First Time Home Buyer Form

First Time Home Buyer Form - Figure out what you can afford. Web under the khrc first time homebuyer program, eligible applicants can receive assistance funds between 15 and 20% of the total purchase price, depending on their. Feel the pride of becoming a homeowner. Web the old first time homebuyers tax credit (fthbc) is an expired tax credit that was available for 2010 and earlier tax returns. Ad make a strong offer on your home with a mortgage first approval! Ad use our site to find the best loan rates for first time home buyer. Apply for an fthb mortgage loan online today! The average starter home cost $243,000 in june, sending the income. Ad make a strong offer on your home with a mortgage first approval! Notify the irs that the home for which you claimed the credit was disposed of or.

Ad use our site to find the best loan rates for first time home buyer. Web the old first time homebuyers tax credit (fthbc) is an expired tax credit that was available for 2010 and earlier tax returns. Web under the khrc first time homebuyer program, eligible applicants can receive assistance funds between 15 and 20% of the total purchase price, depending on their. Feel the pride of becoming a homeowner. Notify the irs that the home for which you claimed the credit was disposed of or. Taxpayers used it to claim a. That boxing out can be bruising in the form of buyer fatigue. These programs provide down payment and/or. The federal housing administration allows down payments as low as 3.5% for. Web t1036 home buyers' plan (hbp) request to withdraw funds from an rrsp for best results, download and open this form in adobe reader.

Ad make a strong offer on your home with a mortgage first approval! Figure out what you can afford. Notify the irs that the home for which you claimed the credit was disposed of or. That boxing out can be bruising in the form of buyer fatigue. Specialized mortgage lenders available nationwide. The best comparison site for first time home buyer loans. Web t1036 home buyers' plan (hbp) request to withdraw funds from an rrsp for best results, download and open this form in adobe reader. Ad make a strong offer on your home with a mortgage first approval! Web the old first time homebuyers tax credit (fthbc) is an expired tax credit that was available for 2010 and earlier tax returns. Feel the pride of becoming a homeowner.

Maryland First Time Home Buyer Addendum Fill and Sign Printable

Web thinking about buying a new home? Notify the irs that the home for which you claimed the credit was disposed of or. Ad make a strong offer on your home with a mortgage first approval! Ad make a strong offer on your home with a mortgage first approval! Web the old first time homebuyers tax credit (fthbc) is an.

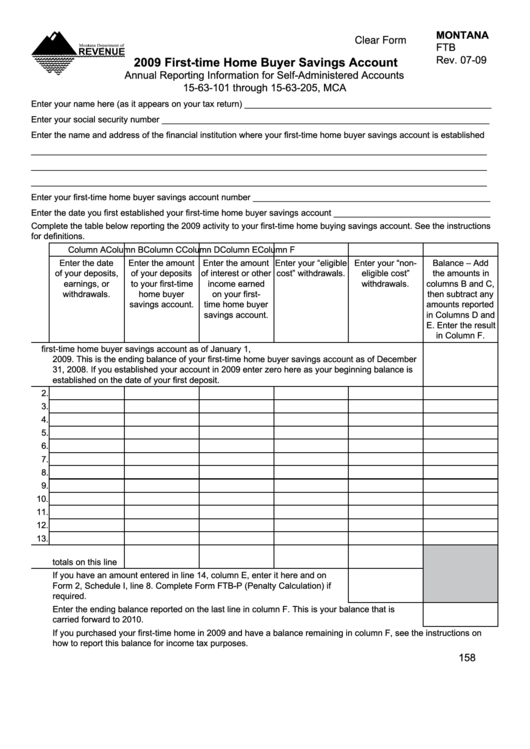

Fillable Form Ftb 2009 FirstTime Home Buyer Savings Account

Figure out what you can afford. Web t1036 home buyers' plan (hbp) request to withdraw funds from an rrsp for best results, download and open this form in adobe reader. That boxing out can be bruising in the form of buyer fatigue. Feel the pride of becoming a homeowner. Web connect with an agent step 1:

First Time Home Buyer Guide First Time Home Buyers Guide

Therefore, 2010 was the last year in which the. Web thinking about buying a new home? Specialized mortgage lenders available nationwide. Ad don’t wait to take your first step: Khrc collaborates with a network of.

Real Estate 101 For The FirstTime Homebuyer

Feel the pride of becoming a homeowner. Specialized mortgage lenders available nationwide. Notify the irs that the home for which you claimed the credit was disposed of or. Therefore, 2010 was the last year in which the. Ad get competitive fthb mortgage rates and guidance from experienced mortgage specialists.

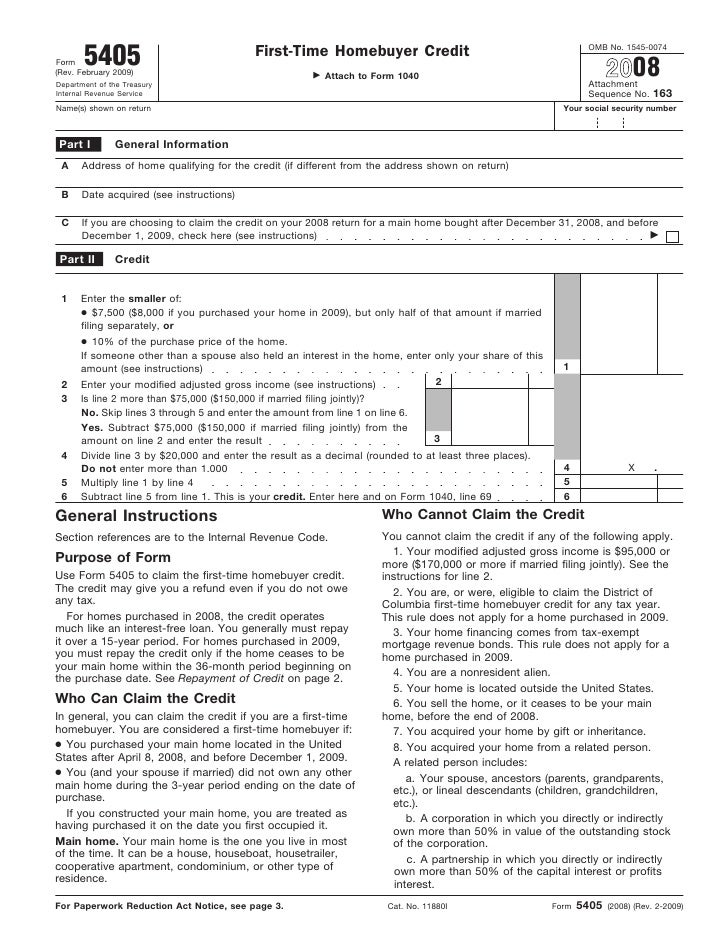

2008 First Time Home Buyer IRS Tax Form

Start saving a down payment one of the most important steps to buying a house for the first time? Apply for an fthb mortgage loan online today! If you are approved up to $500,000,. Ad use our site to find the best loan rates for first time home buyer. Ad get competitive fthb mortgage rates and guidance from experienced mortgage.

How to Complete Your FirstTime Home Buyer Application Mortgage

Web t1036 home buyers' plan (hbp) request to withdraw funds from an rrsp for best results, download and open this form in adobe reader. Web create your home wish list. If you are approved up to $500,000,. Ad get competitive fthb mortgage rates and guidance from experienced mortgage specialists. Khrc collaborates with a network of.

First Time Home Buyers Austin Real Estate Guide

Figure out what you can afford. If you are approved up to $500,000,. Taxpayers used it to claim a. The best comparison site for first time home buyer loans. Feel the pride of becoming a homeowner.

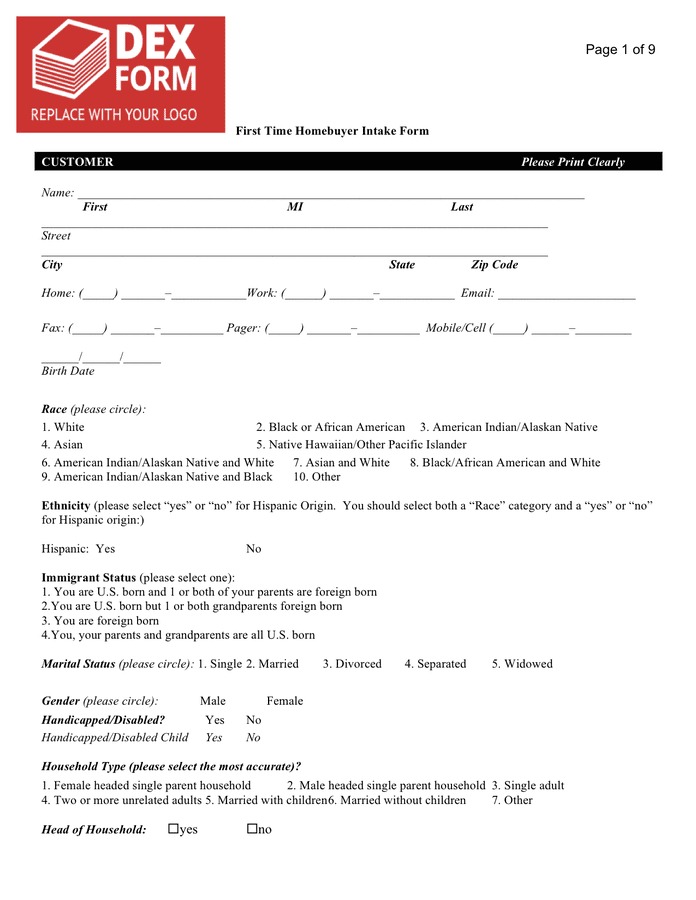

First time homebuyer intake form in Word and Pdf formats

Notify the irs that the home for which you claimed the credit was disposed of or. Ad get competitive fthb mortgage rates and guidance from experienced mortgage specialists. Web thinking about buying a new home? Ad use our site to find the best loan rates for first time home buyer. Web the old first time homebuyers tax credit (fthbc) is.

Home Essential Tips for the FirstTime Home Buyer publishthispost

Therefore, 2010 was the last year in which the. Feel the pride of becoming a homeowner. Ad use our site to find the best loan rates for first time home buyer. Web thinking about buying a new home? Check home loan eligibility & get a quote in minutes.

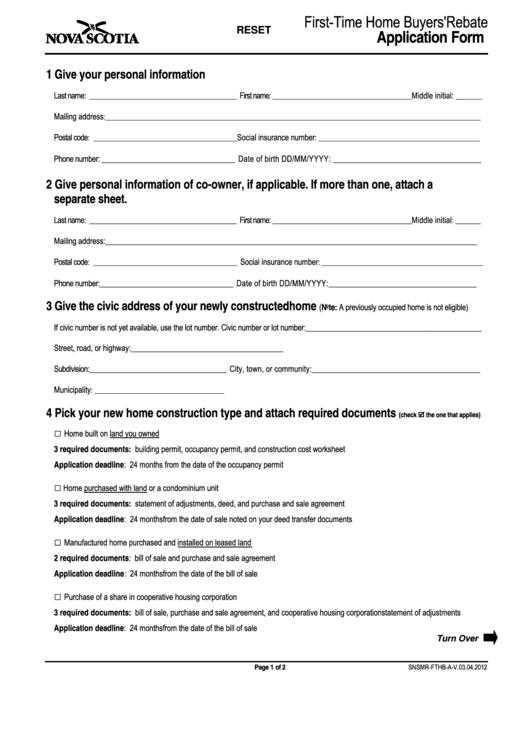

Fillable FirstTime Home Buyers Rebate Application Form printable pdf

Taxpayers used it to claim a. Notify the irs that the home for which you claimed the credit was disposed of or. Web connect with an agent step 1: Check home loan eligibility & get a quote in minutes. Ad get competitive fthb mortgage rates and guidance from experienced mortgage specialists.

Ad Use Our Site To Find The Best Loan Rates For First Time Home Buyer.

Ad make a strong offer on your home with a mortgage first approval! Taxpayers used it to claim a. Specialized mortgage lenders available nationwide. That boxing out can be bruising in the form of buyer fatigue.

Web Create Your Home Wish List.

Web connect with an agent step 1: If you are approved up to $500,000,. Start saving a down payment one of the most important steps to buying a house for the first time? Web t1036 home buyers' plan (hbp) request to withdraw funds from an rrsp for best results, download and open this form in adobe reader.

Notify The Irs That The Home For Which You Claimed The Credit Was Disposed Of Or.

These programs provide down payment and/or. Khrc collaborates with a network of. Ad don’t wait to take your first step: Feel the pride of becoming a homeowner.

The Average Starter Home Cost $243,000 In June, Sending The Income.

Figure out what you can afford. The federal housing administration allows down payments as low as 3.5% for. Web the old first time homebuyers tax credit (fthbc) is an expired tax credit that was available for 2010 and earlier tax returns. Web thinking about buying a new home?