Form 2848 Instructions 2023

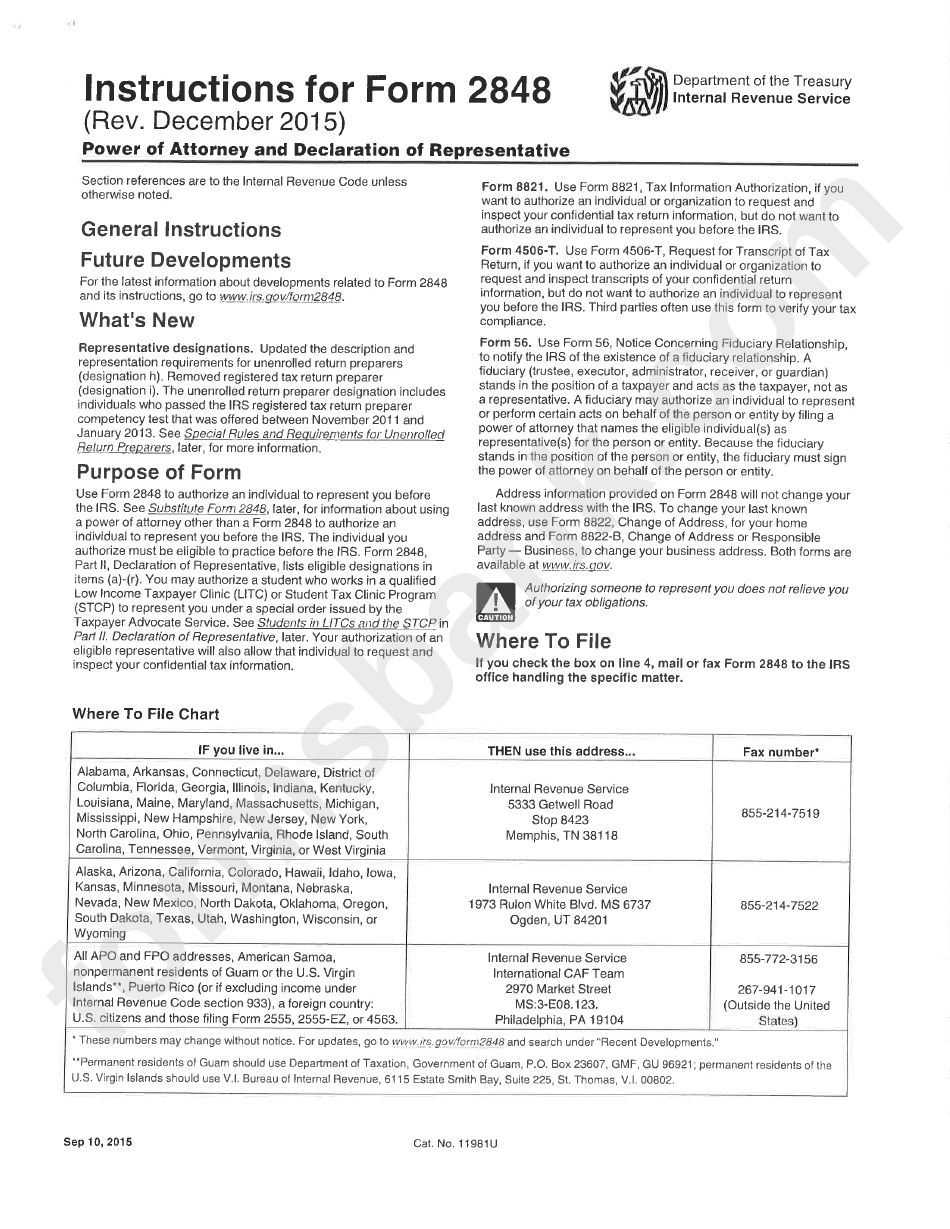

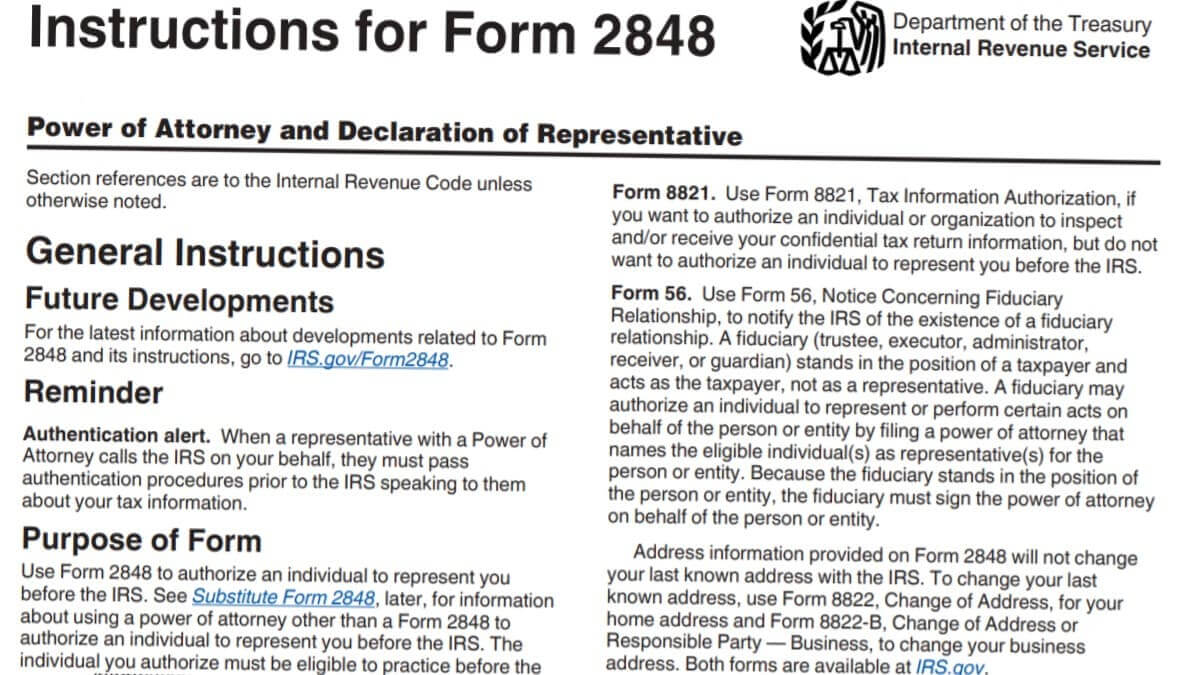

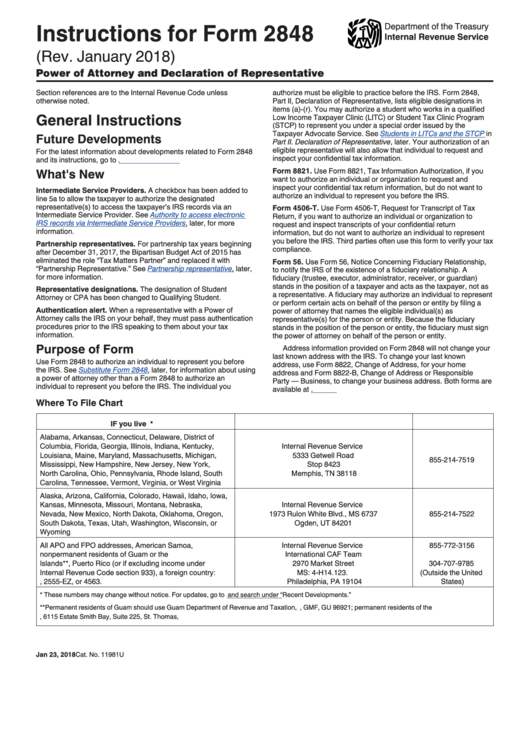

Form 2848 Instructions 2023 - For instructions and the latest information. If your parent is no longer competent and you are your parent’s power of attorney, you can fill out the form to appoint yourself as a representative. Form 2848, part ii, declaration of representative, lists eligible designations in items (a. Web washington — victims of severe storms, tornadoes and flooding in florida from april 12 to april 14, 2023, now have until august 15, 2023, to file various individual and business tax returns and make tax payments, the. Form 2848 allows taxpayers to name someone to represent them before the irs. See substitute form 2848, later, for information about using a power of attorney other than a form 2848 to authorize an individual to represent you before the irs. Web for more information on designating a partnership representative, see form 8979, partnership representative revocation, designation, and resignation, and its instructions. Web this article aims to provide a comprehensive guideline on irs form 2848, ensuring that you have all the necessary information to use the document correctly. Date / / part i power of attorney. We will cover the form's purpose, who cannot use it, a fictional example to showcase its benefits, and common problems with their solutions.

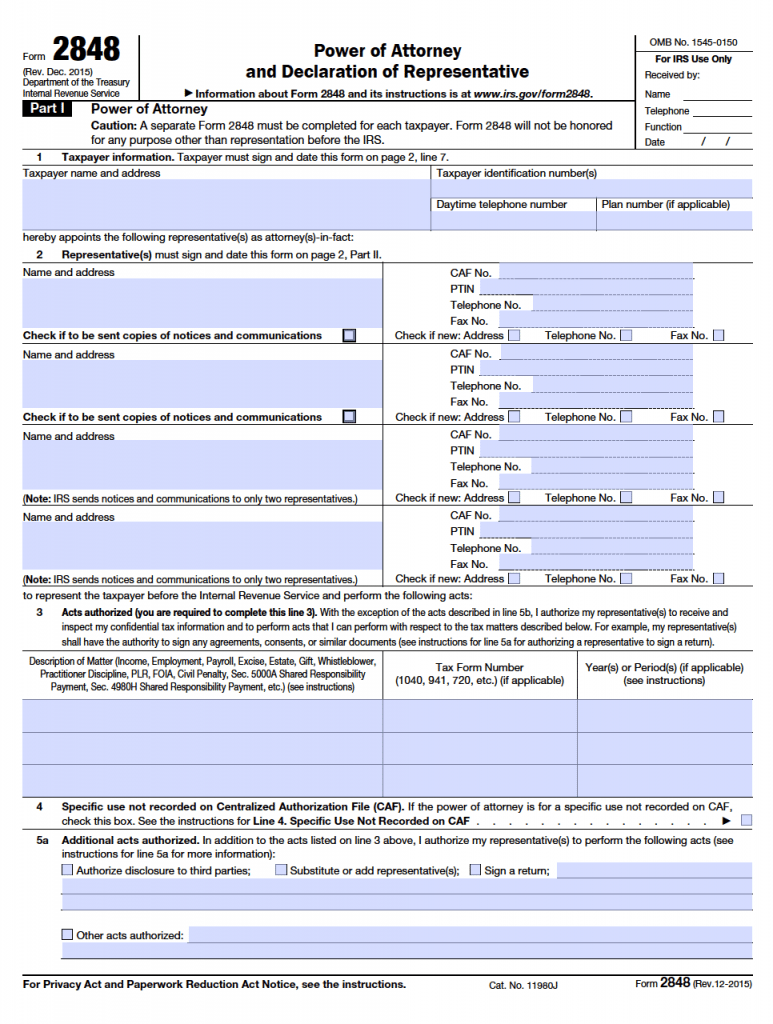

Web form 2848, power of attorney and declaration of representative pdf form 8821, tax information authorization pdf log in to submit before you get started ensure you have authenticated the identity of your client. Make sure the form is signed by all parties either electronically or with an ink signature. Power of attorney and declaration of representative. Form 2848 is used to authorize an eligible individual to. January 2021) department of the treasury internal revenue service. Web washington — victims of severe storms, tornadoes and flooding in florida from april 12 to april 14, 2023, now have until august 15, 2023, to file various individual and business tax returns and make tax payments, the. We will cover the form's purpose, who cannot use it, a fictional example to showcase its benefits, and common problems with their solutions. Form 2848 allows taxpayers to name someone to represent them before the irs. Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. See substitute form 2848, later, for information about using a power of attorney other than a form 2848 to authorize an individual to represent you before the irs.

You can download a form 2848 from irs.gov or access the file in the image below. This form grants a designated individual the authority to represent you before the irs, so it's essential to fill it out correctly. Form 2848 is used to authorize an eligible individual to. Web what is a form 2848? January 2021) department of the treasury internal revenue service. Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. We will cover the form's purpose, who cannot use it, a fictional example to showcase its benefits, and common problems with their solutions. The individual you authorize must be eligible to practice before the irs. Form 2848 allows taxpayers to name someone to represent them before the irs. If your parent is no longer competent and you are your parent’s power of attorney, you can fill out the form to appoint yourself as a representative.

Breanna Form 2848 Instructions

The individual you authorize must be eligible to practice before the irs. If your parent is no longer competent and you are your parent’s power of attorney, you can fill out the form to appoint yourself as a representative. Filling instructions for 2023 filling out the declaration can be a daunting task for some, but with proper guidance, it can.

Instructions For Form 2848 Power Of Attorney And Declaration Of

The individual you authorize must be eligible to practice before the irs. Make sure the form is signed by all parties either electronically or with an ink signature. Form 2848, part ii, declaration of representative, lists eligible designations in items (a. We will cover the form's purpose, who cannot use it, a fictional example to showcase its benefits, and common.

Form 2848 YouTube

If your parent is no longer competent and you are your parent’s power of attorney, you can fill out the form to appoint yourself as a representative. Web what is a form 2848? Date / / part i power of attorney. We will cover the form's purpose, who cannot use it, a fictional example to showcase its benefits, and common.

Form 2848 Instructions for IRS Power of Attorney Community Tax

Web what is a form 2848? Make sure the form is signed by all parties either electronically or with an ink signature. Filling instructions for 2023 filling out the declaration can be a daunting task for some, but with proper guidance, it can be done accurately and efficiently. Form 2848 allows taxpayers to name someone to represent them before the.

[Form 2848 Instructions] How to Fill out Form 2848 EaseUS in 2022

You can download a form 2848 from irs.gov or access the file in the image below. Web for more information on designating a partnership representative, see form 8979, partnership representative revocation, designation, and resignation, and its instructions. The individual you authorize must be eligible to practice before the irs. For instructions and the latest information. Web form 2848, power of.

Instructions For Form 2848 Power Of Attorney And Declaration Of

Web washington — victims of severe storms, tornadoes and flooding in florida from april 12 to april 14, 2023, now have until august 15, 2023, to file various individual and business tax returns and make tax payments, the. Form 2848 is used to authorize an eligible individual to. This form grants a designated individual the authority to represent you before.

Instructions for Form 2848 IRS Tax Lawyer

Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Make sure the form is signed by all parties either electronically or with an ink signature. The individual you authorize must be eligible to practice before the irs. Web form 2848, power.

IRS Power of Attorney Form 2848 Year 2016 Power of Attorney

Make sure the form is signed by all parties either electronically or with an ink signature. Filling instructions for 2023 filling out the declaration can be a daunting task for some, but with proper guidance, it can be done accurately and efficiently. Web what is a form 2848? Web form 2848, power of attorney and declaration of representative pdf form.

Form 2848 IRS Power of Attorney (2023)

Power of attorney and declaration of representative. Web what is a form 2848? Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. See substitute form 2848, later, for information about using a power of attorney other than a form 2848 to authorize an individual to represent.

Form 2848 Instructions

Form 2848, part ii, declaration of representative, lists eligible designations in items (a. Web this article aims to provide a comprehensive guideline on irs form 2848, ensuring that you have all the necessary information to use the document correctly. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how.

Web Information About Form 2848, Power Of Attorney And Declaration Of Representative, Including Recent Updates, Related Forms, And Instructions On How To File.

January 2021) department of the treasury internal revenue service. Date / / part i power of attorney. This form grants a designated individual the authority to represent you before the irs, so it's essential to fill it out correctly. Form 2848, part ii, declaration of representative, lists eligible designations in items (a.

Web Form 2848, Power Of Attorney And Declaration Of Representative Pdf Form 8821, Tax Information Authorization Pdf Log In To Submit Before You Get Started Ensure You Have Authenticated The Identity Of Your Client.

Make sure the form is signed by all parties either electronically or with an ink signature. Web for more information on designating a partnership representative, see form 8979, partnership representative revocation, designation, and resignation, and its instructions. Filling instructions for 2023 filling out the declaration can be a daunting task for some, but with proper guidance, it can be done accurately and efficiently. See substitute form 2848, later, for information about using a power of attorney other than a form 2848 to authorize an individual to represent you before the irs.

If Your Parent Is No Longer Competent And You Are Your Parent’s Power Of Attorney, You Can Fill Out The Form To Appoint Yourself As A Representative.

Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. You can download a form 2848 from irs.gov or access the file in the image below. Web this article aims to provide a comprehensive guideline on irs form 2848, ensuring that you have all the necessary information to use the document correctly. Form 2848 is used to authorize an eligible individual to.

For Instructions And The Latest Information.

We will cover the form's purpose, who cannot use it, a fictional example to showcase its benefits, and common problems with their solutions. Web washington — victims of severe storms, tornadoes and flooding in florida from april 12 to april 14, 2023, now have until august 15, 2023, to file various individual and business tax returns and make tax payments, the. Form 2848 allows taxpayers to name someone to represent them before the irs. Power of attorney and declaration of representative.

![[Form 2848 Instructions] How to Fill out Form 2848 EaseUS in 2022](https://i.pinimg.com/originals/5d/2e/e7/5d2ee7f7d89068e86f739e40ac8cd1e8.png)