Form 3804-Cr 2022

Form 3804-Cr 2022 - I have two shareholders and need to get them the form 3804. Web 128 rows final revision details. Purpose s use this form to request for classified access it access periodic reinvestigations and for. Web tax software 2022 prepare the 3804 go to california > ca29. Web up to 10% cash back for tax years 2022 through 2025, the tax is due in two installments: By june 15 of the tax year of the election, at least 50% of the elective tax paid in. Pick the document template you will need from our collection of legal form samples. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. Web up to $40 cash back description of forscom form 380 4. Form ftb 3804 also includes a schedule of qualified taxpayers that requires.

Web fill out fort lee form 380 4 in a couple of moments by using the instructions below: Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Web up to $40 cash back description of forscom form 380 4. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web up to 10% cash back for tax years 2022 through 2025, the tax is due in two installments: Web tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Web tax software 2022 prepare the 3804 go to california > ca29. Pick the document template you will need from our collection of legal form samples. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. Follow these steps to enter a pte tax credit received.

Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Follow these steps to enter a pte tax credit received. I have two shareholders and need to get them the form 3804. Web tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Web tax software 2022 prepare the 3804 go to california > ca29. Web up to $40 cash back description of forscom form 380 4. Web 128 rows final revision details. Pick the document template you will need from our collection of legal form samples. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. By june 15 of the tax year of the election, at least 50% of the elective tax paid in.

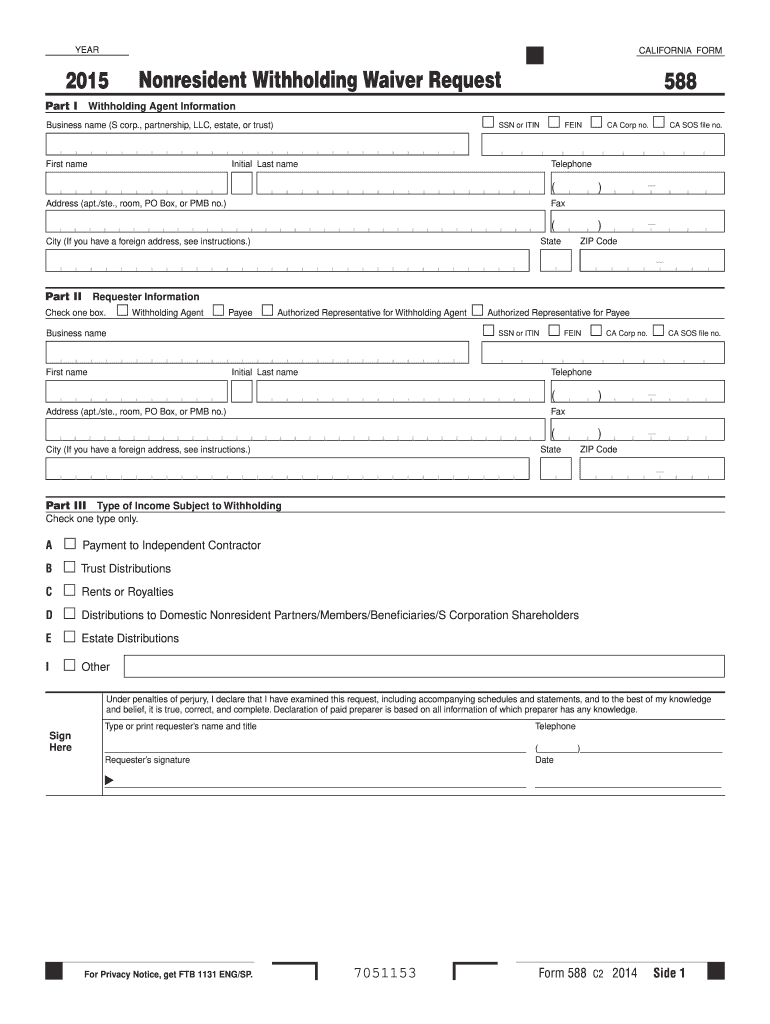

Form 588 California Franchise Tax Board Fill out & sign online DocHub

Commanders will interview the recr u iter in order to validate the information and submit. Purpose s use this form to request for classified access it access periodic reinvestigations and for. Pick the document template you will need from our collection of legal form samples. Follow these steps to enter a pte tax credit received. By june 15 of the.

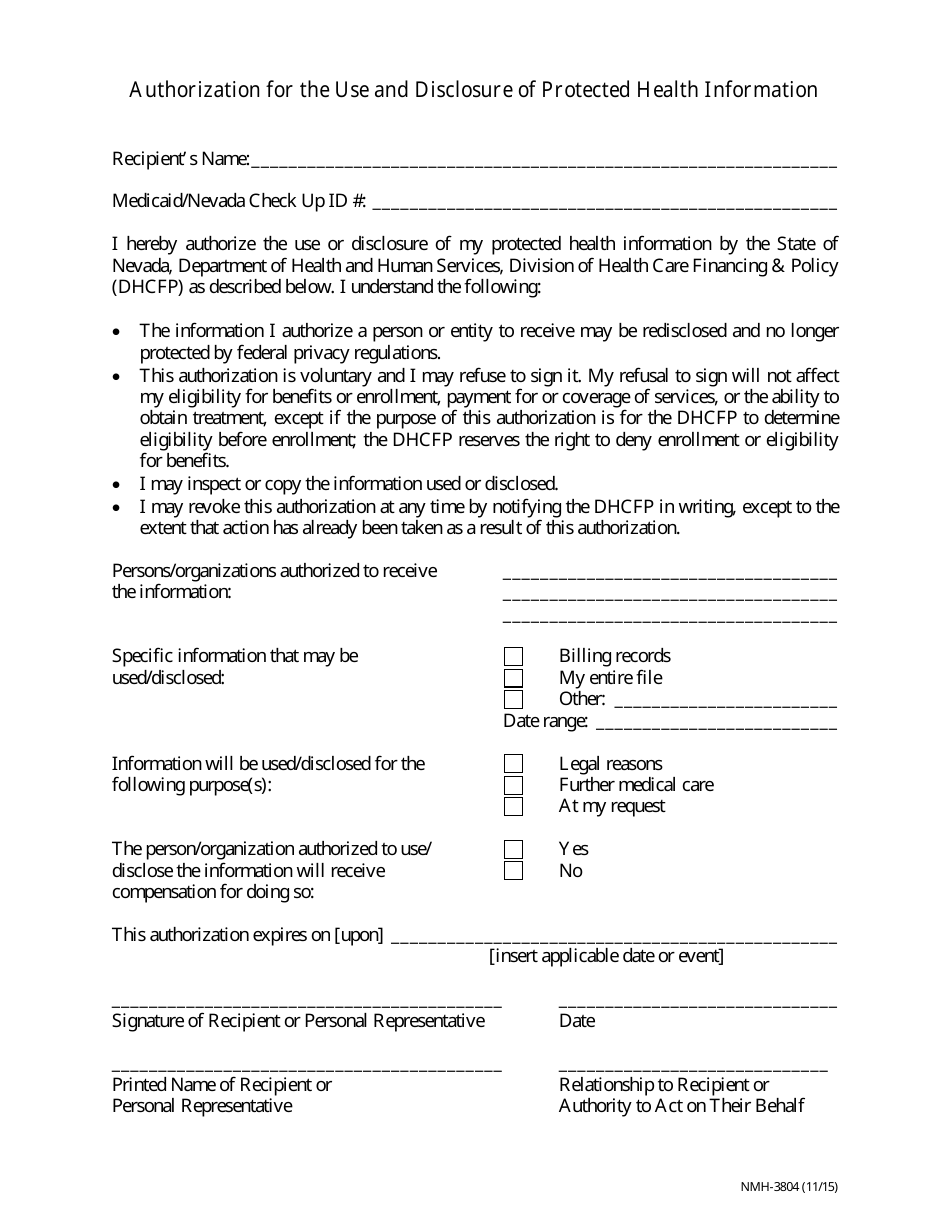

Form NMH3804 Download Fillable PDF or Fill Online Authorization for

By june 15 of the tax year of the election, at least 50% of the elective tax paid in. Web tax software 2022 prepare the 3804 go to california > ca29. Web tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet. Use form 4804 when submitting the following types of information returns magnetically: Follow these.

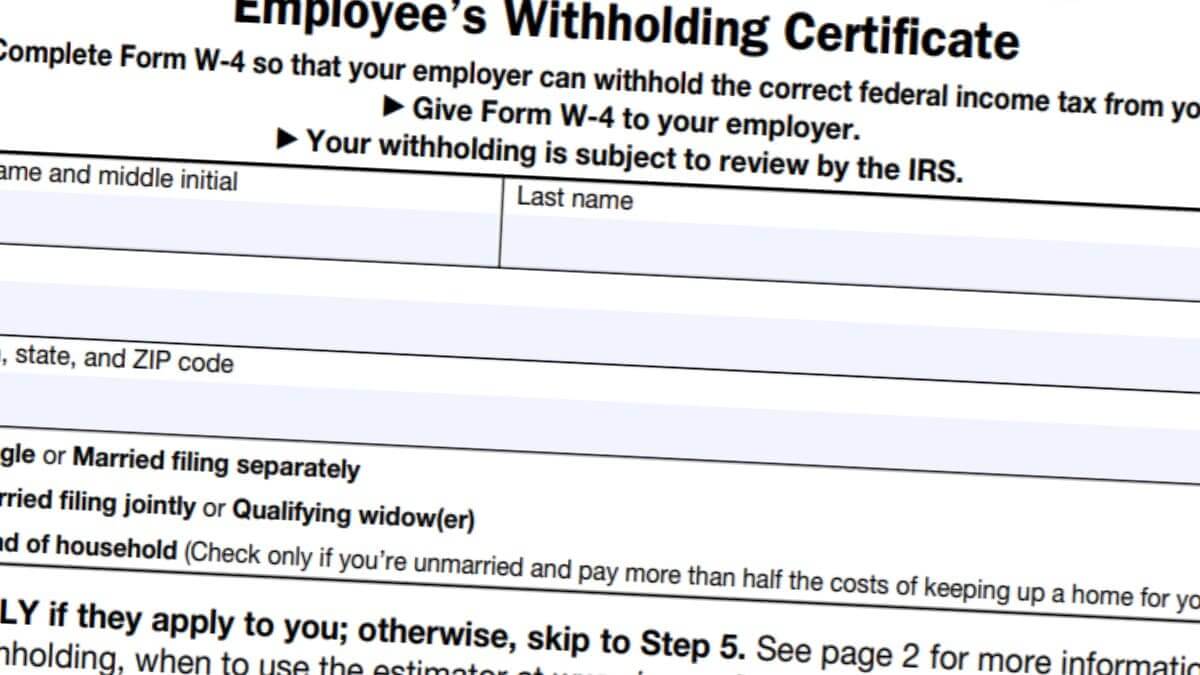

Example Of A W4 Filled 2022 Calendar Template 2022

Follow these steps to enter a pte tax credit received. Web up to 10% cash back for tax years 2022 through 2025, the tax is due in two installments: Web tax software 2022 prepare the 3804 go to california > ca29. Web fill out fort lee form 380 4 in a couple of moments by using the instructions below: By.

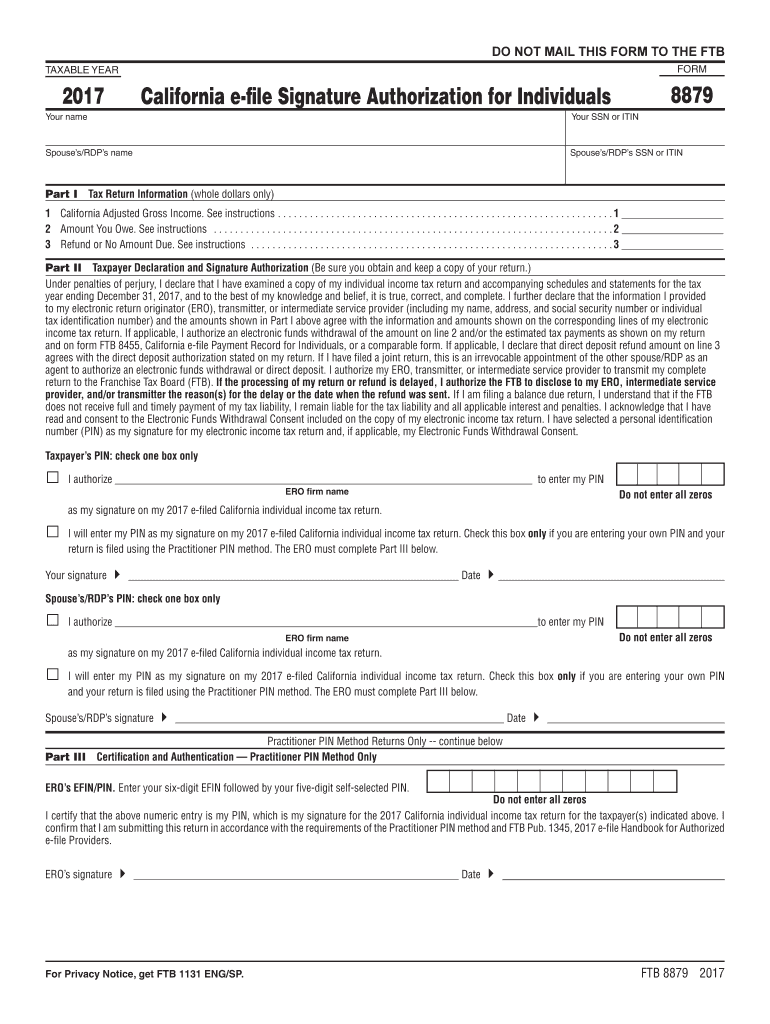

CA Form FTB 3801CR 20202022 Fill and Sign Printable Template Online

Use form 4804 when submitting the following types of information returns magnetically: Commanders will interview the recr u iter in order to validate the information and submit. Purpose s use this form to request for classified access it access periodic reinvestigations and for. I have two shareholders and need to get them the form 3804. By june 15 of the.

MACC Annual Report 2021 MACC Charities

Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web tax software 2022 prepare the 3804 go to california > ca29. Web up to $40 cash back description of forscom form 380 4. Pick the document template you will need from our collection of legal form samples. Web use form ftb 3804 to report the elective tax.

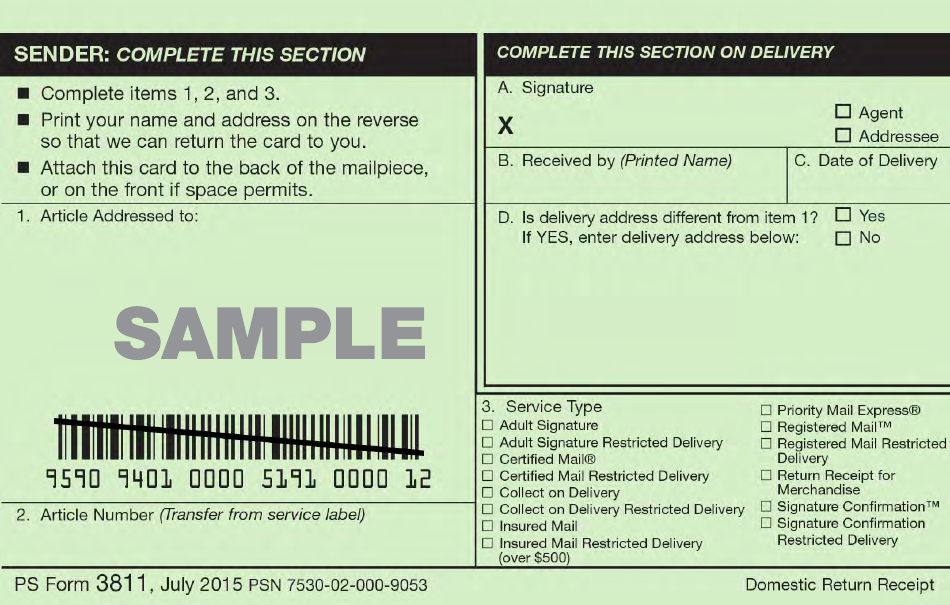

PS Form 3811 Download Printable PDF or Fill Online Domestic Return

Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Follow these steps to enter a pte tax credit received. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. Use form 4804 when submitting the following.

Form 3832 Instructions Fill Out and Sign Printable PDF Template signNow

Pick the document template you will need from our collection of legal form samples. Web up to 10% cash back for tax years 2022 through 2025, the tax is due in two installments: Web tax software 2022 prepare the 3804 go to california > ca29. Commanders will interview the recr u iter in order to validate the information and submit..

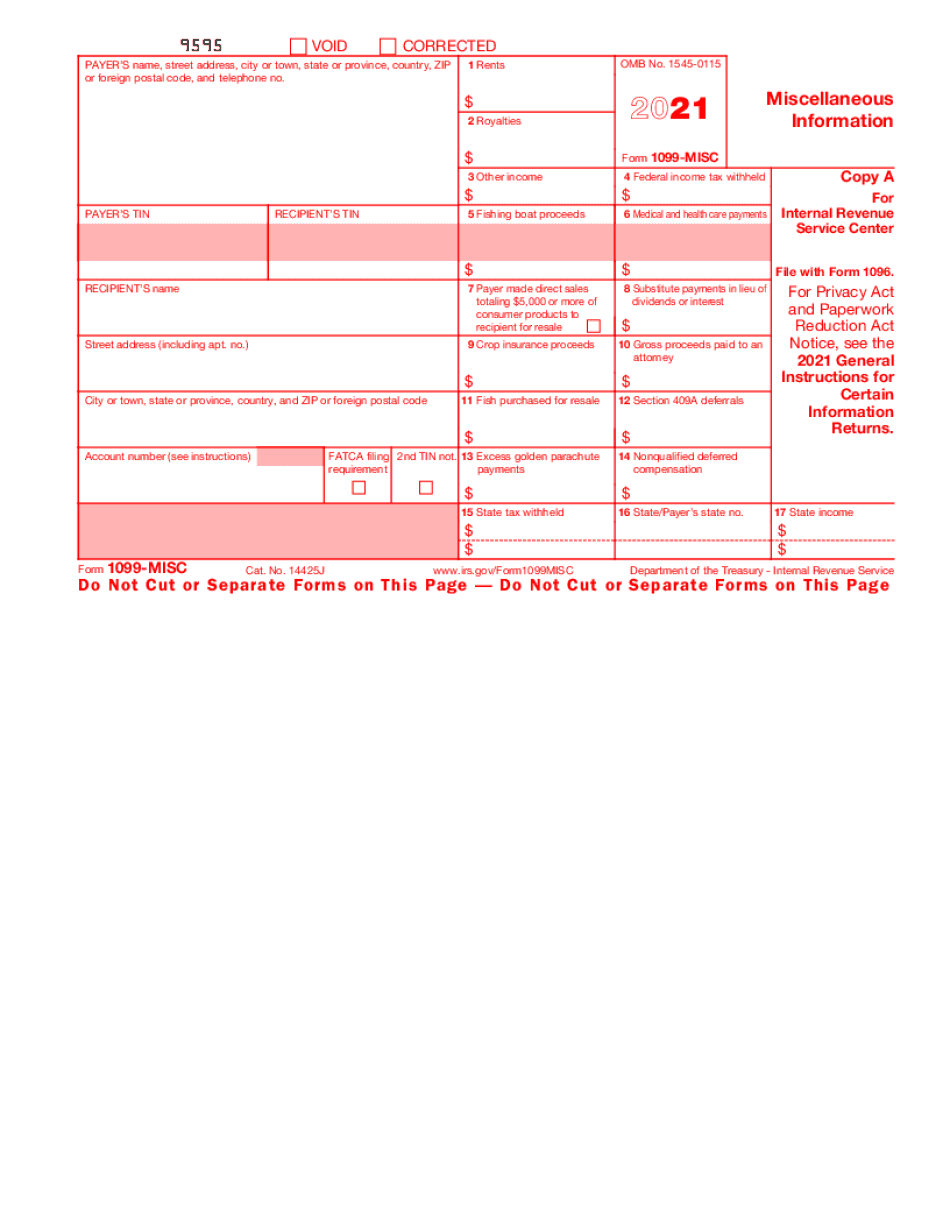

1099MISC Form 2022 Fillable Template

Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Web fill out fort lee form 380 4 in a couple of moments by using the instructions below: I have two shareholders and need to get them the form 3804. Commanders will interview the recr u iter in order to validate the.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

Web 128 rows final revision details. Use form 4804 when submitting the following types of information returns magnetically: Web up to 10% cash back for tax years 2022 through 2025, the tax is due in two installments: By june 15 of the tax year of the election, at least 50% of the elective tax paid in. Form ftb 3804 also.

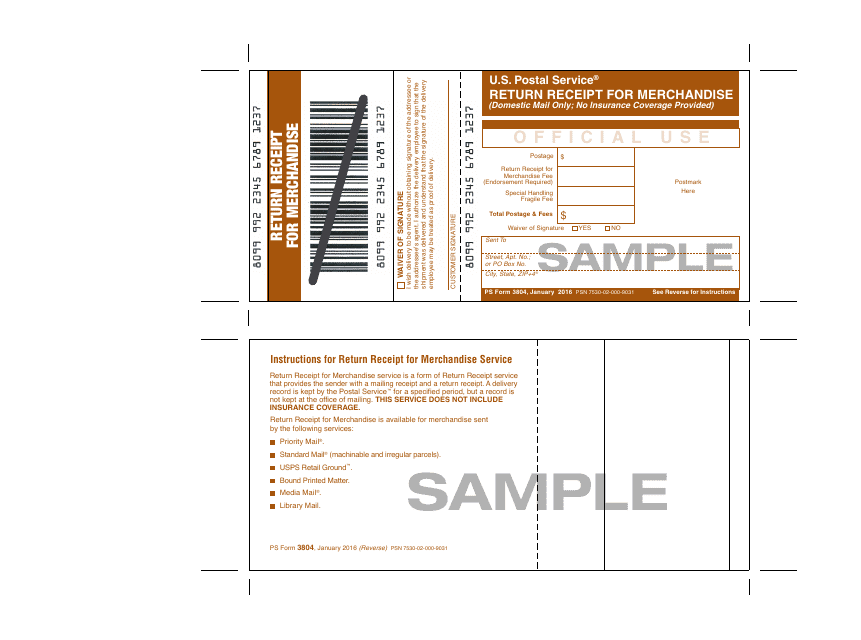

Sample PS Form 3804 Download Printable PDF or Fill Online Return

Web 128 rows final revision details. Web tax software 2022 prepare the 3804 go to california > ca29. I have two shareholders and need to get them the form 3804. Web up to 10% cash back for tax years 2022 through 2025, the tax is due in two installments: Use form 4804 when submitting the following types of information returns.

Pick The Document Template You Will Need From Our Collection Of Legal Form Samples.

Purpose s use this form to request for classified access it access periodic reinvestigations and for. Web tax software 2022 prepare the 3804 go to california > ca29. Enter the 13d amount in credit from passthrough elective entity tax (pte) {ca}. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income.

Web Up To $40 Cash Back Description Of Forscom Form 380 4.

Commanders will interview the recr u iter in order to validate the information and submit. Web fill out fort lee form 380 4 in a couple of moments by using the instructions below: Use form 4804 when submitting the following types of information returns magnetically: Follow these steps to enter a pte tax credit received.

Form Ftb 3804 Also Includes A Schedule Of Qualified Taxpayers That Requires.

I have two shareholders and need to get them the form 3804. Web 128 rows final revision details. Web up to 10% cash back for tax years 2022 through 2025, the tax is due in two installments: Web tax software 2022 prepare the 3804 go to california > passthrough entity tax worksheet.