Form 2441 Instructions 2021

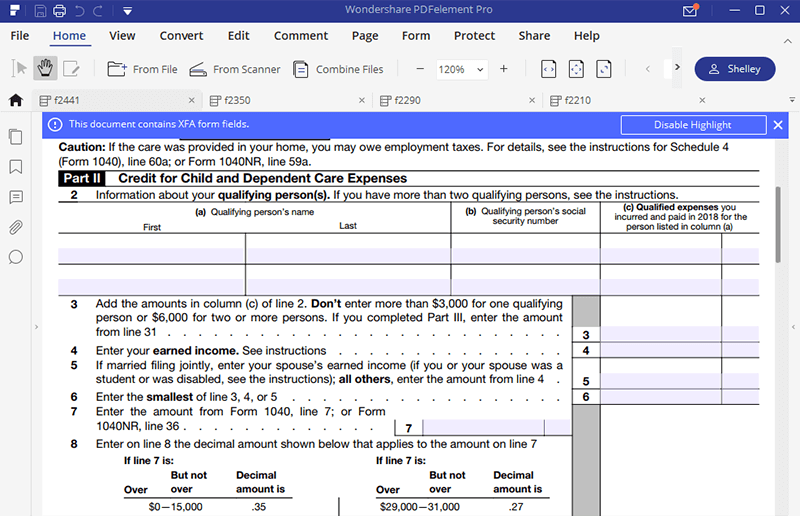

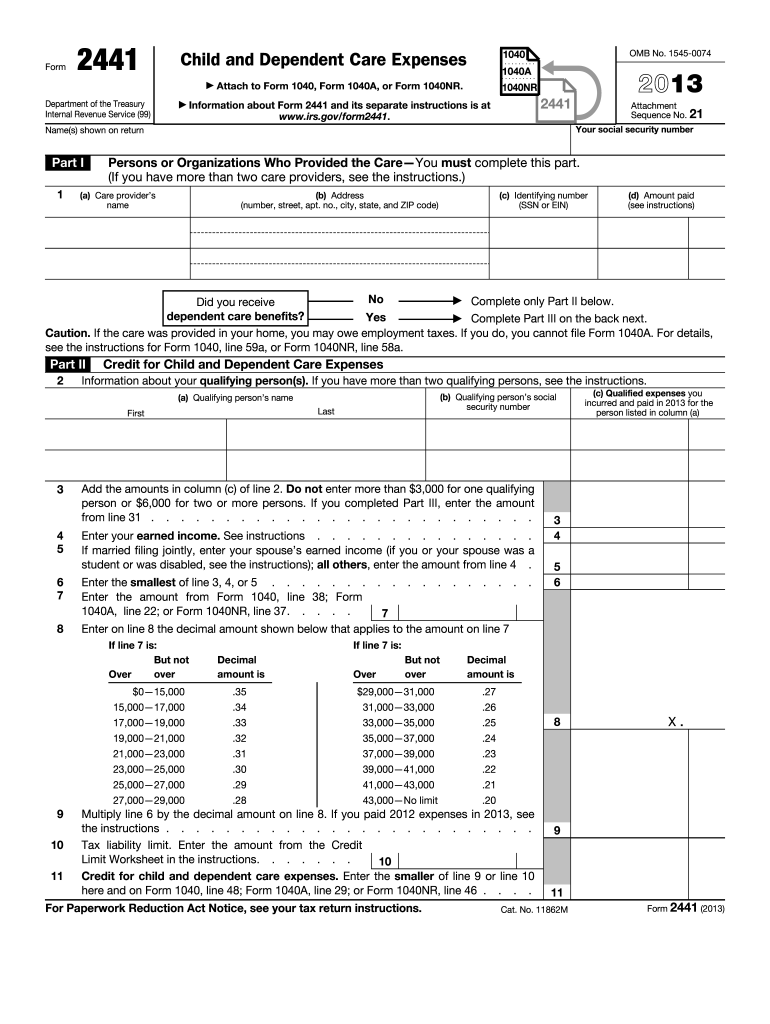

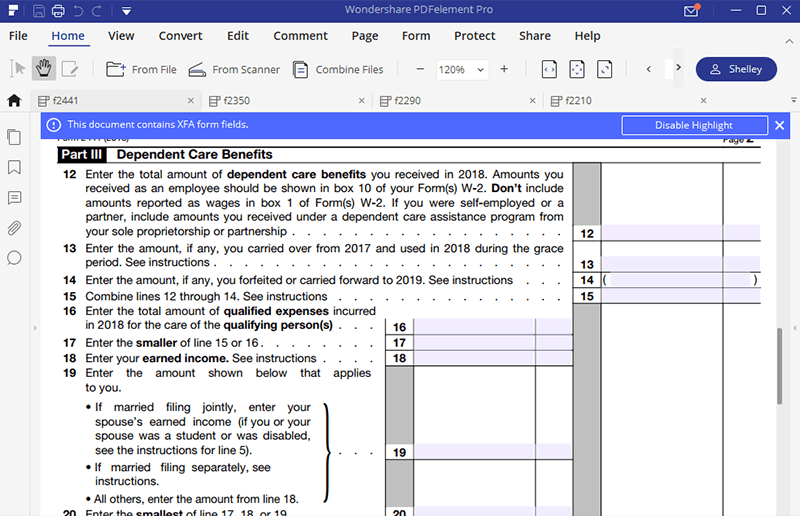

Form 2441 Instructions 2021 - Try it for free now! Web for more information on the percentage applicable to your income level, please refer to the 2021 instructions for form 2441 or irs publication 503, child and. Web form 2441 based on the income rules listed in the instructions under if you or your spouse was a student or disabled, check this box. • dependent care benefits• qualifying persons• qualified expenses part i — persons or organizations who provide the care •. For more information refer to form. Web irs form 2441 is used to report child and dependent care expenses as part of your federal income tax return. Web irs form 2441 instructions. By reporting these expenses, you may be entitled to a. Complete, edit or print tax forms instantly. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules.

Form 2441 is used to by. Ad access irs tax forms. Web for more information on the percentage applicable to your income level, please refer to the 2021 instructions for form 2441 or irs publication 503, child and. Try it for free now! The maximum credit percentage has been. Complete, edit or print tax forms instantly. • dependent care benefits• qualifying persons• qualified expenses part i — persons or organizations who provide the care •. Web for tax year 2021 only: For more information refer to form. Web irs form 2441 instructions.

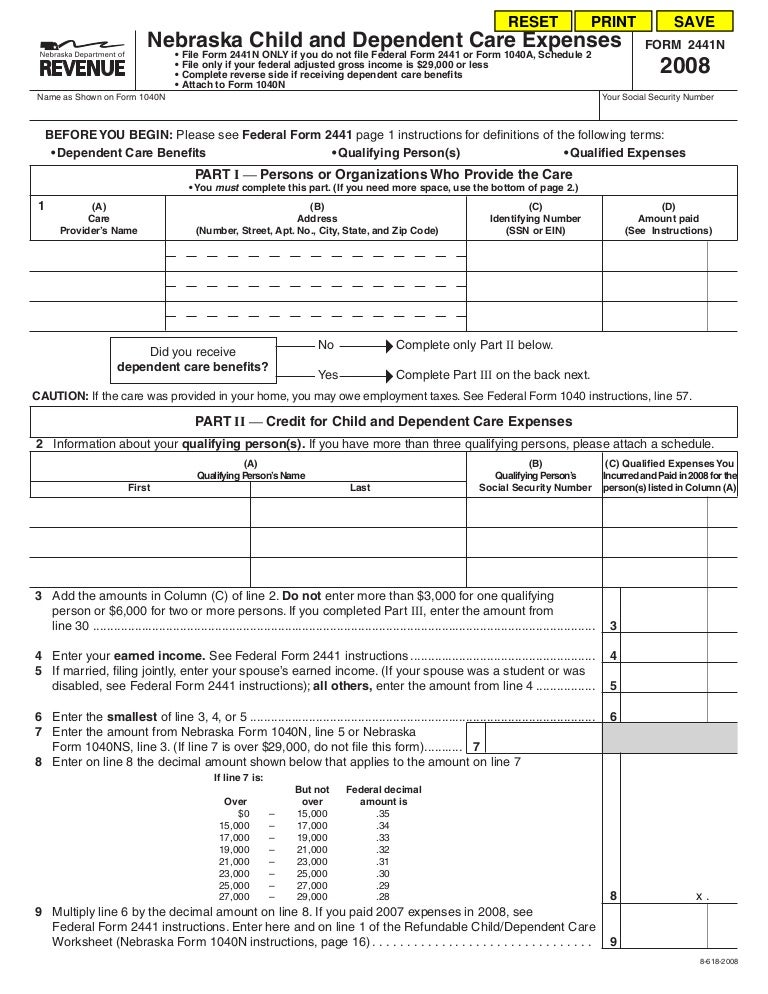

Web irs form 2441 instructions. Ad access irs tax forms. Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2441. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. By reporting these expenses, you may be entitled to a. Web form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441. The expense limit has been raised to $8,000 for one individual, and to $16,000 for more than one. Persons or organizations who provided the care; Web only if your adjusted gross income is $29,000 or less, and you are claiming the aska refundable child and dependent care credit.nebr •complete the reverse side of this form. Web for tax year 2021 only:

Ssurvivor Form 2441

Persons or organizations who provided the care; The irs has released form 2441 (child and dependent care expenses) and its accompanying instructions for the 2021 tax year. Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2441. The maximum credit percentage has been. Form 2441.

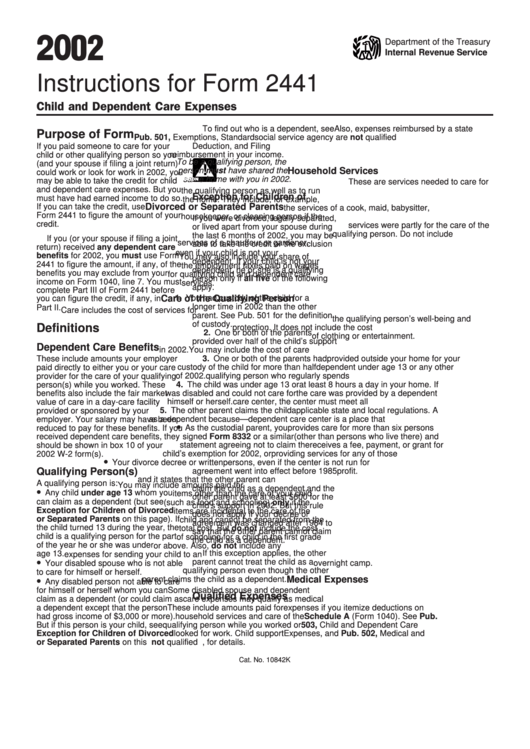

2002 Instructions For Form 2441 printable pdf download

Web instructions for definitions of the following terms: Web for more information on the percentage applicable to your income level, please refer to the 2021 instructions for form 2441 or irs publication 503, child and. The expense limit has been raised to $8,000 for one individual, and to $16,000 for more than one. • dependent care benefits• qualifying persons• qualified.

Breanna Form 2441 Tax

Web instructions for definitions of the following terms: •complete the reverse side of this form if. Web only if your adjusted gross income is $29,000 or less, and you are claiming the nebraska refundable child and dependent care credit. Ad access irs tax forms. Web for tax year 2021 only:

Breanna Form 2441 Instructions Provider Amount Paid

By reporting these expenses, you may be entitled to a. Web irs form 2441 instructions. Web irs form 2441 is used to report child and dependent care expenses as part of your federal income tax return. Web instructions for form 2441 child and dependent care expenses department of the treasury internal revenue service reminder married persons filing separately. The expense.

Form 2441 Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. Web form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441. Form 2441 is used to by. Web irs form 2441 instructions. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a.

Breanna Form 2441 Tax Liability Limit

Web for tax year 2021 only: Web instructions for definitions of the following terms: The irs has released form 2441 (child and dependent care expenses) and its accompanying instructions for the 2021 tax year. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on.

IRS Form 2441 What It Is, Who Can File, and How To Fill it Out (2023)

The irs has released form 2441 (child and dependent care expenses) and its accompanying instructions for the 2021 tax year. Try it for free now! Complete, edit or print tax forms instantly. Form 2441 is used to by. • dependent care benefits• qualifying persons• qualified expenses part i — persons or organizations who provide the care •.

944 Form 2021 2022 IRS Forms Zrivo

The irs has released form 2441 (child and dependent care expenses) and its accompanying instructions for the 2021 tax year. Web form 2441 based on the income rules listed in the instructions under if you or your spouse was a student or disabled, check this box. Web instructions for form 2441 child and dependent care expenses department of the treasury.

Form 5695 2021 2022 IRS Forms TaxUni

Credit for child or dependent care expenses; Web form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441. Web for tax year 2021 only: Web irs form 2441 instructions. Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to.

Breanna Form 2441 Instructions 2016

Web form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441. Get ready for tax season deadlines by completing any required tax forms today. For more information refer to form. •complete the reverse side of this form if. Web irs form 2441 instructions.

What’s New The 2021 Enhancements To The Credit For Child And.

By reporting these expenses, you may be entitled to a. Form 2441 is used to by. Credit for child or dependent care expenses; Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules.

Persons Or Organizations Who Provided The Care;

The irs has released form 2441 (child and dependent care expenses) and its accompanying instructions for the 2021 tax year. Ad access irs tax forms. Web to complete form 2441 child and dependent care expenses in the taxact program: •complete the reverse side of this form if.

Web Only If Your Adjusted Gross Income Is $29,000 Or Less, And You Are Claiming The Nebraska Refundable Child And Dependent Care Credit.

Complete, edit or print tax forms instantly. From within your taxact return (online or desktop), click federal (on smaller devices, click in. Web only if your adjusted gross income is $29,000 or less, and you are claiming the aska refundable child and dependent care credit.nebr •complete the reverse side of this form. Web instructions for definitions of the following terms:

Web For Tax Year 2021 Only:

Try it for free now! Web for more information on the percentage applicable to your income level, please refer to the 2021 instructions for form 2441 or irs publication 503, child and. Complete, edit or print tax forms instantly. Web form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441.

/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)