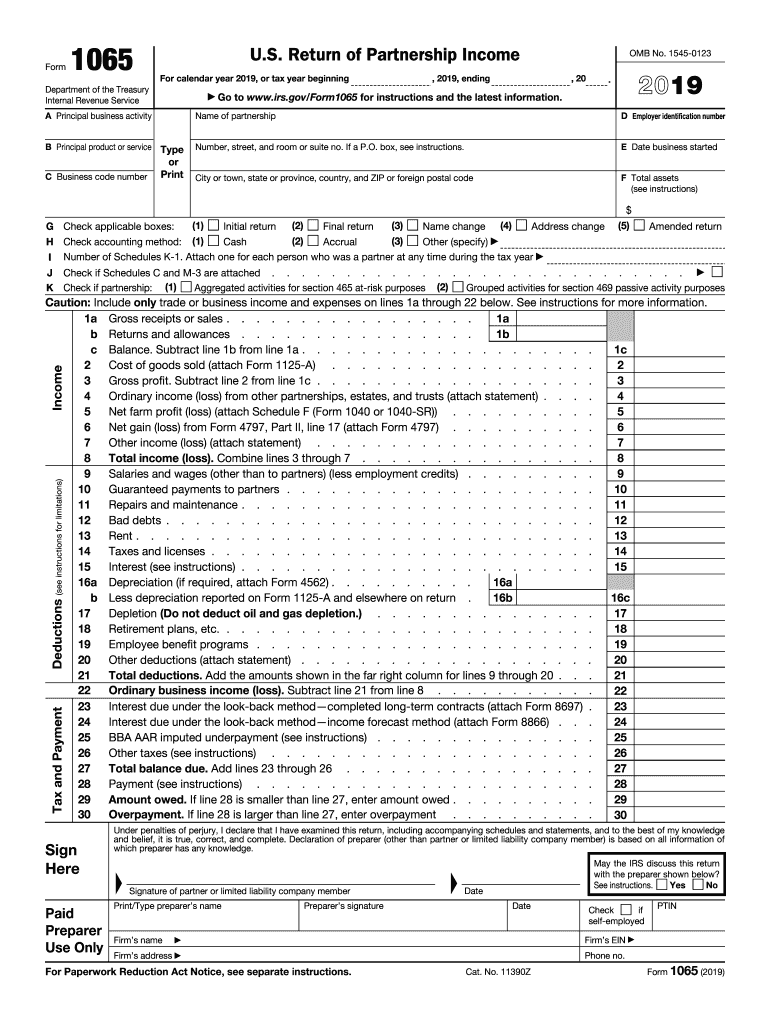

Form 1065 Printable

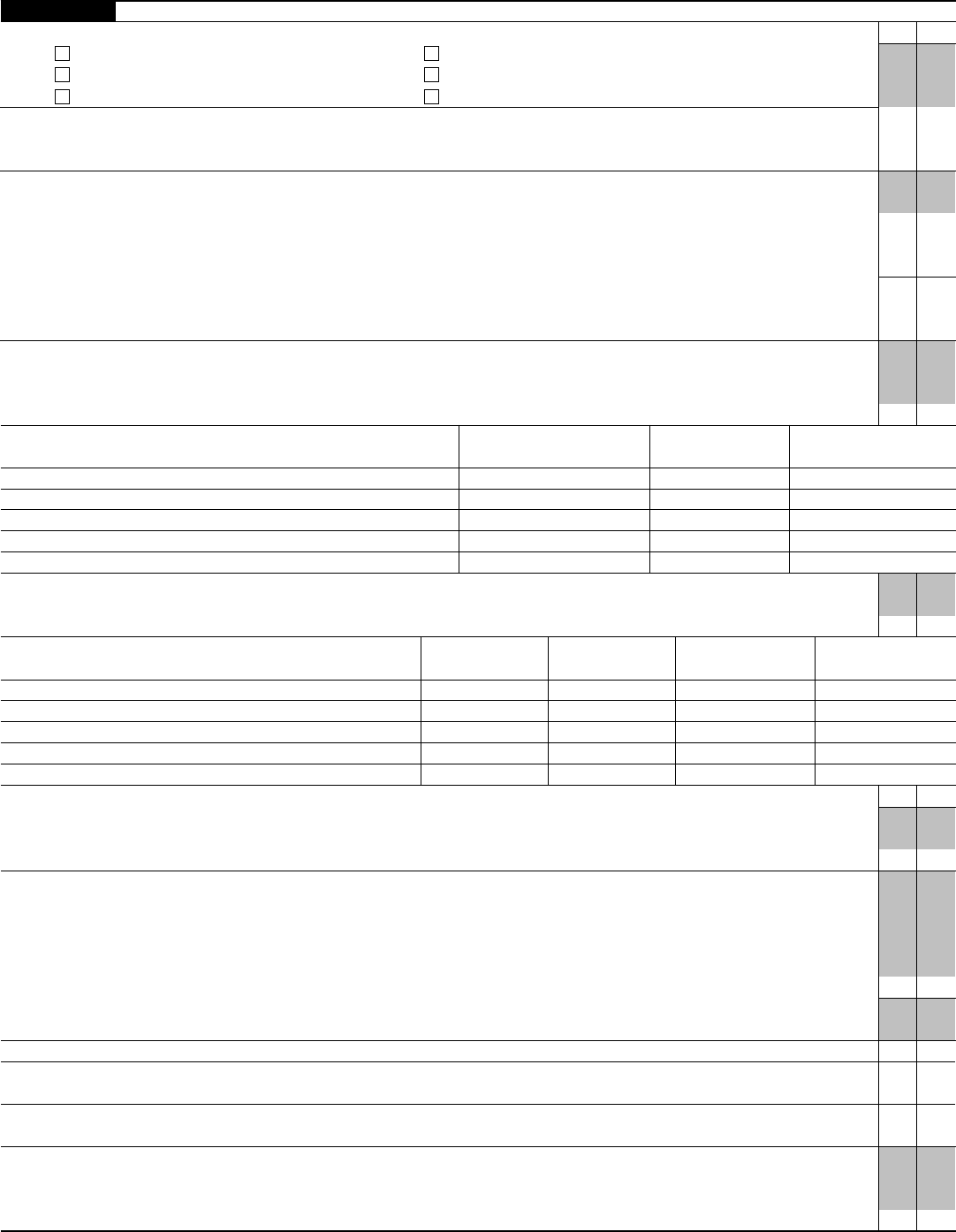

Form 1065 Printable - Web go to www.irs.gov/form1065 for instructions and the latest information. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. Department of the treasury internal revenue service. Use the following internal revenue service center address: Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Web information about form 1065, u.s. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web you can fill out the form using tax software or print it to complete it by hand. And the total assets at the end of the tax year are: Part i information about the partnership.

Web information about form 1065, u.s. Web go to www.irs.gov/form1065 for instructions and the latest information. Web we last updated federal form 1065 in december 2022 from the federal internal revenue service. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each tax year. Part i information about the partnership. Return of partnership income, including recent updates, related forms and instructions on how to file. For calendar year 2022, or tax year beginning / / 2022. This form is for income earned in tax year 2022, with tax returns due in april 2023. The 2022 form 1065 may also be used if: Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts.

If your partnership has more than 100 partners, you’re required to file form 1065 online. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web we last updated federal form 1065 in december 2022 from the federal internal revenue service. Web what is form 1065? And the total assets at the end of the tax year are: Web go to www.irs.gov/form1065 for instructions and the latest information. Web you can fill out the form using tax software or print it to complete it by hand. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each tax year. Department of the treasury internal revenue service. If the partnership's principal business, office, or agency is located in:

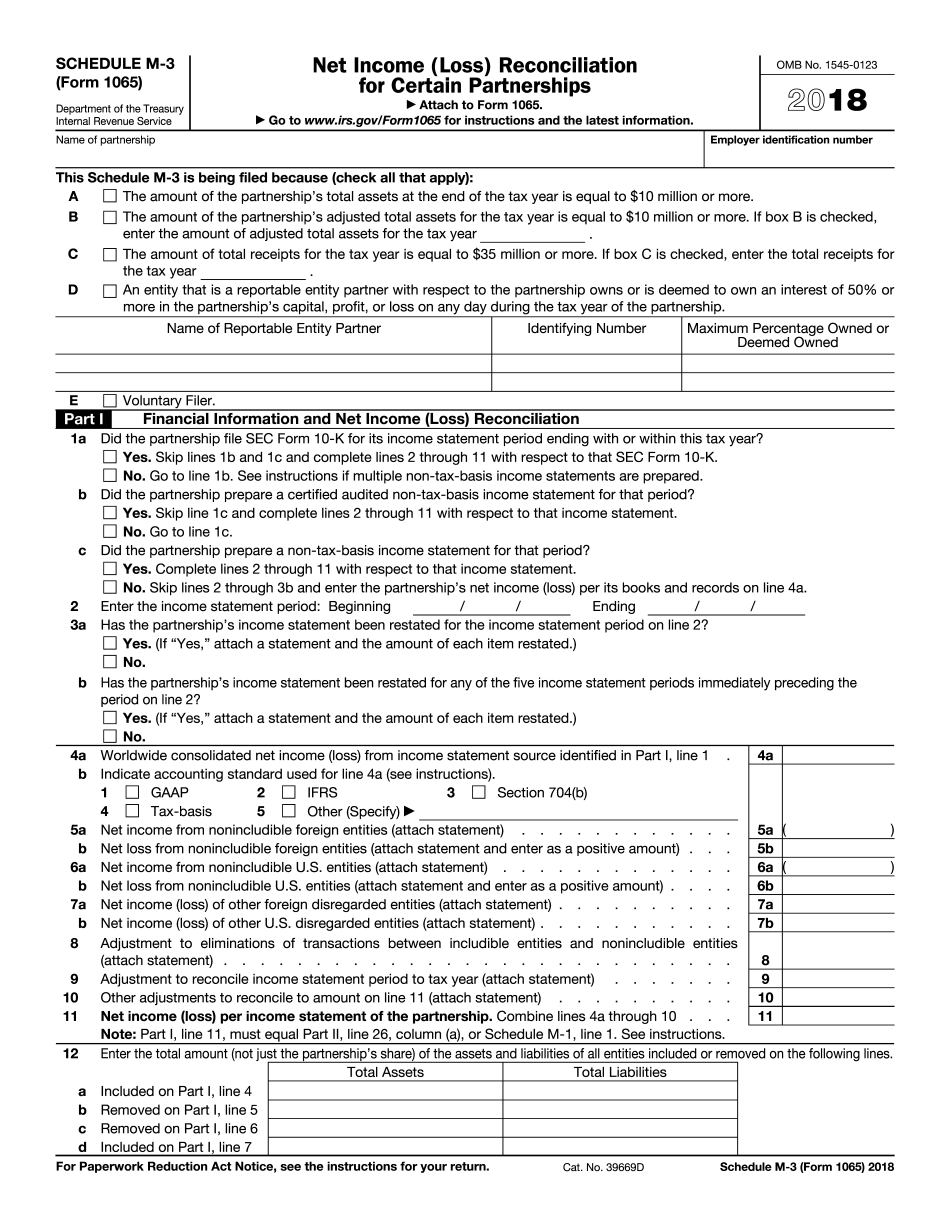

IRS Form 1065 (Schedule M3) 2018 2019 Fill out and Edit Online PDF

Return of partnership income, including recent updates, related forms and instructions on how to file. For calendar year 2022, or tax year beginning / / 2022. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that.

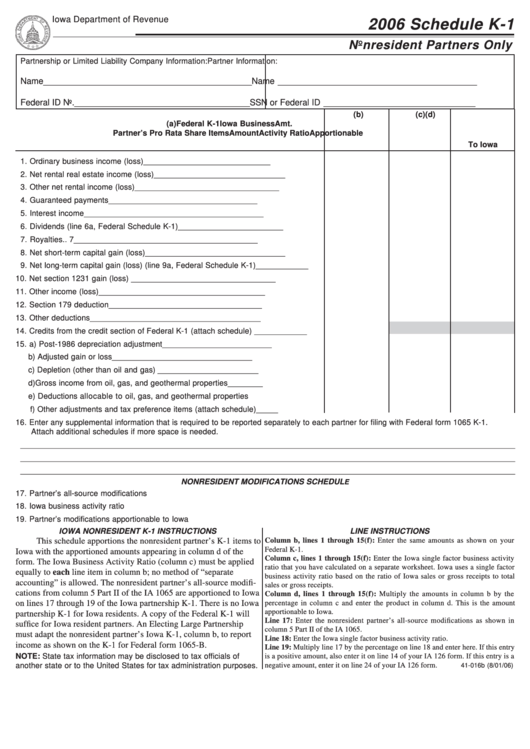

Form Ia 1065 Schedule K1 Nonresident Partners Only 2006

Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the u.s. For calendar year 2022, or tax year beginning / / 2022. Web information about form 1065, u.s. And the total assets at the end of the tax year are: Web you can fill out the form using tax software.

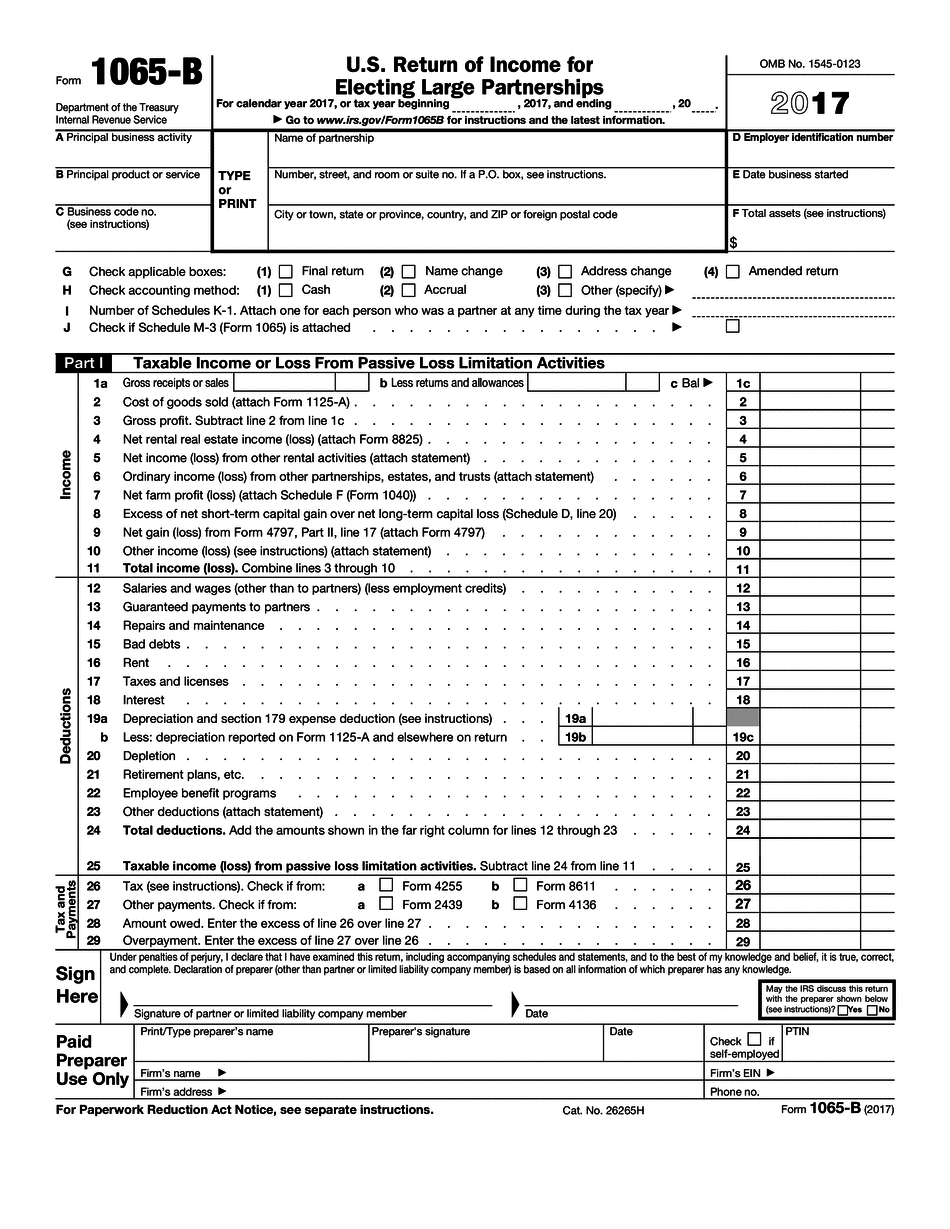

2022 Irs Form 1065 Fillable Fillable and Editable PDF Template

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web you can fill out the form using tax software or print it to complete it by hand. For calendar year 2022, or tax year beginning / / 2022. And the total assets at the.

IRS Form 1065 (Schedule D) 2019 Fill out and Edit Online PDF Template

Part i information about the partnership. The 2022 form 1065 may also be used if: City or town, state or province, country, and zip or foreign postal code a Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts. Web go to www.irs.gov/form1065 for instructions and the latest information.

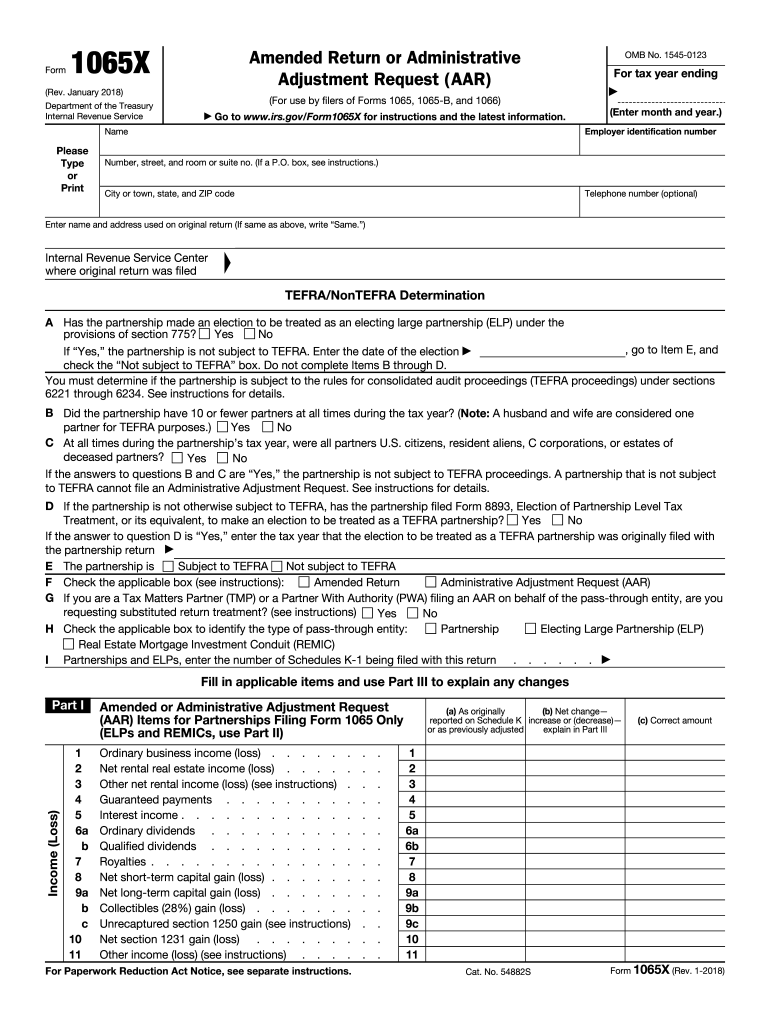

20182020 Form IRS 1065X Fill Online, Printable, Fillable, Blank

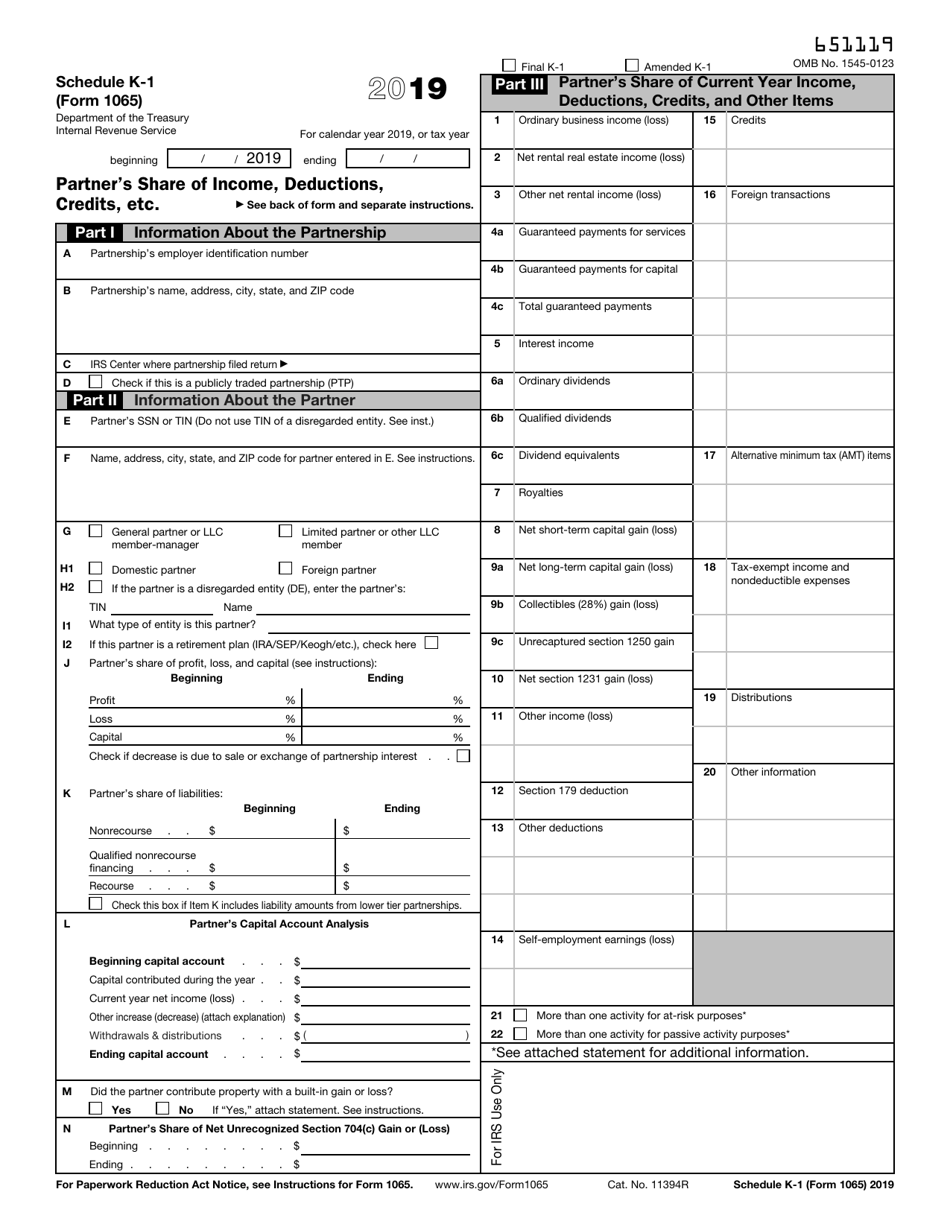

Web what is form 1065? If your partnership has more than 100 partners, you’re required to file form 1065 online. Web a 1065 form is the annual us tax return filed by partnerships. Web go to www.irs.gov/form1065 for instructions and the latest information. Ending / / partner’s share of income, deductions, credits, etc.

Form 1065 2019 Fill Out and Sign Printable PDF Template signNow

If the partnership's principal business, office, or agency is located in: And the total assets at the end of the tax year are: Web information about form 1065, u.s. Use the following internal revenue service center address: Ending / / partner’s share of income, deductions, credits, etc.

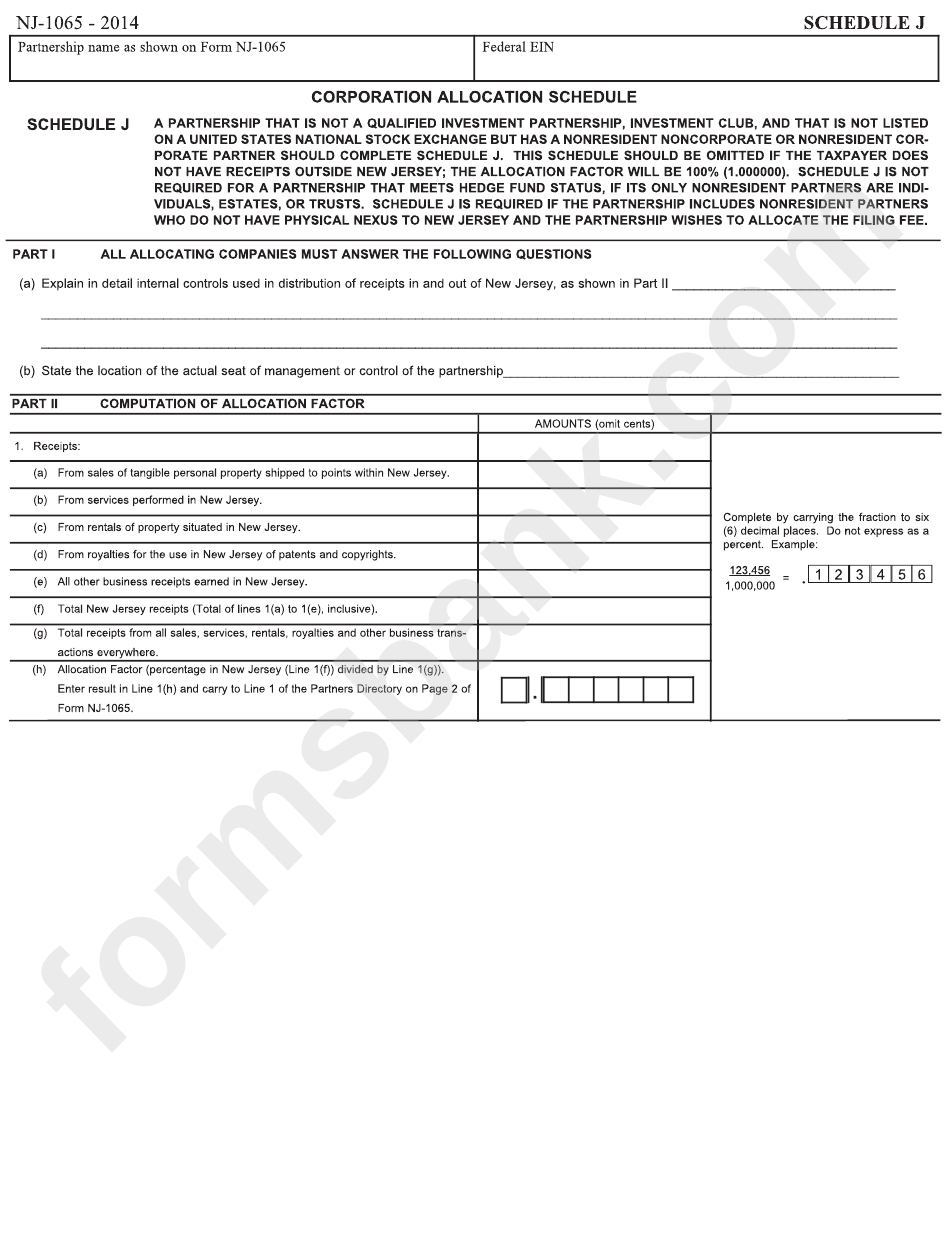

Fillable Form Nj1065 Corporation Allocation Schedule printable pdf

Use the following internal revenue service center address: Web go to www.irs.gov/form1065 for instructions and the latest information. Web what is form 1065? Web information about form 1065, u.s. Web business profits tax return business organization name 1(a) enter the amount of ordinary business income (loss) reported on federal form 1065, schedule k, line 1 1(a) 1(b) enter the amount.

IRS Form 1065 Schedule K1 Download Fillable PDF or Fill Online Partner

Department of the treasury internal revenue service. Part i information about the partnership. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. For calendar year 2022, or tax year beginning / / 2022. Use the following internal revenue service center address:

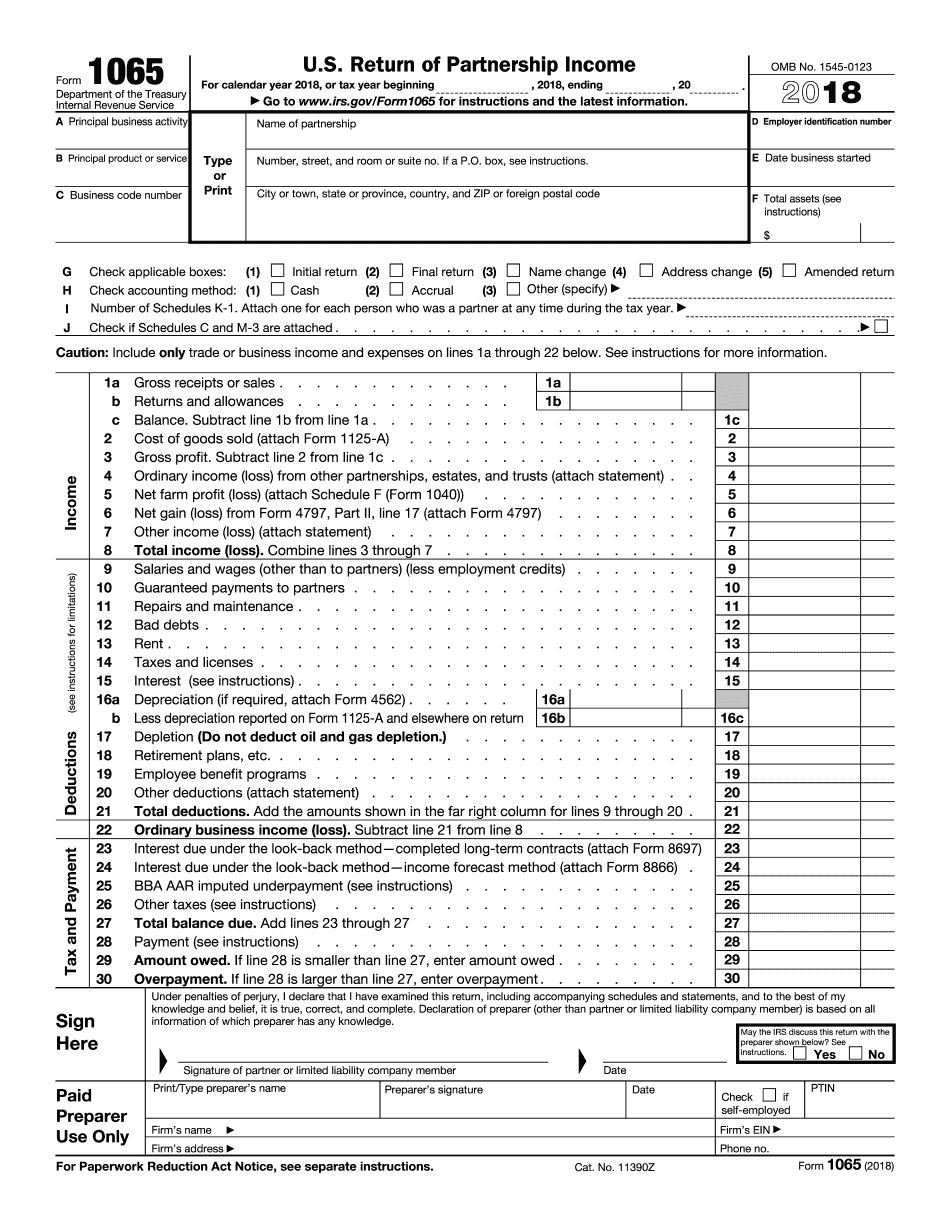

Form 1065 2018 2019 Blank Sample to Fill out Online in PDF

Web a 1065 form is the annual us tax return filed by partnerships. Web go to www.irs.gov/form1065 for instructions and the latest information. Use the following internal revenue service center address: Web what is form 1065? Web where to file your taxes for form 1065.

2014 Form 1065 Edit, Fill, Sign Online Handypdf

Web we last updated federal form 1065 in december 2022 from the federal internal revenue service. For calendar year 2022, or tax year beginning / / 2022. The form includes information related to a partnership’s income and deductions, gains and losses, taxes and payments during the tax year. Web what is form 1065? Web a 1065 form is the annual.

Or Getting Income From U.s.

Ending / / partner’s share of income, deductions, credits, etc. Web a 1065 form is the annual us tax return filed by partnerships. Web where to file your taxes for form 1065. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts.

Form 1065 Is Used To Report The Income Of Every Domestic Partnership And Every Foreign Partnership Doing Business In The U.s.

Return of partnership income, including recent updates, related forms and instructions on how to file. Web go to www.irs.gov/form1065 for instructions and the latest information. Use the following internal revenue service center address: This form is for income earned in tax year 2022, with tax returns due in april 2023.

Department Of The Treasury Internal Revenue Service.

Part i information about the partnership. Web information about form 1065, u.s. Web business profits tax return business organization name 1(a) enter the amount of ordinary business income (loss) reported on federal form 1065, schedule k, line 1 1(a) 1(b) enter the amount of net rental real estate income (loss) reported on federal form 1065, schedule k, line 2 1(b) Web you can fill out the form using tax software or print it to complete it by hand.

If Your Partnership Has More Than 100 Partners, You’re Required To File Form 1065 Online.

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. The form includes information related to a partnership’s income and deductions, gains and losses, taxes and payments during the tax year. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs.