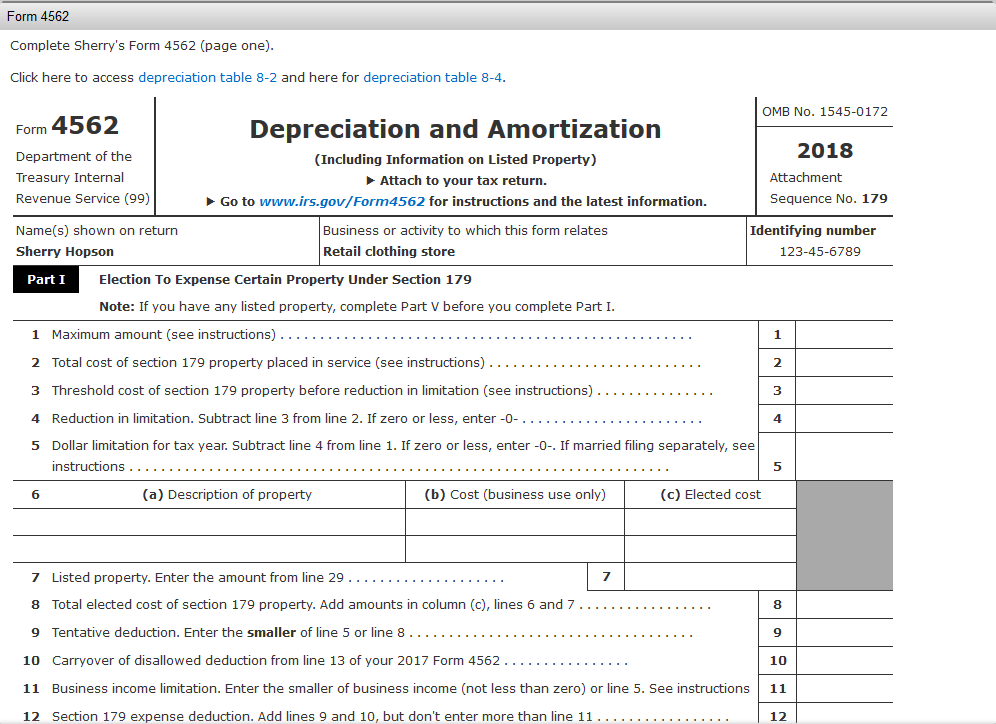

Form 4562 Instruction

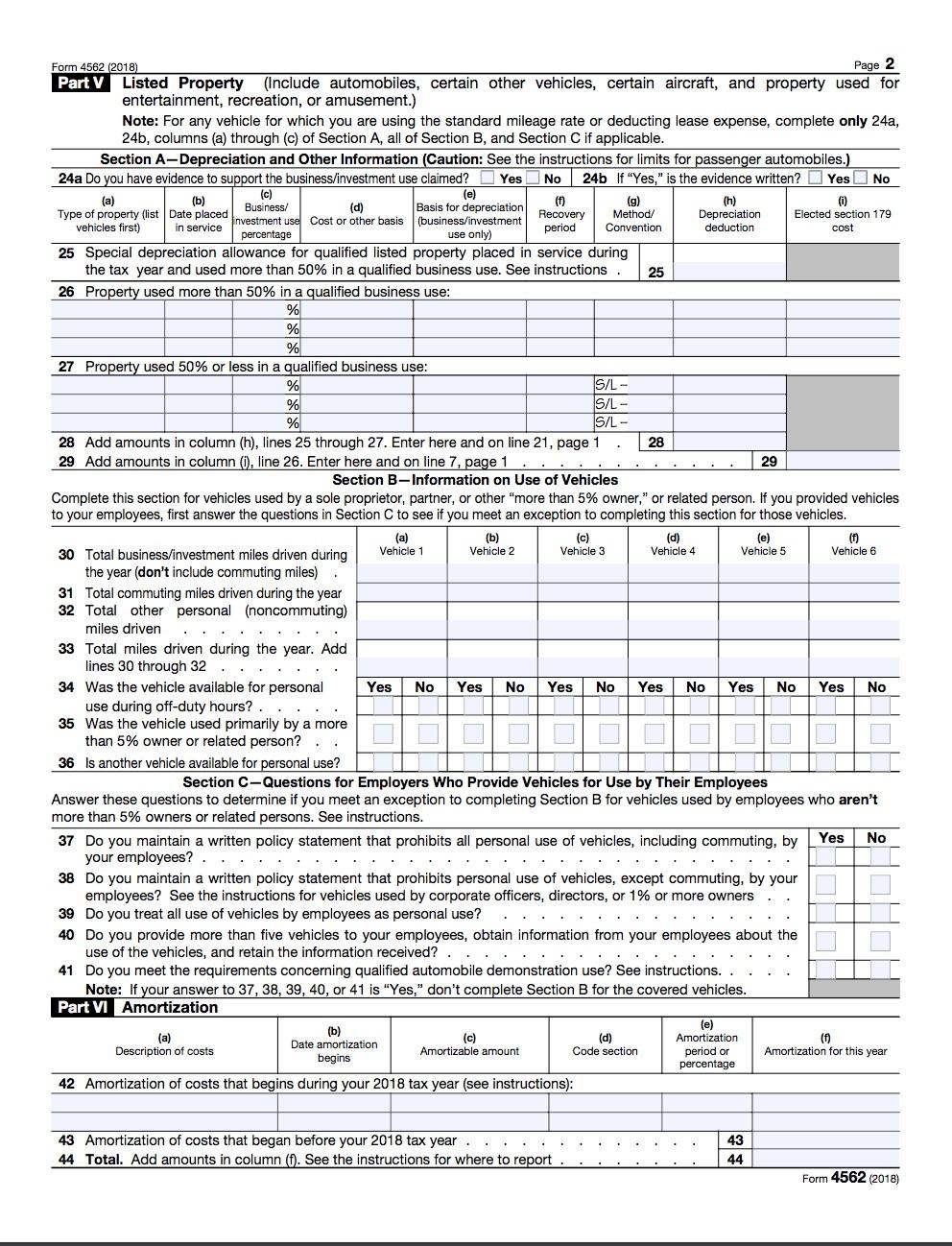

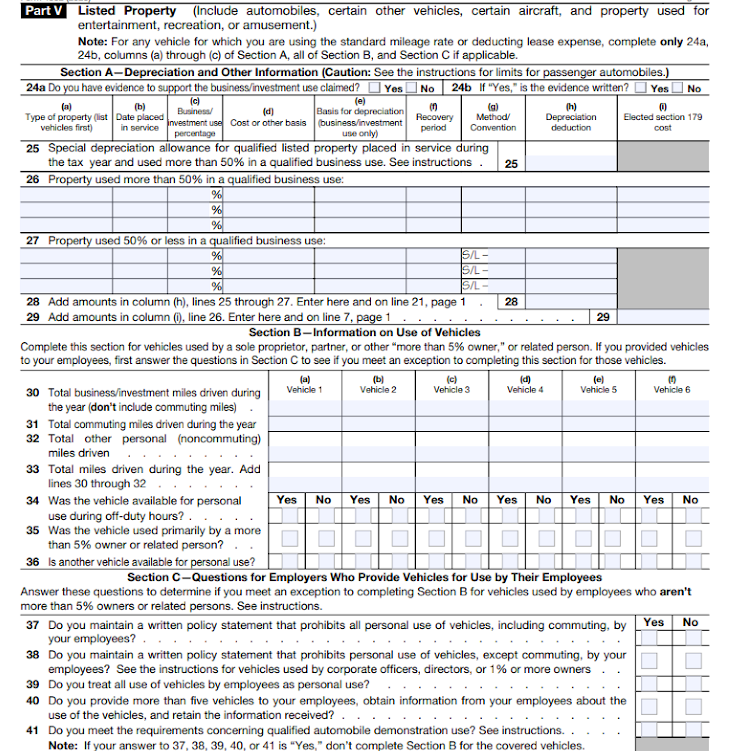

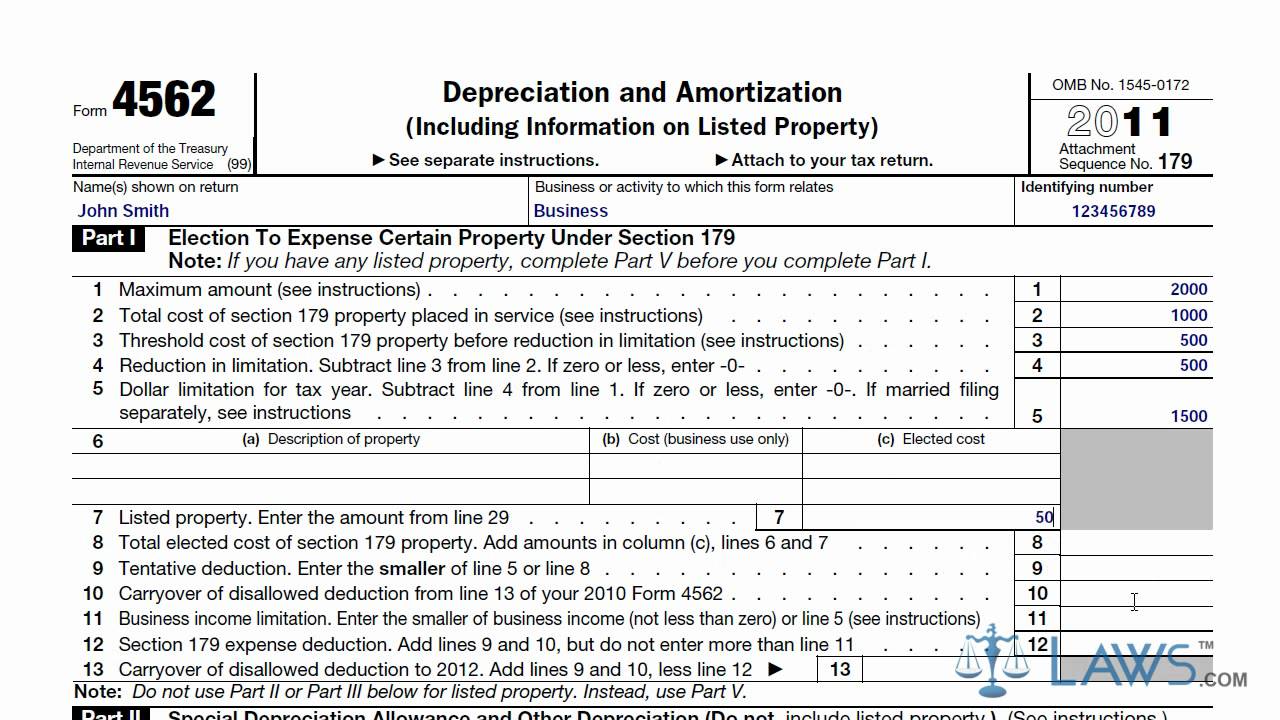

Form 4562 Instruction - Something you’ll need to consider is that the amount you can deduct. Web irs form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible property. • claim your deduction for depreciation and amortization, •. Web what is the purpose of this form? Web form 4562 and the following modifications: Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them. Some examples of tax reductions that require the use of this form include: Web instructions for form 4562 depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted. Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic: Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file.

• claim your deduction for depreciation and amortization, •. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web instructions for form 4562. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense. Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic: Assets such as buildings, machinery,. To complete form 4562, you'll need to know the. • subtract $975,000 from line 1 of federal form 4562, and enter the result on line 1 of minnesota form 4562. 534, depreciating property • for tax years beginning after 2011, • claim your deduction for placed in service before 1987. See the instructions for lines 20a through 20d, later.

To complete form 4562, you'll need to know the. • claim your deduction for depreciation and amortization, •. Web when is form 4562 required? Something you’ll need to consider is that the amount you can deduct. Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them. Web here’s what each line should look like as outlined in the irs form 4562 instructions, along with a few examples. Web general instructions purpose of form use form 4562 to: According to form 4562 instructions, the form is required if the taxpayer claims any of the following: • subtract $975,000 from line 1 of federal form 4562, and enter the result on line 1 of minnesota form 4562. Web the instructions for form 4562 include a worksheet that you can use to complete part i.

How To File Irs Form 4562 Ethel Hernandez's Templates

Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them. Some examples of tax reductions that require the use of this form include: Form 4562 is used to claim a. Assets such as buildings, machinery,. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and.

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

Web when is form 4562 required? Form 4562 is used to claim a. Web what is the purpose of this form? • subtract $975,000 from line 1 of federal form 4562, and enter the result on line 1 of minnesota form 4562. Web here’s what each line should look like as outlined in the irs form 4562 instructions, along with.

Instructions for IRS Form 4562 Depreciation and Amortization

Web here’s what each line should look like as outlined in the irs form 4562 instructions, along with a few examples. Form 4562 is used to claim a. 534, depreciating property • for tax years beginning after 2011, • claim your deduction for placed in service before 1987. Web irs form 4562 is used to claim deductions for depreciation and.

2012 Form 4562 Instructions Universal Network

Web you’ll need to file form 4562 each year you continue to depreciate the asset. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense. 534, depreciating property • for tax years beginning after 2011, • claim your deduction for placed in service before 1987. Web the instructions for form 4562 include a.

How do I fill out Irs Form 4562 for this computer.

Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web when is form 4562 required? Web instructions for form 4562 depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted. Assets such as buildings, machinery,. Web get answers to frequently asked questions about form.

IRS Form 4562 Explained A StepbyStep Guide The Blueprint

• claim your deduction for depreciation and amortization, • make the election under section 179 to expense. General instructions purpose of form use form 4562 to: • claim your deduction for depreciation and amortization, •. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web you’ll need to file form.

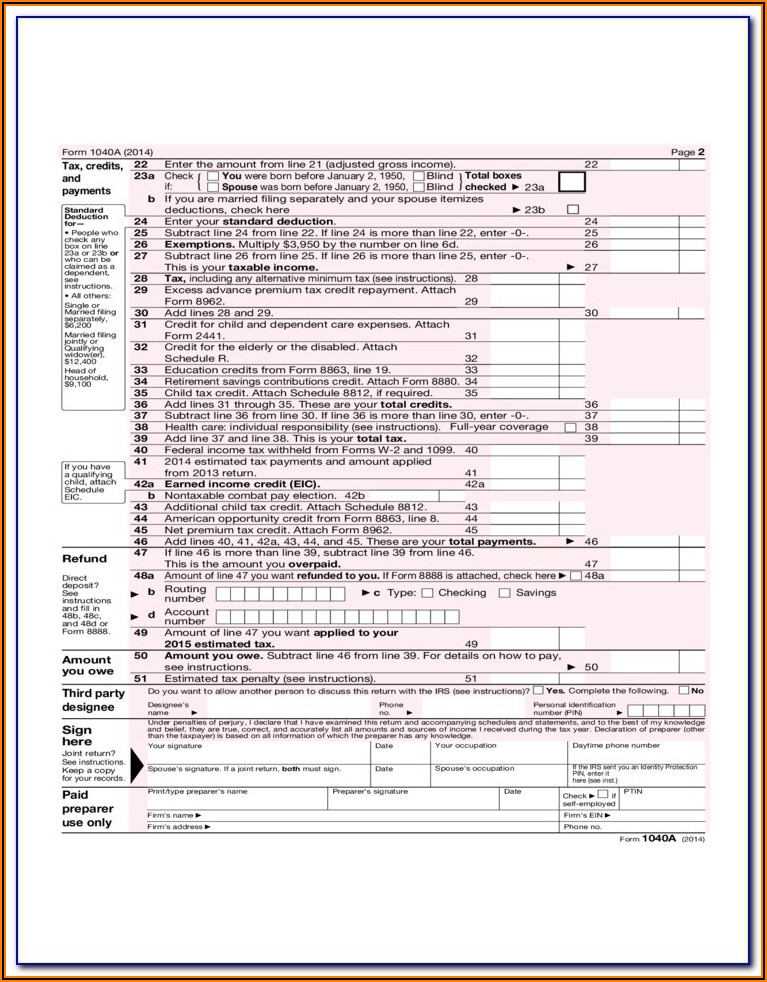

Irs Form 1040x Instructions 2014 Form Resume Examples nO9bk6AY4D

See the instructions for lines 20a through 20d, later. Line 1 = $1 million, the maximum possible. • claim your deduction for depreciation and amortization, •. Web when is form 4562 required? 05/26/22) georgia depreciation and amortization (i ncludinginformationon listed property) assets placed in service during tax years.

Form 4562 YouTube

Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web use form 4562 to: Line 1 = $1 million, the maximum possible. Web irs form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible property. Web get answers to frequently asked questions about form.

I couldn’t figure out the answer for Schedule 4562

Web here’s what each line should look like as outlined in the irs form 4562 instructions, along with a few examples. Web the instructions for form 4562 include a worksheet that you can use to complete part i. Web general instructions purpose of form use form 4562 to: Assets such as buildings, machinery,. • subtract $975,000 from line 1 of.

IRS Form 4562 Instructions The Complete Guide

Web irs form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible property. Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic: Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Line 1 =.

534, Depreciating Property • For Tax Years Beginning After 2011, • Claim Your Deduction For Placed In Service Before 1987.

Web you’ll need to file form 4562 each year you continue to depreciate the asset. Web the instructions for form 4562 include a worksheet that you can use to complete part i. To complete form 4562, you'll need to know the. Web instructions for form 4562 depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted.

According To Form 4562 Instructions, The Form Is Required If The Taxpayer Claims Any Of The Following:

See the instructions for lines 20a through 20d, later. Web when is form 4562 required? • subtract $975,000 from line 1 of federal form 4562, and enter the result on line 1 of minnesota form 4562. Web instructions for form 4562.

Assets Such As Buildings, Machinery,.

Web use form 4562 to: Form 4562 is used to claim a. Web here’s what each line should look like as outlined in the irs form 4562 instructions, along with a few examples. Web form 4562 and the following modifications:

05/26/22) Georgia Depreciation And Amortization (I Ncludinginformationon Listed Property) Assets Placed In Service During Tax Years.

Some examples of tax reductions that require the use of this form include: Web general instructions purpose of form use form 4562 to: • claim your deduction for depreciation and amortization, •. General instructions purpose of form use form 4562 to: