Form 2290 Exemptions

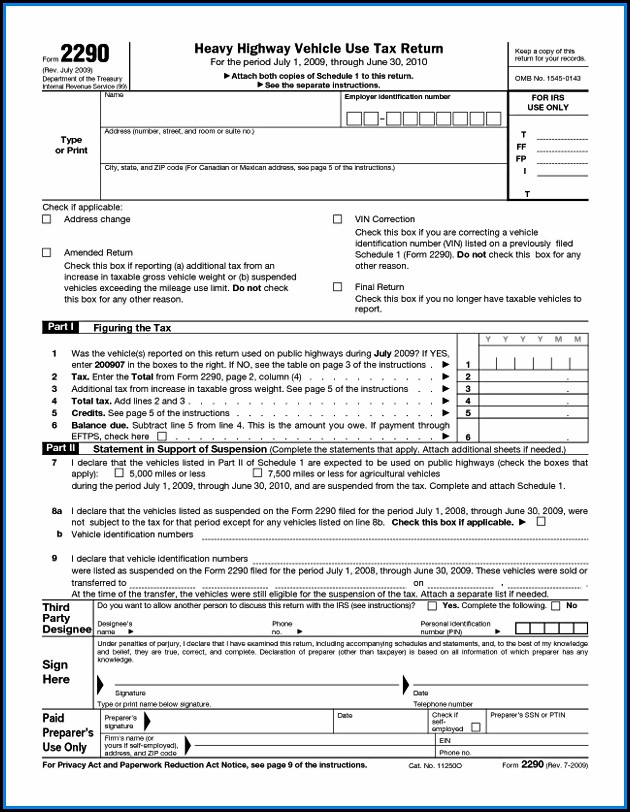

Form 2290 Exemptions - Form 2290 is used to figure and pay the tax due on highway motor vehicles for any taxable period with a taxable gross weight of 55,000 pounds or more.it is. Web file your form 2290. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Ad get your schedule 1 now. Web highway motor vehicles that do not exceed 5,000 miles (7,500 miles for agricultural vehicles) are exempted from paying heavy vehicle use tax, and they fall. If your vehicle falls under. This form is used to report and pay the heavy highway. Qualified blood collector vehicles (see below) used by qualified blood collector organizations mobile machinery. But an irs also provides a special offer to. Web agricultural vehicles that are driven less than 7500 miles are exempted from paying hvut.

Use coupon code get20b & get 20% off. Web file your form 2290. This form is used to report and pay the heavy highway. Electronic federal tax payment system (eftps). If your vehicle falls under. Do your truck tax online & have it efiled to the irs! File your hvut 2290 with 2290heavytax.com. Web when form 2290 taxes are due for vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31. Web electronic funds withdrawal. Web here is the answer:

If your vehicle falls under. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. When filing your form 2290, you'll need to indicate that your vehicle is exempt from the heavy vehicle use tax (hvut) due to agricultural use. Web when form 2290 taxes are due for vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31. Web irs form 2290: Web here is the answer: Generally, the internal revenue service collects the 2290 highway tax amount from the heavy vehicle owners. Use coupon code get20b & get 20% off. Web also exempt from the tax (not required to file form 2290) are: Do your truck tax online & have it efiled to the irs!

How to Efile Form 2290 for 202223 Tax Period

In this article, we cover the following topics: But an irs also provides a special offer to. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Web this article will guide you through understanding exemptions, and debunking the myth of the 2290 exemption form..

Fillable Form 2290 20232024 Create, Fill & Download 2290

Use coupon code get20b & get 20% off. Web electronic funds withdrawal. If your vehicle falls under. Electronic federal tax payment system (eftps). When filing your form 2290, you'll need to indicate that your vehicle is exempt from the heavy vehicle use tax (hvut) due to agricultural use.

PPT IRS TAX Form 2290 Exemptions PowerPoint Presentation, free

Web when form 2290 taxes are due for vehicles first used on a public highway during the month of july, file form 2290 and pay the appropriate tax between july 1 and august 31. Web in order to qualify for the 2290 exemption, taxpayers must meet the following criteria: A highway motor vehicle which runs 5,000 miles or less (7,500.

File IRS Form 2290 Online Heavy Vehicle Use Tax (HVUT) Return

We help you file form 2290 quick. Web electronic funds withdrawal. If your vehicle falls under. When filing your form 2290, you'll need to indicate that your vehicle is exempt from the heavy vehicle use tax (hvut) due to agricultural use. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period.

Form 2290 Irs Online Form Resume Examples o7Y3xpzVBN

Web this article will guide you through understanding exemptions, and debunking the myth of the 2290 exemption form. Do your truck tax online & have it efiled to the irs! Web about form 2290, heavy highway vehicle use tax return. Web keep your trucking company operations legal, saving you time and the costs of expensive fines. Web form 2290 exemptions.

Irs Form 2290 Due Date Form Resume Examples EY392gD82V

Figure and pay the tax due on highway motor vehicles used during the period with a. Qualified blood collector vehicles (see below) used by qualified blood collector organizations mobile machinery. Generally, the internal revenue service collects the 2290 highway tax amount from the heavy vehicle owners. Web file your form 2290. Ad with 2290 online, you can file your heavy.

Agricultural Vehicle Exemptions for Form 2290 Eligibility and Requirements

But an irs also provides a special offer to. Generally, the internal revenue service collects the 2290 highway tax amount from the heavy vehicle owners. In this article, we cover the following topics: Web keep your trucking company operations legal, saving you time and the costs of expensive fines. When filing your form 2290, you'll need to indicate that your.

FMCSA HOS Exemptions And Other Big COVID19 Updates You Need To Know

Do your truck tax online & have it efiled to the irs! Ad get your schedule 1 now. Form 2290 is used to figure and pay the tax due on highway motor vehicles for any taxable period with a taxable gross weight of 55,000 pounds or more.it is. Web also exempt from the tax (not required to file form 2290).

FILING YOUR IRS HVUT FORM 2290 ONLINE FOR THE TY 202223 TaxSeer 2290

Electronic federal tax payment system (eftps). Qualified blood collector vehicles (see below) used by qualified blood collector organizations mobile machinery. Web form 2290 exemptions tax season can be a stressful time of year for those who are required to file the form 2290. When filing your form 2290, you'll need to indicate that your vehicle is exempt from the heavy.

Form 2290 Exemptions YouTube

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. We help you file form 2290 quick. Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Qualified blood collector vehicles (see below) used by qualified blood collector organizations mobile machinery. #1 choice for fleets & drivers.

This Form Is Used To Report And Pay The Heavy Highway.

Generally, the internal revenue service collects the 2290 highway tax amount from the heavy vehicle owners. Ad get your schedule 1 now. File your hvut 2290 with 2290heavytax.com. Web electronic funds withdrawal.

Web Form 2290 Exemptions Tax Season Can Be A Stressful Time Of Year For Those Who Are Required To File The Form 2290.

A highway motor vehicle which runs 5,000 miles or less (7,500 miles or less for agricultural vehicles) is exempt from tax but still requires a form. Do your truck tax online & have it efiled to the irs! Ad with 2290 online, you can file your heavy vehicle use tax form in just 3 easy steps. Electronic federal tax payment system (eftps).

Web In Order To Qualify For The 2290 Exemption, Taxpayers Must Meet The Following Criteria:

Qualified blood collector vehicles (see below) used by qualified blood collector organizations mobile machinery. Web keep your trucking company operations legal, saving you time and the costs of expensive fines. Web irs form 2290: If your vehicle falls under.

When Filing Your Form 2290, You'll Need To Indicate That Your Vehicle Is Exempt From The Heavy Vehicle Use Tax (Hvut) Due To Agricultural Use.

Easy, fast, secure & free to try. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30,. Web this article will guide you through understanding exemptions, and debunking the myth of the 2290 exemption form. #1 choice for fleets & drivers.