Form 5227 Due Date

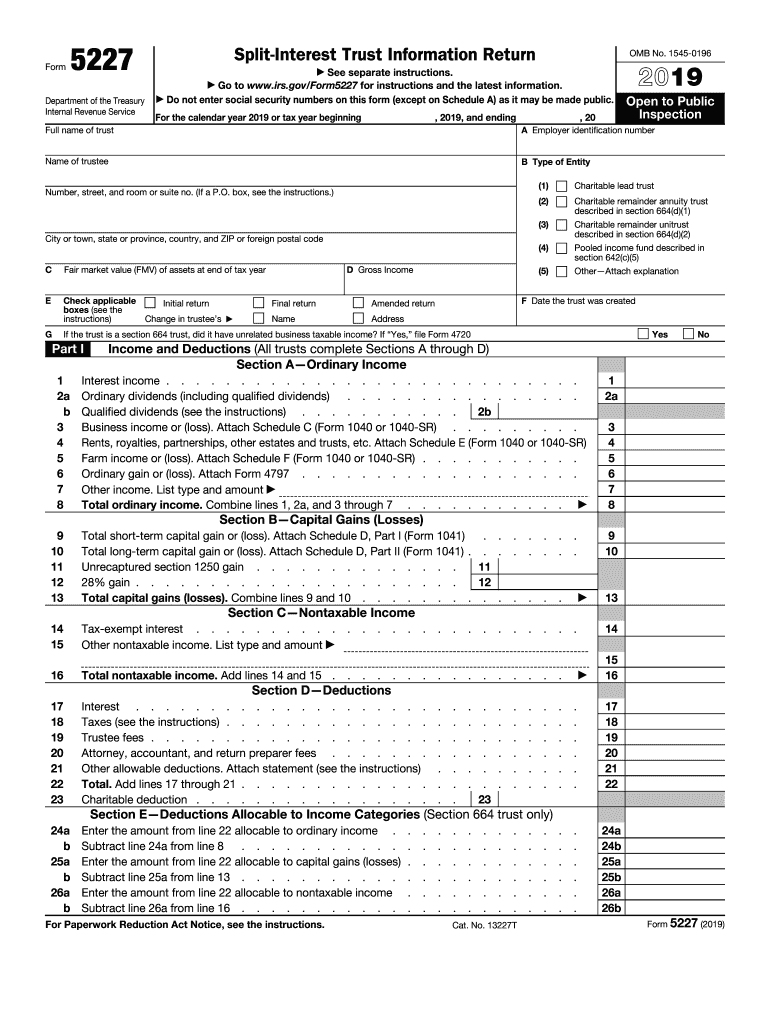

Form 5227 Due Date - Web tags the irs extends filing deadlines for nonprofit organizations to further provide aid to nonprofit organizations and foundations,. These regulations are effective january 30, 2020. Part i income and deductions. Form 6069 returns of excise taxes shall be. Form 6069 returns of excise. 2 part ii schedule of distributable income (section 664. Web date the trust was created. Web 16 rows form 5227, split interest trust information return pdf. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. Web a calendar year form 5227 is due by april 15, 20yy.

Web 16 rows form 5227, split interest trust information return pdf. Web the trustee will file form 5227 for the crt (crat or crut) using a calendar tax year. Gross income for the taxable year of. Web tags the irs extends filing deadlines for nonprofit organizations to further provide aid to nonprofit organizations and foundations,. 2 part ii schedule of distributable income (section 664. 2 part ii schedule of distributable income (section 664. Web electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes online. Part i income and deductions. See the instructions pdf for more. Web date the trust was created.

Web tags the irs extends filing deadlines for nonprofit organizations to further provide aid to nonprofit organizations and foundations,. A separate extension may need to be filed to extend the due date of these. Part i income and deductions. 5227 (2021) form 5227 (2021) page. Web 16 rows form 5227, split interest trust information return pdf. Web an extension of 6 months for the filing of the return of income taxes imposed by subtitle a shall be allowed any corporation if, in such manner and at such time as the secretary. Web a calendar year form 5227 is due by april 15, 20yy. Gross income for the taxable year of. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. If an extension of time to file is.

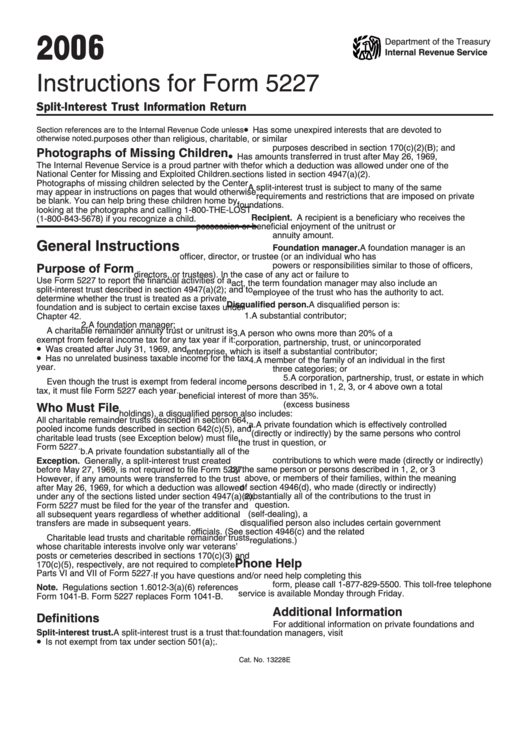

Instructions For Form 5227 printable pdf download

Part i income and deductions. Part i income and deductions. Gross income for the taxable year of. See the instructions pdf for more. 5227 (2022) form 5227 (2022) page.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

2 part ii schedule of distributable income (section 664. The tax return has schedules which track various ‘buckets’ or. Web an alternative minimum tax liability. Web the most recent guidance released april 9, 2020, extends the july 15 tax filing and payment deadline for estimated tax payments and any income, gift, or estate tax due dates —. Part i income.

5227 Instructions Form Fill Out and Sign Printable PDF Template signNow

The tax return has schedules which track various ‘buckets’ or. Part i income and deductions. A separate extension may need to be filed to extend the due date of these. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. 5227 (2022) form 5227 (2022) page.

Date due library form stock photo. Image of public, post 79103678

A separate extension may need to be filed to extend the due date of these. Gross income for the taxable year of. 5227 (2022) form 5227 (2022) page. These regulations are effective january 30, 2020. The tax return has schedules which track various ‘buckets’ or.

Due Date for furnishing FORM GSTR1 for April 2021 extended amid COVID19

Web the trustee will file form 5227 for the crt (crat or crut) using a calendar tax year. Form 6069 returns of excise taxes shall be. These regulations are effective january 30, 2020. Web tags the irs extends filing deadlines for nonprofit organizations to further provide aid to nonprofit organizations and foundations,. Web date the trust was created.

Escort GL 1.6 Alcool FIA Historic Database

The tax return has schedules which track various ‘buckets’ or. Web date the trust was created. Web a calendar year form 5227 is due by april 15, 20yy. Form 6069 returns of excise. Part i income and deductions.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Web internal revenue service dates: Web date the trust was created. Web * when the due date for doing any act for tax purposes—filing a return, paying taxes, etc.— falls on a saturday, sunday, or legal holiday, the due date is delayed until the next. See the instructions pdf for more. 5227 (2022) form 5227 (2022) page.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

See the instructions pdf for more. 2 part ii schedule of distributable income (section 664. 5227 (2021) form 5227 (2021) page. 5227 (2022) form 5227 (2022) page. Web * when the due date for doing any act for tax purposes—filing a return, paying taxes, etc.— falls on a saturday, sunday, or legal holiday, the due date is delayed until the.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. Part i income and deductions. Web an extension of 6 months for the filing of the return of income taxes imposed by subtitle a shall be allowed any corporation if, in such manner and at such time as the secretary. Part i.

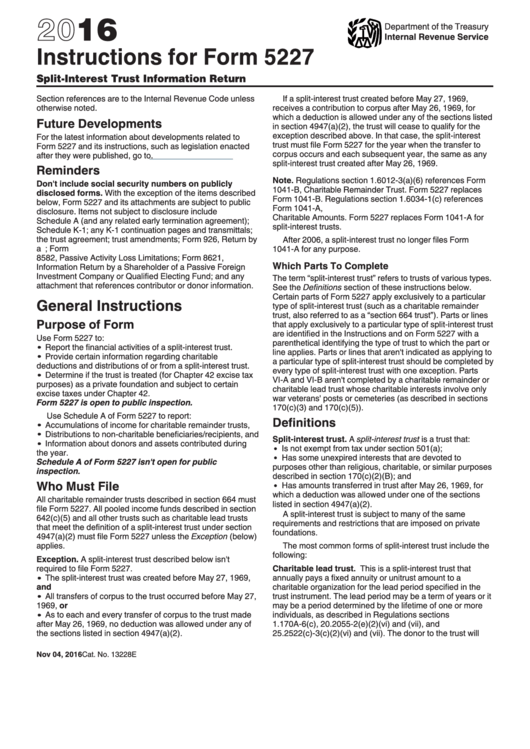

Instructions For Form 5227 2016 printable pdf download

Gross income for the taxable year of. A separate extension may need to be filed to extend the due date of these. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. Part i income and deductions. The fiduciary (or one of the fiduciaries) must file form 541 for a trust if.

See The Instructions Pdf For More.

Web an extension of 6 months for the filing of the return of income taxes imposed by subtitle a shall be allowed any corporation if, in such manner and at such time as the secretary. A separate extension may need to be filed to extend the due date of these. Web electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes online. Web internal revenue service dates:

Web A Calendar Year Form 5227 Is Due By April 15, 20Yy.

Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. Form 6069 returns of excise. The fiduciary (or one of the fiduciaries) must file form 541 for a trust if any of the following apply: Web date the trust was created.

Web Date The Trust Was Created.

Part i income and deductions. Form 6069 returns of excise taxes shall be. Web 16 rows form 5227, split interest trust information return pdf. 2 part ii schedule of distributable income (section 664.

2 Part Ii Schedule Of Distributable Income (Section 664.

Gross income for the taxable year of. 5227 (2021) form 5227 (2021) page. Web an alternative minimum tax liability. Web tags the irs extends filing deadlines for nonprofit organizations to further provide aid to nonprofit organizations and foundations,.