Form 204 Colorado

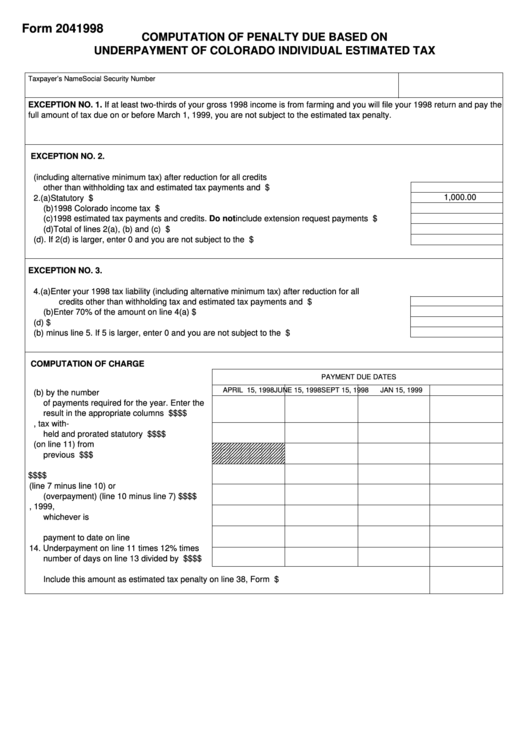

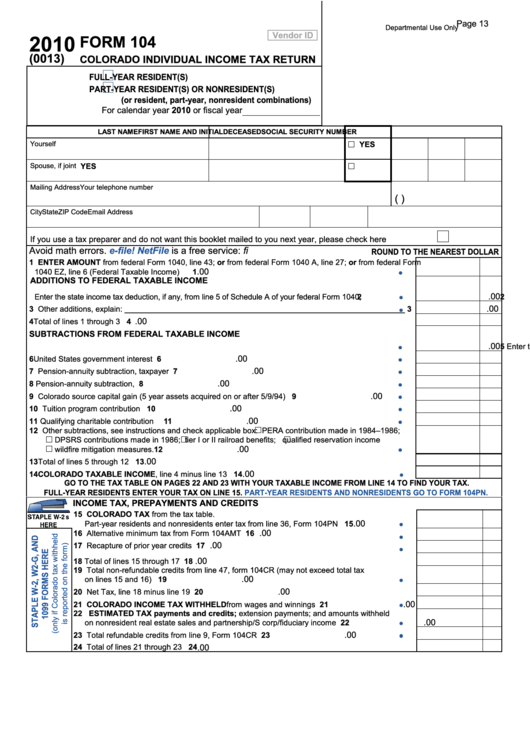

Form 204 Colorado - Web colorado department of revenue division of motor vehicles registration section www.colorado.gov/revenue fleet owners request for common registration expiration. This form is for income earned in tax year 2022, with tax returns due in april. Form dr 0077 certification of. Web tax forms, colorado form 104. Web colorado individual income tax filing guide mailing address for form dr 0104 104 book 2021 booklet includes: All forms and documents in number order. Web we last updated colorado form dr 0204 in january 2023 from the colorado department of revenue. Web individual taxpayers can use the following schedule, taken from part 4 of form 204, to calculate their required quarterly estimated payments using the annualized income. Web form 104 is the general, and simplest, income tax return for individual residents of colorado. The estimated tax penalty will not be.

Form dr 0716 statement of nonprofit church, synagogue, or organization; You need to fill out form 204 to. Web colorado individual income tax filing guide mailing address for form dr 0104 104 book 2021 booklet includes: License forms and documents by name. Web colorado secretary of state Web tax forms, colorado form 104. You may file by mail with paper forms or efile online (contains forms dr 0104, dr. The estimated tax penalty will not be. Web form 104 is the general, and simplest, income tax return for individual residents of colorado. This form is for income earned in tax year 2022, with tax returns due in april.

You may file by mail with paper forms or efile online (contains forms dr 0104, dr. Web individual taxpayers can use the following schedule, taken from part 4 of form 204, to calculate their required quarterly estimated payments using the annualized income. The estimated tax penalty will not be. Form dr 0077 certification of. Instructions | dr 0104 | related forms tax.colorado.gov. License forms and documents by name. Web colorado secretary of state Web tax forms, colorado form 104. Tax day is april 17th. Form dr 0716 statement of nonprofit church, synagogue, or organization;

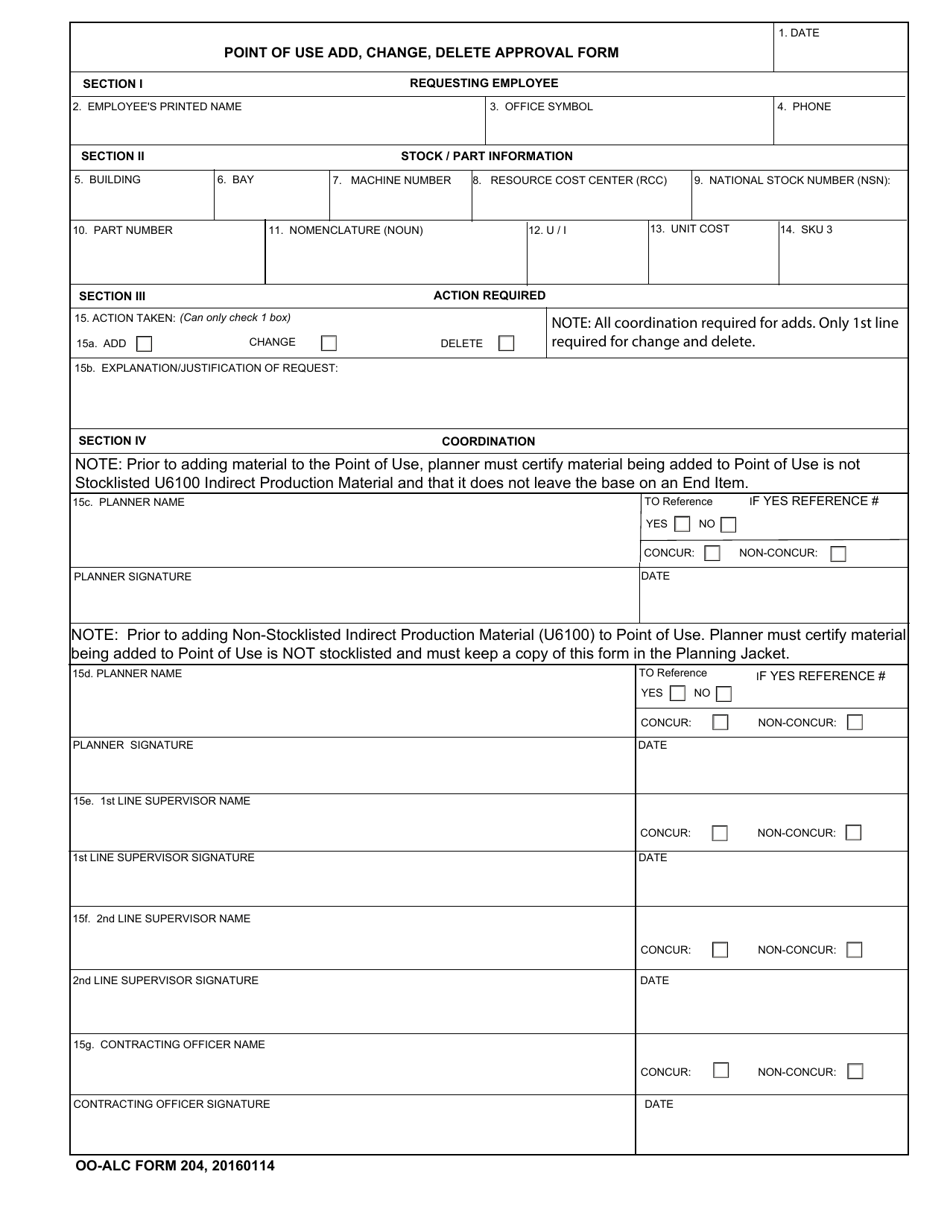

OOALC Form 204 Download Fillable PDF or Fill Online Point of Use Add

The estimated tax penalty will not be. Web tax forms, colorado form 104. Web this form and all supporting documents shall be submitted to the executive director of the department of revenue within 30 days from the payment date of the late fee. You need to fill out form 204 to. If you failed to pay or underpaid your estimated.

Fillable Form 204 Computation Of Penalty Due Based On Underpayment Of

You may file by mail with paper forms or efile online (contains forms dr 0104, dr. Web tax forms, colorado form 104. Web colorado individual income tax filing guide mailing address for form dr 0104 104 book 2021 booklet includes: If you failed to pay or underpaid your estimated income taxes the previous tax year, you need to fill out.

2165 County Road 204, Durango, CO 81301 4 Bed, 4 Bath SingleFamily

The estimated tax penalty will not be. Web colorado individual income tax filing guide mailing address for form dr 0104 104 book 2021 booklet includes: Web colorado composite nonresident income tax return form dr 1316*—colorado source capital gain affidavit form dr 5785*—authorization for electronic funds transfer (eft). Web individual taxpayers can use the following schedule, taken from part 4 of.

Form 104 Colorado Individual Tax Return 2010 printable pdf

Web we last updated colorado form dr 0204 in january 2023 from the colorado department of revenue. Generally you are subject to an estimated tax penalty if your current year estimated tax payments are not paid in a timely manner. This form is for income earned in tax year 2022, with tax returns due in april. Web colorado secretary of.

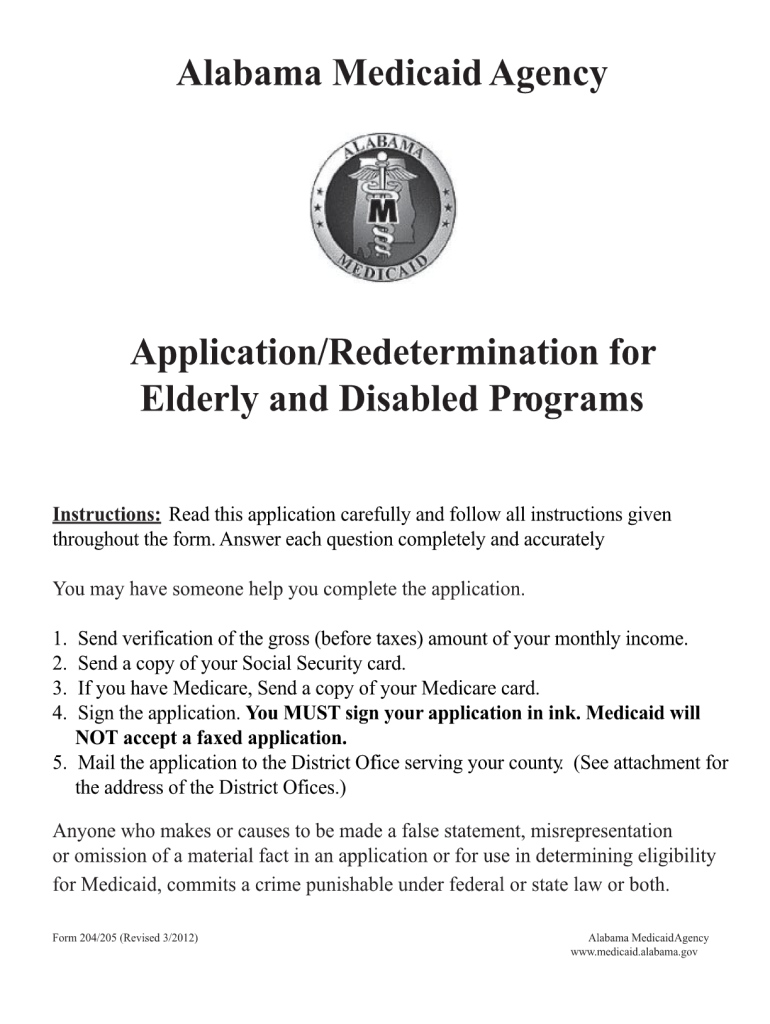

2012 AL Form 204/205 Fill Online, Printable, Fillable, Blank pdfFiller

Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. Web colorado department of revenue division of motor vehicles registration section www.colorado.gov/revenue fleet owners request for common registration expiration. Web instructions for dr 0204 part 1 generally you are subject to an estimated tax penalty if your current year estimated tax payments are not.

204 Colorado Blvd, Glendive, MT 59330 The Plainview Apartments

Web individual taxpayers can use the following schedule, taken from part 4 of form 204, to calculate their required quarterly estimated payments using the annualized income. The estimated tax penalty will not be. Web colorado department of revenue division of motor vehicles registration section www.colorado.gov/revenue fleet owners request for common registration expiration. Web form 104 is the general, and simplest,.

CROWNING GLORY BY ARIEL 5641 N Academy Blvd, Colorado Springs, CO Yelp

Generally you are subject to an estimated tax penalty if your current year estimated tax payments are not paid in a timely manner. Tax day is april 17th. Web colorado secretary of state You need to fill out form 204 to. Web colorado composite nonresident income tax return form dr 1316*—colorado source capital gain affidavit form dr 5785*—authorization for electronic.

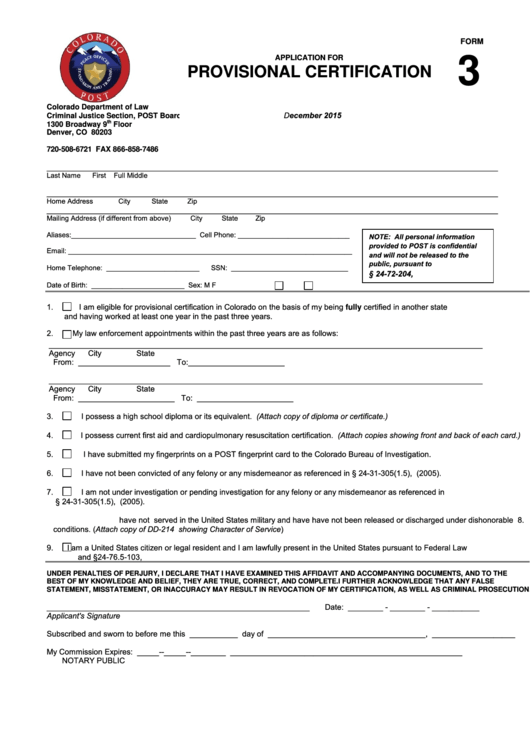

Fillable Form 3 Application For Provisional Certification Colorado

Form dr 0716 statement of nonprofit church, synagogue, or organization; Web colorado department of revenue division of motor vehicles registration section www.colorado.gov/revenue fleet owners request for common registration expiration. If you failed to pay or underpaid your estimated income taxes the previous tax year, you need to fill out form 204 to calculate and pay. Web form 104 is the.

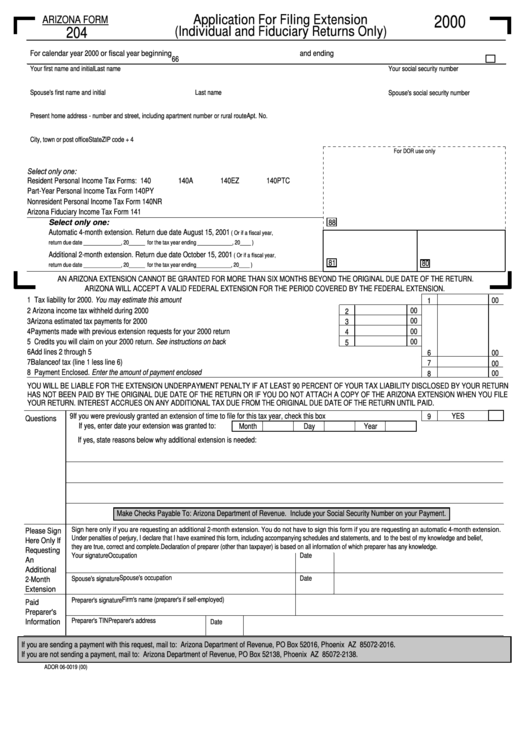

Form 204 Application For Filing Extension (Individual And Fiduciary

Web we last updated colorado form dr 0204 in january 2023 from the colorado department of revenue. Form dr 0716 statement of nonprofit church, synagogue, or organization; You need to fill out form 204 to. Generally you are subject to an estimated tax penalty if your current year estimated tax payments are not paid in a timely manner. Web colorado.

Historic Shooks Run Middle Shooks Run Neighborhood Association

Generally you are subject to an estimated tax penalty if your current year estimated tax payments are not paid in a timely manner. Form dr 0716 statement of nonprofit church, synagogue, or organization; This form is for income earned in tax year 2022, with tax returns due in april. Web dmv forms and documents. All forms and documents in number.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

If you failed to pay or underpaid your estimated income taxes the previous tax year, you need to fill out form 204 to calculate and pay. Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. Web we last updated colorado form dr 0204 in january 2023 from the colorado department of revenue. All forms and documents in number order.

In Colorado, A Person May Be Released Early From Probation At.

Web printable colorado income tax form 204. Instructions | dr 0104 | related forms tax.colorado.gov. Generally you are subject to an estimated tax penalty if your current year estimated tax payments are not paid in a timely manner. Web colorado individual income tax filing guide mailing address for form dr 0104 104 book 2021 booklet includes:

License Forms And Documents By Name.

You may file by mail with paper forms or efile online (contains forms dr 0104, dr. Web colorado department of revenue division of motor vehicles registration section www.colorado.gov/revenue fleet owners request for common registration expiration. Web individual taxpayers can use the following schedule, taken from part 4 of form 204, to calculate their required quarterly estimated payments using the annualized income. Tax day is april 17th.

Form Dr 0716 Statement Of Nonprofit Church, Synagogue, Or Organization;

You need to fill out form 204 to. Web colorado secretary of state The estimated tax penalty will not be. Web dmv forms and documents.