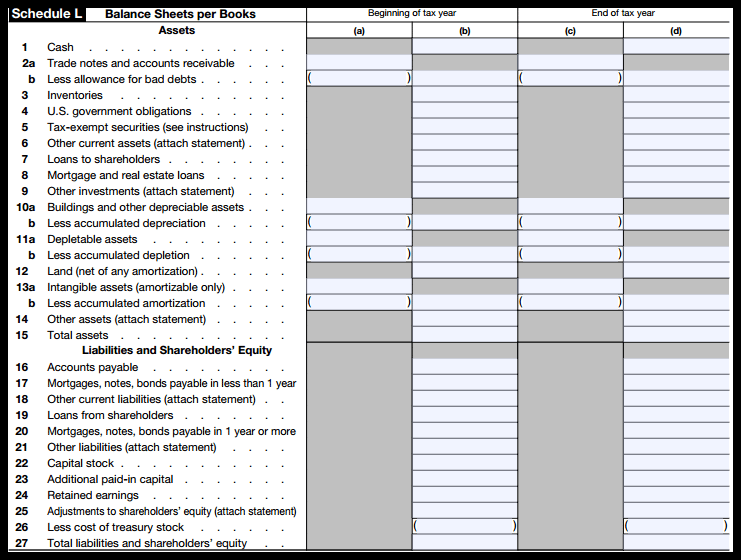

Form 1120S Schedule L

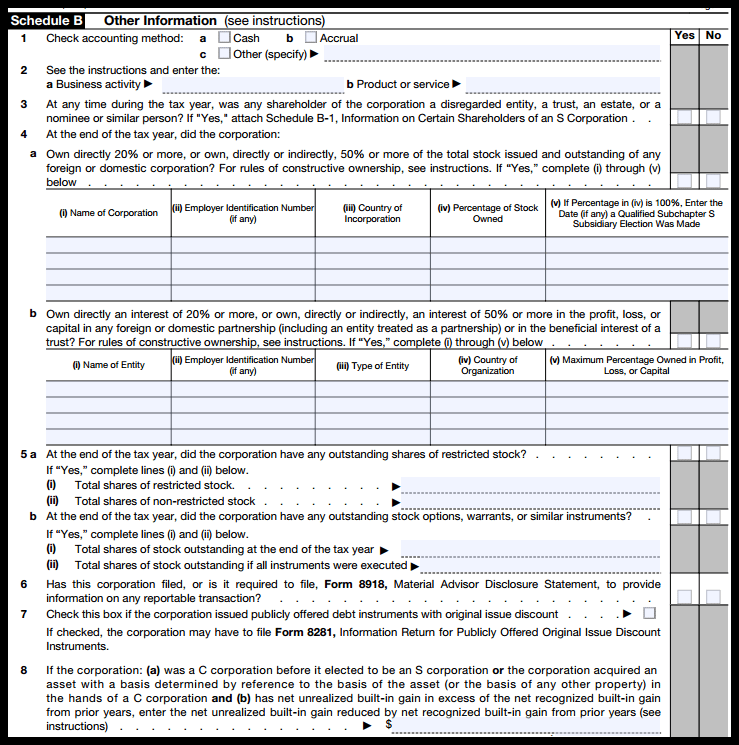

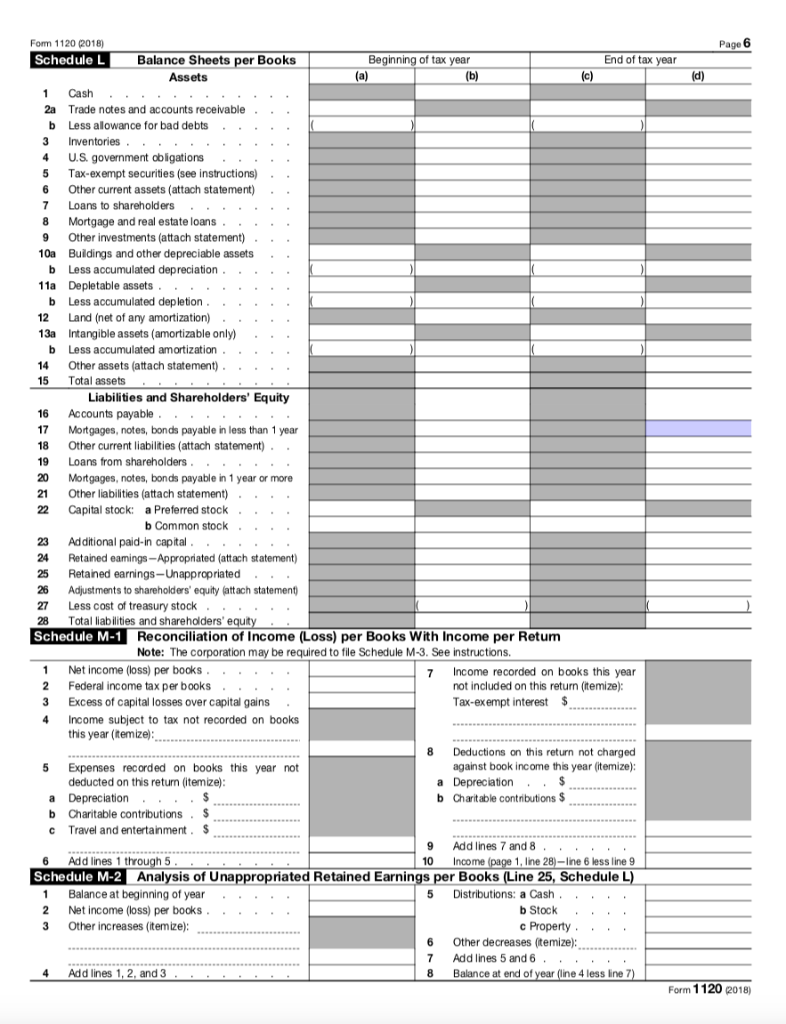

Form 1120S Schedule L - 2022 estimated tax payments and 2021 overpayment credited to 2022. Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records. Here's an excerpt from that section. The format that is used for reporting schedule l will follow basic accounting principles for completing a balance sheet. Near the end of the post, i briefly mentioned schedule l, the balance sheet. Add lines 22a and 22b (see instructions for additional taxes). Life insurance companies with total assets of $10 million or more. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Web schedule l balance sheet is out of balance on form 1065, 1120s, 1120 or 990 in proseries this article will provide tips and common areas to review when the schedule l balance sheet is out of balance, for form 1065, 1120s, 1120, or 990 part x. Accumulated adjustments account (s corp) undistributed taxed income (s corp)

Here's an excerpt from that section. Accumulated adjustments account (s corp) undistributed taxed income (s corp) Exception for insurance companies filing. 2022 estimated tax payments and 2021 overpayment credited to 2022. Web schedule l balance sheet is out of balance on form 1065, 1120s, 1120 or 990 in proseries this article will provide tips and common areas to review when the schedule l balance sheet is out of balance, for form 1065, 1120s, 1120, or 990 part x. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records. Forms 1065, 1120s, and 1120: Add lines 22a and 22b (see instructions for additional taxes). The format that is used for reporting schedule l will follow basic accounting principles for completing a balance sheet.

The format that is used for reporting schedule l will follow basic accounting principles for completing a balance sheet. Life insurance companies with total assets of $10 million or more. Web schedule l balance sheet is out of balance on form 1065, 1120s, 1120 or 990 in proseries this article will provide tips and common areas to review when the schedule l balance sheet is out of balance, for form 1065, 1120s, 1120, or 990 part x. Here's an excerpt from that section. 2022 estimated tax payments and 2021 overpayment credited to 2022. Accumulated adjustments account (s corp) undistributed taxed income (s corp) Exception for insurance companies filing. Web form 1120 department of the treasury internal revenue service u.s. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Tax deposited with form 7004.

IRS Form 1120S Definition, Download & Filing Instructions

2022 estimated tax payments and 2021 overpayment credited to 2022. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Tax deposited with form 7004. Forms 1065, 1120s, and 1120: Near the end of the post, i briefly mentioned schedule l, the balance sheet.

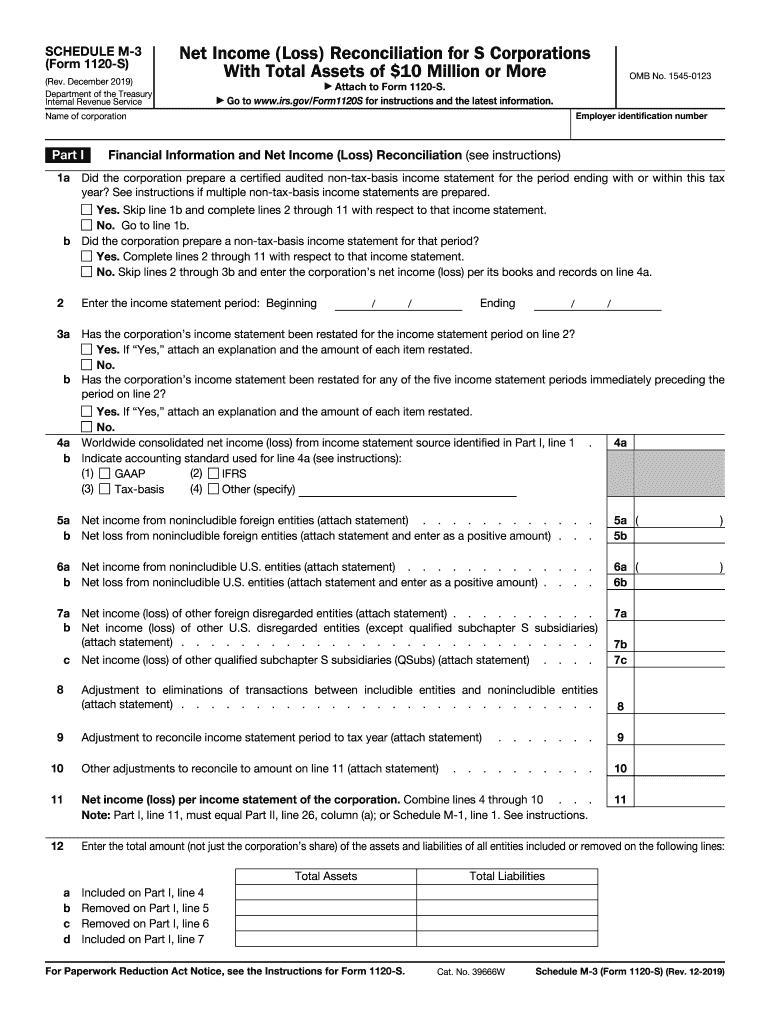

20192021 Form IRS 1120S Schedule M3 Fill Online, Printable

2022 estimated tax payments and 2021 overpayment credited to 2022. Web schedule l balance sheet is out of balance on form 1065, 1120s, 1120 or 990 in proseries this article will provide tips and common areas to review when the schedule l balance sheet is out of balance, for form 1065, 1120s, 1120, or 990 part x. Here's an excerpt.

Schedule L (Balance Sheets per Books) for Form 1120S White Coat

Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Here's an excerpt from that section. Add lines 22a and 22b (see instructions for additional taxes). Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found.

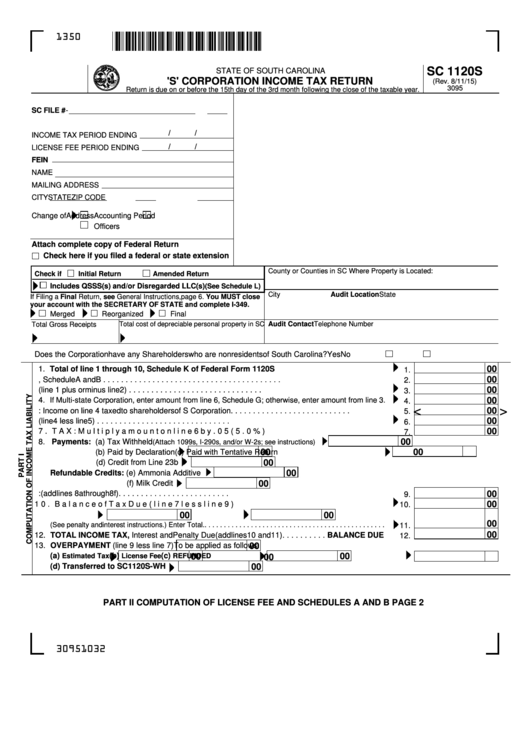

Form Sc 1120s 'S' Corporation Tax Return printable pdf download

Life insurance companies with total assets of $10 million or more. Tax deposited with form 7004. Accumulated adjustments account (s corp) undistributed taxed income (s corp) 2022 estimated tax payments and 2021 overpayment credited to 2022. Here's an excerpt from that section.

Form 1120L (Schedule M3) Net Reconciliation for U.S. Life

Forms 1065, 1120s, and 1120: Life insurance companies with total assets of $10 million or more. Here's an excerpt from that section. Near the end of the post, i briefly mentioned schedule l, the balance sheet. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest.

Publication 542 Corporations; Sample Returns

Here's an excerpt from that section. Accumulated adjustments account (s corp) undistributed taxed income (s corp) The format that is used for reporting schedule l will follow basic accounting principles for completing a balance sheet. Forms 1065, 1120s, and 1120: Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in.

Form 1120S (Schedule M3) Net (Loss) Reconciliation for S

Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Web form 1120 department of the treasury internal revenue service u.s. The format that is used for reporting schedule l will follow basic accounting principles for completing a balance sheet. Exception for insurance companies filing..

Form 1120S (Schedule D) Capital Gains and Losses and Builtin Gains

2022 estimated tax payments and 2021 overpayment credited to 2022. Near the end of the post, i briefly mentioned schedule l, the balance sheet. The format that is used for reporting schedule l will follow basic accounting principles for completing a balance sheet. Forms 1065, 1120s, and 1120: Income tax return for an s corporation where the corporation reports to.

IRS Form 1120S Definition, Download, & 1120S Instructions

Here's an excerpt from that section. Life insurance companies with total assets of $10 million or more. Forms 1065, 1120s, and 1120: The format that is used for reporting schedule l will follow basic accounting principles for completing a balance sheet. Web form 1120 department of the treasury internal revenue service u.s.

Solved Form Complete Schedule L For The Balance Sheet Inf...

Web form 1120 department of the treasury internal revenue service u.s. Exception for insurance companies filing. Here's an excerpt from that section. Tax deposited with form 7004. Add lines 22a and 22b (see instructions for additional taxes).

Here's An Excerpt From That Section.

Exception for insurance companies filing. Web form 1120 department of the treasury internal revenue service u.s. Forms 1065, 1120s, and 1120: Near the end of the post, i briefly mentioned schedule l, the balance sheet.

2022 Estimated Tax Payments And 2021 Overpayment Credited To 2022.

Web schedule l balance sheet is out of balance on form 1065, 1120s, 1120 or 990 in proseries this article will provide tips and common areas to review when the schedule l balance sheet is out of balance, for form 1065, 1120s, 1120, or 990 part x. Add lines 22a and 22b (see instructions for additional taxes). Tax deposited with form 7004. Income tax return for an s corporation where the corporation reports to the irs their balance sheet as found in the corporation’s books and records.

Life Insurance Companies With Total Assets Of $10 Million Or More.

Accumulated adjustments account (s corp) undistributed taxed income (s corp) The format that is used for reporting schedule l will follow basic accounting principles for completing a balance sheet. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information.