Form 5471 Sch M

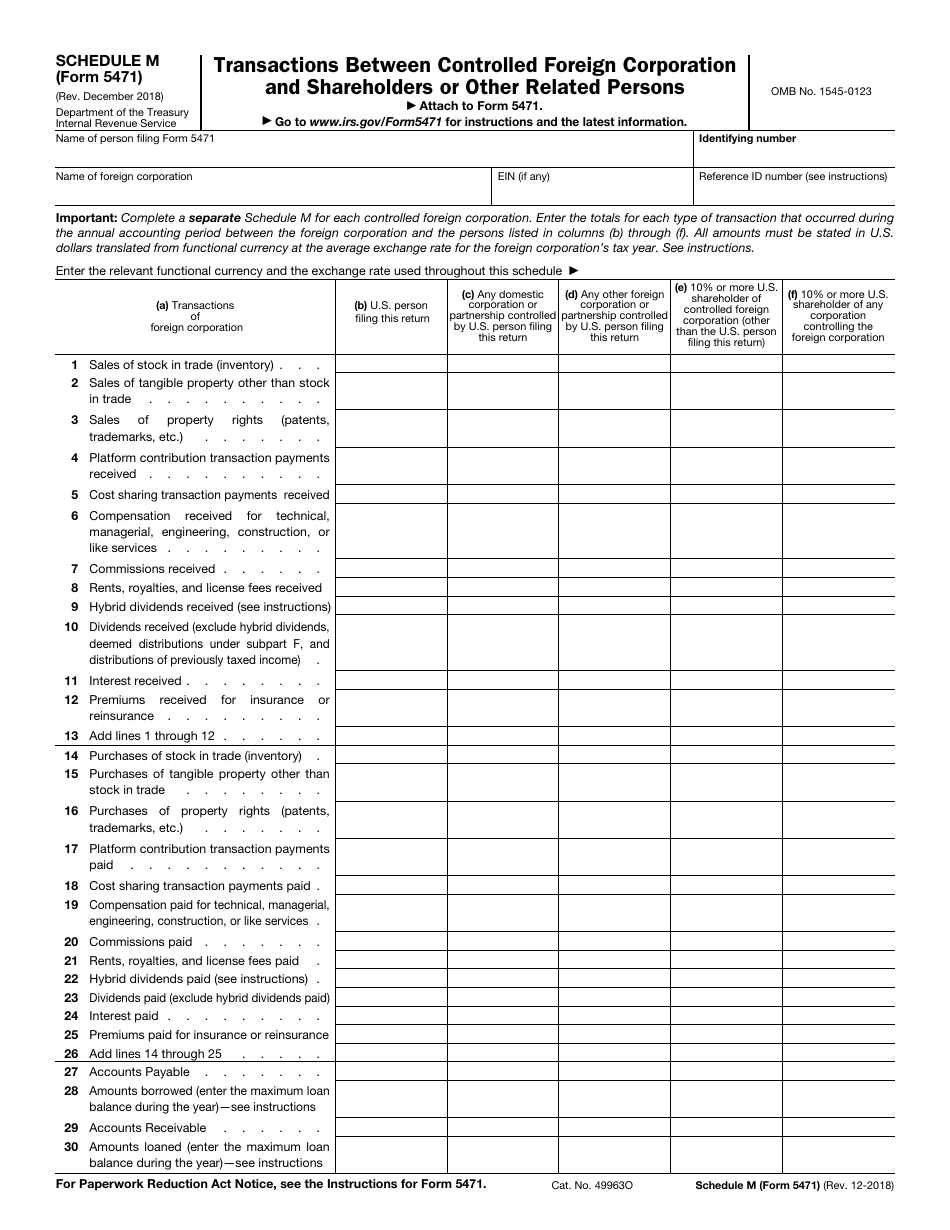

Form 5471 Sch M - Web form 5471 filers generally use the same category of filer codes used on form 1118. Web changes to separate schedule e (form 5471). Web schedule m must be completed by category 4 filers of the form 5471 to report the transactions that occurred during the cfc’s annual accounting period ending with or within the u.s. For instructions and the latest information. Schedule m (form 5471) (rev. Web schedule m (form 5471) (rev. Transactions between controlled foreign corporation and shareholders or other related persons. Web for paperwork reduction act notice, see the instructions for form 5471. December 2021) department of the treasury internal revenue service. Web changes to separate schedule e (form 5471).

Officers and directors, part ii to be completed by. Transactions between controlled foreign corporation and shareholders or other related persons. Web schedule m (form 5471), transactions between controlled foreign corporation and shareholders or other related persons foreign corporation’s that file form 5471 use this schedule to report the transactions that occurred during the foreign corporation's annual accounting period ending with or within the u.s. Web schedule m must be completed by category 4 filers of the form 5471 to report the transactions that occurred during the cfc’s annual accounting period ending with or within the u.s. For instructions and the latest information. Web changes to separate schedule e (form 5471). Web schedule m (form 5471) (rev. Form 5471 filers generally use the same category of filer codes used on form 1118. Schedule m (form 5471) (rev. Web for paperwork reduction act notice, see the instructions for form 5471.

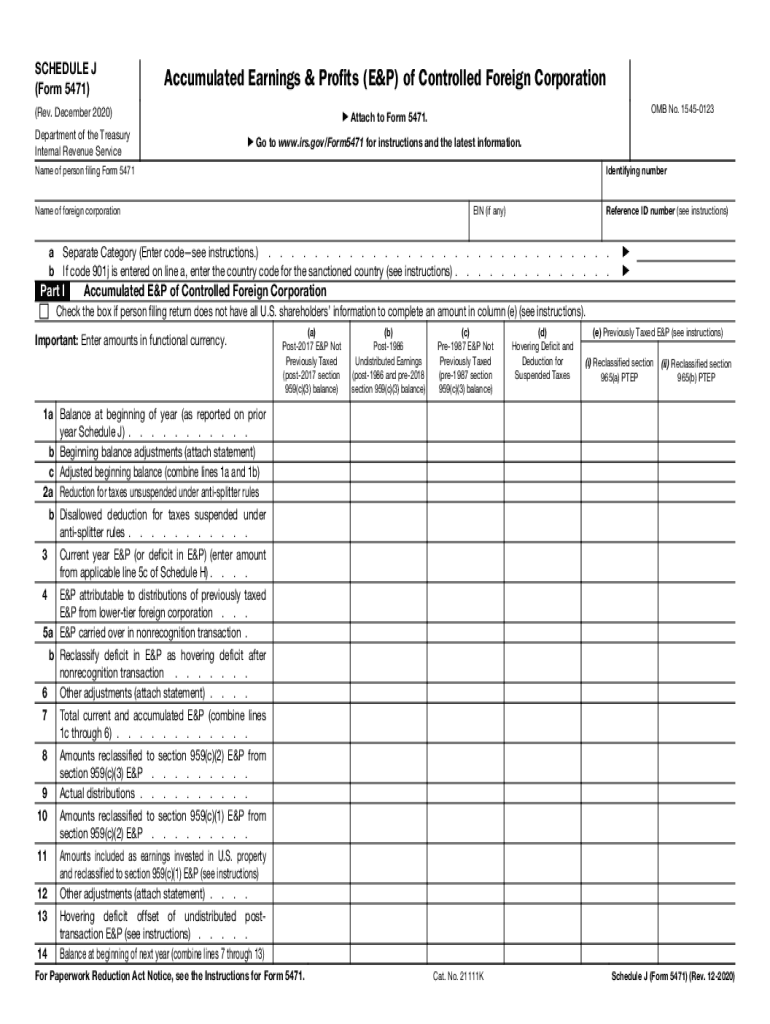

Web form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company transactions, foreign taxes, foreign bank and financial accounts, accumulated earnings and profits, and currency conversions. December 2021) department of the treasury internal revenue service. Web schedule m (form 5471) (rev. Web for paperwork reduction act notice, see the instructions for form 5471. Transactions between controlled foreign corporation and shareholders or other related persons. Form 5471 filers generally use the same category of filer codes used on form 1118. For instructions and the latest information. Web changes to separate schedule e (form 5471). However, in the case of schedule j (form 5471) filers, if a foreign corporation has more than one of those categories of income, the filer must also complete and file a separate schedule j using code “total” that aggregates all amounts Person described in category 4 must file schedule m to report the transactions that occurred during the foreign corporation’s annual accounting period ending with or within the u.s.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Web as provided by the schedule m, form 5471 instructions: Web schedule m must be completed by category 4 filers of the form 5471 to report the transactions that occurred during the cfc’s annual accounting period ending with or within the u.s. Form 5471 filers generally use the same category of filer codes used on form 1118. However, in the.

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Form 5471 filers generally use the same category of filer codes used on form 1118. However, in the case of schedule j (form 5471) filers, if a foreign corporation has more than one of those categories of income, the filer must also complete and file a separate schedule j using code “total” that aggregates all amounts Schedule m (form 5471).

IRS Form 5471 Carries Heavy Penalties and Consequences

Web changes to separate schedule e (form 5471). However, in the case of schedule j (form 5471) filers, if a foreign corporation has more than one of those categories of income, the filer must also complete and file a separate schedule j using code “total” that aggregates all amounts Web schedule m must be completed by category 4 filers of.

IRS 5471 Schedule J 20202022 Fill out Tax Template Online US

Name of person filing form. Web changes to separate schedule e (form 5471). Person described in category 4 must file schedule m to report the transactions that occurred during the foreign corporation’s annual accounting period ending with or within the u.s. Form 5471 filers generally use the same category of filer codes used on form 1118. Web changes to separate.

The Tax Times IRS Issues Updated New Form 5471 What's New?

Reporting transactions on schedule m schedule m categorizes transactions in multiple ways. Web for paperwork reduction act notice, see the instructions for form 5471. Web schedule m must be completed by category 4 filers of the form 5471 to report the transactions that occurred during the cfc’s annual accounting period ending with or within the u.s. Web as provided by.

Should You File a Form 5471 or Form 5472? Asena Advisors

Officers and directors, part ii to be completed by. Web form 5471 filers generally use the same category of filer codes used on form 1118. Reporting transactions on schedule m schedule m categorizes transactions in multiple ways. Person described in category 4 must file schedule m to report the transactions that occurred during the foreign corporation’s annual accounting period ending.

IRS Form 5471 Schedule M Download Fillable PDF or Fill Online

Form 5471 filers generally use the same category of filer codes used on form 1118. However, in the case of schedule j (form 5471) filers, if a foreign corporation has more than one of those categories of income, the filer must also complete and file a separate schedule j using code “total” that aggregates all amounts Officers and directors, part.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Person described in category 4 must file schedule m to report the transactions that occurred during the foreign corporation’s annual accounting period ending with or within the u.s. Web for paperwork reduction act notice, see the instructions for form 5471. Schedule m (form 5471) (rev. For instructions and the latest information. Form 5471 filers generally use the same category of.

Editable IRS Form 5471 2018 2019 Create A Digital Sample in PDF

Web as provided by the schedule m, form 5471 instructions: Web form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company transactions, foreign taxes, foreign bank and financial accounts, accumulated earnings and profits, and currency conversions. Transactions between controlled foreign corporation and shareholders or other related persons. For instructions and the latest information. Web schedule.

Demystifying the Form 5471 Part 8. Schedule M SF Tax Counsel

Form 5471 filers generally use the same category of filer codes used on form 1118. For instructions and the latest information. Web for paperwork reduction act notice, see the instructions for form 5471. Web schedule m must be completed by category 4 filers of the form 5471 to report the transactions that occurred during the cfc’s annual accounting period ending.

Officers And Directors, Part Ii To Be Completed By.

Web form 5471 filers generally use the same category of filer codes used on form 1118. Web as provided by the schedule m, form 5471 instructions: December 2021) department of the treasury internal revenue service. Web schedule m must be completed by category 4 filers of the form 5471 to report the transactions that occurred during the cfc’s annual accounting period ending with or within the u.s.

Form 5471 Filers Generally Use The Same Category Of Filer Codes Used On Form 1118.

Web changes to separate schedule e (form 5471). Transactions between controlled foreign corporation and shareholders or other related persons. Reporting transactions on schedule m schedule m categorizes transactions in multiple ways. Form 5471 filers generally use the same category of filer codes used on form 1118.

Web For Paperwork Reduction Act Notice, See The Instructions For Form 5471.

Person described in category 4 must file schedule m to report the transactions that occurred during the foreign corporation’s annual accounting period ending with or within the u.s. Web schedule m (form 5471), transactions between controlled foreign corporation and shareholders or other related persons foreign corporation’s that file form 5471 use this schedule to report the transactions that occurred during the foreign corporation's annual accounting period ending with or within the u.s. Web schedule m (form 5471) (rev. However, in the case of schedule j (form 5471) filers, if a foreign corporation has more than one of those categories of income, the filer must also complete and file a separate schedule j using code “total” that aggregates all amounts

Schedule M (Form 5471) (Rev.

Name of person filing form. For instructions and the latest information. Web changes to separate schedule e (form 5471). Web form 5471 requires information and details about the corporation's ownership, stock transactions, shareholder and company transactions, foreign taxes, foreign bank and financial accounts, accumulated earnings and profits, and currency conversions.