Form 3520 Online

Form 3520 Online - Many americans who interact with a foreign trust are required to file form 3520. Owner, including recent updates, related forms and instructions on how to file. Sign it in a few clicks. Web form 3520 is a tax form used to report certain transactions involving foreign trusts. Web what is form 3520? Get ready for tax season deadlines by completing any required tax forms today. Web how to file irs form 3520 online? Ad register and subscribe now to work on your irs form 3520 & more fillable forms. Complete, edit or print tax forms instantly. The irs form annual return to report transactions with foreign trusts and receipt of certain foreign gifts in accordance with internal revenue code section.

Web how to file irs form 3520 online? Ad talk to our skilled attorneys by scheduling a free consultation today. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Irs form 3520 is an informational document used to report particular transactions with ownerships of foreign trusts, foreign trusts, or if you get some large gifts. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. A calendar year trust is due march 15. Decedents) file form 3520 with the irs to report: Web form 3520 & instructions: Web form 709, u.s. Many americans who interact with a foreign trust are required to file form 3520.

Irs form 3520 is an informational document used to report particular transactions with ownerships of foreign trusts, foreign trusts, or if you get some large gifts. It does not have to be a “foreign gift.” rather, if a. Web form 3520 & instructions: Send form 3520 to the. The form must be completed manually and submitted. Type text, add images, blackout confidential details, add comments, highlights and more. Edit your form 3520 online. Many americans who interact with a foreign trust are required to file form 3520. Draw your signature, type it,. Web form 709, u.s.

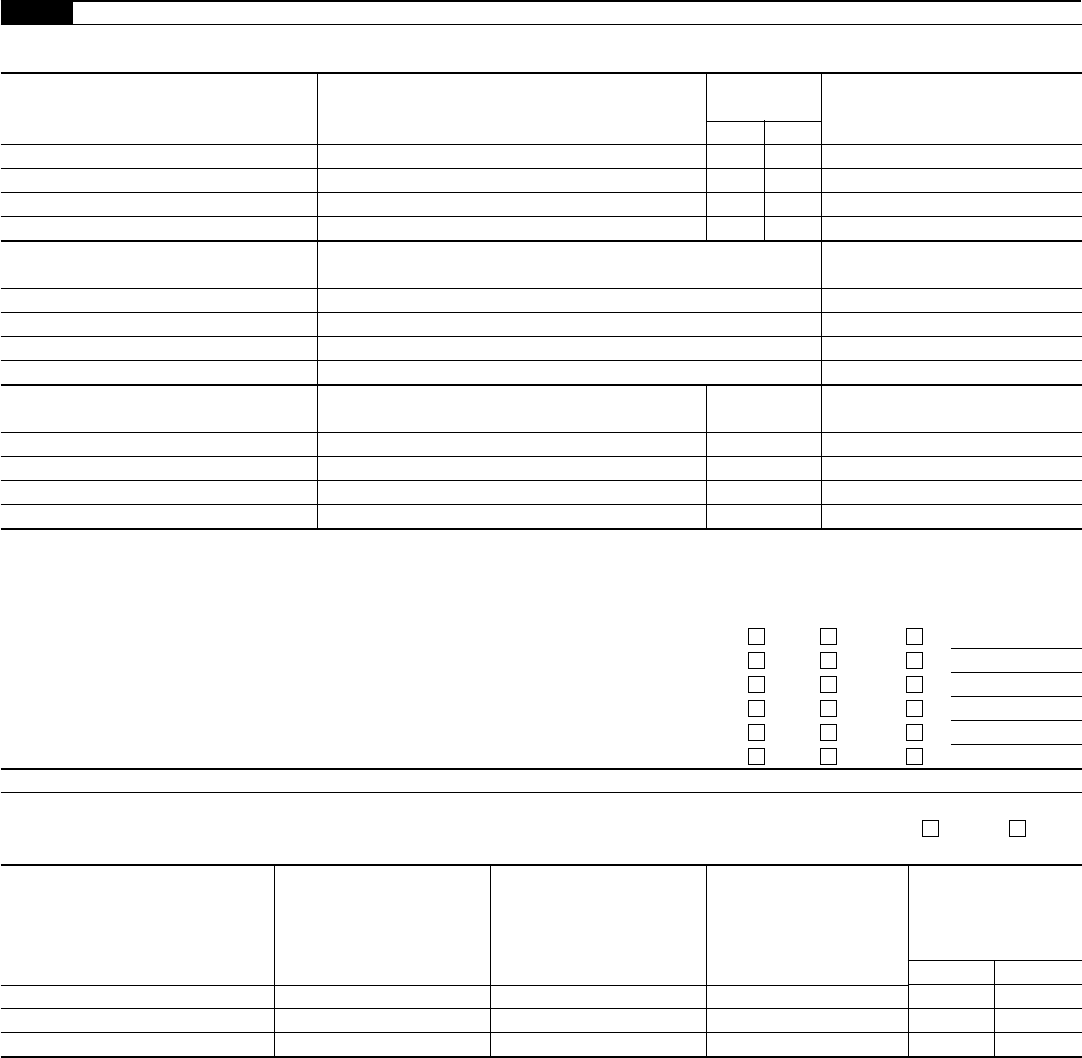

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Sign it in a few clicks. Web unlike a tax return, where a tax liability or refund is calculated, form 3520 is an informational return. Persons (and executors of estates of u.s.

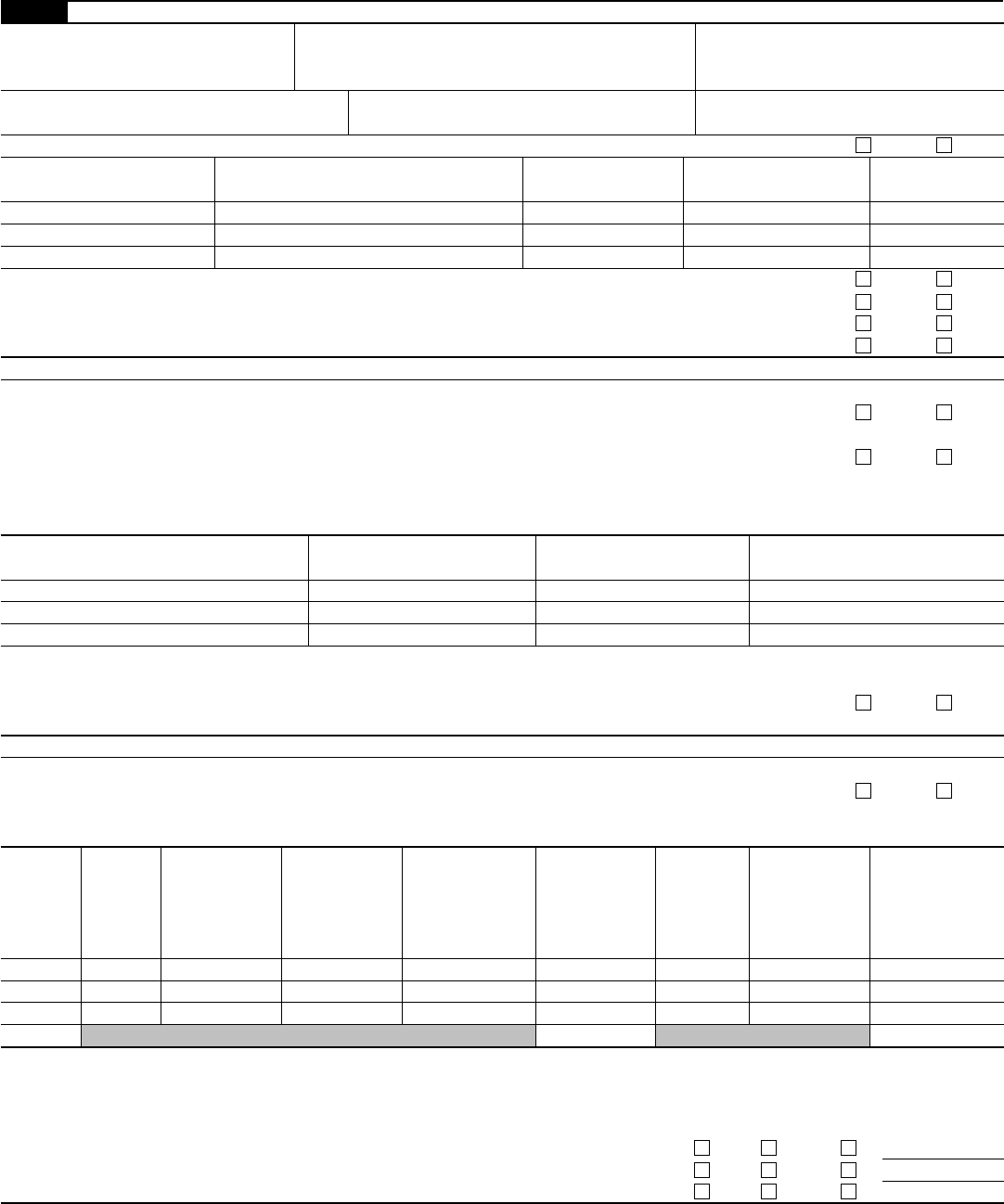

Form 3520 2012 Edit, Fill, Sign Online Handypdf

Ad talk to our skilled attorneys by scheduling a free consultation today. Web what is form 3520? Web form 3520 & instructions: Web unlike a tax return, where a tax liability or refund is calculated, form 3520 is an informational return. Many americans who interact with a foreign trust are required to file form 3520.

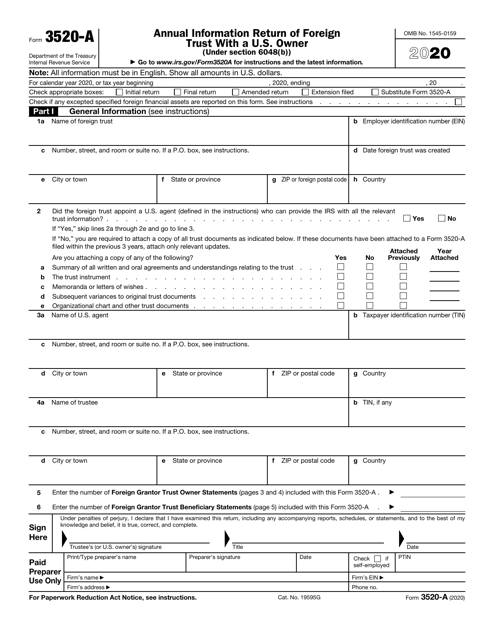

Form 3520A Annual Information Return of Foreign Trust with a U.S

Currently, the irs does not offer an online filing option for form 3520. Irs form 3520 is an informational document used to report particular transactions with ownerships of foreign trusts, foreign trusts, or if you get some large gifts. Decedents) file form 3520 with the irs to report: Ad talk to our skilled attorneys by scheduling a free consultation today..

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web form 709, u.s. Certain transactions with foreign trusts, ownership of foreign trusts under the. Draw your signature, type it,. Web what is form 3520? Send form 3520 to the.

Steuererklärung dienstreisen Form 3520

Web form 709, u.s. Complete, edit or print tax forms instantly. Many americans who interact with a foreign trust are required to file form 3520. Web form 3520 is a tax form used to report certain transactions involving foreign trusts. Web if you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt.

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

Send form 3520 to the. Web how to file irs form 3520 online? Draw your signature, type it,. Get ready for tax season deadlines by completing any required tax forms today. Many americans who interact with a foreign trust are required to file form 3520.

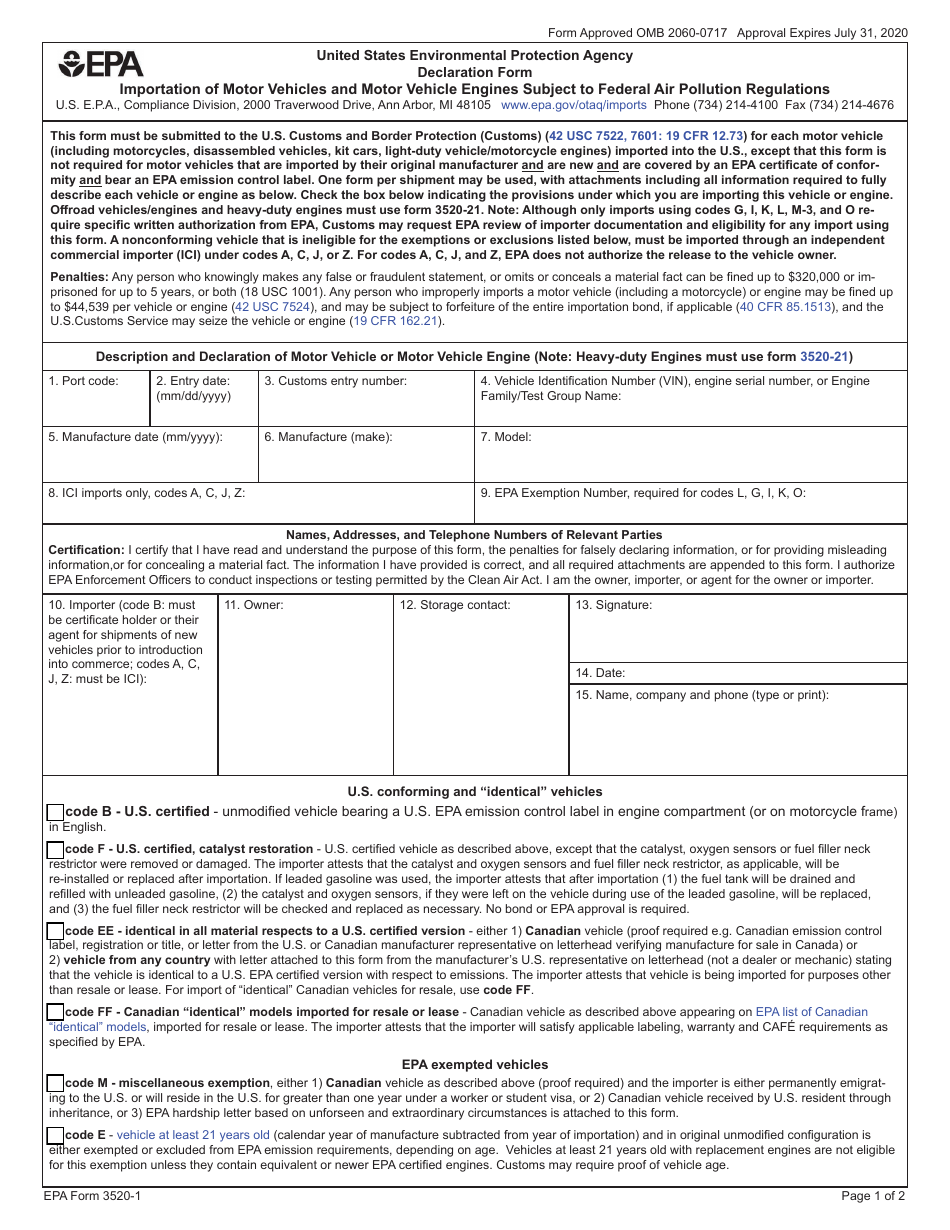

EPA Form 35201 Download Fillable PDF or Fill Online Declaration Form

The form provides information about the foreign trust, its u.s. Send form 3520 to the. As the title suggests, form 3520 is used by u.s. Owner, including recent updates, related forms and instructions on how to file. Web form 3520 is a tax form used to report certain transactions involving foreign trusts.

Form 3520 2012 Edit, Fill, Sign Online Handypdf

Ad register and subscribe now to work on your irs form 3520 & more fillable forms. Owner, including recent updates, related forms and instructions on how to file. Many americans who interact with a foreign trust are required to file form 3520. Get ready for tax season deadlines by completing any required tax forms today. Web unlike a tax return,.

3.21.19 Foreign Trust System Internal Revenue Service

As the title suggests, form 3520 is used by u.s. Ad register and subscribe now to work on your irs form 3520 & more fillable forms. Owner, including recent updates, related forms and instructions on how to file. Sign it in a few clicks. Web an income tax return, the due date for filing form 3520 is the 15th day.

form 3520a 2021 Fill Online, Printable, Fillable Blank

Web individual or fiduciary power of attorney declaration (ftb 3520 pit) form; Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Irs form 3520 is an informational document used to report particular transactions with ownerships of foreign trusts, foreign trusts, or.

It Does Not Have To Be A “Foreign Gift.” Rather, If A.

Send form 3520 to the. Type text, add images, blackout confidential details, add comments, highlights and more. Many americans who interact with a foreign trust are required to file form 3520. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web if you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you can do that manually, by. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. The form provides information about the foreign trust, its u.s. Decedents) file form 3520 with the irs to report:

Don’t Feel Alone If You’re Dealing With Irs Form 3520 Penalty Abatement Issues.

Sign it in a few clicks. The form must be completed manually and submitted. Web form 3520 & instructions: Web what is form 3520?

Web Form 709, U.s.

Ad register and subscribe now to work on your irs form 3520 & more fillable forms. Complete, edit or print tax forms instantly. Currently, the irs does not offer an online filing option for form 3520. Web individual or fiduciary power of attorney declaration (ftb 3520 pit) form;