Form 540 2Ez Instructions

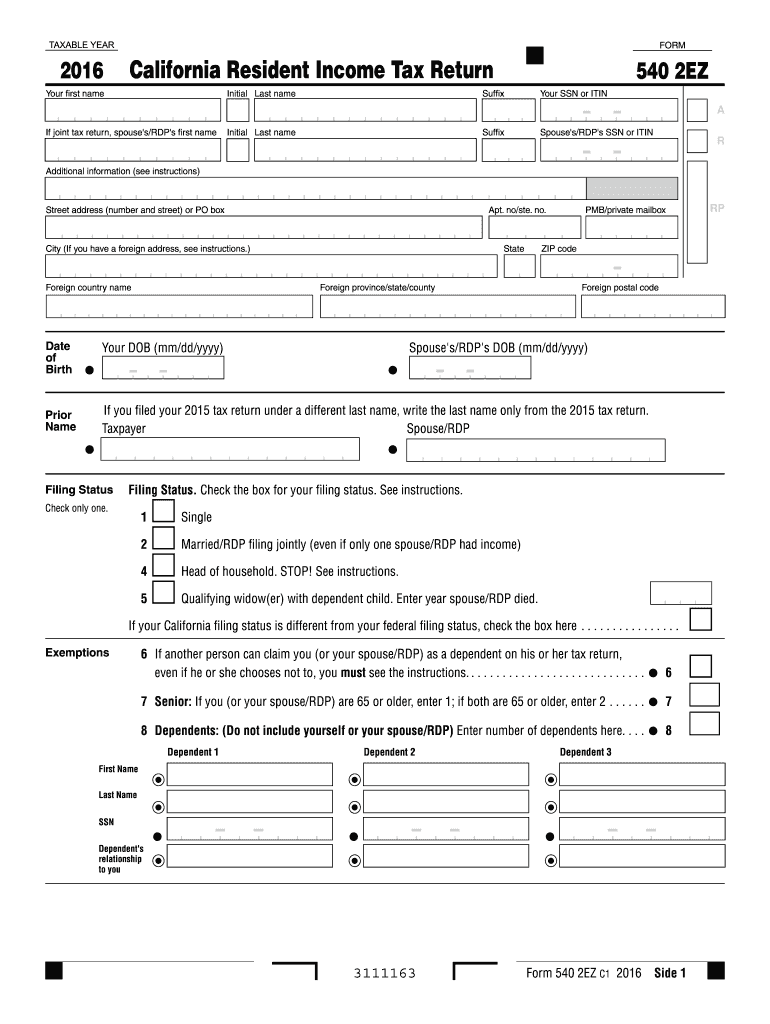

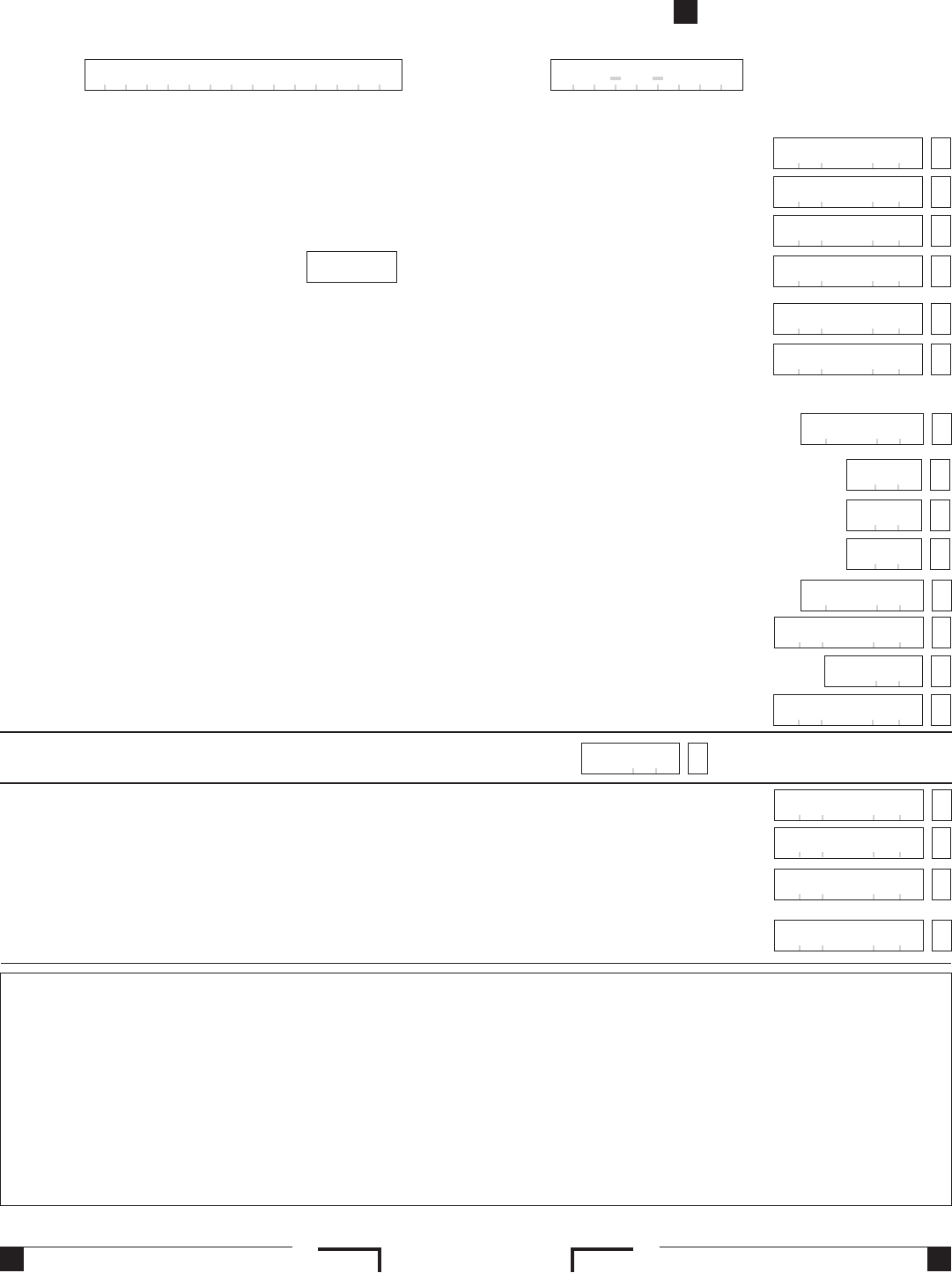

Form 540 2Ez Instructions - This form is for income earned in tax year 2022, with tax returns due in april. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. 5 m qualifying widow(er) with dependent child. Web even if he or she chooses not to, you must see the instructions. Web 2019 instructions for form 540 2ez. This form is for income earned in tax year 2022, with tax returns due in april. Pick the template from the library. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. Single married/rdp filing jointly (even if only one spouse/rdp had income) filing status. Web head of household qualifying surviving spouse/rdp with dependent child * california taxable income enter line 19 of 2022 form 540 or form 540nr caution:

This form is for income earned in tax year 2022, with tax returns due in april. Citizens of the state with moderate incomes and few deductions can save. Web the 540 2ez is a simplified california state tax form for residents who meet certain filing requirements. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. Web adhere to our simple steps to get your california state tax form 540ez instructions well prepared quickly: This form is for income earned in tax year 2022, with tax returns due in april. Things you need to know before you complete. If your california filing status is different from your federal. See “qualifying to use form 540 2ez” on page 3. Web 2019 instructions for form 540 2ez.

Web 540 california resident income tax return form 540pdf download form 540 booklet 540 2ez california resident income tax return form 540 2ezpdf download form 540. Single married/rdp filing jointly (even if only one spouse/rdp had income) filing status. Web 2019 instructions for form 540 2ez. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. Web head of household qualifying surviving spouse/rdp with dependent child * california taxable income enter line 19 of 2022 form 540 or form 540nr caution: Web for example, a single individual, under the age of 65 years, with no dependents and who cannot be claimed by another person, must fi le a pit return if the fi ler’s gross income. See “qualifying to use form 540 2ez” on. 5 m qualifying widow(er) with dependent child. Things you need to know before you complete.

CA FTB 540NR Short 2018 Fill out Tax Template Online US Legal Forms

Pick the template from the library. 5 m qualifying widow(er) with dependent child. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and the california revenue and. See “qualifying to use form 540 2ez” on. Web 540 2ez california resident income tax return.

2018 Form CA FTB 540 Fill Online, Printable, Fillable, Blank pdfFiller

Pick the template from the library. Web even if he or she chooses not to, you must see the instructions. Web the 540 2ez is a simplified california state tax form for residents who meet certain filing requirements. Citizens of the state with moderate incomes and few deductions can save. Web 540 california resident income tax return form 540pdf download.

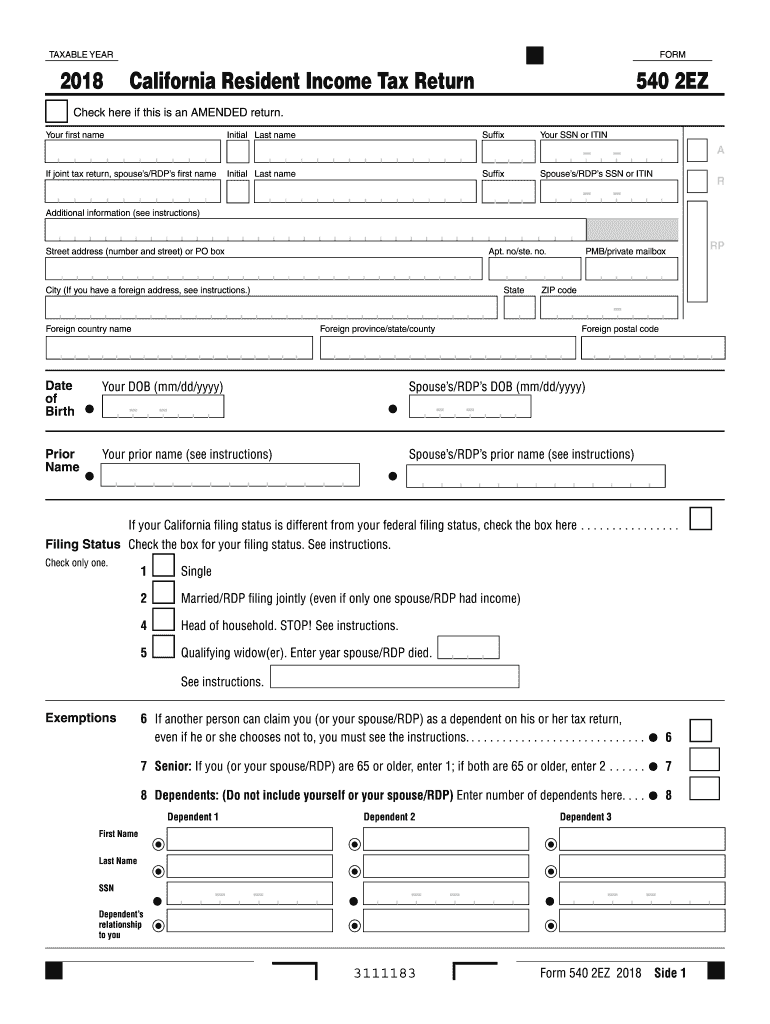

2018 Form CA FTB 540 2EZ Fill Online, Printable, Fillable, Blank

See “qualifying to use form 540 2ez” on page 3. Web 540 california resident income tax return form 540pdf download form 540 booklet 540 2ez california resident income tax return form 540 2ezpdf download form 540. See “qualifying to use form 540 2ez” on. Single married/rdp filing jointly (even if only one spouse/rdp had income) filing status. Web 540 2ez.

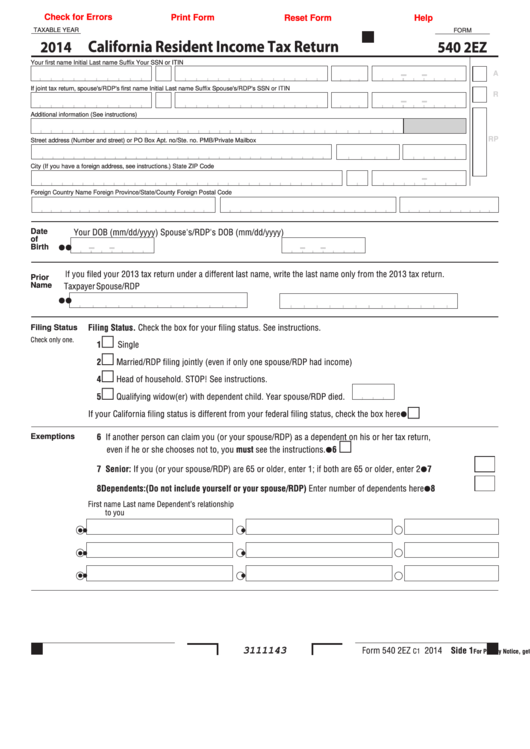

Fillable Form 540 2ez California Resident Tax Return 2014

Citizens of the state with moderate incomes and few deductions can save. Web even if he or she chooses not to, you must see the instructions. This form is for income earned in tax year 2022, with tax returns due in april. Web 540 2ez california resident income tax return. Web the 540 2ez is a simplified california state tax.

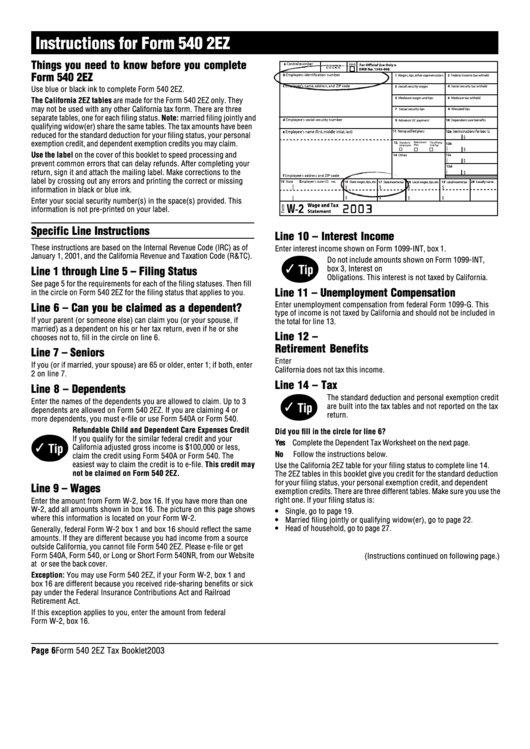

Instructions For Form 540 2ez California Resident Tax Return

References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and the california revenue and. Web 540 california resident income tax return form 540pdf download form 540 booklet 540 2ez california resident income tax return form 540 2ezpdf download form 540. Web adhere to our simple steps to get your california state tax form.

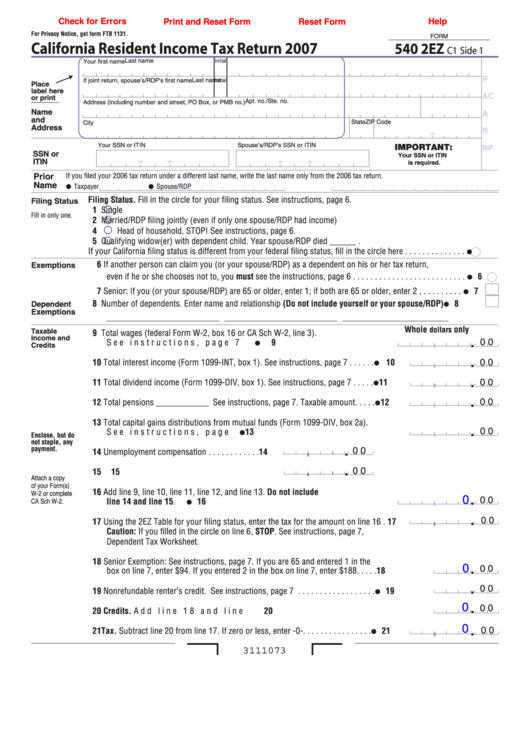

Fillable Form 540 2ez California Resident Tax Return 2007

Web even if he or she chooses not to, you must see the instructions. Pick the template from the library. Single married/rdp filing jointly (even if only one spouse/rdp had income) filing status. This form is for income earned in tax year 2022, with tax returns due in april. If your california filing status is different from your federal.

Form 540 2ez Fill Out and Sign Printable PDF Template signNow

Things you need to know before you complete. Citizens of the state with moderate incomes and few deductions can save. Web adhere to our simple steps to get your california state tax form 540ez instructions well prepared quickly: If your california filing status is different from your federal. See “qualifying to use form 540 2ez” on.

2015 California Resident Tax Return Form 540 2Ez Edit, Fill

5 m qualifying widow(er) with dependent child. Enter all necessary information in. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. See “qualifying to use form 540 2ez” on. This form is for income earned in tax year 2022, with tax returns due in april.

CA FTB 540 20202022 Fill out Tax Template Online US Legal Forms

Citizens of the state with moderate incomes and few deductions can save. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. Web the 540 2ez is a simplified california state tax form for residents who meet certain filing requirements. Web 540 california resident income tax.

20202022 Form CA 540 2EZ Tax Booklet Fill Online, Printable, Fillable

See “qualifying to use form 540 2ez” on. Web 540 california resident income tax return form 540pdf download form 540 booklet 540 2ez california resident income tax return form 540 2ezpdf download form 540. Web the 540 2ez is a simplified california state tax form for residents who meet certain filing requirements. Things you need to know before you complete..

Web Even If He Or She Chooses Not To, You Must See The Instructions.

5 m qualifying widow(er) with dependent child. Web 540 california resident income tax return form 540pdf download form 540 booklet 540 2ez california resident income tax return form 540 2ezpdf download form 540. This form is for income earned in tax year 2022, with tax returns due in april. Web 2019 instructions for form 540 2ez.

If Your California Filing Status Is Different From Your Federal.

References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and the california revenue and. Enter all necessary information in. Web head of household qualifying surviving spouse/rdp with dependent child * california taxable income enter line 19 of 2022 form 540 or form 540nr caution: See “qualifying to use form 540 2ez” on page 3.

Web January 1, 2015, Things You Need To Know Before You Complete Form 540 2Ez Determine If You Qualify To Use Form 540 2Ez.

Web the 540 2ez is a simplified california state tax form for residents who meet certain filing requirements. Web january 1, 2015, things you need to know before you complete form 540 2ez determine if you qualify to use form 540 2ez. Web for example, a single individual, under the age of 65 years, with no dependents and who cannot be claimed by another person, must fi le a pit return if the fi ler’s gross income. This form is for income earned in tax year 2022, with tax returns due in april.

Web January 1, 2015, Things You Need To Know Before You Complete Form 540 2Ez Determine If You Qualify To Use Form 540 2Ez.

Single married/rdp filing jointly (even if only one spouse/rdp had income) filing status. Web adhere to our simple steps to get your california state tax form 540ez instructions well prepared quickly: See “qualifying to use form 540 2ez” on. This form is for income earned in tax year 2022, with tax returns due in april.