Form 5498 Charles Schwab

Form 5498 Charles Schwab - What, if anything, do i need to do now? Form 5498 is an informational return sent by your ira account custodian to the irs (for example, by. Power of attorney for schwab one brokerage. I filed my taxes months ago. Web need information to plan or file your taxes? Its banking subsidiary, charles schwab bank, ssb (member fdic and an equal housing. Form 5498 is not generally issued until after the april 15th tax filing deadline (it must be. Other tax forms (e.g., form. Web this form may also be used to report the fair market value (fmv) of your ira each year as of december 31. Web form 5498 will report contributions or rollovers (including returns of rmds) made in 2020.

Web need information to plan or file your taxes? Schwab offers comprehensive wealth management, including a dedicated advisor backed by an experienced team and professionally. Web schwab 529 college savings plan account application • use this application to open a schwab 529 college savings plan account. Form 5498 is an informational return sent by your ira account custodian to the irs (for example, by. Any state or its agency or. Web who sends the form, and what am i supposed to do with it? What, if anything, do i need to do now? The schwab 529 plan is only available to. Charles schwab just gave me a 5498 form (roth ira contribution form) for the year 2019. Web form 5498 will report contributions or rollovers (including returns of rmds) made in 2020.

Its banking subsidiary, charles schwab bank, ssb (member fdic and an equal housing. Any state or its agency or. Charles schwab just gave me a 5498 form (roth ira contribution form) for the year 2019. Web form 5498 will report contributions or rollovers (including returns of rmds) made in 2020. If you haven’t already, you'll need to create your schwab login id and password first. The trustee or custodian of your ira reports. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. Web complete this form to designate or change a financial professional on your account. Web who sends the form, and what am i supposed to do with it? I filed my taxes months ago.

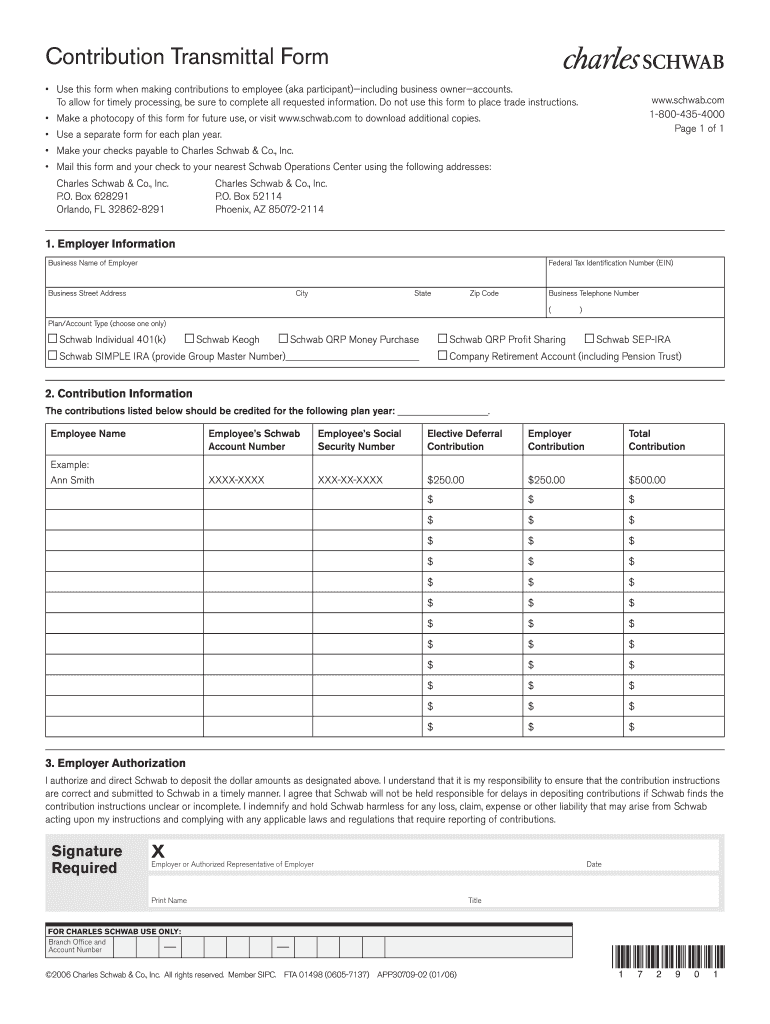

Edward Jones Simple Ira Contribution Transmittal Form Fill Out and

Any state or its agency or. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. Web log in below to get started and complete your schwab client profile. Other tax forms (e.g., form. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form.

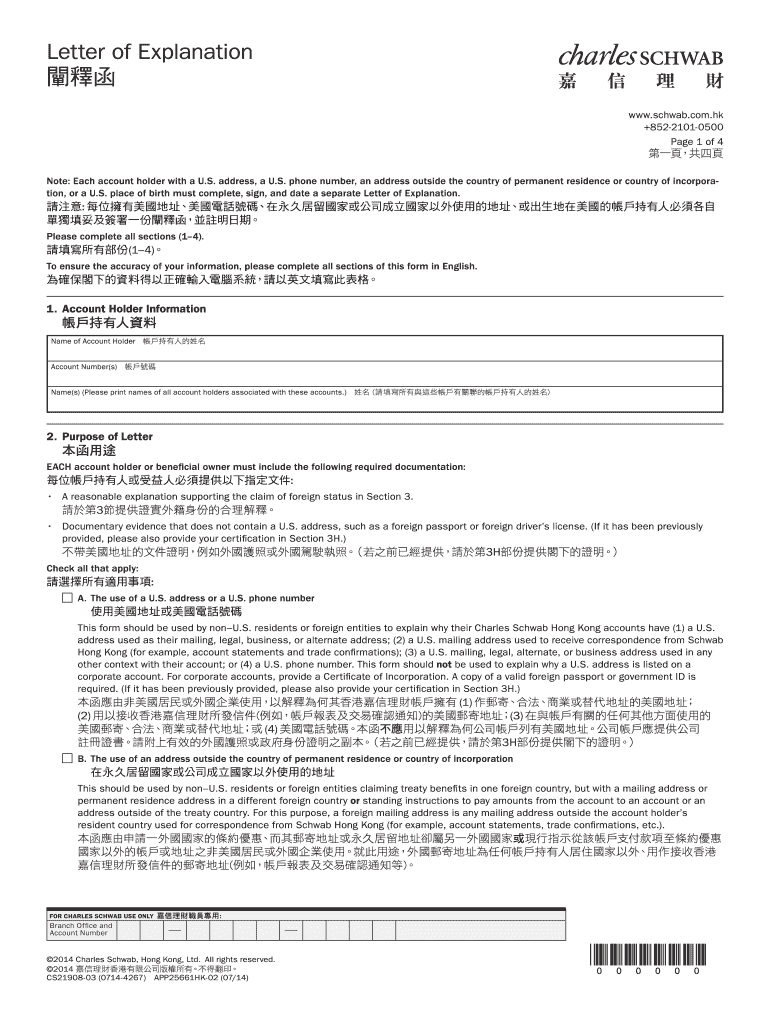

Schwab Proof of Funds Letter Form Fill Out and Sign Printable PDF

Web need information to plan or file your taxes? Charles schwab just gave me a 5498 form (roth ira contribution form) for the year 2019. The schwab 529 plan is only available to. Any state or its agency or. If you haven’t already, you'll need to create your schwab login id and password first.

All About IRS Tax Form 5498 for 2020 IRA for individuals

Web schwab 529 college savings plan account application • use this application to open a schwab 529 college savings plan account. Web this form may also be used to report the fair market value (fmv) of your ira each year as of december 31. Web log in below to get started and complete your schwab client profile. Form 5498 is.

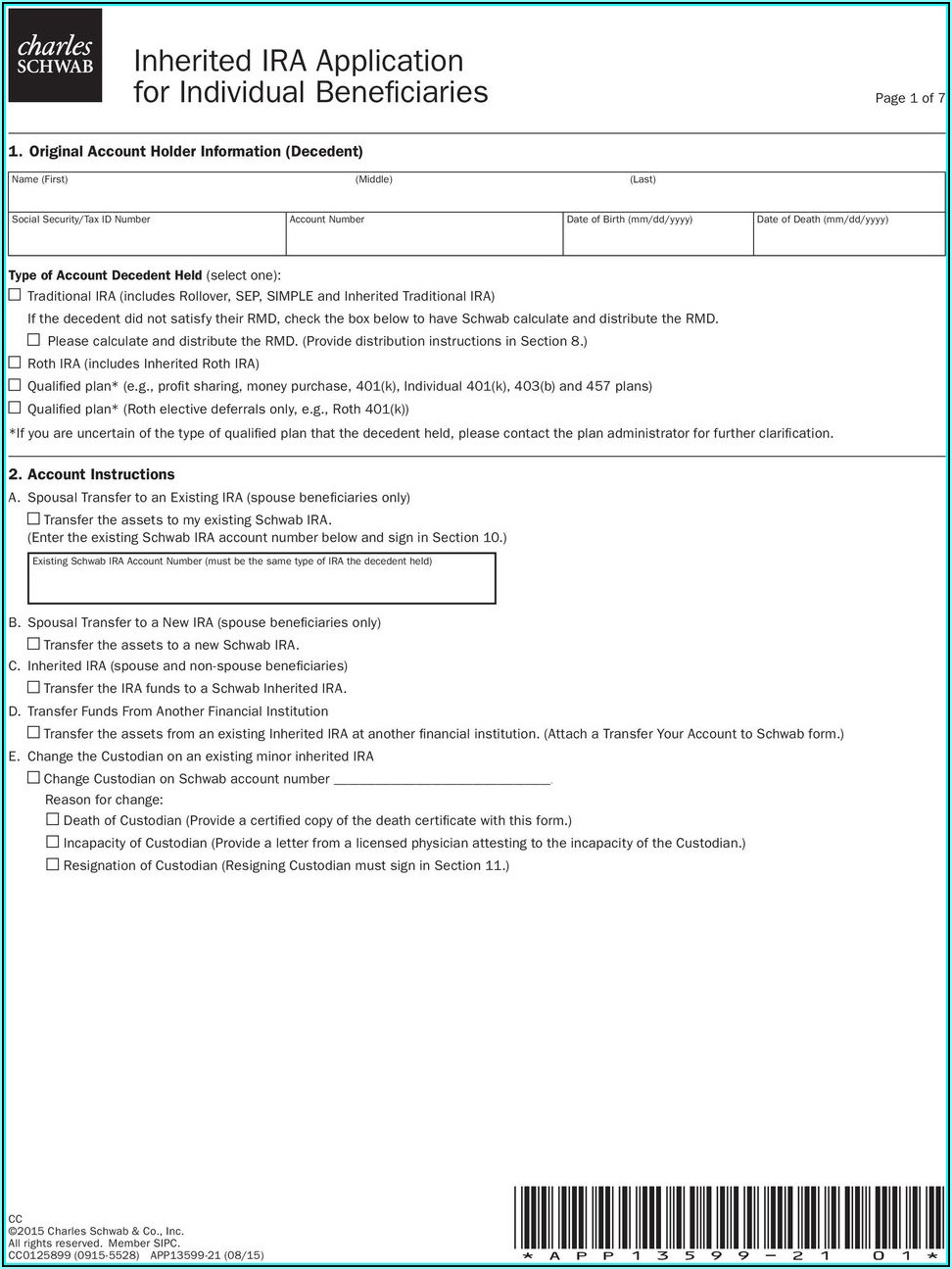

401k Rollover Form Charles Schwab Form Resume Examples MoYo65B9ZB

Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. The schwab 529 plan is only available to. If applicable, it will include employer contributions and. Form 5498 is not generally issued until after the april 15th tax filing deadline (it must be. Web need information to plan or file.

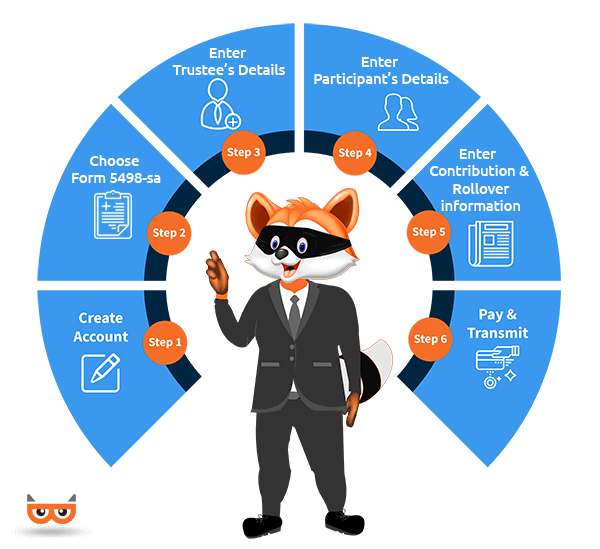

File 2020 Form 5498SA Online EFile as low as 0.50/Form

Other tax forms (e.g., form. Any state or its agency or. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. What, if anything, do i need to do now? Web log in below to get started and complete your schwab client profile.

form 5498sa instructions 2017 Fill Online, Printable, Fillable Blank

Web who sends the form, and what am i supposed to do with it? When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Its banking subsidiary, charles schwab bank, ssb (member fdic and an equal housing. Web need information to plan or file your taxes? Form 5498 is an informational.

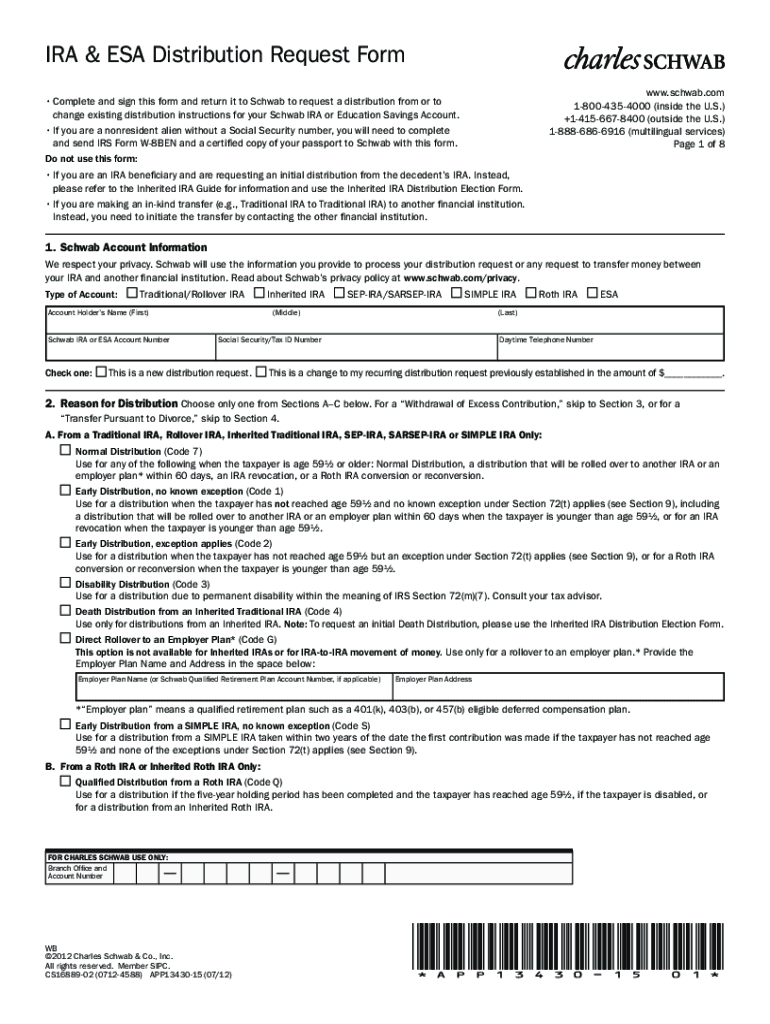

Charles Distribution Form Fill Online, Printable, Fillable, Blank

If applicable, it will include employer contributions and. If you haven’t already, you'll need to create your schwab login id and password first. Web the ira contribution tax form, or tax form 5498, is an official document containing information about your ira contributions. Its banking subsidiary, charles schwab bank, ssb (member fdic and an equal housing. Power of attorney for.

5498 Software to Create, Print & EFile IRS Form 5498

Web complete this form to designate or change a financial professional on your account. Form 5498 is for informational purposes only. Web who sends the form, and what am i supposed to do with it? What, if anything, do i need to do now? (schwab) (member sipc), is registered by the securities and exchange commission (sec) in.

Schwab 401k Rollover Form Form Resume Examples X42M7qzYkG

If applicable, it will include employer contributions and. Web complete this form to designate or change a financial professional on your account. Web schwab 529 college savings plan account application • use this application to open a schwab 529 college savings plan account. Web who sends the form, and what am i supposed to do with it? Schwab offers comprehensive.

The Purpose of IRS Form 5498

Form 5498 is for informational purposes only. Web need information to plan or file your taxes? Form 5498 is an informational return sent by your ira account custodian to the irs (for example, by. When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. If applicable, it will include employer contributions.

What, If Anything, Do I Need To Do Now?

When you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. Form 5498 is an informational return sent by your ira account custodian to the irs (for example, by. If you haven’t already, you'll need to create your schwab login id and password first. Ad discover innovative investment & wealth management solutions from schwab.

Charles Schwab Just Gave Me A 5498 Form (Roth Ira Contribution Form) For The Year 2019.

If applicable, it will include employer contributions and. Web need information to plan or file your taxes? I filed my taxes months ago. (schwab) (member sipc), is registered by the securities and exchange commission (sec) in.

Form 5498 Is Not Generally Issued Until After The April 15Th Tax Filing Deadline (It Must Be.

Web form 5498 will report contributions or rollovers (including returns of rmds) made in 2020. Web complete this form to designate or change a financial professional on your account. Web get professional investing advice. Web who sends the form, and what am i supposed to do with it?

Other Tax Forms (E.g., Form.

Its banking subsidiary, charles schwab bank, ssb (member fdic and an equal housing. Form 5498 is for informational purposes only. Any state or its agency or. Web this form may also be used to report the fair market value (fmv) of your ira each year as of december 31.

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)