Form 500 Ga Instructions

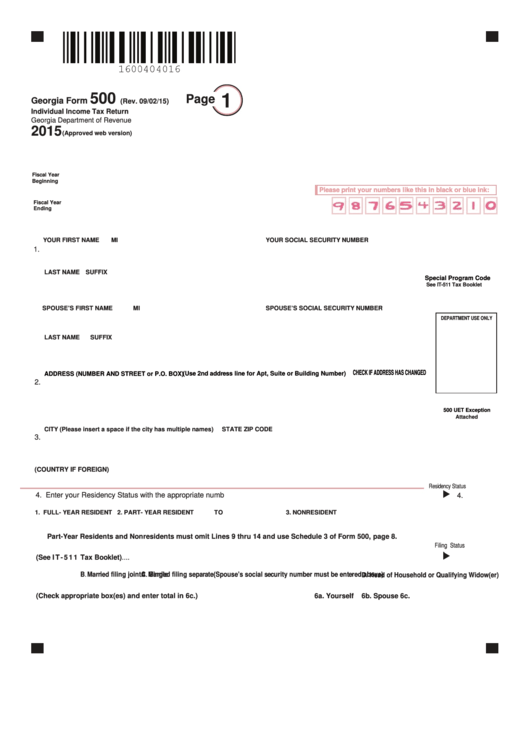

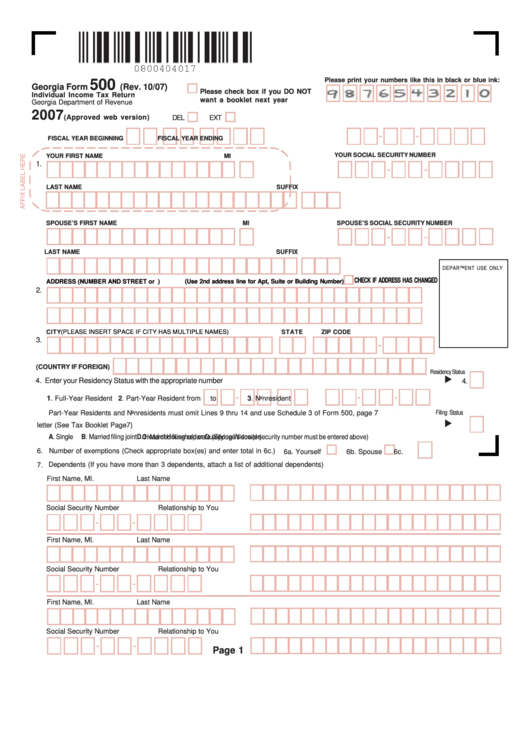

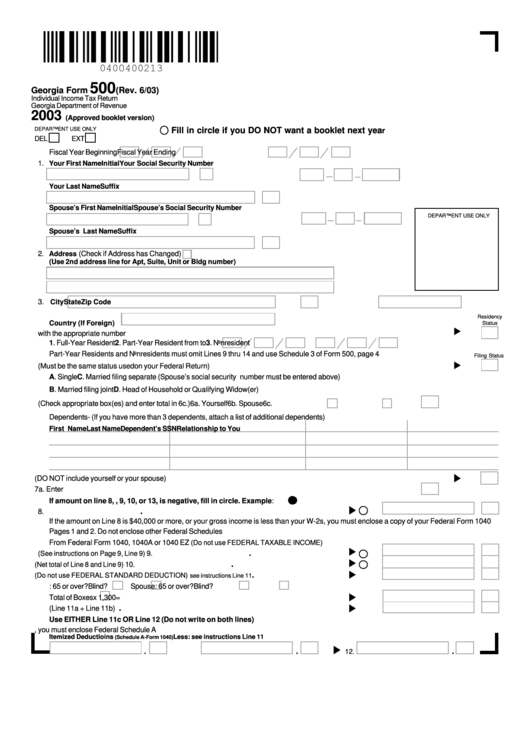

Form 500 Ga Instructions - Web georgia form 500 instructions general instructions where do you file? Web georgia department of revenue save form. Web get form download the form how to edit the ga 500 instructions quickly and easily online start on editing, signing and sharing your ga 500 instructions online with the. Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Follow all instructions to complete the form and be sure to verify that all your information is correct before. Web form 500 instructions include all completed schedules with your georgia return. Dependents (if you have more. Web more about the georgia form 500 individual income tax tax return ty 2022. Form 500 is the general income tax return form for all georgia residents. 06/20/20) individual income tax return georgia department of revenue 2020 (approved web version) page 1 fiscal year beginning r fsion)iscal year.

Print blank form > georgia department of revenue. This form is for income earned in tax year 2022, with tax returns due in april. Georgia individual income tax is based on the taxpayer's. Follow all instructions to complete the form and be sure to verify that all your information is correct before. Web more about the georgia form 500 individual income tax tax return ty 2022. Completing the form online is. Web georgia form 500 (rev. Web georgia department of revenue use this form for the 2019 tax year only. Web forms in tax booklet: Web form 500 instructions include all completed schedules with your georgia return.

Web the tips below will help you fill in ga 500 instructions quickly and easily: 06/20/19) individual income tax return georgia department of revenue 2019(approved web version) pag e1 fiscal yearbeginning fiscal year. 06/20/20) individual income tax return georgia department of revenue 2020 (approved web version) page 1 fiscal year beginning r fsion)iscal year. Form 500 is the general income tax return form for all georgia residents. Submitting this form for a prior tax year, will delay the processing of your return. Dependents (if you have more. Web georgia department of revenue use this form for the 2019 tax year only. Form 500 requires you to. Complete your federal return before starting your georgia return. Web georgia department of revenue save form.

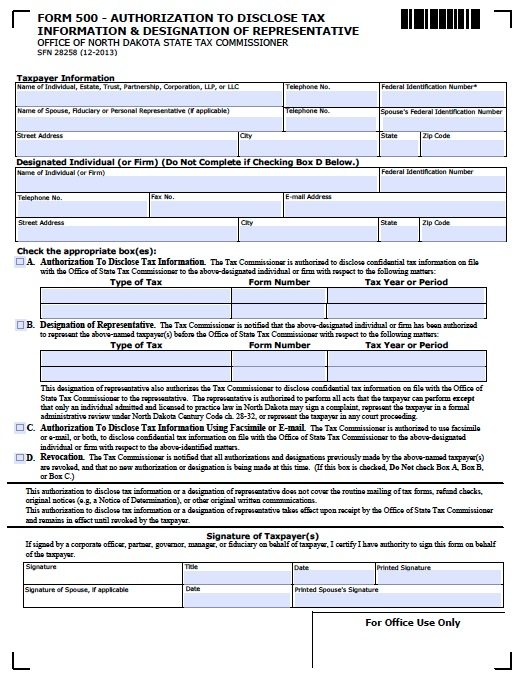

Free Tax Power of Attorney North Dakota Form 500 Adobe PDF

Form 500 is the general income tax return form for all georgia residents. Web more about the georgia form 500 individual income tax tax return ty 2022. Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Your social security number gross income is less than your you must. Fill out the.

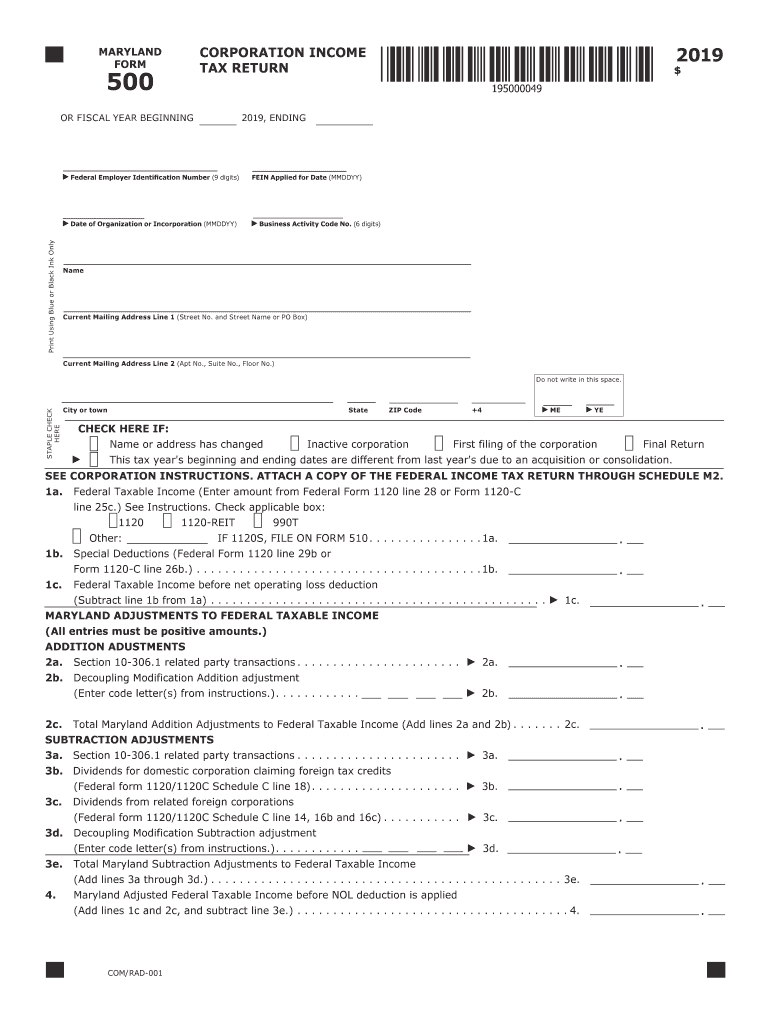

Form 500 Instructions 2019 lwtaylorartanddesign

Web the tips below will help you fill in ga 500 instructions quickly and easily: Follow all instructions to complete the form and be sure to verify that all your information is correct before. Web forms in tax booklet: Submitting this form for a prior tax year, will delay the processing of your return. Web georgia department of revenue use.

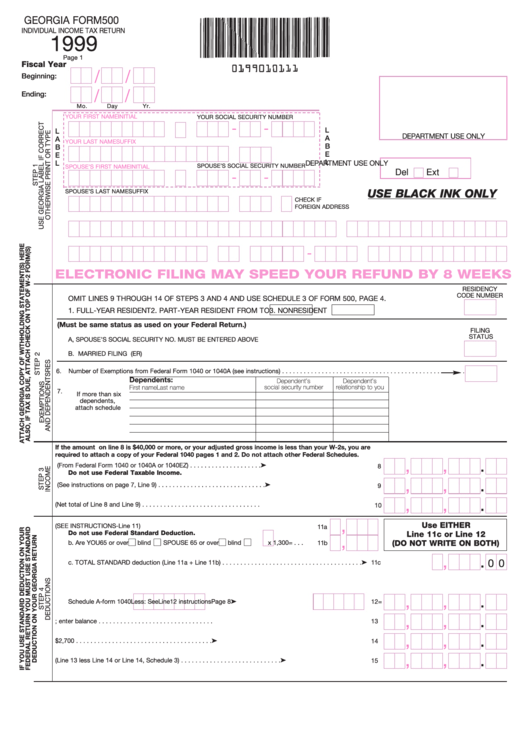

Form 500 Individual Tax Return 1999 printable pdf

Web form 500 instructions include all completed schedules with your georgia return. Fill out the required boxes. Web more about the georgia form 500 individual income tax tax return ty 2022. Complete your federal return before starting your georgia return. Completing the form online is.

GA Form 500 20182022 Fill out Tax Template Online US Legal Forms

Web georgia form 500 (rev. 06/20/20) individual income tax return georgia department of revenue 2020 (approved web version) page 1 fiscal year beginning r fsion)iscal year. Follow all instructions to complete the form and be sure to verify that all your information is correct before. Web georgia individual income tax returns must be received or postmarked by the april 18,.

Form 500 Instructions 2019 lwtaylorartanddesign

Web form 500 instructions include all completed schedules with your georgia return. 06/20/20) individual income tax return georgia department of revenue 2020 (approved web version) page 1 fiscal year beginning r fsion)iscal year. Fill out the required boxes. Submitting this form for a prior tax year, will delay the processing of your return. Web forms in tax booklet:

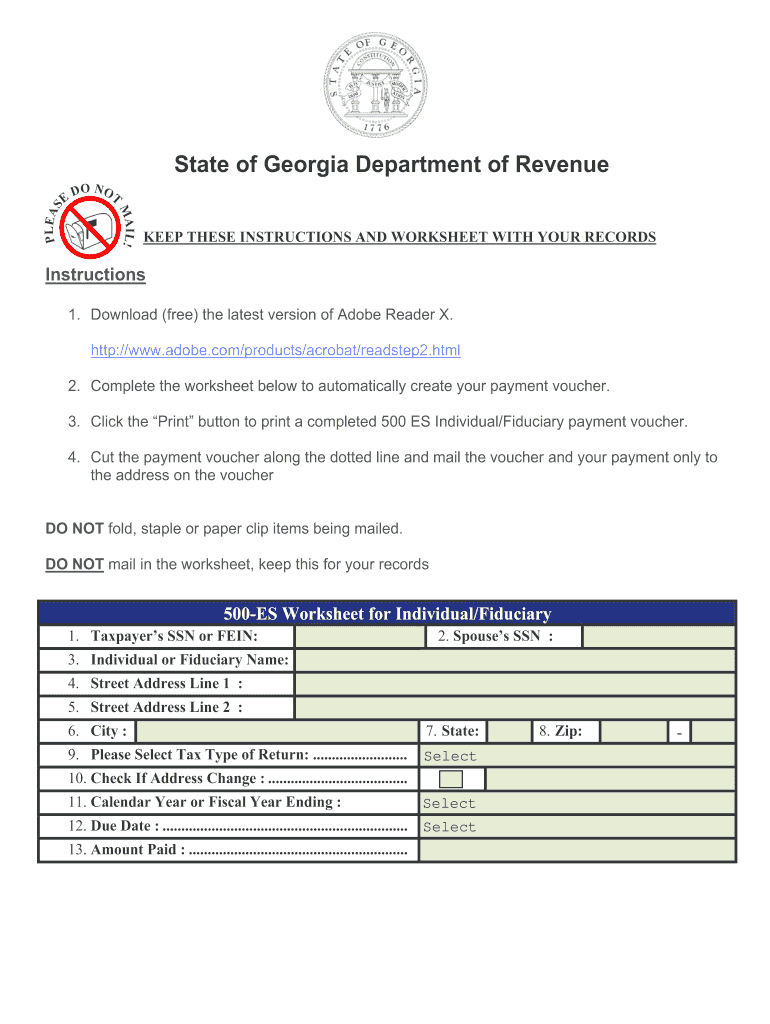

Estimated Tax Payments 2021 Fill Online, Printable, Fillable

Your social security number gross income is less than your you must. Form 500 requires you to. Web georgia form 500 instructions general instructions where do you file? Web fill out and submit a form 500 individual income tax return. Web georgia department of revenue save form.

Fillable Form 500 Indvidual Tax Form

Complete your federal return before starting your georgia return. Web georgia department of revenue save form. Web form 500 instructions include all completed schedules with your georgia return. Web the tips below will help you fill in ga 500 instructions quickly and easily: Web fill out and submit a form 500 individual income tax return.

Fillable Form 500 Individual Tax Return (2007)

Web georgia department of revenue use this form for the 2019 tax year only. Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Completing the form online is. Submitting this form for a prior tax year, will delay the processing of your return. Georgia individual income tax is based on the.

State Tax Form 500ez bestkup

Web we last updated georgia form 500 in january 2023 from the georgia department of revenue. Dependents (if you have more. Web georgia form 500 (rev. Submitting this form for a prior tax year, will delay the processing of your return. Georgia individual income tax is based on the taxpayer's.

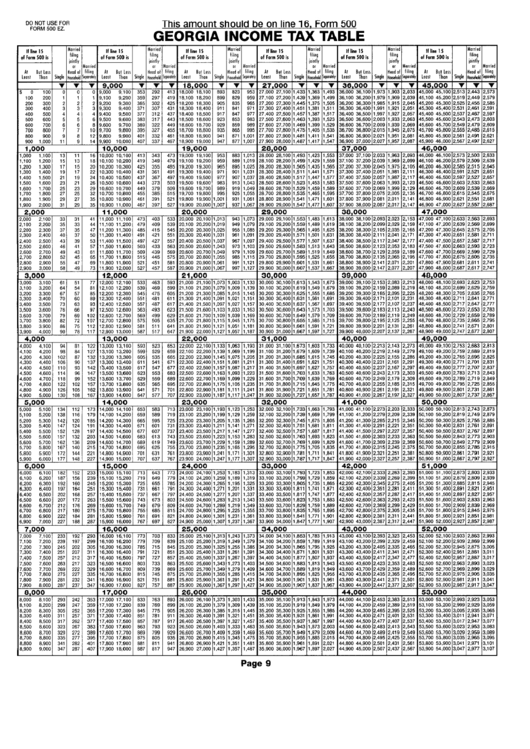

Form 500 Tax Table printable pdf download

Form 500 is the general income tax return form for all georgia residents. Submitting this form for a prior tax year, will delay the processing of your return. Print blank form > georgia department of revenue. All forms must be printed and mailed to address listed on the form. Web we last updated georgia form 500 in january 2023 from.

Web Forms In Tax Booklet:

Fill out the required boxes. Your social security number gross income is less than your you must. Dependents (if you have more. Complete your federal return before starting your georgia return.

Georgia Individual Income Tax Is Based On The Taxpayer's.

Web the tips below will help you fill in ga 500 instructions quickly and easily: Print blank form > georgia department of revenue. Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Web form 500 instructions include all completed schedules with your georgia return.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Web georgia form 500 (rev. Form 500 is the general income tax return form for all georgia residents. 06/20/19) individual income tax return georgia department of revenue 2019(approved web version) pag e1 fiscal yearbeginning fiscal year. Web georgia department of revenue use this form for the 2019 tax year only.

Form 500 Requires You To.

Web more about the georgia form 500 individual income tax tax return ty 2022. Web georgia form 500 instructions general instructions where do you file? Web georgia department of revenue save form. Completing the form online is.