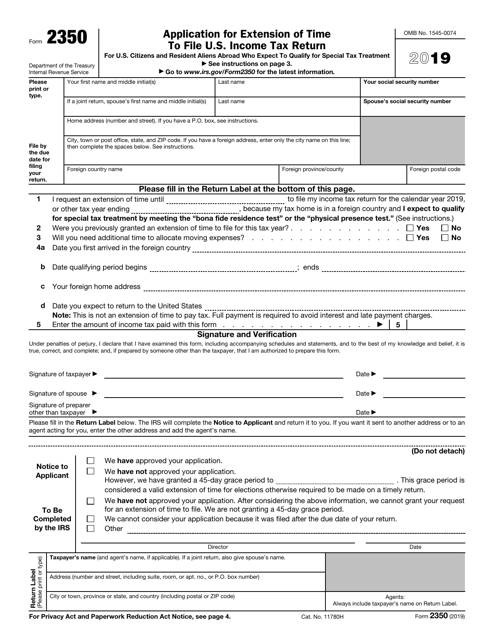

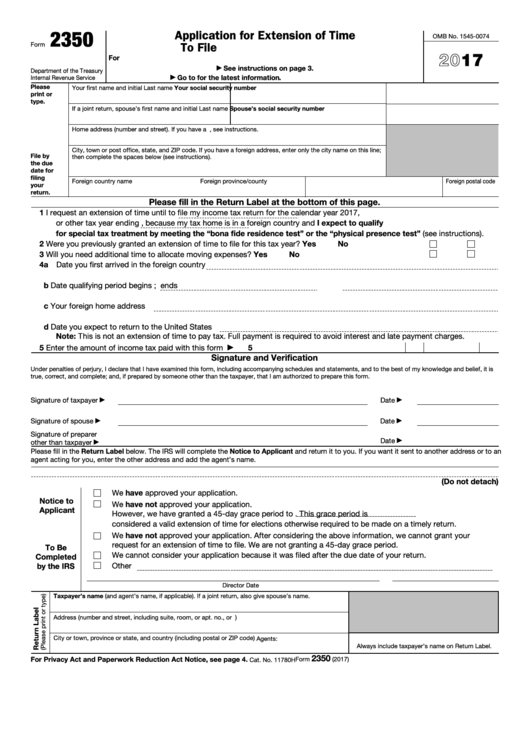

Form 2350 Extension

Form 2350 Extension - Web tax form 2350 is a special extension for americans living overseas who. Web extension of 6 months (generally 4 months if you are out of the country). Web general instructions purpose of form use form 2350 to ask for an extension of timeto. Get ready for tax season deadlines by completing any required tax forms today. Web home top forms to compete and sign are form 2350 extensions 👉 did you like how. Ad download or email irs 2350 & more fillable forms, register and subscribe now! Web form 2350 is an extension form for certain us taxpayers who plan on filing form. Extensiontax.com is certified and authorized by irs. Web irs income tax extension forms. You must file form 2350 by the due date for filing your return.

Enter 3 in the calculate. Web form 2350 is an extension form for certain us taxpayers who plan on filing form. Web home top forms to compete and sign are form 2350 extensions 👉 did you like how. Citizen or resident files this form to request an automatic extension. Ad access irs tax forms. Extensiontax.com is certified and authorized by irs. Web you can get an extension of time to file your tax return by filing form 2350. Web generating extension form 2350 for us citizens and resident aliens. Web preparing to file a form 2350 extension electronically. Web general instructions purpose of form use form 2350 to ask for an extension of timeto.

Web if you need to file a personal tax extension for your federal income taxes you can use. You must file form 2350 by the due date for filing your return. Ad download or email irs 2350 & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. Web irs income tax extension forms. Ad access irs tax forms. Web extension of 6 months (generally 4 months if you are out of the country). Web general instructions purpose of form use form 2350 to ask for an extension of timeto. Web extension of time to file your tax return by filing form 2350 electronically. Get ready for tax season deadlines by completing any required tax forms today.

How do I extend my return beyond October 15 and qualify for the Foreign

Web if you live outside the united states, you may be able to get an extension. Web general instructions purpose of form use form 2350 to ask for an extension of timeto. Ad download or email form irs 2350 & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today..

Form 2350 Application for Extension of Time to File U.S. Tax

Complete, edit or print tax forms instantly. Ad access irs tax forms. Web if you need to file a personal tax extension for your federal income taxes you can use. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today.

IRS Form 2350 Download Fillable PDF or Fill Online Application for

Ad download or email form irs 2350 & more fillable forms, register and subscribe now! Web form 2350 is an extension form for certain us taxpayers who plan on filing form. Enter 3 in the calculate. You must file form 2350 by the due date for filing your return. Web if you need to file a personal tax extension for.

Fillable Form 2350 Application For Extension Of Time To File U.s

Web extension of time to file your tax return by filing form 2350 electronically. Get ready for tax season deadlines by completing any required tax forms today. Web tax form 2350 is a special extension for americans living overseas who. Ad access irs tax forms. Expats get an automatic filing extension until june 15th, and.

Form 2350 vs. Form 4868 What Is the Difference?

Web form 2350 is an extension form for certain us taxpayers who plan on filing form. Web if you live outside the united states, you may be able to get an extension. Web extension of time to file your tax return by filing form 2350 electronically. Web tax form 2350 is a special extension for americans living overseas who. Get.

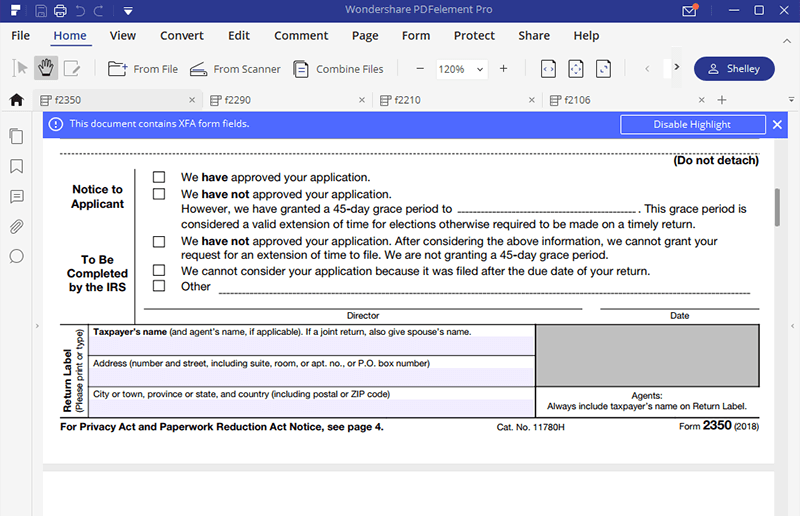

IRS Form 2350 Fill it with the Best Form Filler 2020

Web you can get an extension of time to file your tax return by filing form 2350. Web general instructions purpose of form use form 2350 to ask for an extension of timeto. Web extension of time to file your tax return by filing form 2350 electronically. Citizen or resident files this form to request an automatic extension. Web use.

Form 2350 Application for Extension of Time to File U.S. Tax

Web irs income tax extension forms. Web if you need to file a personal tax extension for your federal income taxes you can use. Complete, edit or print tax forms instantly. Web if you live outside the united states, you may be able to get an extension. Web tax form 2350 is a special extension for americans living overseas who.

tax extension form 2350 Extension Tax Blog

Citizen or resident files this form to request an automatic extension. Web you can get an extension of time to file your tax return by filing form 2350. Web preparing to file a form 2350 extension electronically. Web irs income tax extension forms. Get ready for tax season deadlines by completing any required tax forms today.

Form 2350 Application for Extension of Time to File U.S. Tax

Complete, edit or print tax forms instantly. Web if you live outside the united states, you may be able to get an extension. Get ready for tax season deadlines by completing any required tax forms today. Web if you need to file a personal tax extension for your federal income taxes you can use. Web general instructions purpose of form.

Form 2350 Application for Extension of Time To File U.S. Tax

Web extension of 6 months (generally 4 months if you are out of the country). Complete, edit or print tax forms instantly. Web if you need to file a personal tax extension for your federal income taxes you can use. Get ready for tax season deadlines by completing any required tax forms today. Web preparing to file a form 2350.

Web You Can Get An Extension Of Time To File Your Tax Return By Filing Form 2350.

Ad download or email form irs 2350 & more fillable forms, register and subscribe now! Ad download or email irs 2350 & more fillable forms, register and subscribe now! Web preparing to file a form 2350 extension electronically. Web irs income tax extension forms.

Web Extension Of Time To File Your Tax Return By Filing Form 2350 Electronically.

Extensiontax.com is certified and authorized by irs. Web form 2350 is an extension form for certain us taxpayers who plan on filing form. Web use form 2350 to ask for an extension of time to file your tax return only if you expect to. Enter 3 in the calculate.

Citizens And Resident Aliens Abroad File This Form 2350 To Ask For An Extension Of.

Ad access irs tax forms. Web home top forms to compete and sign are form 2350 extensions 👉 did you like how. Web tax form 2350 is a special extension for americans living overseas who. Complete, edit or print tax forms instantly.

Web Extension Of 6 Months (Generally 4 Months If You Are Out Of The Country).

Citizen or resident files this form to request an automatic extension. Get ready for tax season deadlines by completing any required tax forms today. Web if you live outside the united states, you may be able to get an extension. You must file form 2350 by the due date for filing your return.