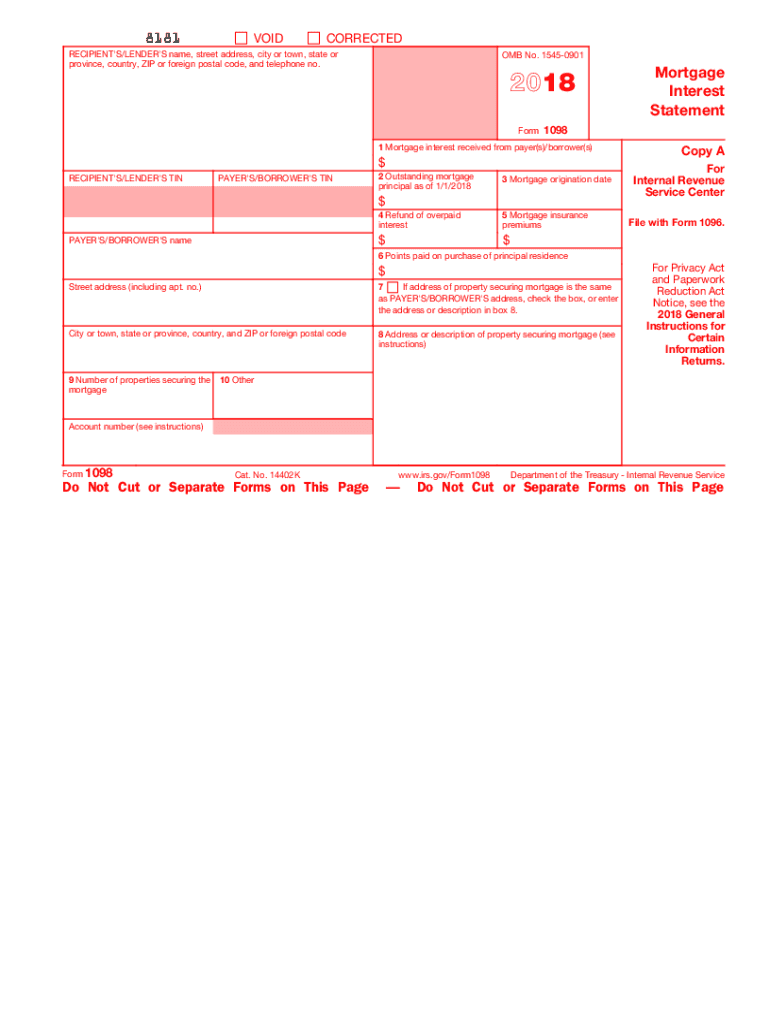

Form 1098 B

Form 1098 B - Order as few as 25 forms and get discounts. Form 1098 mortgage interest statement is used by lenders to report the amounts paid by a borrower if it is $600 or more in interest,. Mail 1098 form copy b to the borrower for reporting mortgage interest when filing their federal tax return. For internal revenue service center. Web what is form 1098? Web your 1098 (mortgage interest statement) shows how much mortgage interest, points, and (oftentimes) real estate/property tax you paid in the previous year. Use form 1098 to report. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. For internal revenue service center. Total amount to be paid pursuant to the.

Form 1098 mortgage interest statement is used by lenders to report the amounts paid by a borrower if it is $600 or more in interest,. For internal revenue service center. Web information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. Web your 1098 (mortgage interest statement) shows how much mortgage interest, points, and (oftentimes) real estate/property tax you paid in the previous year. Order as few as 25 forms and get discounts. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Mail 1098 form copy b to the borrower for reporting mortgage interest when filing their federal tax return. For internal revenue service center. Use form 1098 to report. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction.

Web your 1098 (mortgage interest statement) shows how much mortgage interest, points, and (oftentimes) real estate/property tax you paid in the previous year. Web information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. For internal revenue service center. Web official 1098 tax forms. Use form 1098 to report. Web what is form 1098? Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Order as few as 25 forms and get discounts. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction.

1098 Fill Out and Sign Printable PDF Template signNow

Web what is form 1098? For internal revenue service center. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Use form 1098 to report. For internal revenue service center.

Form 1098T, Tuition Statement, Student Copy B

Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Mail 1098 form copy b to the borrower for reporting mortgage interest when filing their federal tax return. Web each borrower is entitled to deduct only the.

Form 1098T, Tuition Statement, Student Copy B

For internal revenue service center. Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. For internal revenue service center. Form 1098 mortgage interest statement is used by lenders to report the amounts paid by a borrower if it.

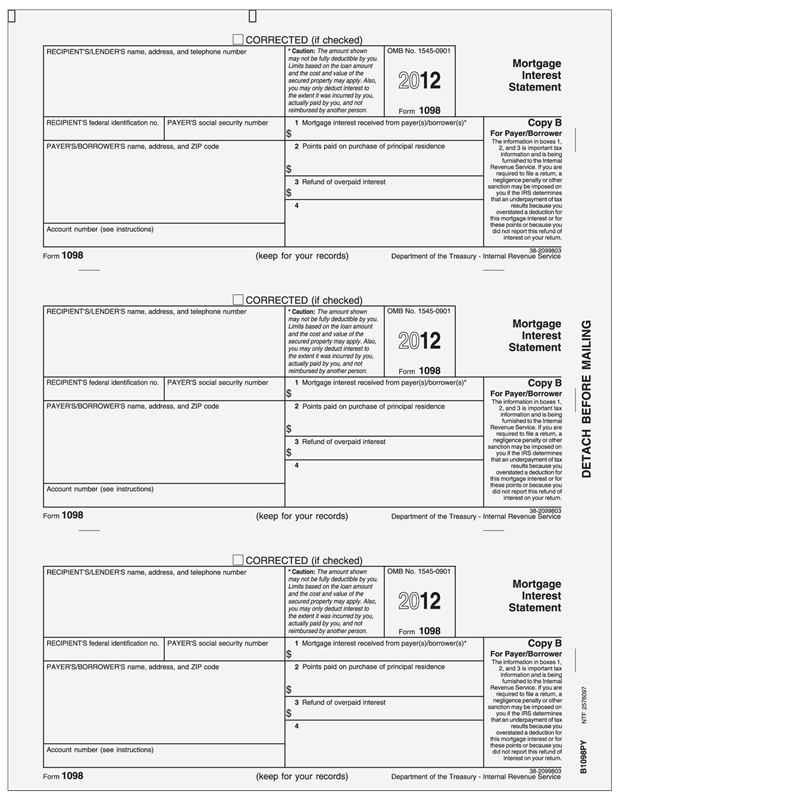

Form 1098 Mortgage Interest Statement, Payer Copy B

For internal revenue service center. Order as few as 25 forms and get discounts. Use form 1098 to report. For internal revenue service center. Mail 1098 form copy b to the borrower for reporting mortgage interest when filing their federal tax return.

Form 1098 Mortgage Interest Statement, Payer Copy B

Total amount to be paid pursuant to the. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. Use form 1098 to report. Form 1098 mortgage interest statement is used by lenders to report the amounts paid.

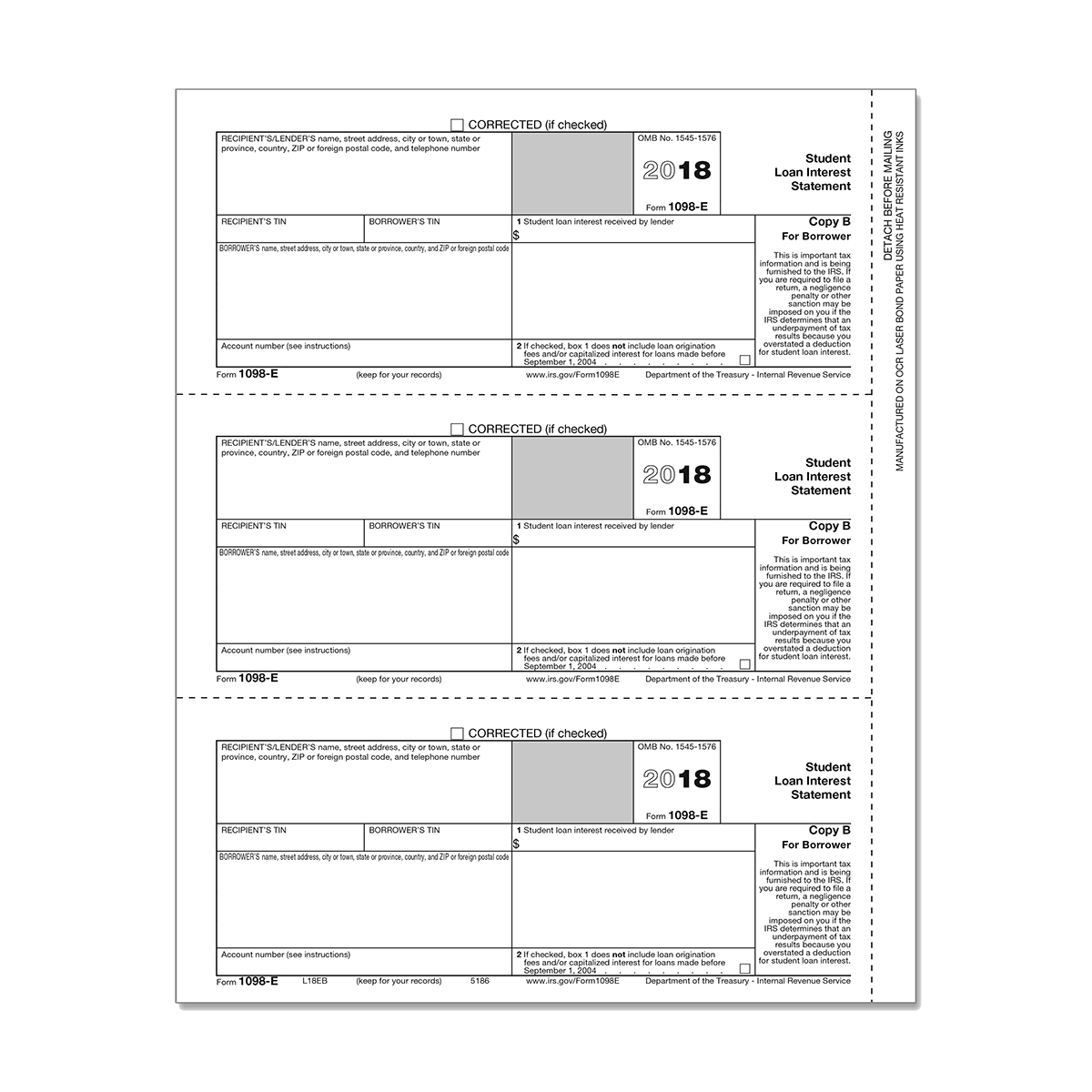

Form 1098E Borrower Copy B Mines Press

Web use form 1098, mortgage interest statement, to report mortgage interest (including points, defined later) of $600 or more you received during the year in the course of your trade or. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount.

Form 1098E, Student Loan Interest Statement.

Web information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. Form 1098 mortgage interest statement is used by lenders to report the amounts paid by a borrower if it is $600 or more in interest,. Use form 1098 to report. Web each borrower is entitled to deduct only the amount he.

Form 1098 Mortgage Interest Statement, Payer Copy B

Order as few as 25 forms and get discounts. Form 1098 mortgage interest statement is used by lenders to report the amounts paid by a borrower if it is $600 or more in interest,. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share.

Form 1098E, Student Loan Interest Statement.

For internal revenue service center. Web your 1098 (mortgage interest statement) shows how much mortgage interest, points, and (oftentimes) real estate/property tax you paid in the previous year. For internal revenue service center. Web official 1098 tax forms. Order as few as 25 forms and get discounts.

Form 1098 Mortgage Interest Statement and How to File

Mail 1098 form copy b to the borrower for reporting mortgage interest when filing their federal tax return. Web your 1098 (mortgage interest statement) shows how much mortgage interest, points, and (oftentimes) real estate/property tax you paid in the previous year. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the.

Web Official 1098 Tax Forms.

Web information about form 1098, mortgage interest statement, including recent updates, related forms and instructions on how to file. Web what is form 1098? Form 1098 mortgage interest statement is used by lenders to report the amounts paid by a borrower if it is $600 or more in interest,. Use form 1098 to report.

Web Use Form 1098, Mortgage Interest Statement, To Report Mortgage Interest (Including Points, Defined Later) Of $600 Or More You Received During The Year In The Course Of Your Trade Or.

Order as few as 25 forms and get discounts. Total amount to be paid pursuant to the. Mail 1098 form copy b to the borrower for reporting mortgage interest when filing their federal tax return. Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction.

For Internal Revenue Service Center.

Web each borrower is entitled to deduct only the amount he or she paid and points paid by the seller that represent his or her share of the amount allowable as a deduction. For internal revenue service center. Web your 1098 (mortgage interest statement) shows how much mortgage interest, points, and (oftentimes) real estate/property tax you paid in the previous year.

/Form1098-5c57730f46e0fb00013a2bee.jpg)