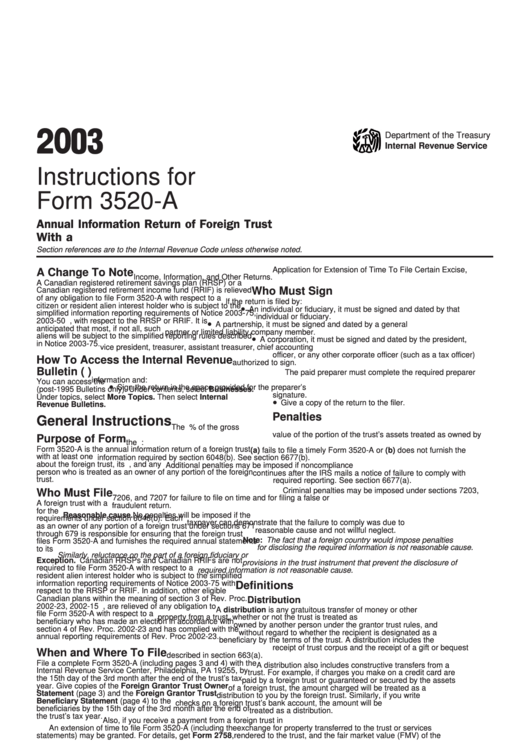

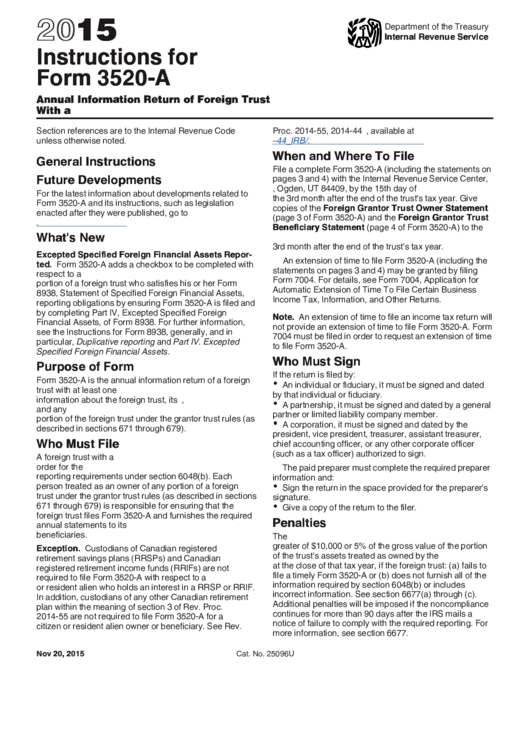

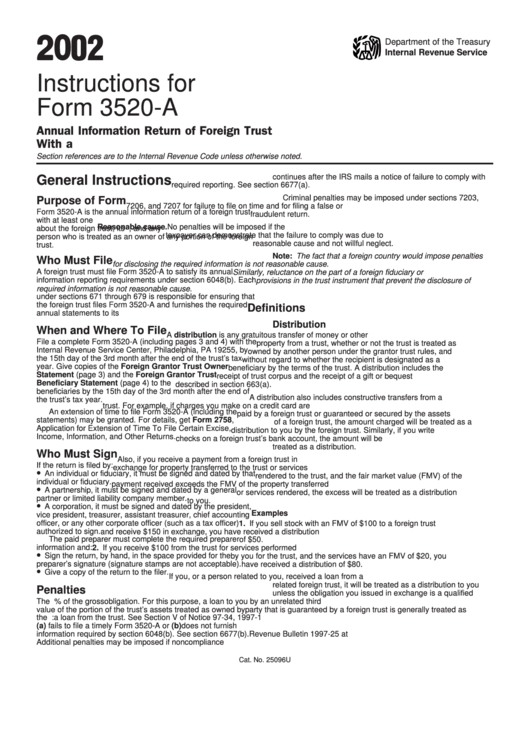

Form 3520-A Instructions

Form 3520-A Instructions - Persons (and executors of estates of u.s. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. Persons (and executors of estates of u.s. Decedent treated as owner of foreign trust immediately prior to death.assets of foreign trust were included in. Read the detailed procedures for importing vehicles and. Ownership of foreign trusts under the rules of sections. Decedent made transfer to a foreign trust by reason of death. Web all representatives listed on a poa declaration will have the ability to remove another representative from the poa declaration. Certain transactions with foreign trusts.

As provided by the irs: Read the detailed procedures for importing vehicles and. It does not have to be a. Web all representatives listed on a poa declaration will have the ability to remove another representative from the poa declaration. Certain transactions with foreign trusts. Ownership of foreign trusts under the rules of sections. Persons (and executors of estates of u.s. However, the trust can request. Decedent made transfer to a foreign trust by reason of death. A valid signature is required.

Decedents) file form 3520 with the irs to report: Owner is required to file in order to report to the irs, and to the u.s. Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign trusts and receipt of certain foreign gifts go. Certain transactions with foreign trusts. A valid signature is required. Decedent treated as owner of foreign trust immediately prior to death.assets of foreign trust were included in. Read the detailed procedures for importing vehicles and. Web having ownership in a foreign trust and/or receiving a distribution from a foreign trust may require that the u.s. Web all representatives listed on a poa declaration will have the ability to remove another representative from the poa declaration. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain.

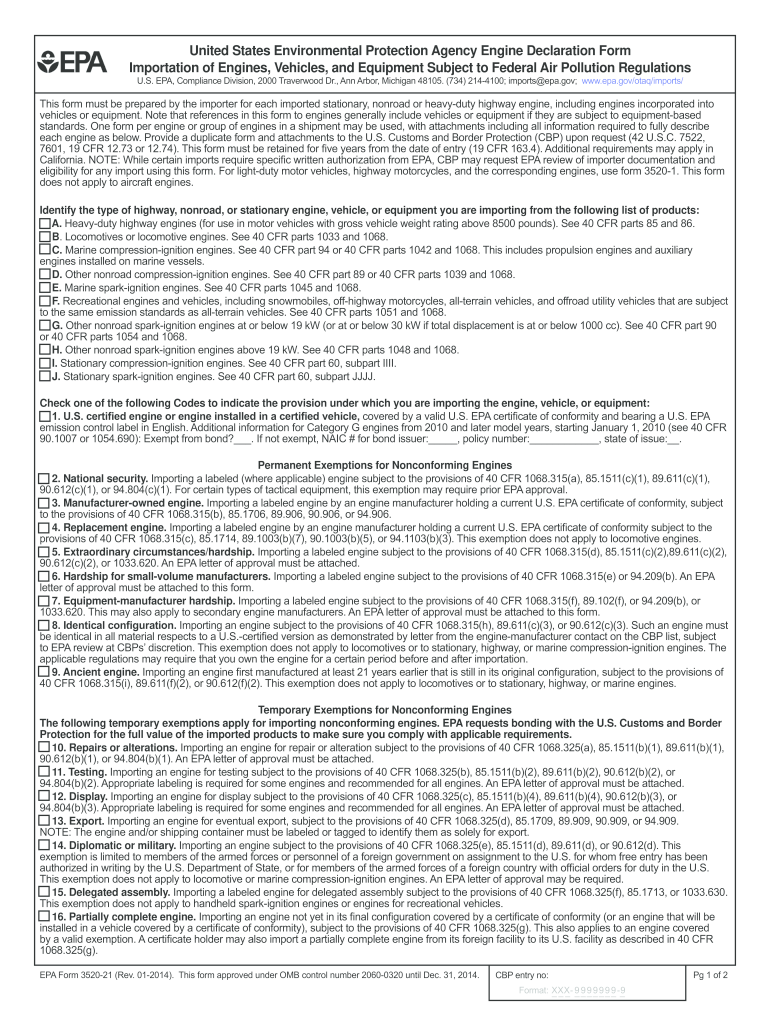

20142020 Form EPA 352021 Fill Online, Printable, Fillable, Blank

Web the following persons are required to file form 3520 to report certain distributions (or deemed distributions) during the tax year from foreign trusts: Certain transactions with foreign trusts. Decedent treated as owner of foreign trust immediately prior to death.assets of foreign trust were included in. The irs f orm 3520 is used to report a foreign gift, inheritance or.

Steuererklärung dienstreisen Form 3520

A grantor trust is any trust to the extent that. Owner files this form annually to provide information. What is a grantor trust? Web this document provides a summary of epa requirements for imported vehicles and engines. Read the detailed procedures for importing vehicles and.

Form 7004 Instructions 2021 2022 IRS Forms TaxUni

As provided by the irs: Web form instructions businesses business entity or group nonresident power of attorney declaration (ftb 3520 be) form instructions length of poa generally, a poa lasts for. Certain transactions with foreign trusts, ownership of foreign trusts under the. Owner is required to file in order to report to the irs, and to the u.s. There may.

Instructions For Form 3520A Annual Information Return Of Foreign

Web having ownership in a foreign trust and/or receiving a distribution from a foreign trust may require that the u.s. Decedent made transfer to a foreign trust by reason of death. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. However, the trust can request..

form 3520a instructions 2019 2020 Fill Online, Printable, Fillable

Owner is required to file in order to report to the irs, and to the u.s. Web form 3520 & instructions: Web having ownership in a foreign trust and/or receiving a distribution from a foreign trust may require that the u.s. As provided by the irs: Decedent treated as owner of foreign trust immediately prior to death.assets of foreign trust.

Instructions For Form 3520A Annual Information Return Of Foreign

Web the following persons are required to file form 3520 to report certain distributions (or deemed distributions) during the tax year from foreign trusts: Decedents) file form 3520 with the irs to report: Web having ownership in a foreign trust and/or receiving a distribution from a foreign trust may require that the u.s. Persons (and executors of estates of u.s..

Form 3520 Fill out & sign online DocHub

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. A foreign trust with at least one u.s. Persons (and executors of estates of u.s. Certain transactions with foreign trusts, ownership of foreign trusts under the. Owner is required to file in order to report to the irs, and to.

Form 3520 (2020) Instructions for Foreign Gifts & Inheritance

However, the trust can request. Decedent treated as owner of foreign trust immediately prior to death.assets of foreign trust were included in. Certain transactions with foreign trusts. Persons (and executors of estates of u.s. Decedents) file form 3520 to report:

Form 3520A Annual Information Return of Foreign Trust with a U.S

Decedent made transfer to a foreign trust by reason of death. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. Owner files this form annually to provide information. For a trust with a calendar year, the due date is march 15th. Persons (and executors of.

Instructions For Form 3520A Annual Information Return Of Foreign

Web having ownership in a foreign trust and/or receiving a distribution from a foreign trust may require that the u.s. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Decedents) file form 3520 with the irs to report: What is a grantor trust? Web form 3520 & instructions:

Decedents) File Form 3520 To Report:

Ownership of foreign trusts under the rules of sections. There may be additional filing requirements. Web this document provides a summary of epa requirements for imported vehicles and engines. A foreign trust with at least one u.s.

A Grantor Trust Is Any Trust To The Extent That.

Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign trusts and receipt of certain foreign gifts go. What is a grantor trust? Decedent treated as owner of foreign trust immediately prior to death.assets of foreign trust were included in. Owner is required to file in order to report to the irs, and to the u.s.

A Valid Signature Is Required.

Persons (and executors of estates of u.s. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. Web form 3520 & instructions: Certain transactions with foreign trusts.

It Does Not Have To Be A.

Web form instructions businesses business entity or group nonresident power of attorney declaration (ftb 3520 be) form instructions length of poa generally, a poa lasts for. Web all representatives listed on a poa declaration will have the ability to remove another representative from the poa declaration. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Certain transactions with foreign trusts, ownership of foreign trusts under the.