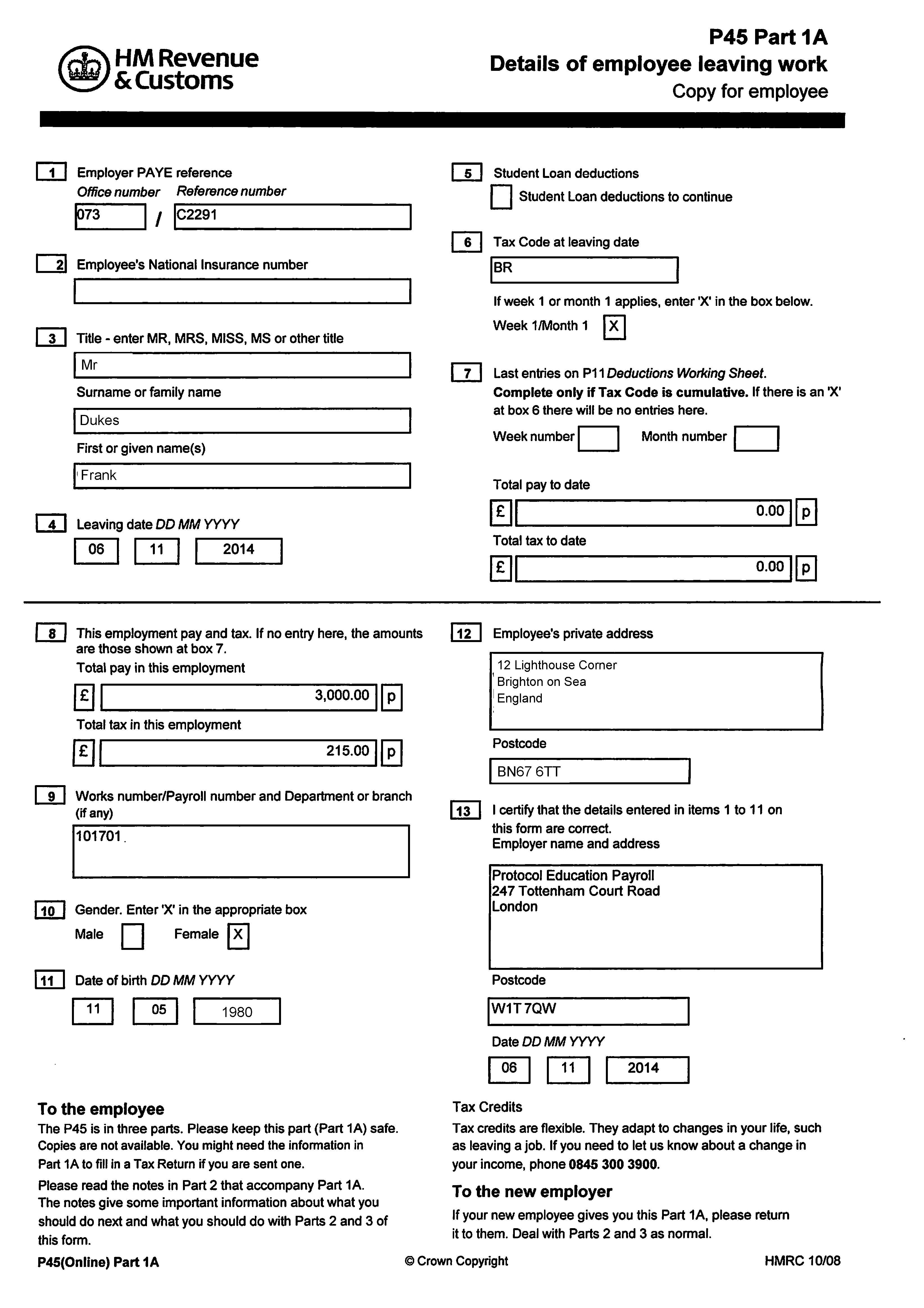

Forex Tax Form

Forex Tax Form - You can elect to have forex income taxed under internal revenue code section 988 or section 1256. Ad trade 80+ forex pairs, plus gold and silver with the #1 us fx broker*. Ad trade 80+ forex pairs, plus gold and silver with the #1 us fx broker*. This is the same form used by individuals to report their income, deductions, and. Web visit our help and support page for account forms, applications and agreements including forex account application, mt4 account application and more. Yes if you're a u.s citizen. Deciding how to file forex taxes; Web your total taxes paid on the capital gains would then be equal to: Web traders on the foreign exchange market, or forex, use irs form 8949 and schedule d to report their capital gains and losses on their federal income tax returns. Ad our international tax services can be customized to fit your specific business needs.

Yes if you declare it to be your source of regular income and that you're doing it from a company or proprietorship level. Send your completed, signed application (in its entirety), required documentation, tax form, and photo id(s) to forex.com: Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web forex reporting can depend on several factors. Eur/usd from as low as 0.2 with the #1 us fx broker*. Eur/usd from as low as 0.2 with the #1 us fx broker*. Ad our international tax services can be customized to fit your specific business needs. We have decades of experience with holistic international tax strategies and planning. Web find irs addresses for private delivery of tax returns, extensions and payments. This is the same form used by individuals to report their income, deductions, and.

Let's say that in your location, the tax on forex trading is 20%. Via fax (for expedited processing): Web complete a forex.com individual account customer application or metatrader individual account customer application. Complete ira trading account customer agreement. Web visit our help and support page for account forms, applications and agreements including forex account application, mt4 account application and more. Send your completed, signed application (in its entirety), required documentation, tax form, and photo id(s) to forex.com: Deciding how to file forex taxes; Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Web traders on the foreign exchange market, or forex, use irs form 8949 and schedule d to report their capital gains and losses on their federal income tax returns. This is the same form used by individuals to report their income, deductions, and.

Forex GreenTraderTax

Complete ira trading account customer agreement. You can elect to have forex income taxed under internal revenue code section 988 or section 1256. Ad our international tax services can be customized to fit your specific business needs. Web answer (1 of 15): Web visit our help and support page for account forms, applications and agreements including forex account application, mt4.

1st Forex ETF in Final Stages Financial Tribune

Web in forex trading, only the profits that you make are taxable, you should not worry about the losses. You can elect to have forex income taxed under internal revenue code section 988 or section 1256. Web traders on the foreign exchange market, or forex, use irs form 8949 and schedule d to report their capital gains and losses on.

Forex trading australia tax table 2016 *

Ad trade 80+ forex pairs, plus gold and silver with the #1 us fx broker*. Let's say that in your location, the tax on forex trading is 20%. Web visit our help and support page for account forms, applications and agreements including forex account application, mt4 account application and more. Send your completed, signed application (in its entirety), required documentation,.

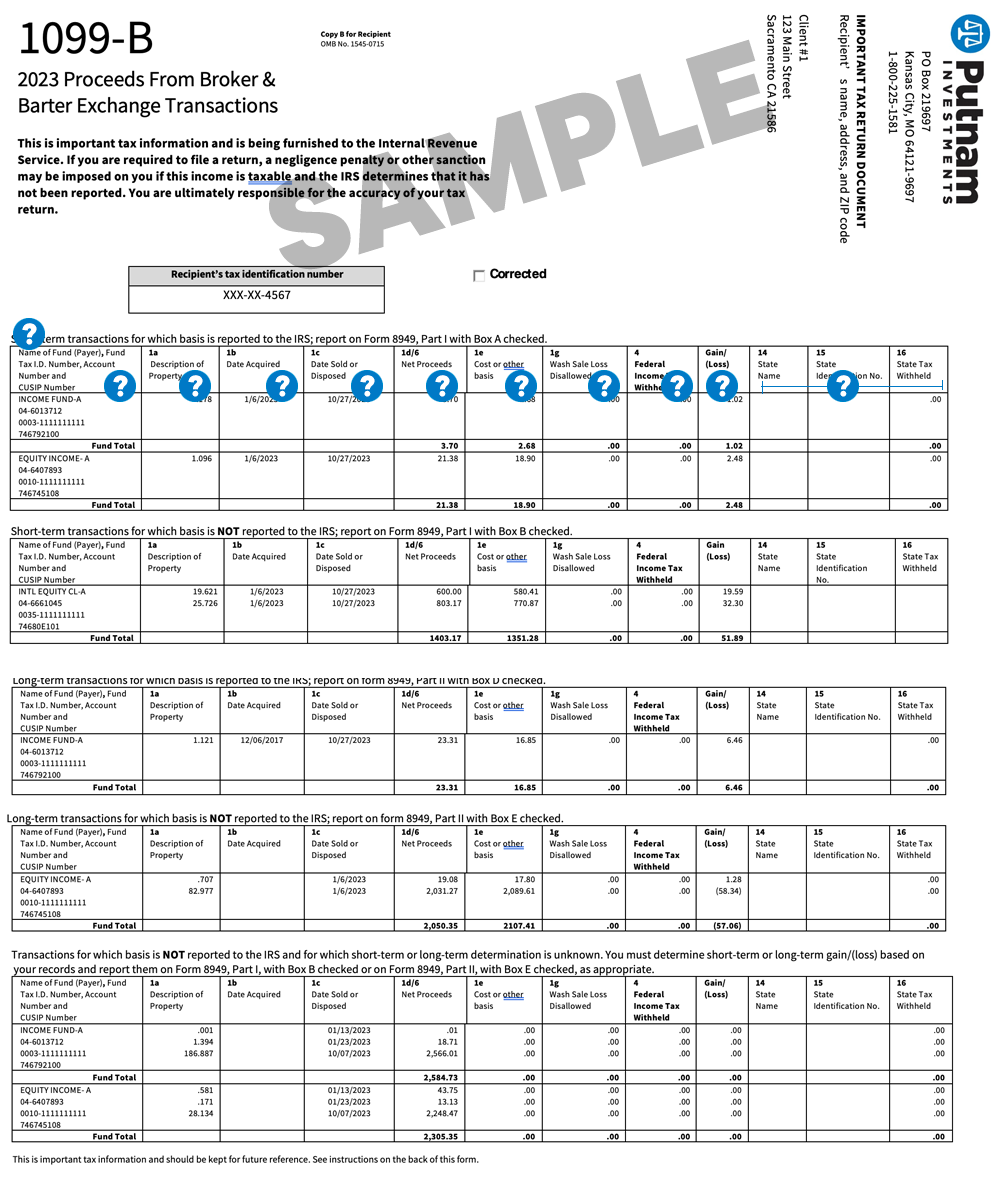

Forex 1099

Web the program will generate a form 6781, on which you report the net gain for the year, and then apply the 60/40 rule to a schedule d, on which you report all investment capital. This is the same form used by individuals to report their income, deductions, and. Web trade or business is not subject to the withholding tax.

Forex Trading Taxes In Uk Best Forex Ea Expert Advisor

Eur/usd from as low as 0.2 with the #1 us fx broker*. We’ll also provide information on how to keep. Web forex reporting can depend on several factors. Deciding how to file forex taxes; Tax rates and how much you may pay in taxes;

Is From Forex Trading Taxable In Singapore Forex Trend Hunter

Eur/usd from as low as 0.2 with the #1 us fx broker*. Web your total taxes paid on the capital gains would then be equal to: This is the same form used by individuals to report their income, deductions, and. Eur/usd from as low as 0.2 with the #1 us fx broker*. Web types of tax reports for forex transactions;

Do You Pay Tax On Forex Profits Australia

Web visit our help and support page for account forms, applications and agreements including forex account application, mt4 account application and more. Web in the united states, forex traders are required to file their taxes using form 1040. Ad trade 80+ forex pairs, plus gold and silver with the #1 us fx broker*. Web in forex trading, only the profits.

Forex Account Termination Form Fx Etrading Platform

You can elect to have forex income taxed under internal revenue code section 988 or section 1256. They don’t provide you any offical documents really, just an account summary where you can select the dates january 1 2021 to december 31 2021. Yes if you're a u.s citizen. Private delivery services should not deliver returns to irs offices other than..

Forex Trading Registration Form

Eur/usd from as low as 0.2 with the #1 us fx broker*. Eur/usd from as low as 0.2 with the #1 us fx broker*. Private delivery services should not deliver returns to irs offices other than. Web complete a forex.com individual account customer application or metatrader individual account customer application. Web find irs addresses for private delivery of tax returns,.

Forex trading irs

Web types of tax reports for forex transactions; Deciding how to file forex taxes; Web the program will generate a form 6781, on which you report the net gain for the year, and then apply the 60/40 rule to a schedule d, on which you report all investment capital. This is the same form used by individuals to report their.

This Is The Same Form Used By Individuals To Report Their Income, Deductions, And.

Eur/usd from as low as 0.2 with the #1 us fx broker*. Yes if you're a u.s citizen. Private delivery services should not deliver returns to irs offices other than. Let's say that in your location, the tax on forex trading is 20%.

Complete Ira Trading Account Customer Agreement.

Web trade or business is not subject to the withholding tax on foreign partners’ share of effectively connected income. Tax rates and how much you may pay in taxes; Web traders on the foreign exchange market, or forex, use irs form 8949 and schedule d to report their capital gains and losses on their federal income tax returns. Via fax (for expedited processing):

They Don’t Provide You Any Offical Documents Really, Just An Account Summary Where You Can Select The Dates January 1 2021 To December 31 2021.

[$1,000 x.60 x.10] + [$1,000 x.40 x.40] = $60 + $160 = $220. We’ll also provide information on how to keep. Ad trade 80+ forex pairs, plus gold and silver with the #1 us fx broker*. Web the program will generate a form 6781, on which you report the net gain for the year, and then apply the 60/40 rule to a schedule d, on which you report all investment capital.

Web In Forex Trading, Only The Profits That You Make Are Taxable, You Should Not Worry About The Losses.

Eur/usd from as low as 0.2 with the #1 us fx broker*. We have decades of experience with holistic international tax strategies and planning. Web complete a forex.com individual account customer application or metatrader individual account customer application. Send your completed, signed application (in its entirety), required documentation, tax form, and photo id(s) to forex.com:

/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-01-a6be7f7fd3124918a519946fead796b8.jpg)