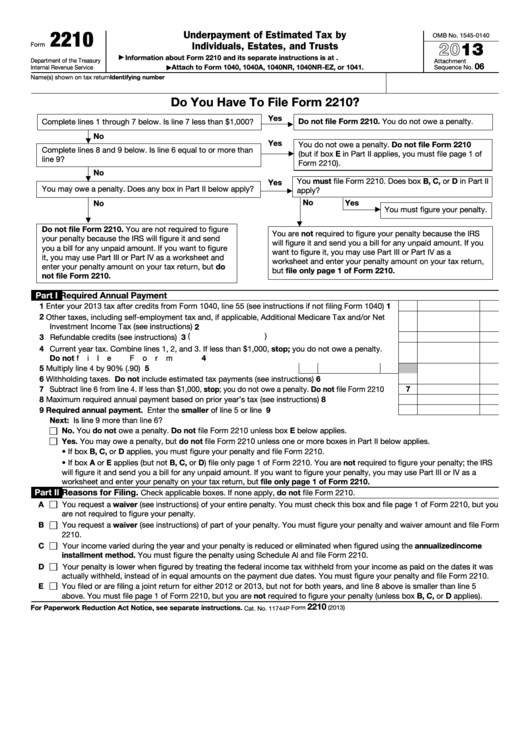

Form 2210 Penalty Calculator

Form 2210 Penalty Calculator - At the top of the form, enter the date that the tax was paid or april 15th, whichever is earlier. For example, if your tax liability is $2,000, it is assumed you. Taxact cannot calculate late filing nor late payment penalties. Web the irs will calculate your penalty amount and send you a bill. Web taxact cannot calculate late filing nor late payment penalties. Find how to figure and pay estimated taxes. Web to calculate the penalty yourself (other than corporations): Web if you need to calculate late filing or late payment penalties, you will need to work directly with the irs. Taxact cannot calculate late filing nor late payment penalties. Web your penalty will be based on the amount you owe and the number of days it is late.

Web form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the course of the year. Web your total underpayment amount. To avoid a penalty, pay your correct estimated taxes on time. Does any box in part ii below apply? Go to irs instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts for more. Web to calculate the penalty yourself (other than corporations): Don’t file form 2210 unless box e in part ii applies, then file page 1 of form 2210. If you owe underpayment penalties, you may need to file form 2210, underpayment of estimated tax by individuals, estates, and trusts. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web if you owe $1,000 or more, the penalty is calculated by quarter then summarized on form 2210.

The interest rate for underpayments, which is updated by the irs each quarter. Web go to form 2210. No you may owe a penalty. If you want to figure it, you may use part iii or. Find how to figure and pay estimated taxes. Web if you need to calculate late filing or late payment penalties, you will need to work directly with the irs. The form doesn't always have to be. You can let the irs. Go to irs instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts for more. Taxact cannot calculate late filing nor late payment penalties.

Fillable Form 2210 Fill Online, Printable, Fillable, Blank pdfFiller

You paid at least 90% of the tax shown on the return for the. Web if you need to calculate late filing or late payment penalties, you will need to work directly with the irs. Go to irs instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts for more. If you want to figure it, you.

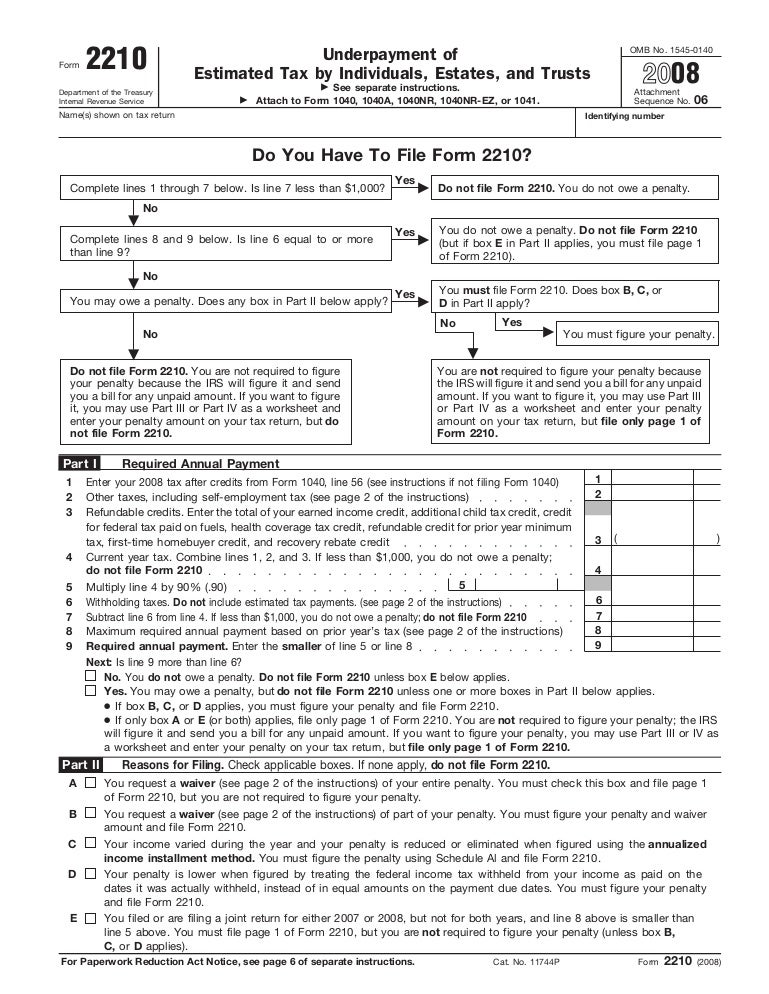

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

You paid at least 90% of the tax shown on the return for the. To avoid a penalty, pay your correct estimated taxes on time. The irs will generally figure your penalty for you and you should not file. The form doesn't always have to be. The quarter that you underpaid.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Add 3% to that percentage rate; If you want to figure it, you may use part iii or. Then 2210 will calculate the. The irs will generally figure your penalty for you and you should not file. You aren’t required to figure your penalty because the irs will figure it and send you a bill for any unpaid amount.

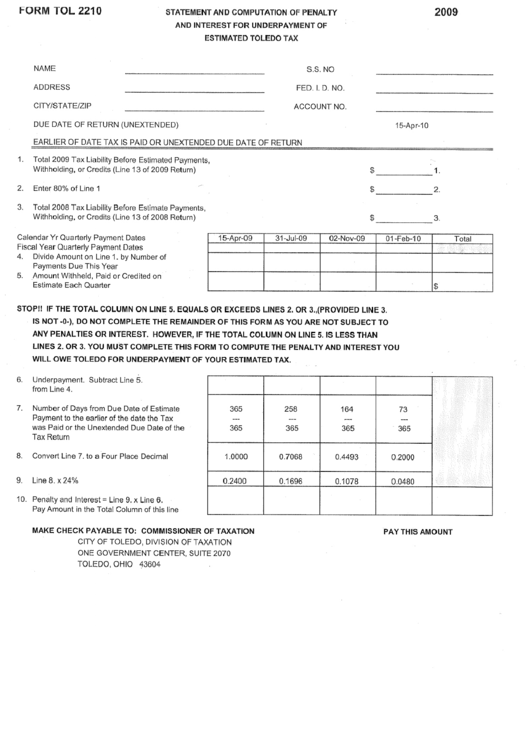

Form Tol2210 Statement And Computation Of Penalty And Interest For

Does any box in part ii below apply? The interest rate for underpayments, which is updated by the irs each quarter. If you owe underpayment penalties, you may need to file form 2210, underpayment of estimated tax by individuals, estates, and trusts. The number of days late value can only be calculated by the irs because they must. You can.

Form Tol 2210 Statement And Computation Of Penalty And Interest

If you owe underpayment penalties, you may need to file form 2210, underpayment of estimated tax by individuals, estates, and trusts. * trial calculations for tax after credits under. Web taxact cannot calculate late filing nor late payment penalties. The number of days late value can only be calculated by the irs because they must. It can be used to.

Ssurvivor Irs Form 2210 Penalty Worksheet

The quarter that you underpaid. Don’t file form 2210 unless box e in part ii applies, then file page 1 of form 2210. * trial calculations for tax after credits under. For example, if your tax liability is $2,000, it is assumed you. The form doesn't always have to be.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and Trusts

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. You may avoid the underpayment of estimated tax by individuals penalty if: * trial calculations for tax after credits under. Web to calculate the penalty yourself (other than corporations): Your filed tax return shows you owe less than $1,000 or 2.

AR2210 Individual Underpayment of Estimated Tax Penalty Form

Web don’t file form 2210. Taxact cannot calculate late filing nor late payment penalties. Web go to form 2210. It can be used to determine if there is a penalty and you may. Go to irs instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts for more.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web what is irs form 2210? To avoid a penalty, pay your correct estimated taxes on time. The form doesn't always have to be. * trial calculations for tax after credits under. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax.

Solved Turbo Tax 2020 not adding Form 2210 for underpayme... Page 2

Web calculate form 2210. Does any box in part ii below apply? Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. You aren’t required to figure your penalty because the irs will figure it and send you a bill for any unpaid amount. * trial calculations for tax after credits under.

At The Top Of The Form, Enter The Date That The Tax Was Paid Or April 15Th, Whichever Is Earlier.

Web the irs will calculate your penalty amount and send you a bill. Taxact cannot calculate late filing nor late payment penalties. The quarter that you underpaid. If you want to figure it, you may use part iii or.

Find How To Figure And Pay Estimated Taxes.

Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web don’t file form 2210. Your filed tax return shows you owe less than $1,000 or 2. Web to calculate the penalty yourself (other than corporations):

Web In General, You May Owe A Penalty For The Current Tax Year If The Total Of Your Withholdings And Timely Estimated Payments Did Not Equal At Least The Smaller Of The Above Amounts.

Web your penalty will be based on the amount you owe and the number of days it is late. Form 2210 is typically used. Web what is irs form 2210? You may avoid the underpayment of estimated tax by individuals penalty if:

Web If You Need To Calculate Late Filing Or Late Payment Penalties, You Will Need To Work Directly With The Irs.

Web if you need to calculate late filing or late payment penalties, you will need to work directly with the irs. Don’t file form 2210 unless box e in part ii applies, then file page 1 of form 2210. Taxact cannot calculate late filing nor late payment penalties. Taxact cannot calculate late filing nor late payment penalties.