Form 2553 Due Date

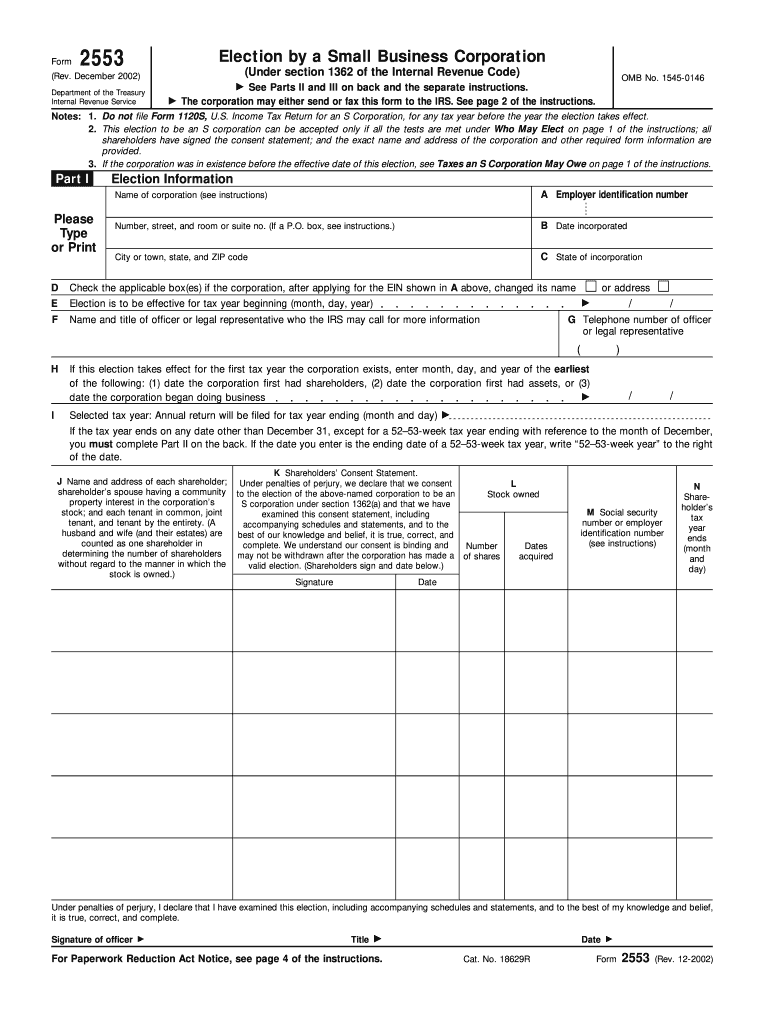

Form 2553 Due Date - Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes. Web due date of form 2553(s corporation election)? The irs provides relief for the late filing of form. Effective june 18, 2019, the filing address has changed for form 2553 filers located in certain states. For most businesses, this is january 1 st, so the form is due by march 15 th. If you file too late, you might have to wait one more year for the election to take effect. The form should be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second month of a tax year if the tax year is 2 ½ months or less. Because the corporation had no prior tax year, an election made before january 7 won’t be valid. Web the authors recommend that the form 2553 be filed by the earlier of 75 days or two months and 15 days after the date the s election is to become effective. Web your irs form 2553 would be due by december 15.

Web form 2553 due date. In order for election to be considered timely, s corporation election form 2553 needs to be filed with the irs within 75 days of formation of the entity. For details, see where to file your taxes for form 2553. Effective june 18, 2019, the filing address has changed for form 2553 filers located in certain states. No more than two months and 15 days after the beginning of the tax year the election is to take effect (typically march 15) Because the corporation had no prior tax year, an election made before january 7 won’t be valid. To be an s corporation beginning with its first tax year, the corporation must file form 2553 during the period that begins january 7 and ends march 21. Web your irs form 2553 would be due by december 15. Web due date of form 2553(s corporation election)? If you file too late, you might have to wait one more year for the election to take effect.

Web form 2553 (the s corp election form) must be filed with the irs. Web due date of form 2553(s corporation election)? Web the authors recommend that the form 2553 be filed by the earlier of 75 days or two months and 15 days after the date the s election is to become effective. No more than two months and 15 days after the beginning of the tax year the election is to take effect (typically march 15) However, in typical irs fashion there are 185 exceptions to the rule and the late s corporation election is another example. If you file too late, you might have to wait one more year for the election to take effect. Web form 2553 due date. Electing s status for an existing c corporation For details, see where to file your taxes for form 2553. Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes.

Form 2553 How To Qualify And An S Corporation Silver Tax Group

Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes. In this way, the form 2553 will be filed within both the form 8832 and form 2553 filing limits. No more than two months and 15 days after the beginning of the tax year the election is to take effect.

Irs Form 2553 Fill in Fill Out and Sign Printable PDF Template signNow

The form should be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second month of a tax year if the tax year is 2 ½ months or less. For details, see where to file your taxes for form 2553. Effective june 18, 2019, the filing address has.

Learn How to Fill the Form 2553 Election by a Small Business

Web form 2553 due date. The form should be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second month of a tax year if the tax year is 2 ½ months or less. Web irs form 2553 is an election to have your business entity recognized as.

Form 2553 Form Pros

If you file too late, you might have to wait one more year for the election to take effect. No more than two months and 15 days after the beginning of the tax year the election is to take effect (typically march 15) This includes having all of your business’ officers and shareholders (if applicable) sign the form and choosing.

IRS Form 2553 Instructions How and Where to File This Tax Form

No more than two months and 15 days after the beginning of the tax year the election is to take effect (typically march 15) Electing s status for an existing c corporation It is typically due within 75 days of forming your business entity or march 15 of the following year. In order for election to be considered timely, s.

Form 2553 Instructions How and Where to File mojafarma

This includes having all of your business’ officers and shareholders (if applicable) sign the form and choosing a fiscal tax year for your business. The irs provides relief for the late filing of form. Web the authors recommend that the form 2553 be filed by the earlier of 75 days or two months and 15 days after the date the.

Ssurvivor Form 2553 Irs Pdf

In this way, the form 2553 will be filed within both the form 8832 and form 2553 filing limits. It is typically due within 75 days of forming your business entity or march 15 of the following year. No more than two months and 15 days after the beginning of the tax year the election is to take effect (typically.

Form 2553 Instructions How and Where To File

Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes. However, in typical irs fashion there are 185 exceptions to the rule and the late s corporation election is another example. It is typically due within 75 days of forming your business entity or march 15 of the following year..

Form 2553 Instructions How and Where to File mojafarma

Web the deadline for filing form 2553, election by a small business corporation, differs depending on whether the corporation is already in existence (i.e., operating as a c corporation) or newly formed. In this way, the form 2553 will be filed within both the form 8832 and form 2553 filing limits. Web irs form 2553 is an election to have.

Form 2553 Election by a Small Business Corporation (2014) Free Download

Because the corporation had no prior tax year, an election made before january 7 won’t be valid. In order for election to be considered timely, s corporation election form 2553 needs to be filed with the irs within 75 days of formation of the entity. Web form 2553 due date. Web irs form 2553 is an election to have your.

Effective June 18, 2019, The Filing Address Has Changed For Form 2553 Filers Located In Certain States.

Web the authors recommend that the form 2553 be filed by the earlier of 75 days or two months and 15 days after the date the s election is to become effective. In this way, the form 2553 will be filed within both the form 8832 and form 2553 filing limits. However, in typical irs fashion there are 185 exceptions to the rule and the late s corporation election is another example. For details, see where to file your taxes for form 2553.

This Includes Having All Of Your Business’ Officers And Shareholders (If Applicable) Sign The Form And Choosing A Fiscal Tax Year For Your Business.

The irs provides relief for the late filing of form. No more than two months and 15 days after the beginning of the tax year the election is to take effect (typically march 15) Electing s status for an existing c corporation The form should be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second month of a tax year if the tax year is 2 ½ months or less.

Web Form 2553 (The S Corp Election Form) Must Be Filed With The Irs.

Web your irs form 2553 would be due by december 15. Because the corporation had no prior tax year, an election made before january 7 won’t be valid. Web the deadline for filing form 2553, election by a small business corporation, differs depending on whether the corporation is already in existence (i.e., operating as a c corporation) or newly formed. Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes.

It Is Typically Due Within 75 Days Of Forming Your Business Entity Or March 15 Of The Following Year.

Web due date of form 2553(s corporation election)? If you file too late, you might have to wait one more year for the election to take effect. Web form 2553 due date. For most businesses, this is january 1 st, so the form is due by march 15 th.