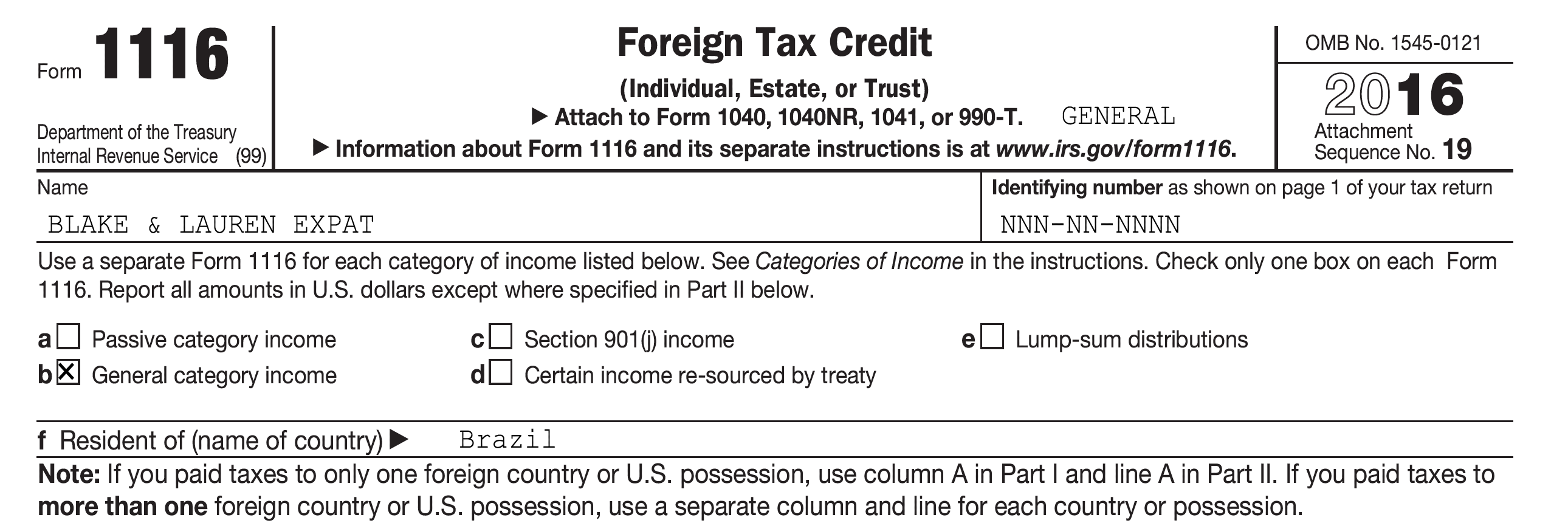

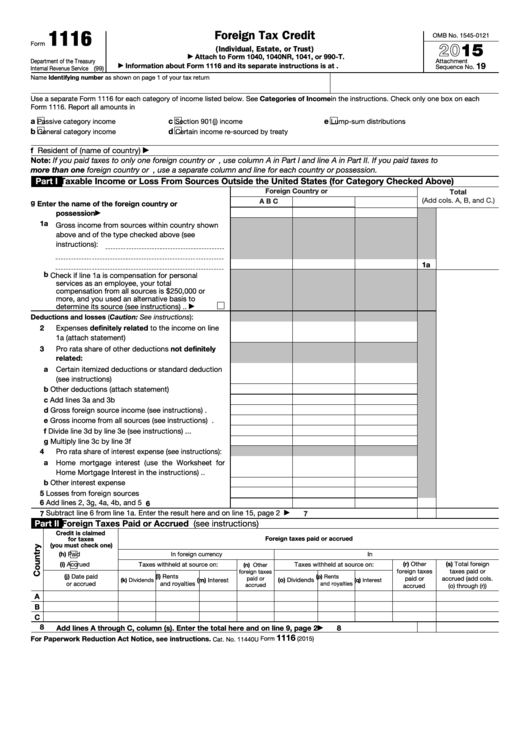

Form 1116 Foreign Tax Credit Example

Form 1116 Foreign Tax Credit Example - The irs form 1116 is a form used to calculate the amount of. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Web for example, if the taxpayer is an employee reporting foreign earned income on line 1a, the taxpayer should include on line 2 expenses such as those incurred to move to a new. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Use form 2555 to claim. In many cases the limit is less than. Web and to tie it all together, we have an example of parts of a sample tax return wherewe can follow some of the items we review today and carry that information into a form 1040. Web your foreign tax credit is the amount of foreign tax you paid or accrued or, if smaller, the foreign tax credit limit. Web there is a new schedule b (form 1116) which is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Work with federal tax credits and incentives specialists who have decades of experience.

Web your foreign tax credit is the amount of foreign tax you paid or accrued or, if smaller, the foreign tax credit limit. Web if you’re a us expat working and living abroad, you need to know about the foreign tax credit for a couple of reasons. Use form 2555 to claim. Web foreign tax credit without filing form 1116 you may be able to claim the foreign tax credit without filing form 1116. Web there is a new schedule b (form 1116) which is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web how to claim the foreign tax credit. You figure your foreign tax credit and the foreign. In many cases the limit is less than. Web select foreign tax credit (1116). Web as an added perk, you can use the difference between foreign taxes paid and your ftc as a carryover credit to apply to the next year’s taxes.

File form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued. By making this election, the foreign tax credit limitation. Web how to claim the foreign tax credit. Web foreign tax credit without filing form 1116 you may be able to claim the foreign tax credit without filing form 1116. Web select foreign tax credit (1116). Web the purpose of form 1116 is to limit the foreign tax credit to no more than the percent that foreign income is of your total income. Select the country from the name of foreign country dropdown list. Ad with the right expertise, federal tax credits and incentives could benefit your business. The irs form 1116 is a form used to calculate the amount of. Tax return rather than the foreign earned income exclusion.

Is From Forex Trading Taxable In Singapore Forex Trend Hunter

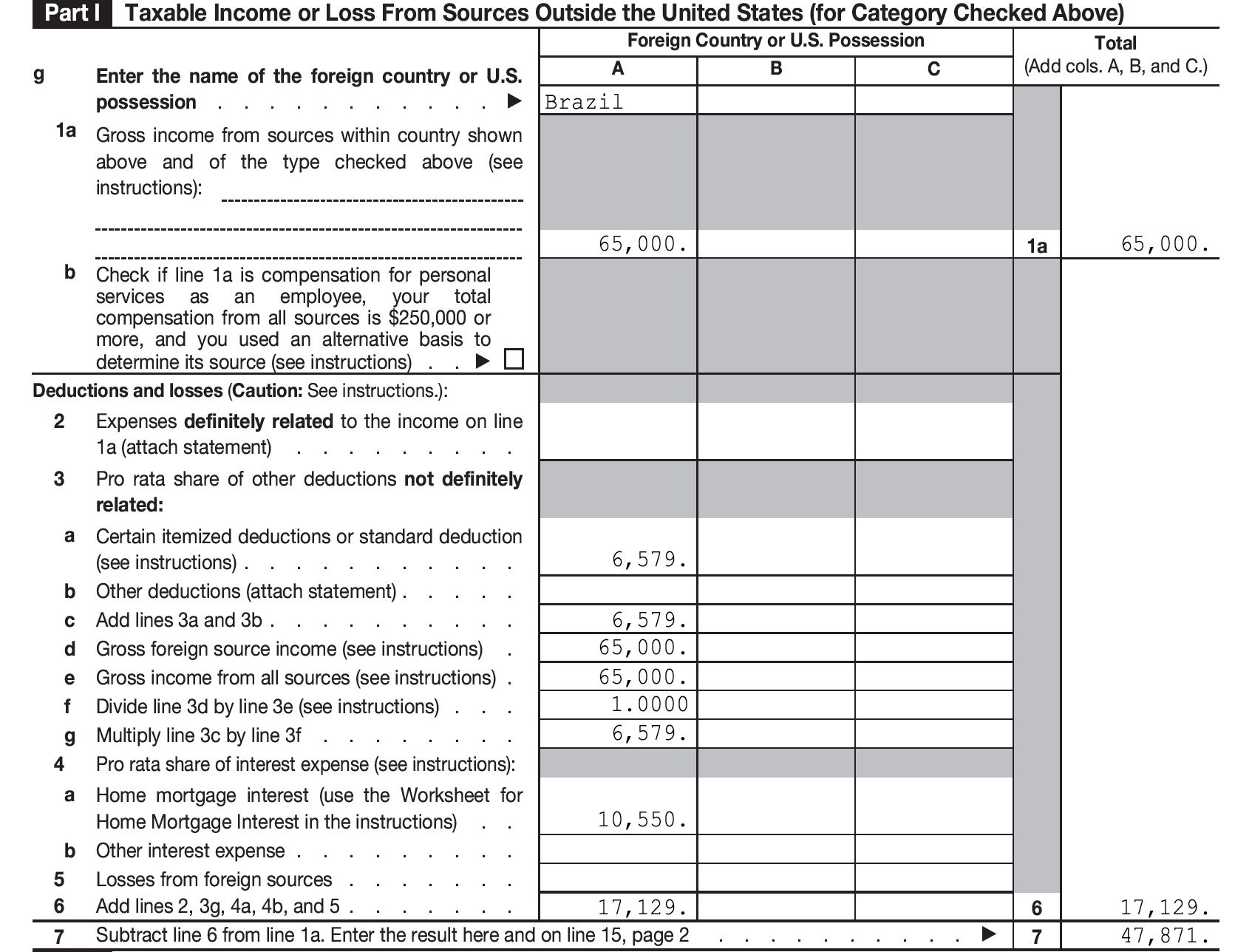

File form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Web calculating the foreign tax credit using form 1116.

Form 1116 Foreign Tax Credit YouTube

Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign. Select the.

Foreign Tax Credit Your Guide to the Form 1116 SDG Accountant

Work with federal tax credits and incentives specialists who have decades of experience. File form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued. Web as an added perk, you can use the difference between foreign taxes paid and your ftc as a carryover credit to.

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

You figure your foreign tax credit and the foreign. Web to claim your foreign tax credit on your tax return as a u.s citizen, you’ll need to use form 1116. Web the good news is you can carry over the difference between $20,500 (japanese taxes paid) and $11,000 (your allowable foreign tax credit), and you can carry. In many cases.

Foreign Tax Credit Form 1116 and how to file it (example for US expats)

Web what are the rules for claiming the foreign tax credit on form 1116? Web most of the us international tax experts prefer claiming foreign tax credit (form 1116) on client’s u.s. Select the country from the name of foreign country dropdown list. Select the category of income from the dropdown menu. Web to claim your foreign tax credit on.

Publication 514 Foreign Tax Credit for Individuals; Simple Example

Web what are the rules for claiming the foreign tax credit on form 1116? Web and to tie it all together, we have an example of parts of a sample tax return wherewe can follow some of the items we review today and carry that information into a form 1040. By making this election, the foreign tax credit limitation. Web.

Foreign Tax Credit Form 1116 and how to file it (example for US expats)

Web if you’re a us expat working and living abroad, you need to know about the foreign tax credit for a couple of reasons. Web what are the rules for claiming the foreign tax credit on form 1116? Web your foreign tax credit is the amount of foreign tax you paid or accrued or, if smaller, the foreign tax credit.

Are capital loss deductions included on Form 1116 for Deductions and

You figure your foreign tax credit and the foreign. Web foreign tax credit without filing form 1116 you may be able to claim the foreign tax credit without filing form 1116. In many cases the limit is less than. Ad with the right expertise, federal tax credits and incentives could benefit your business. Web to claim your foreign tax credit.

Demystifying IRS Form 1116 Calculating Foreign Tax Credits SF Tax

According to the irs official website, you can use form 1116 to. Web the good news is you can carry over the difference between $20,500 (japanese taxes paid) and $11,000 (your allowable foreign tax credit), and you can carry. Firstly, tax credits are more valuable than. You figure your foreign tax credit and the foreign. Web use form 1116 to.

Fillable Form 1116 Foreign Tax Credit printable pdf download

Web and to tie it all together, we have an example of parts of a sample tax return wherewe can follow some of the items we review today and carry that information into a form 1040. Web the purpose of form 1116 is to limit the foreign tax credit to no more than the percent that foreign income is of.

Use Form 2555 To Claim.

Ad with the right expertise, federal tax credits and incentives could benefit your business. Select the country from the name of foreign country dropdown list. By making this election, the foreign tax credit limitation. If the foreign tax paid is more than $300 ($600 for married filing jointly) or they do not meet the other.

Web If You’re A Us Expat Working And Living Abroad, You Need To Know About The Foreign Tax Credit For A Couple Of Reasons.

You figure your foreign tax credit and the foreign. File form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued. The irs form 1116 is a form used to calculate the amount of. Select the category of income from the dropdown menu.

In Many Cases The Limit Is Less Than.

Web what are the rules for claiming the foreign tax credit on form 1116? Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign. Web select foreign tax credit (1116). Web calculating the foreign tax credit using form 1116 can be complex, especially if you have multiple sources of foreign income or have paid taxes to more than one foreign.

Web Foreign Tax Credit Without Filing Form 1116 You May Be Able To Claim The Foreign Tax Credit Without Filing Form 1116.

Tax return rather than the foreign earned income exclusion. Web the purpose of form 1116 is to limit the foreign tax credit to no more than the percent that foreign income is of your total income. Web your foreign tax credit is the amount of foreign tax you paid or accrued or, if smaller, the foreign tax credit limit. Web to claim your foreign tax credit on your tax return as a u.s citizen, you’ll need to use form 1116.