Form 1120 Schedule J

Form 1120 Schedule J - Check the “yes” box if the corporation is a specified domestic entity that is required to file form. Step 1, line 1 — do not include any amount reported on line 6 of federal. A partial tax on the. Enter the total amount you received during this tax period from a. Dividends, inclusions, and special deductions. Corporation income tax return, on the taxable income of the bank, excluding the life insurance department; Web for more information: A foreign corporation is any corporation. Web fincen form 114 is not a tax form, do not file it with your return. Web schedule j 1120 form:

You can download or print current. Dividends, inclusions, and special deductions. A foreign corporation is any corporation. Web form 1120 department of the treasury internal revenue service u.s. In general, you should follow the instructions on the form, with the following exceptions: Check the “yes” box if the corporation is a specified domestic entity that is required to file form. A foreign corporation is any corporation. A member of a controlled group,. A partial tax on the. Web we last updated the form 1120 foreign dividends in january 2023, so this is the latest version of schedule j, fully updated for tax year 2022.

You can download or print current. A partial tax on the. Web fincen form 114 is not a tax form, do not file it with your return. A foreign corporation is any corporation. Step 1, line 1 — do not include any amount reported on line 6 of federal. Check the “yes” box if the corporation is a specified domestic entity that is required to file form. Enter the applicable authority of the equivalent exemption. Web form 1120 department of the treasury internal revenue service u.s. Members of a controlled group (form 1120 only). Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or.

Schedule G Form 1120 Instructions 2016 Best Product Reviews

Web form 1120 department of the treasury internal revenue service u.s. Web a partial tax computed on form 1120, u.s. A member of a controlled group,. Lines 1 and 2, form 1120. Dividends, inclusions, and special deductions.

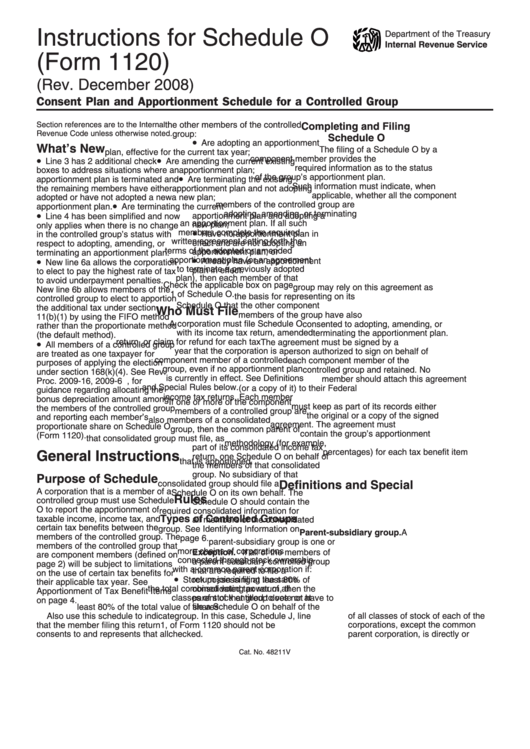

Instructions For Schedule O (Form 1120) 2008 printable pdf download

Lines 1 and 2, form 1120. Web schedule j 1120 form: Web we last updated the form 1120 foreign dividends in january 2023, so this is the latest version of schedule j, fully updated for tax year 2022. Enter the applicable authority of the equivalent exemption. You can download or print current.

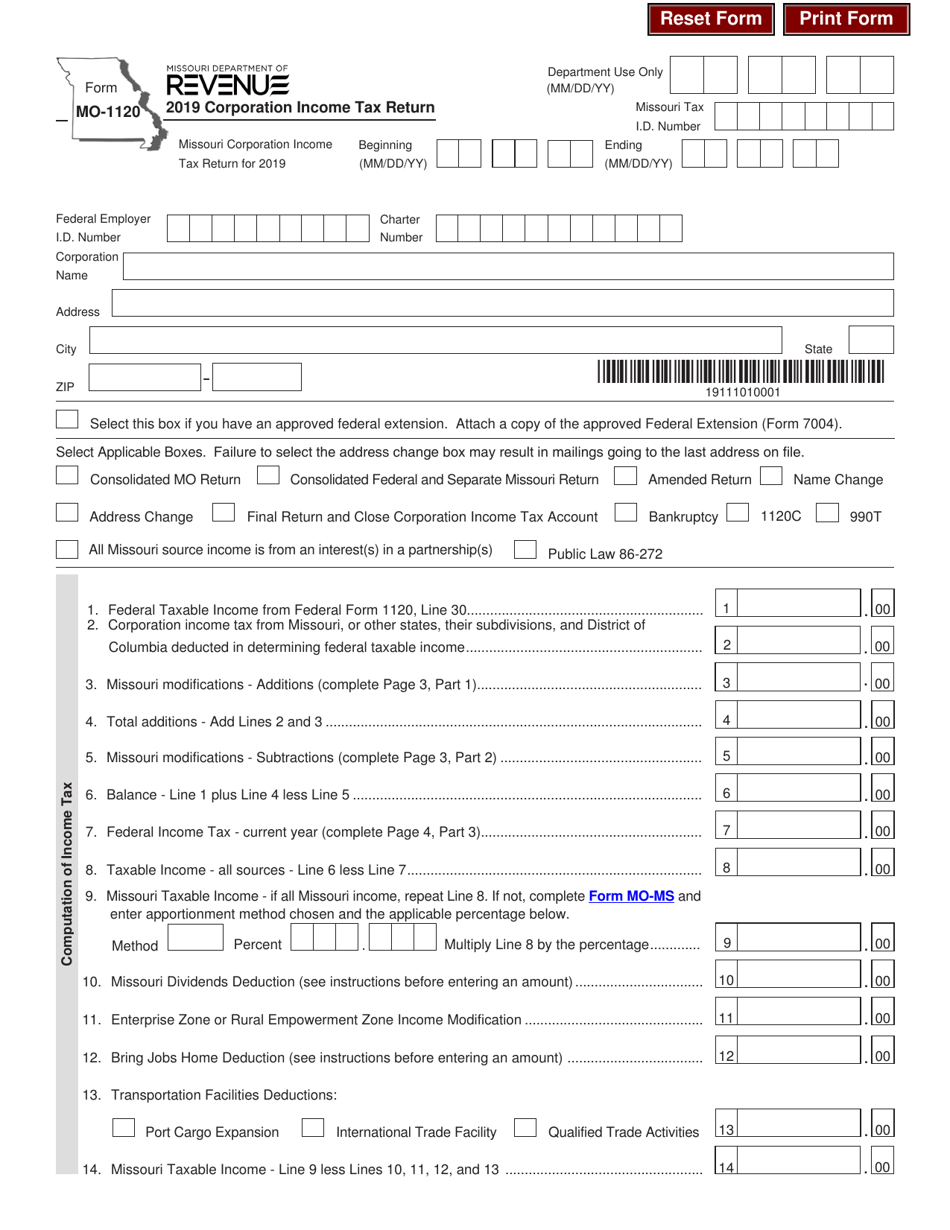

Form MO1120 Download Fillable PDF or Fill Online Corporation

Web form 1120 department of the treasury internal revenue service u.s. Web for more information: You can download or print current. Enter the total amount you received during this tax period from a. Check the “yes” box if the corporation is a specified domestic entity that is required to file form.

Form 1120 (Schedule M3) Net Reconciliation for Corporations

Members of a controlled group (form 1120 only). Enter the applicable authority of the equivalent exemption. Web form 1120 department of the treasury internal revenue service u.s. Check the “yes” box if the corporation is a specified domestic entity that is required to file form. A foreign corporation is any corporation.

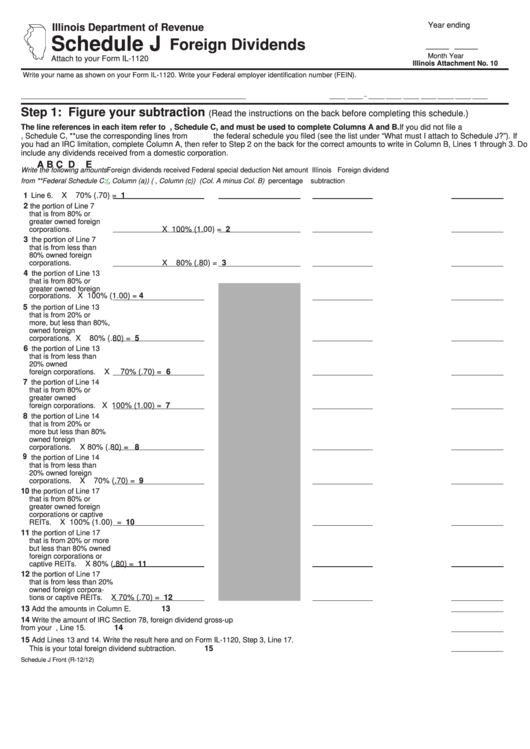

Schedule J Attach To Your Form Il1120 Foreign Dividends printable

Web we last updated the form 1120 foreign dividends in january 2023, so this is the latest version of schedule j, fully updated for tax year 2022. Web form 1120 department of the treasury internal revenue service u.s. Web fincen form 114 is not a tax form, do not file it with your return. You can download or print current..

Form 1120 Schedule J Instructions

Web form 1120 department of the treasury internal revenue service u.s. Step 1, line 1 — do not include any amount reported on line 6 of federal. A foreign corporation is any corporation. You can download or print current. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years.

Editable IRS Form 1120S (Schedule K1) 2018 2019 Create A Digital

A member of a controlled group,. Web for more information: Web form 1120 department of the treasury internal revenue service u.s. Web a partial tax computed on form 1120, u.s. Enter the applicable authority of the equivalent exemption.

1120s Create A Digital Sample in PDF

Web for more information: Web fincen form 114 is not a tax form, do not file it with your return. A member of a controlled group,. A foreign corporation is any corporation. Check the “yes” box if the corporation is a specified domestic entity that is required to file form.

Solved Form 1120 (2018) Schedule J Tax Computation and

Check the “yes” box if the corporation is a specified domestic entity that is required to file form. Corporation income tax return for calendar year 2013 or tax year beginning, 2013, ending, 20 information. A foreign corporation is any corporation. Enter the total amount you received during this tax period from a. Web schedule j 1120 form:

Form 1120 (Schedule M3) Net Reconciliation for Corporations

Enter the applicable authority of the equivalent exemption. Enter the total amount you received during this tax period from a. Web fincen form 114 is not a tax form, do not file it with your return. In general, you should follow the instructions on the form, with the following exceptions: Corporation income tax return, on the taxable income of the.

Web Form 1120 Department Of The Treasury Internal Revenue Service U.s.

Web fincen form 114 is not a tax form, do not file it with your return. Dividends, inclusions, and special deductions. A foreign corporation is any corporation. Members of a controlled group (form 1120 only).

Lines 1 And 2, Form 1120.

A partial tax on the. In general, you should follow the instructions on the form, with the following exceptions: Web we last updated the form 1120 foreign dividends in january 2023, so this is the latest version of schedule j, fully updated for tax year 2022. Web for more information:

Web Schedule J 1120 Form:

You can download or print current. Enter the applicable authority of the equivalent exemption. For example, enter a citation of the statute in the country. Check the “yes” box if the corporation is a specified domestic entity that is required to file form.

A Foreign Corporation Is Any Corporation.

Step 1, line 1 — do not include any amount reported on line 6 of federal. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or. Enter the total amount you received during this tax period from a. A member of a controlled group,.