are telling you, so that you have done your due diligence on that item. Form 5498 is an informational form. Lacerte doesn't have direct inputs for each of these boxes, but the form often provides valuable information for completing. Web form 5498 is an informational form. Web proseries doesn't have a 5498 worksheet. The taxpayer isn't required to attach form 5498 to their tax return. Web form 5498 is information only and does not go on a tax return. The taxpayer isn't required to attach form 5498 to their tax return. The taxpayer isn't required to attach this form to their tax return.

Web solved•by intuit•1377•updated 1 year ago. Form 5498 is an informational form. The taxpayer isn't required to attach form 5498 to their tax return. Web form 5498 is an informational form. Web you use the 5498 to confirm that the client (and their broker) did in fact put their stated to you amount into the type of account as they are telling you, so that you have done your due diligence on that item. The irs requires companies that maintain any individual retirement arrangement (ira) to file a form 5498, including a deemed ira under section 408 (q) in the tax year. The irs requires the form be filed by companies that maintain an individual retirement arrangement (ira) during the tax year. The irs requires the form be filed by companies that maintain an individual retirement arrangement (ira) during the tax year. Web form 5498 is information only and does not go on a tax return. I understand that this amount doesn't need to be reported or included if no distribution occurred.

What is IRS Form 5498SA? BRI Benefit Resource

Lacerte doesn't have direct inputs for each of these boxes, but the form often provides valuable information for completing. This post is for discussion purposes only and is not tax advice. The irs requires companies that maintain any individual retirement arrangement (ira) to file a form 5498, including a deemed ira under section 408 (q) in the tax year. I.

5498 Software to Create, Print & EFile IRS Form 5498

Web form 5498 is an informational form. The irs requires companies that maintain any individual retirement arrangement (ira) to file a form 5498, including a deemed ira under section 408 (q) in the tax year. For taxpayers, form 5498 is informational only. The taxpayer isn't required to attach form 5498 to their tax return. The taxpayer isn't required to attach.

The Purpose of IRS Form 5498

Web proseries doesn't have a 5498 worksheet. Web you use the 5498 to confirm that the client (and their broker) did in fact put their stated to you amount into the type of account as they are telling you, so that you have done your due diligence on that item. Form 5498 is an informational form. The taxpayer isn't required.

IRS Form 5498 What It Is and What The IRS Extension Means For Your IRA

Web form 5498 is information only and does not go on a tax return. The irs requires the form be filed by companies that maintain an individual retirement arrangement (ira) during the tax year. Web form 5498 is an informational form. This post is for discussion purposes only and is not tax advice. Web proseries doesn't have a 5498 worksheet.

Lacerte keyboard shortcuts ‒ defkey

The irs requires the form be filed by companies that maintain an individual retirement arrangement (ira) during the tax year. The irs requires the form be filed by companies that maintain an individual retirement arrangement (ira) during the tax year. Web you use the 5498 to confirm that the client (and their broker) did in fact put their stated to.

IRS Form 5498 Instructions for 2021 Line by Line 5498 Instruction

The irs requires the form be filed by companies that maintain an individual retirement arrangement (ira) during the tax year. The taxpayer isn't required to attach this form to their tax return. Form 5498 is an informational form. For taxpayers, form 5498 is informational only. The irs requires the form be filed by companies that maintain an individual retirement arrangement.

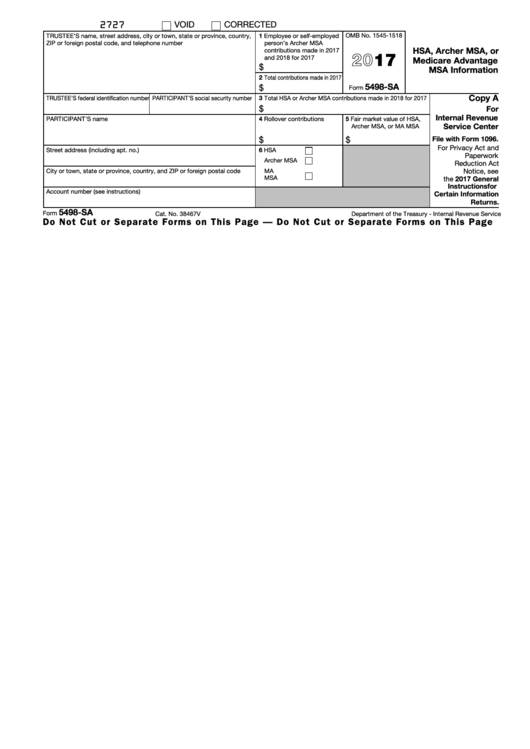

Fillable Form 5498Sa Hsa, Archer Msa, Or Medicare Advantage Msa

Lacerte doesn't have direct inputs for each of these boxes, but the form often provides valuable information for completing. Web form 5498 is information only and does not go on a tax return. Form 5498 is an informational form. Web you use the 5498 to confirm that the client (and their broker) did in fact put their stated to you.

All About IRS Tax Form 5498 for 2020 IRA for individuals

I understand that this amount doesn't need to be reported or included if no distribution occurred. The taxpayer isn't required to attach this form to their tax return. This post is for discussion purposes only and is not tax advice. The irs requires companies that maintain any individual retirement arrangement (ira) to file a form 5498, including a deemed ira.

IRS Form 5498 Changes 2015 & Beyond IRA Financial Trust

Web proseries doesn't have a 5498 worksheet. Web solved•by intuit•1377•updated 1 year ago. This post is for discussion purposes only and is not tax advice. The taxpayer isn't required to attach form 5498 to their tax return. The irs requires companies that maintain any individual retirement arrangement (ira) to file a form 5498, including a deemed ira under section 408.

IRS Form 5498 IRA Contribution Information

The irs requires companies that maintain any individual retirement arrangement (ira) to file a form 5498, including a deemed ira under section 408 (q) in the tax year. Web form 5498 is an informational form. Web proseries doesn't have a 5498 worksheet. The irs requires the form be filed by companies that maintain an individual retirement arrangement (ira) during the.

The Irs Requires The Form Be Filed By Companies That Maintain An Individual Retirement Arrangement (Ira) During The Tax Year.

For taxpayers, form 5498 is informational only. The irs requires the form be filed by companies that maintain an individual retirement arrangement (ira) during the tax year. This post is for discussion purposes only and is not tax advice. The taxpayer isn't required to attach form 5498 to their tax return.

The Taxpayer Isn't Required To Attach Form 5498 To Their Tax Return.

Web form 5498 is an informational form. I understand that this amount doesn't need to be reported or included if no distribution occurred. Web solved•by intuit•1377•updated 1 year ago. Form 5498 is an informational form.

Lacerte Doesn't Have Direct Inputs For Each Of These Boxes, But The Form Often Provides Valuable Information For Completing.

Web form 5498 is information only and does not go on a tax return. The taxpayer isn't required to attach this form to their tax return. The irs requires companies that maintain any individual retirement arrangement (ira) to file a form 5498, including a deemed ira under section 408 (q) in the tax year. Web you use the 5498 to confirm that the client (and their broker) did in fact put their stated to you amount into the type of account as they are telling you, so that you have done your due diligence on that item.

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)