Form 2848 Instructions 2021

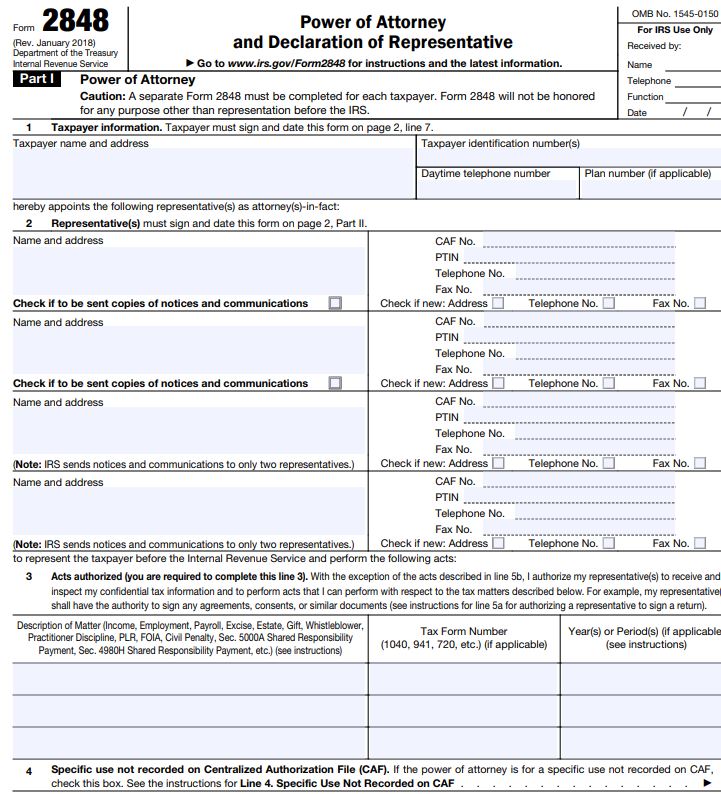

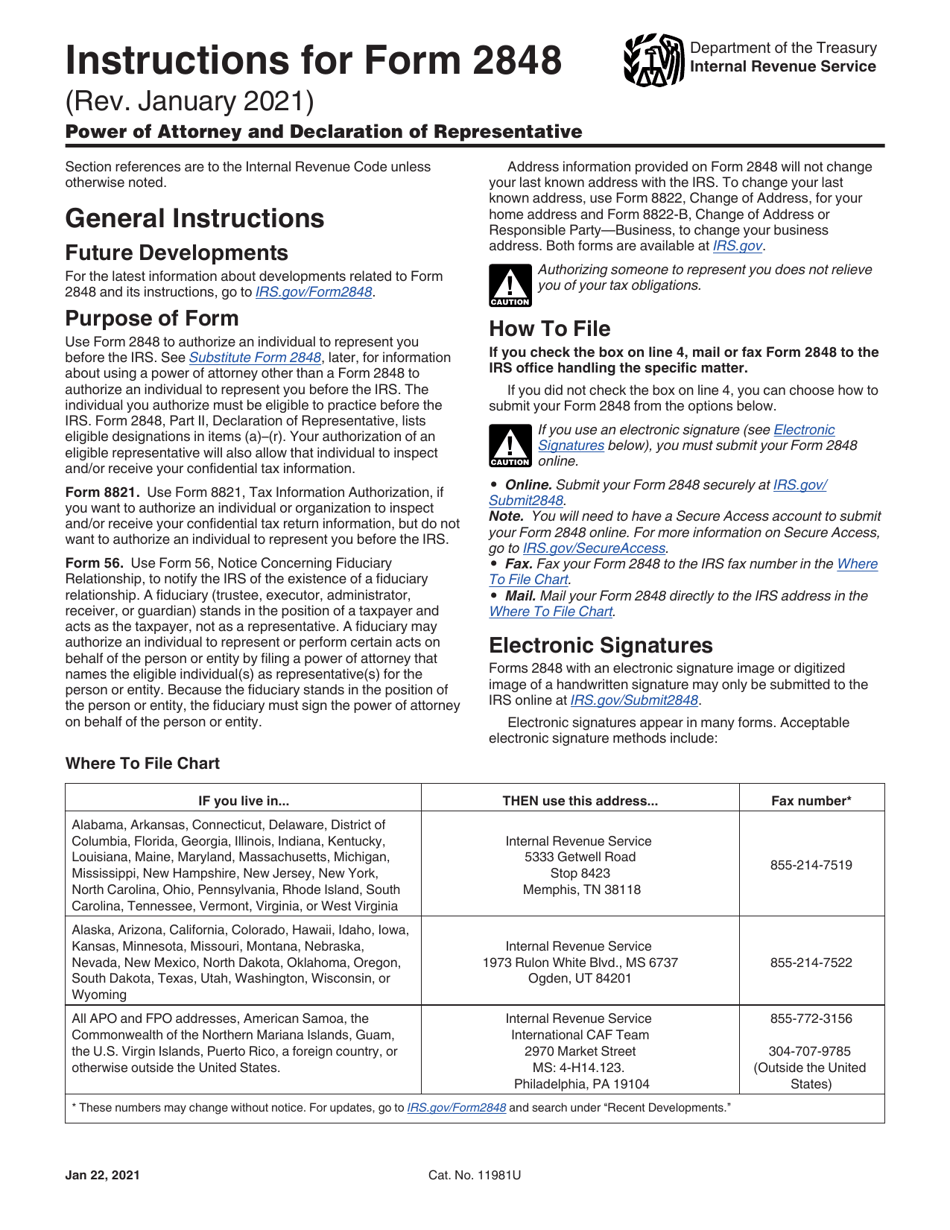

Form 2848 Instructions 2021 - Select the document you want to. Web use form 2848 to authorize an individual to represent you before the irs. 2/17/23) dor.sc.gov 3307 part i: Web what is a form 2848? Enero de 2021) department of the treasury internal revenue service. Therefore form 56 or new form 2848 signed by estate executor or. And you need to know that the person who's representing the taxpayer needs to be eligible to. January 2021) department of the treasury internal revenue service. Web power of attorney and sc2848 declaration of representative (rev. Form 2848 allows taxpayers to name someone to represent them before the irs.

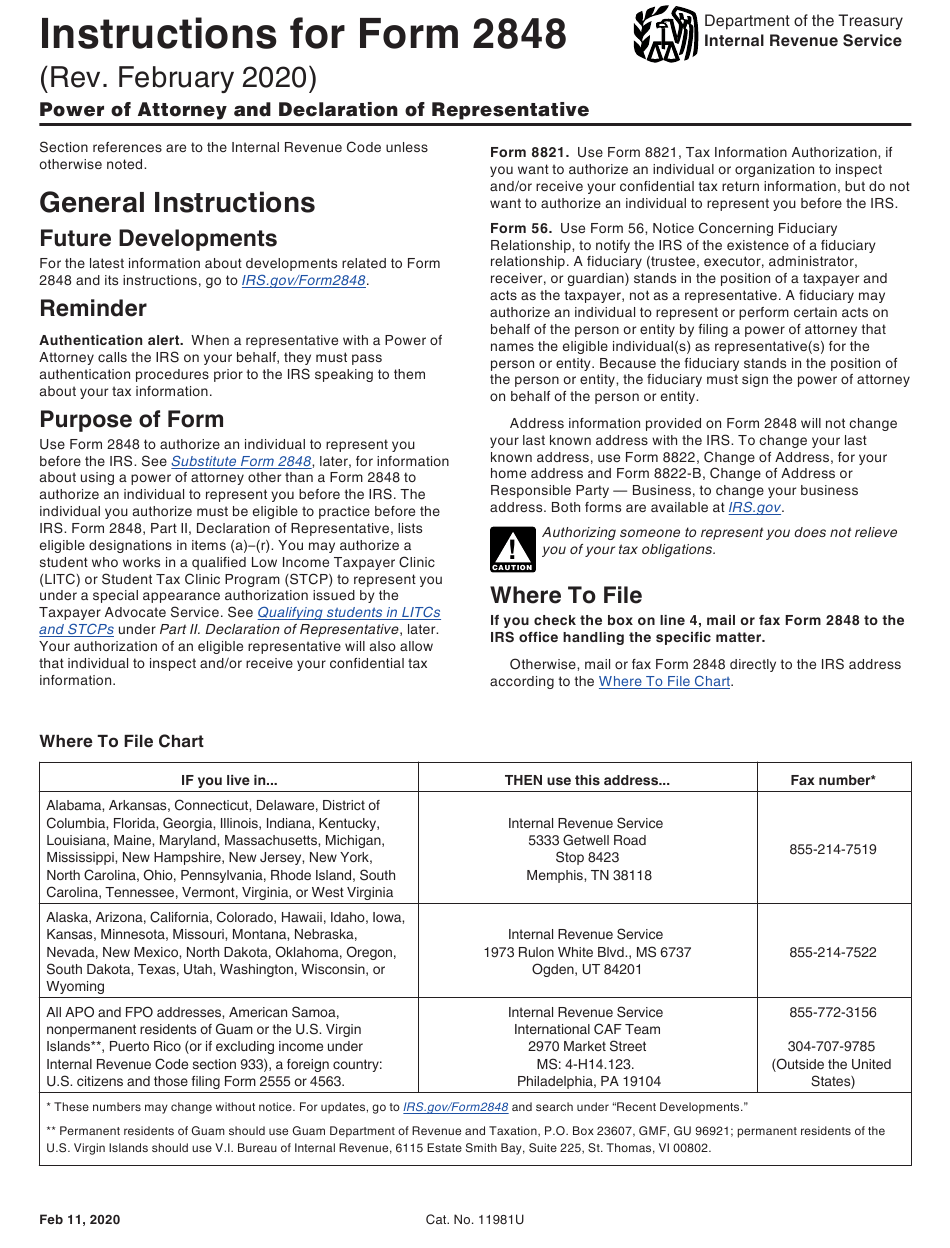

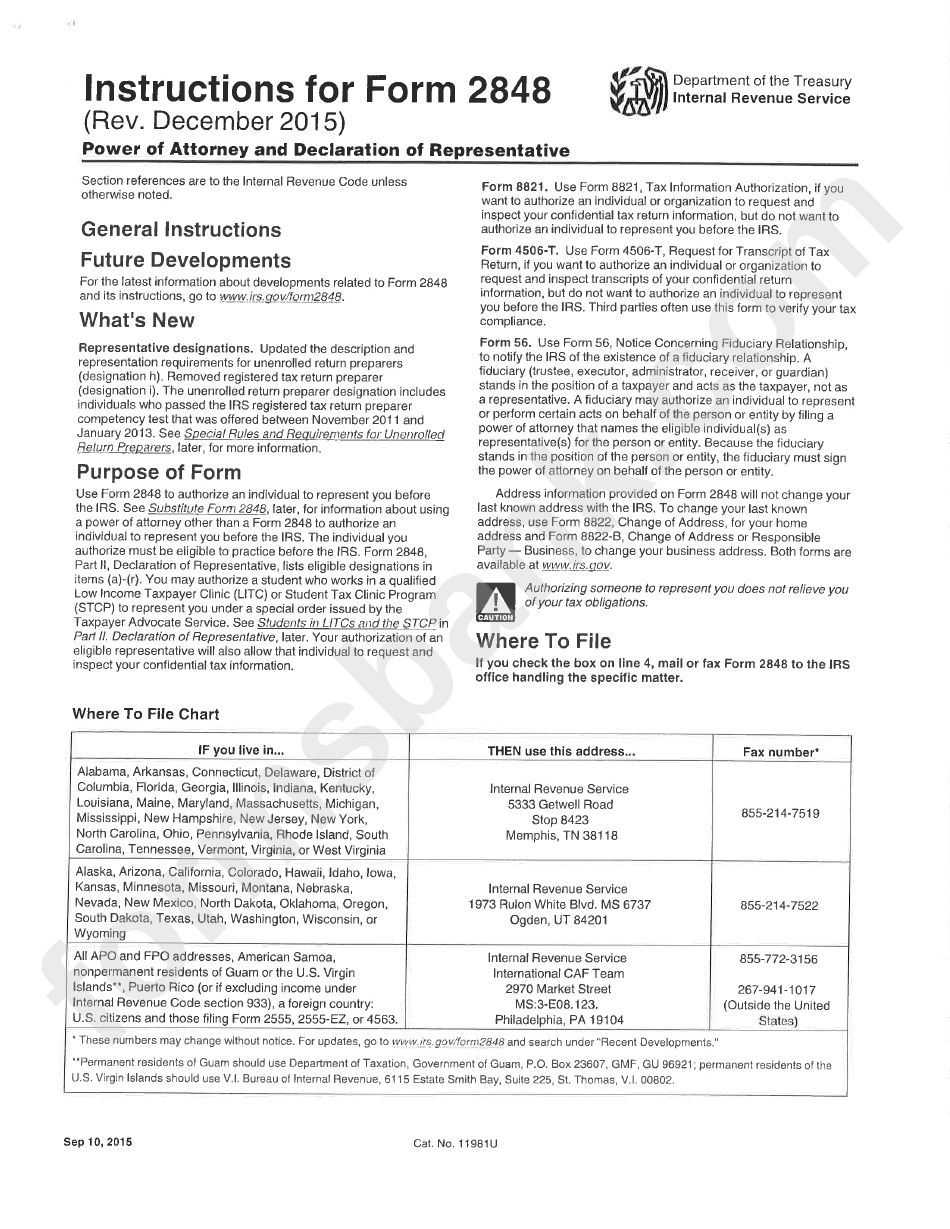

To do so, they must write withdraw across the top of the first page of. January 2021) department of the treasury internal revenue service. Web withdrawing form 2848 or 8821 authorization. For the latest information about. See substitute form 2848, later, for information about using a power of attorney other than a form 2848. Practitioners may withdraw an authorization at any time. Poder legal y declaración del representante. Power of attorney and declaration of representative is used to authorize an individual to appear before the irs to represent a taxpayer. Web instructions for form 2848(rev. Web form 2848, power of attorney and declaration of representative pdf, and form 8821, tax information authorization pdf, are two forms that allow taxpayers to.

Web form 2848, power of attorney and declaration of representative pdf, and form 8821, tax information authorization pdf, are two forms that allow taxpayers to. Web what is a form 2848? September 2021) power of attorney and declaration of representative department of the treasury. Web withdrawing form 2848 or 8821 authorization. Web form 2848, power of attorney and declaration of representative, is invalid once the taxpayer dies; Power of attorney indicates a required field. For the latest information about. Form 2848 allows taxpayers to name someone to represent them before the irs. If your parent is no longer competent and you are your parent’s power. Select the document you want to.

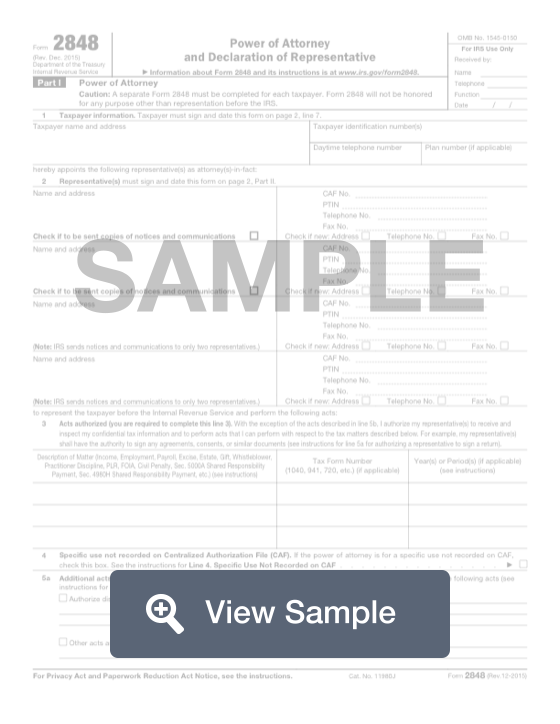

2848

Web form 2848, power of attorney and declaration of representative pdf, and form 8821, tax information authorization pdf, are two forms that allow taxpayers to. Web form 2848, power of attorney and declaration of representative, is invalid once the taxpayer dies; See substitute form 2848, later, for information about using a power of attorney other than a form 2848. Select.

Purpose of IRS Form 2848 How to fill & Instructions Accounts Confidant

January 2021) department of the treasury internal revenue service. Web form 2848, power of attorney and declaration of representative pdf, and form 8821, tax information authorization pdf, are two forms that allow taxpayers to. Web power of attorney and sc2848 declaration of representative (rev. Web use form 2848 to authorize an individual to represent you before the irs. September 2021).

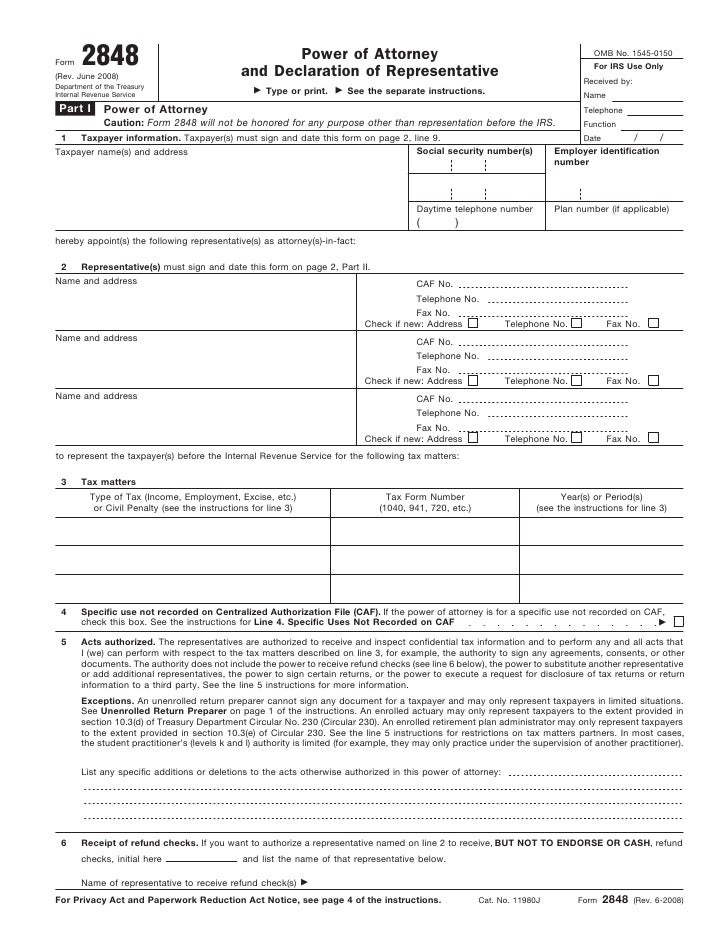

Download Instructions For IRS Form 2848 Power Of Attorney Power Of

Poder legal y declaración del representante. Web form 2848, power of attorney and declaration of representative, is invalid once the taxpayer dies; Power of attorney and declaration of representative is used to authorize an individual to appear before the irs to represent a taxpayer. And you need to know that the person who's representing the taxpayer needs to be eligible.

Instructions For Form 2848 Power Of Attorney And Declaration Of

Web form 2848, power of attorney and declaration of representative pdf, and form 8821, tax information authorization pdf, are two forms that allow taxpayers to. January 2021) department of the treasury internal revenue service. For the latest information about. Enero de 2021) department of the treasury internal revenue service. If your parent is no longer competent and you are your.

[Form 2848 Instructions] How to Fill out Form 2848 EaseUS in 2022

Web instructions for form 2848(rev. January 2021) department of the treasury internal revenue service. Poder legal y declaración del representante. Ad download or email irs 2848 & more fillable forms, register and subscribe now! Web use form 2848 to authorize an individual to represent you before the irs.

The Tax Times IRS Has Updated Its Taxpayer And Third Party

For the latest information about. To do so, they must write withdraw across the top of the first page of. Practitioners may withdraw an authorization at any time. Web withdrawing form 2848 or 8821 authorization. Power of attorney indicates a required field.

Download Instructions for IRS Form 2848 Power of Attorney and

2/17/23) dor.sc.gov 3307 part i: Web form 2848, power of attorney and declaration of representative, is invalid once the taxpayer dies; Therefore form 56 or new form 2848 signed by estate executor or. Web instructions for form 2848(rev. If your parent is no longer competent and you are your parent’s power.

IRS Form 2848 [Report Power Of Attorney] Internal Revenue Service

Web withdrawing form 2848 or 8821 authorization. See substitute form 2848, later, for information about using a power of attorney other than a form 2848. January 2021) department of the treasury internal revenue service. Web use form 2848 to authorize an individual to represent you before the irs. Web form 2848, power of attorney and declaration of representative pdf, and.

Form 2848 Fill Out Online IRS Power of Attorney Instructions FormSwift

2/17/23) dor.sc.gov 3307 part i: Web form 2848, power of attorney and declaration of representative, is invalid once the taxpayer dies; Poder legal y declaración del representante. Select the document you want to. September 2021) power of attorney and declaration of representative department of the treasury.

Download Instructions for Form IL2848, IL2848A, IL2848B PDF

Power of attorney and declaration of representative is used to authorize an individual to appear before the irs to represent a taxpayer. January 2021) department of the treasury internal revenue service. Web what is a form 2848? See substitute form 2848, later, for information about using a power of attorney other than a form 2848. Form 2848 allows taxpayers to.

And You Need To Know That The Person Who's Representing The Taxpayer Needs To Be Eligible To.

If your parent is no longer competent and you are your parent’s power. Practitioners may withdraw an authorization at any time. Web instructions for form 2848(rev. Web form 2848, power of attorney and declaration of representative, is invalid once the taxpayer dies;

To Do So, They Must Write Withdraw Across The Top Of The First Page Of.

Form 2848 allows taxpayers to name someone to represent them before the irs. January 2021) department of the treasury internal revenue service. See substitute form 2848, later, for information about using a power of attorney other than a form 2848. 2/17/23) dor.sc.gov 3307 part i:

Power Of Attorney Indicates A Required Field.

Select the document you want to. Power of attorney and declaration of representative is used to authorize an individual to appear before the irs to represent a taxpayer. Web withdrawing form 2848 or 8821 authorization. Ad download or email irs 2848 & more fillable forms, register and subscribe now!

Enero De 2021) Department Of The Treasury Internal Revenue Service.

Web what is a form 2848? Poder legal y declaración del representante. For the latest information about. September 2021) power of attorney and declaration of representative department of the treasury.

![[Form 2848 Instructions] How to Fill out Form 2848 EaseUS in 2022](https://i.pinimg.com/originals/5d/2e/e7/5d2ee7f7d89068e86f739e40ac8cd1e8.png)

![IRS Form 2848 [Report Power Of Attorney] Internal Revenue Service](https://help.taxreliefcenter.org/wp-content/uploads/2018/04/scales-justice-judge-gavel-on-table-form-2848-ss-Featured-1024x573.jpg)