Form 2290 Due Date 2020

Form 2290 Due Date 2020 - 2020 is a leap year, so there are 366 days in this year. If you already have a balance due (tax) on a later date, you may need to pay a part of the balance before filing form 2290. All taxpayers who file form 2290. The short form for this date. Do your truck tax online & have it efiled to the irs! Web 13 rows form 2290 due dates for vehicles placed into service during reporting period. Try it for free now! For heavy vehicles with a taxable gross weight of 55,000 pounds or more, form 2290 due date is by august 31 of every year. A typical tax year for form 2290 begins on july 1. Don't miss out on important info!

Web your starting date is august 22, 2020 so that means that 90 days later would be. Web form 2290 due dates and extended due dates for tax year 2021 tax period beginning and ending dates form 2290 tax period due date (weekends and holidays. Do your truck tax online & have it efiled to the irs! Web the deadline to file your form 2290 return depends on the first used month (fum) of the vehicle for the tax year. A typical tax year for form 2290 begins on july 1. If you already have a balance due (tax) on a later date, you may need to pay a part of the balance before filing form 2290. The current heavy vehicle use tax begins on july 1, 2020, and ends on june 30, 2021 The present tax period for heavy vehicles initiates on. Form 2290 specifies your due date for form 1140 and. Web irs form 2290 due date is august 31st.

Web the deadline to file your form 2290 return depends on the first used month (fum) of the vehicle for the tax year. Don't miss out on important info! Upload, modify or create forms. Web the current period begins july 1, 2023, and ends june 30, 2024. Month new vehicle is first used. Web 2290 taxes are due now. Try it for free now! All taxpayers who file form 2290. Web does form 2290 always reflect your due date for form 1140, irs tax withholding and estimated tax or form 1040? If you use your vehicle for the first time in july 2022, your form 2290 due date will be august 31, 2022.

IRS Form 2290 Due Date For 20212022 Tax Period

Web 2290 due date form: Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Try it for free now! That time of the year and time to renew federal vehicle use tax form 2290. Ad get schedule 1 in minutes, your form 2290 is efiled.

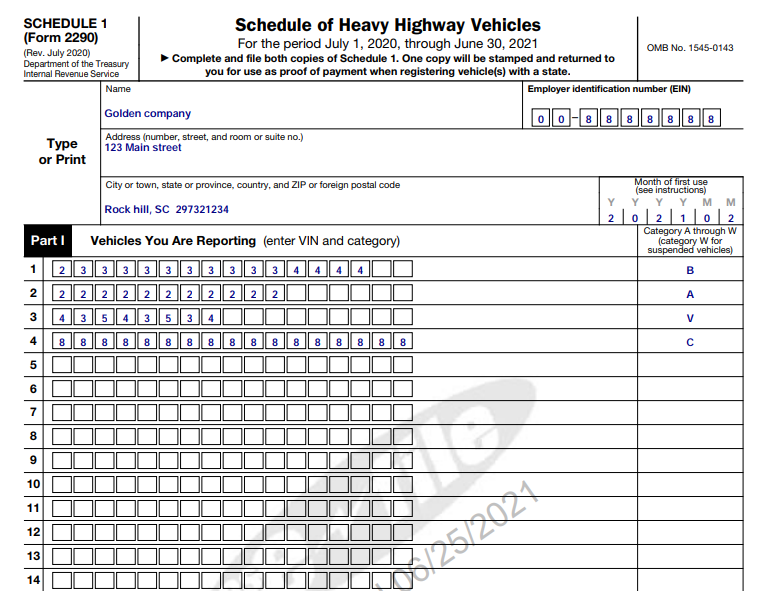

Form 2290 for 20202021 To efile vehicle use tax

The present tax period for heavy vehicles initiates on. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. If you already have a balance due (tax) on a later date, you may need to pay a part of the balance before filing form 2290. Current tax period for heavy vehicles use tax begins on.

form 2290 efile for 2020 2290 Tax Due

Web the deadline to file your form 2290 return depends on the first used month (fum) of the vehicle for the tax year. Go to www.irs.gov/form2290 for instructions and the latest information. Do your truck tax online & have it efiled to the irs! Easy, fast, secure & free to try. Don't miss out on important info!

Understanding Form 2290 StepbyStep Instructions for 20222023

It must be filed every year. For heavy vehicles with a taxable gross weight of 55,000 pounds or more, form 2290 due date is by august 31 of every year. Upload, modify or create forms. Month new vehicle is first used. Web get a quick guide on form 2290 & it's due date to fulfill your tax obligations and meet.

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 2290 due dates and extended due dates for tax year 2021 tax period beginning and ending dates form 2290 tax period due date (weekends and holidays. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Go to www.irs.gov/form2290 for instructions and the latest.

4 Things You Need to Know When Filing Your 202021 HVUT Form 2290

All taxpayers who file form 2290. Current tax period for heavy vehicles use tax begins on july 1st, 2019 and ends on. If you use your vehicle for the first time in july 2022, your form 2290 due date will be august 31, 2022. Web irs form 2290 due date is august 31st. For heavy vehicles with a taxable gross.

Printable IRS Form 2290 for 2020 Download 2290 Form

Web 2290 taxes are due now. Web form 2290 due dates and extended due dates for tax year 2021 tax period beginning and ending dates form 2290 tax period due date (weekends and holidays. For newly purchased vehicles, form 2290. Web 13 rows form 2290 due dates for vehicles placed into service during reporting period. Web your starting date is.

IRS FORM 2290 ONLINE DUE DATE FOR 20202021

Easy, fast, secure & free to try. Web irs form 2290 due date is august 31st. If you use your vehicle for the first time in july 2022, your form 2290 due date will be august 31, 2022. A typical tax year for form 2290 begins on july 1. For heavy vehicles with a taxable gross weight of 55,000 pounds.

IRS Form 2290 Printable for 202122 Download 2290 for 6.90

Web the current period begins july 1, 2023, and ends june 30, 2024. Web 13 rows form 2290 due dates for vehicles placed into service during reporting period. Do your truck tax online & have it efiled to the irs! Web 2290 taxes are due now. Web form 2290 due dates and extended due dates for tax year 2021 tax.

Irs Form 2290 Printable Form Resume Examples

The current heavy vehicle use tax begins on july 1, 2020, and ends on june 30, 2021 If you use your vehicle for the first time in july 2022, your form 2290 due date will be august 31, 2022. Web august 26, 2020 the form 2290 for hvut is mandatory for truckers and is filed each year by august 31.

Easy, Fast, Secure & Free To Try.

For heavy vehicles with a taxable gross weight of 55,000 pounds or more, form 2290 due date is by august 31 of every year. Ad get ready for tax season deadlines by completing any required tax forms today. Web for the period july 1, 2019, through june 30, 2020 attach both copies of schedule 1 to this return. Web the current tax period is from july 1, 2022,to june 30, 2023.

The Present Tax Period For Heavy Vehicles Initiates On.

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web truckers and trucking businesses must be filed the irs form 2290 for heavy vehicle use taxes (hvut) every year by august 31st for the current tax period for heavy. Don't miss out on important info! Web 2290 due date form:

The Current Heavy Vehicle Use Tax Begins On July 1, 2020, And Ends On June 30, 2021

The short form for this date. Go to www.irs.gov/form2290 for instructions and the latest information. All taxpayers who file form 2290. If you use your vehicle for the first time in july 2022, your form 2290 due date will be august 31, 2022.

If You Already Have A Balance Due (Tax) On A Later Date, You May Need To Pay A Part Of The Balance Before Filing Form 2290.

Web the deadline to file your form 2290 return depends on the first used month (fum) of the vehicle for the tax year. Web does form 2290 always reflect your due date for form 1140, irs tax withholding and estimated tax or form 1040? Month new vehicle is first used. It is important to file form 2290 before the due date to avoid penalties.