Form 3804-Cr

Form 3804-Cr - Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Attach the completed form ftb 3804. Web refer to the following for form numbers and dates available: Ssn or itin fein part i elective tax credit amount. I have two shareholders and need to get them the form 3804. Any credit disallowed based on these provisions will carryover to future returns. Web an order for the deposit of funds of a minor or a person with a disability, and a petition for the withdrawal of such funds, must comply with rules 7.953 and 7.954. If this does not apply you will have to delete the state tax form. Form ftb 3804 also includes a schedule of qualified taxpayers that requires.

Any credit disallowed based on these provisions will carryover to future returns. Purpose s use this form to request for classified access it access periodic reinvestigations and for. Web up to $40 cash back description of forscom form 380 4. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Web information, get form ftb 3804. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Attach the completed form ftb 3804. If this does not apply you will have to delete the state tax form. Web refer to the following for form numbers and dates available: Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income.

Any credit disallowed based on these provisions will carryover to future returns. If this does not apply you will have to delete the state tax form. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Web an order for the deposit of funds of a minor or a person with a disability, and a petition for the withdrawal of such funds, must comply with rules 7.953 and 7.954. Attach the completed form ftb 3804. Web information, get form ftb 3804. This is a nonrefundable credit. Ssn or itin fein part i elective tax credit amount. Form ftb 3804 also includes a schedule of qualified taxpayers that requires.

특정용도에 사용되는 전기용품의 확인신청서 샘플, 양식 다운로드

Web up to $40 cash back description of forscom form 380 4. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Web an order for the deposit of funds of a minor or a person with a disability, and a petition for the withdrawal of such funds, must comply with rules.

2013 Form CA FTB 3805V Fill Online, Printable, Fillable, Blank pdfFiller

Web refer to the following for form numbers and dates available: Web information, get form ftb 3804. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. I have two shareholders and need to get them the form 3804. Commanders will interview the recr u iter in order to validate the information and submit.

CA Form FTB 3801CR 20202022 Fill and Sign Printable Template Online

Web an order for the deposit of funds of a minor or a person with a disability, and a petition for the withdrawal of such funds, must comply with rules 7.953 and 7.954. Web up to $40 cash back description of forscom form 380 4. Web information, get form ftb 3804. If this does not apply you will have to.

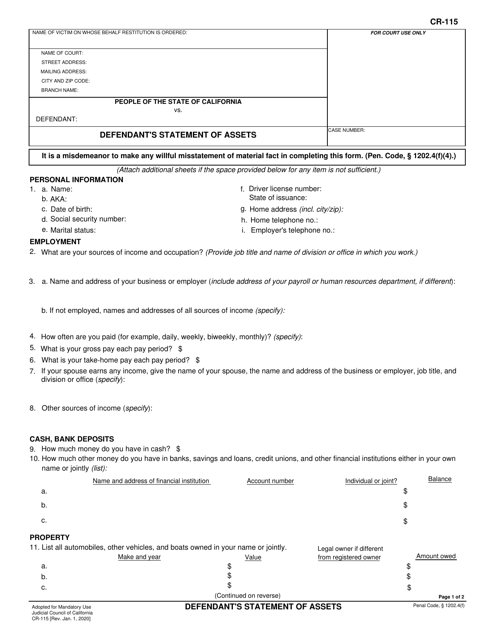

Form CR115 Download Fillable PDF or Fill Online Defendant's Statement

Web up to $40 cash back description of forscom form 380 4. Commanders will interview the recr u iter in order to validate the information and submit. This is a nonrefundable credit. If this does not apply you will have to delete the state tax form. Purpose s use this form to request for classified access it access periodic reinvestigations.

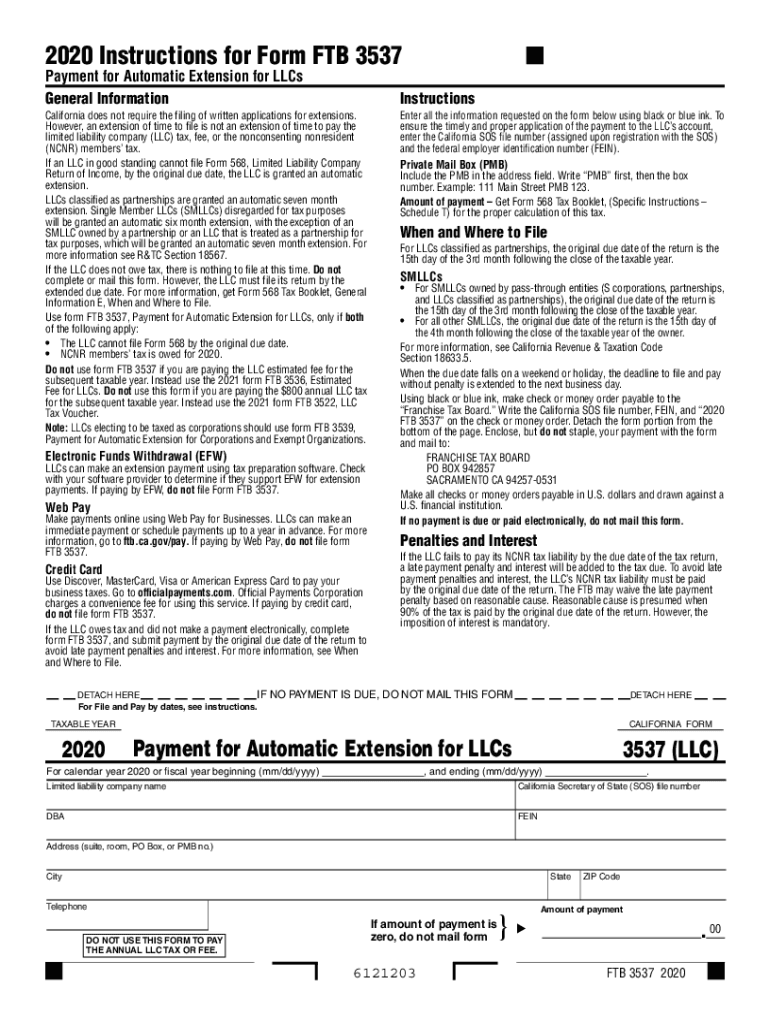

Form 3537 California Fill Out and Sign Printable PDF Template signNow

This is a nonrefundable credit. Any credit disallowed based on these provisions will carryover to future returns. I have two shareholders and need to get them the form 3804. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Web an order for the deposit of funds of a minor or a.

LILLY Style 3804

Commanders will interview the recr u iter in order to validate the information and submit. Web an order for the deposit of funds of a minor or a person with a disability, and a petition for the withdrawal of such funds, must comply with rules 7.953 and 7.954. Web information, get form ftb 3804. Form ftb 3804 also includes a.

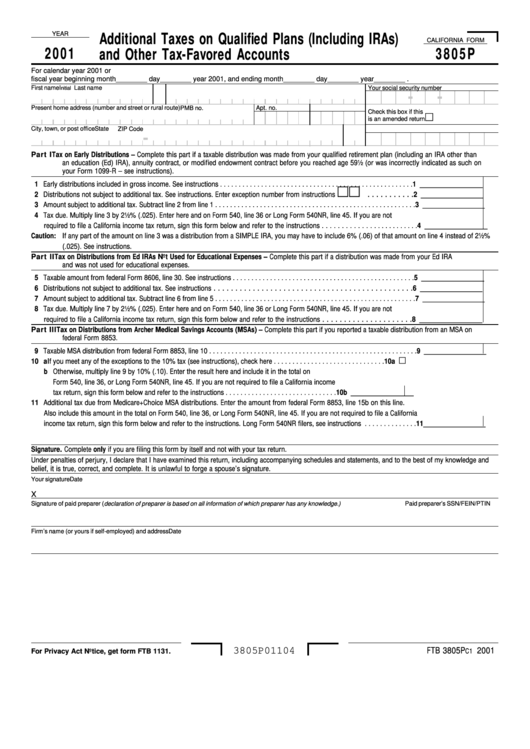

California Form 3805p Additional Taxes On Qualified Plans (Including

The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Ssn or itin fein part i elective tax credit amount. Web up to $40 cash back description of forscom form 380 4. Web refer to the following for form numbers and dates available: Web information, get form ftb 3804.

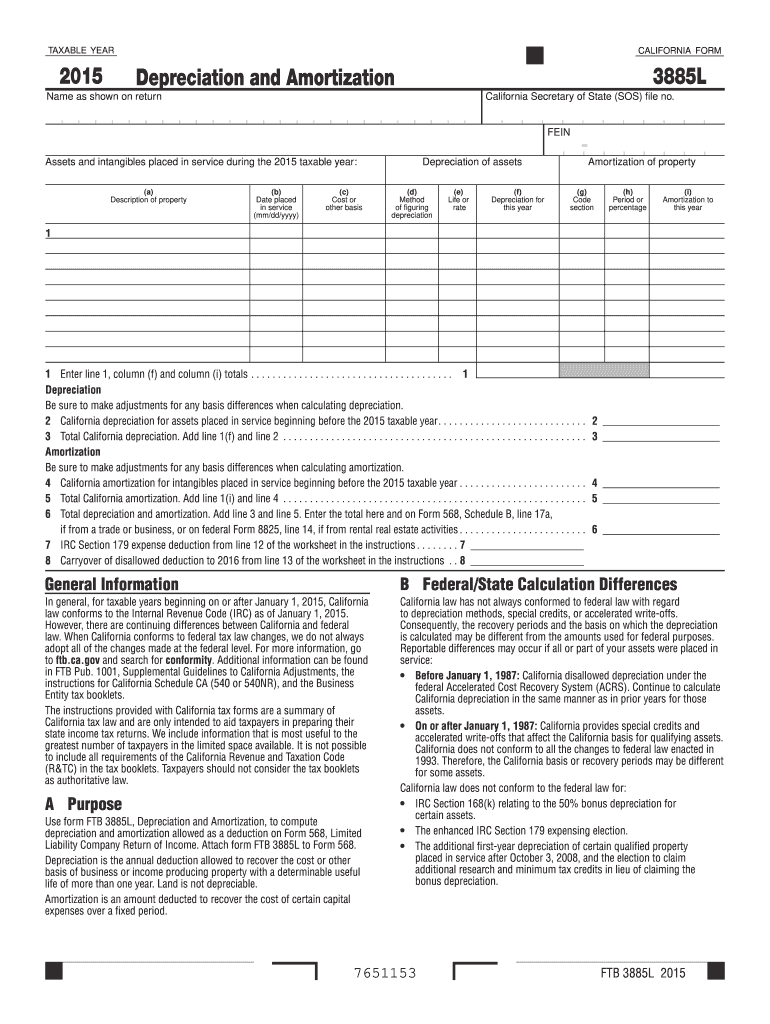

Form 3885L Fill Out and Sign Printable PDF Template signNow

When will the elective tax expire? Attach the completed form ftb 3804. Web information, get form ftb 3804. Web an order for the deposit of funds of a minor or a person with a disability, and a petition for the withdrawal of such funds, must comply with rules 7.953 and 7.954. Web refer to the following for form numbers and.

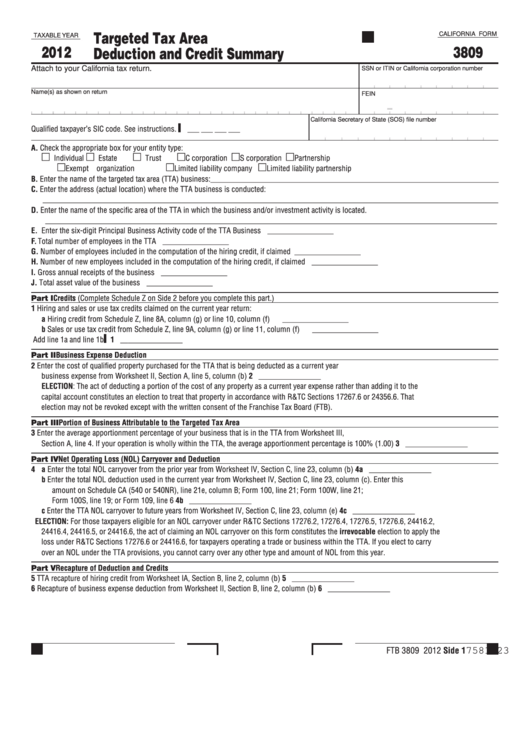

Fillable California Form 3809 Targeted Tax Area Deduction And Credit

Web up to $40 cash back description of forscom form 380 4. I have two shareholders and need to get them the form 3804. Ssn or itin fein part i elective tax credit amount. Purpose s use this form to request for classified access it access periodic reinvestigations and for. Web refer to the following for form numbers and dates.

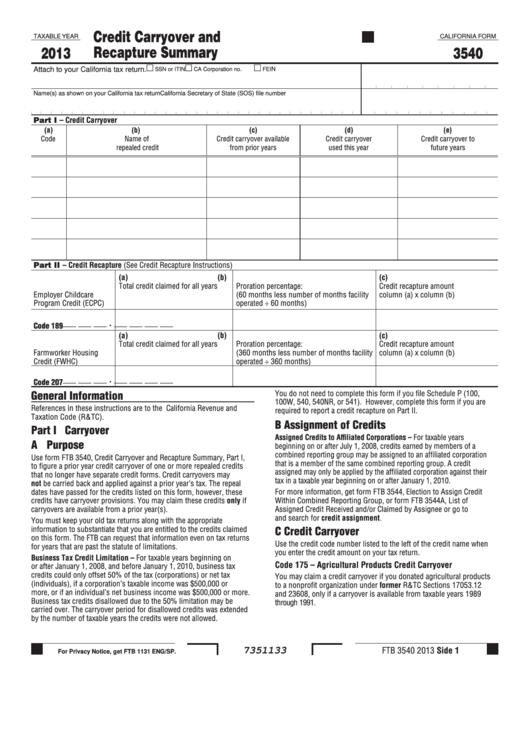

Fillable California Form 3540 Credit Carryover And Recapture Summary

Web up to $40 cash back description of forscom form 380 4. This is a nonrefundable credit. Attach the completed form ftb 3804. Web information, get form ftb 3804. Commanders will interview the recr u iter in order to validate the information and submit.

I Have Two Shareholders And Need To Get Them The Form 3804.

Web refer to the following for form numbers and dates available: Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Attach the completed form ftb 3804. Ssn or itin fein part i elective tax credit amount.

Web Up To $40 Cash Back Description Of Forscom Form 380 4.

Web an order for the deposit of funds of a minor or a person with a disability, and a petition for the withdrawal of such funds, must comply with rules 7.953 and 7.954. Commanders will interview the recr u iter in order to validate the information and submit. Purpose s use this form to request for classified access it access periodic reinvestigations and for. If this does not apply you will have to delete the state tax form.

The Credit Is Nonrefundable, And The Unused Credit May Be Carried Forward For Five Years, Or Until Exhausted.

Web information, get form ftb 3804. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Any credit disallowed based on these provisions will carryover to future returns. This is a nonrefundable credit.