Form 4952 Pdf

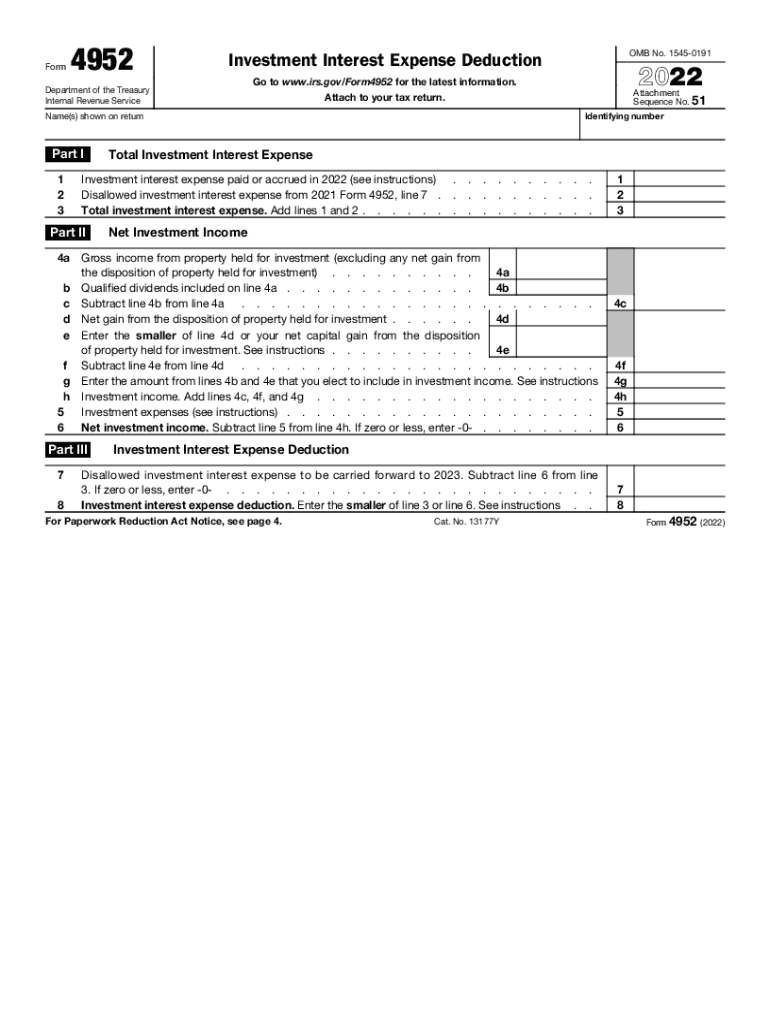

Form 4952 Pdf - Web form 4952 investment interest expense deduction department of the treasury internal revenue service (99) go to www.irs.gov/form4952 for the latest information. Complete, edit or print tax forms instantly. How you can identify investment interest expense as one of your tax. Web form 4952 department of the treasury internal revenue service (99) investment interest expense deduction go to www.irs.gov/form4952 for the latest information. Web this article will walk you through irs form 4952 so you can better understand: More about the federal form 4952 we last updated. One day you may decide to loan a certain sum and make your first investment. The program automatically includes portfolio deductions (other) on line 5 of form 4952,. Web form 4952 investment interest expense deduction department of the treasury internal revenue service (99) a go to www.irs.gov/form4952 for the latest information. Instructions for form 4952 created date:

Web deduction on schedule a (form 1040), line 23, the 2% adjusted gross income limitation on schedule a (form 1040), line 26, may reduce the amount you must include on form. 13177y form 4952 (2020) title: Web form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Instructions for form 4952 created date: Web form 4952 department of the treasury internal revenue service (99) investment interest expense deduction go to www.irs.gov/form4952 for the latest information. Investment interest expense deduction keywords: More about the federal form 4952 we last updated. Web irs form 4952 determines the amount of deductible investment interest expense as well as interest expense that can be carried forward. Complete, edit or print tax forms instantly. Web form 4952 department of the treasury internal revenue service (99) investment interest expense deduction go to www.irs.gov/form4952 for the latest information.

The program automatically includes portfolio deductions (other) on line 5 of form 4952,. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 4952 investment interest expense deduction department of the treasury internal revenue service. Web irs form 4952 determines the amount of deductible investment interest expense as well as interest expense that can be carried forward. Upload, modify or create forms. Web form 4952 investment interest expense deduction department of the treasury internal revenue service (99) a go to www.irs.gov/form4952 for the latest information. Try it for free now! The form must be filed. Web form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Web form 4952 department of the treasury internal revenue service (99) investment interest expense deduction go to www.irs.gov/form4952 for the latest information.

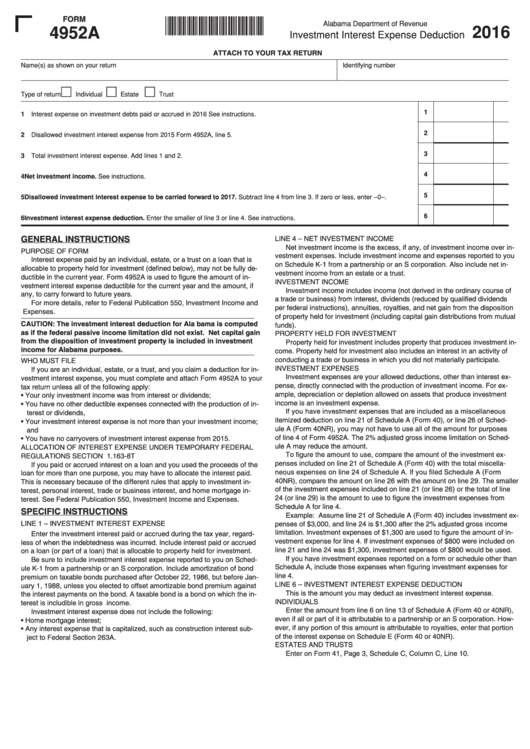

Form 4952a Investment Interest Expense Deduction 2016 printable pdf

Instructions for form 4952 created date: The form must be filed. As with many tax forms, form 6252 is very lengthy and can take some time to fill out. Web irs form 4952 determines the amount of deductible investment interest expense as well as interest expense that can be carried forward. Web any income earned from this installment plan will.

Form 4952 Fill Out and Sign Printable PDF Template signNow

Try it for free now! The form must be filed. Web irs form 4952 determines the amount of deductible investment interest expense as well as interest expense that can be carried forward. Web form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to.

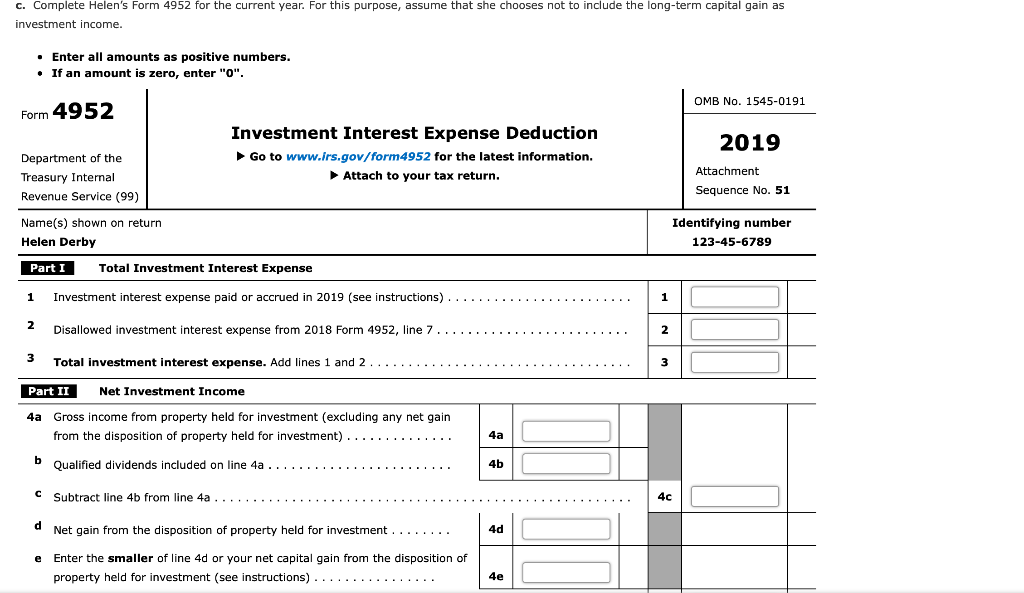

Helen Derby borrowed 150,000 to acquire a parcel of

Ad get ready for tax season deadlines by completing any required tax forms today. More about the federal form 4952 we last updated. The program automatically includes portfolio deductions (other) on line 5 of form 4952,. Instructions for form 4952 created date: 13177y form 4952 (2020) title:

Fill Free fillable Investment Interest Expense Deduction 4952 PDF form

Try it for free now! Web enter the amount of investment expenses reported on line 20b. Upload, modify or create forms. The form must be filed. Complete, edit or print tax forms instantly.

1.4952 DIN/EN Steel Material Sheet

The form must be filed. Upload, modify or create forms. Web deduction on schedule a (form 1040), line 23, the 2% adjusted gross income limitation on schedule a (form 1040), line 26, may reduce the amount you must include on form. Download or email irs 4952 & more fillable forms, register and subscribe now! Web irs form 4952 determines the.

Form 4952 Investment Interest Expense Deduction Overview

Download or email irs 4952 & more fillable forms, register and subscribe now! Web any income earned from this installment plan will be reported on form 6252. Web form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. Web this article.

Form 4952 Investment Interest Expense Deduction (2015) Free Download

Instructions for form 4952 created date: Investment interest expense deduction keywords: Web irs form 4952 determines the amount of deductible investment interest expense as well as interest expense that can be carried forward. Web form 4952 investment interest expense deduction department of the treasury internal revenue service (99) go to www.irs.gov/form4952 for the latest information. Complete, edit or print tax.

Form 4952 Investment Interest Expense Deduction (2015) Free Download

Web form 4952 department of the treasury internal revenue service (99) investment interest expense deduction go to www.irs.gov/form4952 for the latest information. Web any income earned from this installment plan will be reported on form 6252. Try it for free now! Web form 4952 is used to determine the amount of investment interest expense you can deduct for the current.

U.S. TREAS Form treasirs49521995

Web deduction on schedule a (form 1040), line 23, the 2% adjusted gross income limitation on schedule a (form 1040), line 26, may reduce the amount you must include on form. One day you may decide to loan a certain sum and make your first investment. As with many tax forms, form 6252 is very lengthy and can take some.

Fill Free fillable F4952 Accessible 2019 Form 4952 PDF form

As with many tax forms, form 6252 is very lengthy and can take some time to fill out. The program automatically includes portfolio deductions (other) on line 5 of form 4952,. Web any income earned from this installment plan will be reported on form 6252. Web we last updated the investment interest expense deduction in december 2022, so this is.

Complete, Edit Or Print Tax Forms Instantly.

Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022. Web form 4952 department of the treasury internal revenue service (99) investment interest expense deduction go to www.irs.gov/form4952 for the latest information. Web irs form 4952 determines the amount of deductible investment interest expense as well as interest expense that can be carried forward. Web form 4952 department of the treasury internal revenue service (99) investment interest expense deduction go to www.irs.gov/form4952 for the latest information.

Web Form 4952 Investment Interest Expense Deduction Department Of The Treasury Internal Revenue Service (99) Go To Www.irs.gov/Form4952 For The Latest Information.

Web form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. The form must be filed. Instructions for form 4952 created date: Try it for free now!

One Day You May Decide To Loan A Certain Sum And Make Your First Investment.

The program automatically includes portfolio deductions (other) on line 5 of form 4952,. Upload, modify or create forms. Investment interest expense deduction keywords: Web form 4952 is also not appropriate if you borrow money for a business or for personal use.

13177Y Form 4952 (2020) Title:

Web deduction on schedule a (form 1040), line 23, the 2% adjusted gross income limitation on schedule a (form 1040), line 26, may reduce the amount you must include on form. More about the federal form 4952 we last updated. Web enter the amount of investment expenses reported on line 20b. Download or email irs 4952 & more fillable forms, register and subscribe now!

:max_bytes(150000):strip_icc()/4592-f64c21a16a3847538c094ee48dee34fe.jpg)