Form 5471 Schedule P Instructions

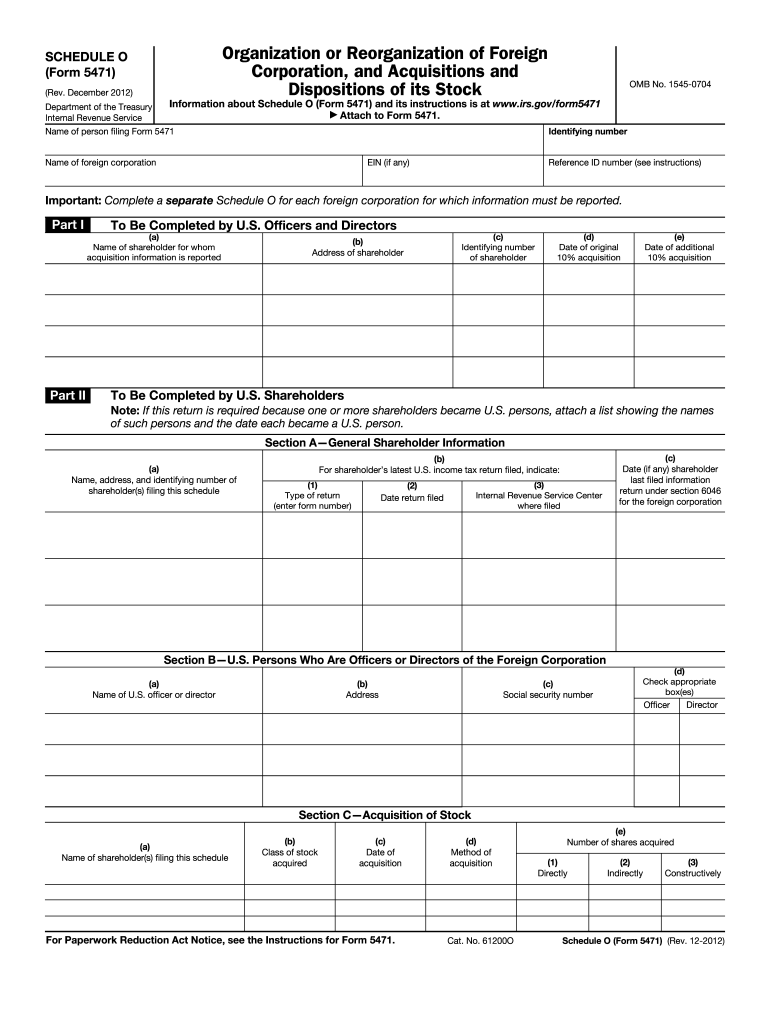

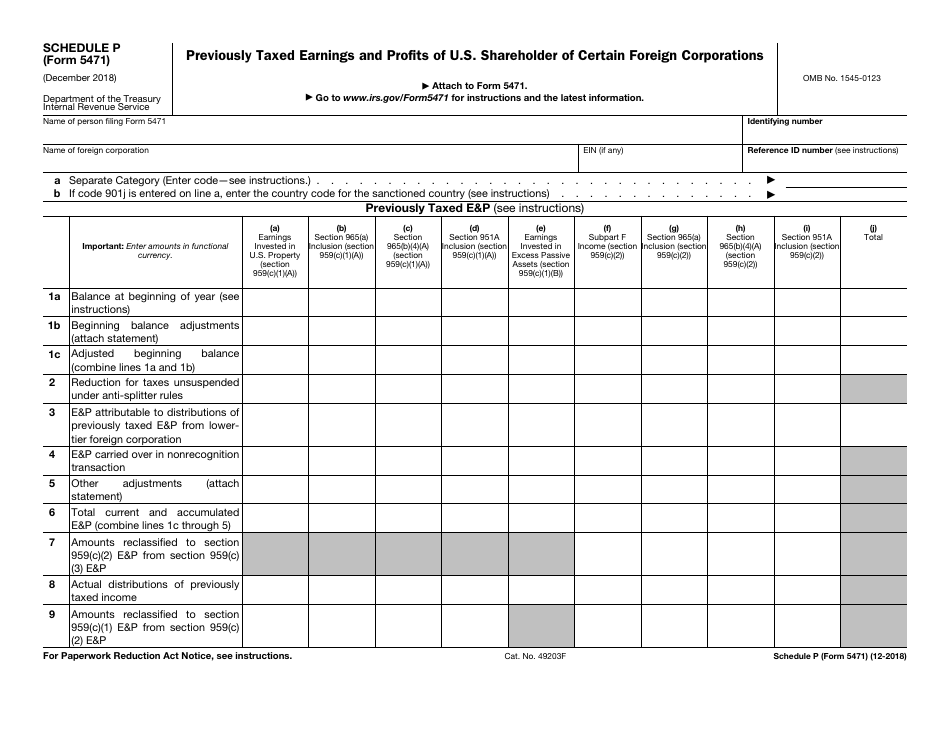

Form 5471 Schedule P Instructions - Specific schedule p reporting rules Web instructions for form 5471(rev. There have been revisions to the form in both 2017 and 2018, with a major revision in 2019. Web 27 apr 2021 by anthony diosdi introduction schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. December 2020) department of the treasury internal revenue service. And the december 2012 revision of separate schedule o.) Let’s go through the basics of schedule p and ptep: January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; Web schedule p (form 5471) (rev. When and where to file.

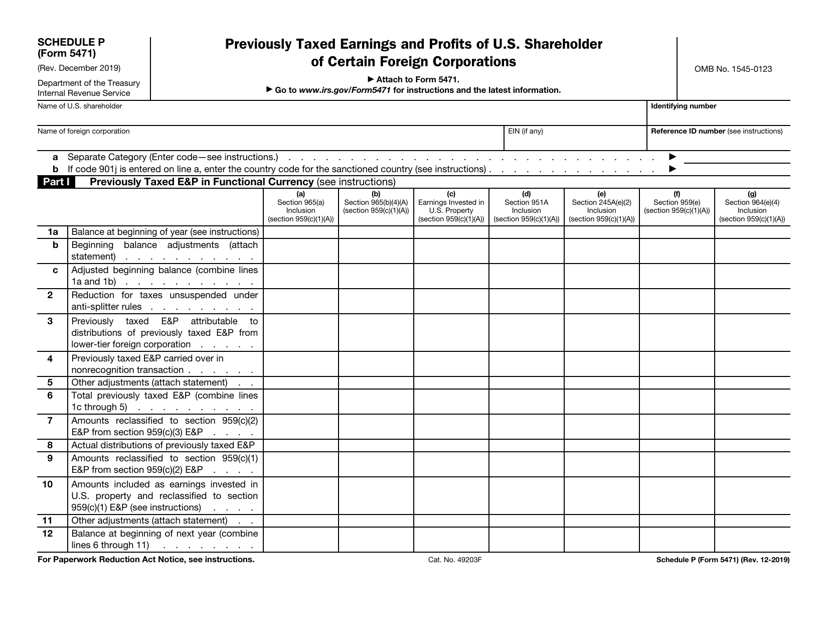

Shareholders are not required to file schedule p. Lines a and b line a asks the preparer to enter a “separate category” code. When and where to file. For instructions and the latest information. December 2019) department of the treasury internal revenue service. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s. Shareholder of certain foreign corporations. Web all persons identified in item h must complete a separate schedule p (form 5471) if the person is a u.s. Shareholder of certain foreign corporations. Web schedule p (form 5471) (rev.

Shareholder described in category 1a, 1b, 4, 5a, or 5b. For instructions and the latest information. The term ptep refers to earnings and. There have been revisions to the form in both 2017 and 2018, with a major revision in 2019. Web schedule p (form 5471) (rev. Specific schedule p reporting rules Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements. In such a case, the schedule p must be attached to the statement described above. The december 2018 revision of schedule m; When and where to file.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

Let’s go through the basics of schedule p and ptep: However, category 1 and 5 filers who are related constructive u.s. Web schedule p (form 5471) (rev. Web schedule p (form 5471) (rev. Web 27 apr 2021 by anthony diosdi introduction schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s.

The Tax Times IRS Issues Updated New Form 5471 What's New?

Shareholder of certain foreign corporations. Web 27 apr 2021 by anthony diosdi introduction schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; December 2019) department of the treasury internal revenue.

Download Instructions for IRS Form 5471 Information Return of U.S

Web schedule p must be completed by category 1, category 4 and category 5 filers of the form 5471. Now, the following forms are also available for download today. Shareholder of certain foreign corporations. Previously taxed earnings and profits of u.s. Shareholder of certain foreign corporations.

Demystifying the Form 5471 Part 7. Schedule P SF Tax Counsel

Web schedule p must be completed by category 1, category 4 and category 5 filers of the form 5471. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s. Shareholders are not required to file schedule p. Web instructions for form 5471(rev. For instructions.

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

Specific schedule p reporting rules Shareholder of a controlled foreign corporation (“cfc”). Shareholders are not required to file schedule p. Web instructions for form 5471(rev. December 2020) department of the treasury internal revenue service.

IRS Form 5471 Schedule P Download Fillable PDF or Fill Online

However, category 1 and 5 filers who are related constructive u.s. Specific schedule p reporting rules December 2019) department of the treasury internal revenue service. Shareholders are not required to file schedule p. For instructions and the latest information.

Demystifying the All New 2020 Tax Year IRS Form 5471 Schedule P

And the december 2012 revision of separate schedule o.) Previously taxed earnings and profits of u.s. Let’s go through the basics of schedule p and ptep: There are five (5) different categories of filers, various schedules to be filed, and balance sheets to prepare. January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h,.

form 5471 schedule i1 instructions Fill Online, Printable, Fillable

Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements. When and where to file. The december 2018 revision of schedule m; There have been revisions to the form in both 2017 and 2018, with a major revision in 2019. Shareholders are not required to file schedule p.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

And the december 2012 revision of separate schedule o.) Shareholder of certain foreign corporations. There have been revisions to the form in both 2017 and 2018, with a major revision in 2019. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s. Now, the.

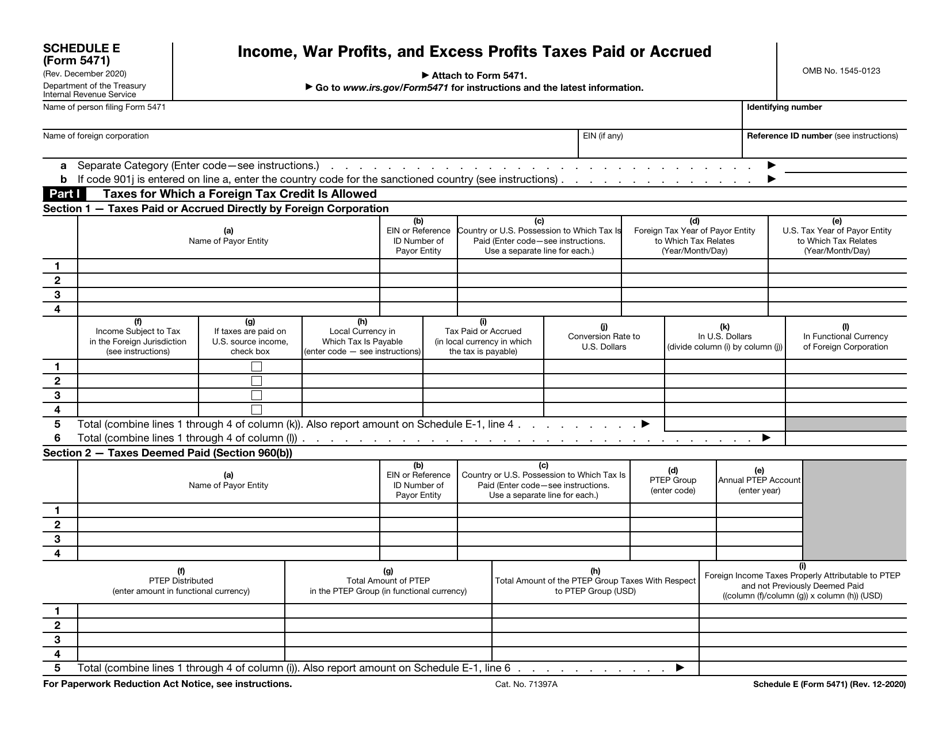

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Previously taxed earnings and profits of u.s. Let’s go through the basics of schedule p and ptep: December 2020) department of the treasury internal revenue service. And the december 2012 revision of separate schedule o.) Shareholder of certain foreign corporations.

Web Schedule P (Form 5471) (Rev.

Web all persons identified in item h must complete a separate schedule p (form 5471) if the person is a u.s. Specific schedule p reporting rules There are five (5) different categories of filers, various schedules to be filed, and balance sheets to prepare. Web in order to track the ptep for foreign corporations, the form 5471 developed schedule p, which refers to previously taxed earnings and profits of u.s.

Let’s Go Through The Basics Of Schedule P And Ptep:

Web schedule p (form 5471) (rev. Now, the following forms are also available for download today. The term ptep refers to earnings and. There have been revisions to the form in both 2017 and 2018, with a major revision in 2019.

Shareholders Are Not Required To File Schedule P.

And the december 2012 revision of separate schedule o.) Web instructions for form 5471(rev. December 2020) department of the treasury internal revenue service. Web the golding & golding form 5471 instructions are designed to simplify your understanding of the reporting requirements.

Lines A And B Line A Asks The Preparer To Enter A “Separate Category” Code.

January 2021) (use with the december 2020 revision of form 5471 and separate schedules e, h, j, p, q, and r; In such a case, the schedule p must be attached to the statement described above. Web 27 apr 2021 by anthony diosdi introduction schedule p of form 5471 is used to report previously taxed earnings and profits (“ptep”) of a u.s. Web schedule p must be completed by category 1, category 4 and category 5 filers of the form 5471.