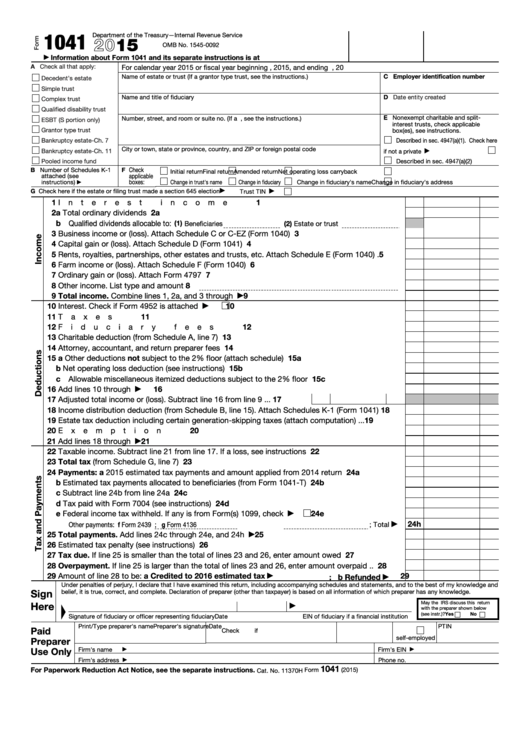

Fillable Form 1041

Fillable Form 1041 - Don’t complete for a simple trust or a pooled income fund. Steps to complete the blank copy. Get the current filing year’s forms, instructions, and publications for free from the irs. Department of the treasury internal revenue service see back of form and instructions. Web on form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees, fiduciary fees and itemized deductions. Web how to fill out form 1041 for the 2021 tax year. 1041 (2022) form 1041 (2022) page. Try it for free now! Ad checkpoint learning provides best in class tax, accounting, finance & more education. For instructions and the latest information.

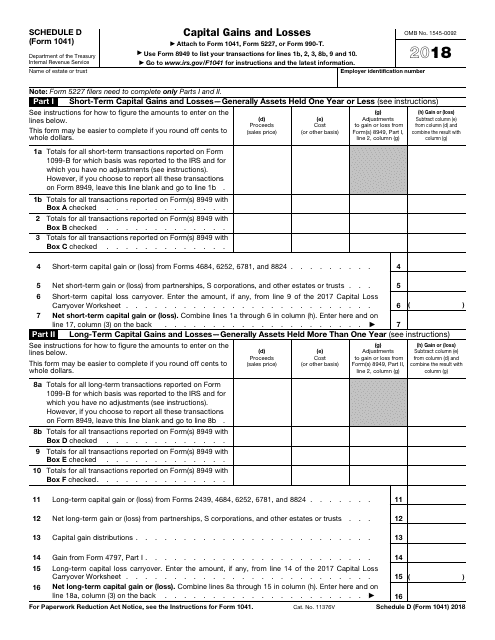

You'll need turbotax business to file form. Pdf form solution • proven solutions to report the earnings (that is accumulated,. Ad access irs tax forms. Web the executor continues to file form 1041 during the election period even if the estate distributes all of its assets before the end of the election period. Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Web fill online, printable, fillable, blank form 1041: Get the current filing year’s forms, instructions, and publications for free from the irs. For instructions and the latest information. Web irs form 1041 for 2022: Ad irs form 1041, get ready for tax deadlines by filling online any tax form for free.

Then download the relevant pdf to print out or find a. Web fill online, printable, fillable, blank form 1041: Web on form 1041, you can claim deductions for expenses such as attorney, accountant and return preparer fees, fiduciary fees and itemized deductions. For instructions and the latest information. Irs 1041 is an official. Ad checkpoint learning provides best in class tax, accounting, finance & more education. Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Ad access irs tax forms. Obtain a sample of the 1041 estates tax return as a reference. Form 5227 filers need to complete only parts i and ii.

Fillable Form 1041 U.s. Tax Return For Estates And Trusts

Upload, modify or create forms. Web (4.6 / 5) 107 votes get your form 1041 in 3 easy steps 01 fill and edit template 02 sign it online 03 export or print immediately what is irs form 1041? Web irs form 1041 for 2022: Form 5227 filers need to complete only parts i and ii. Then download the relevant pdf.

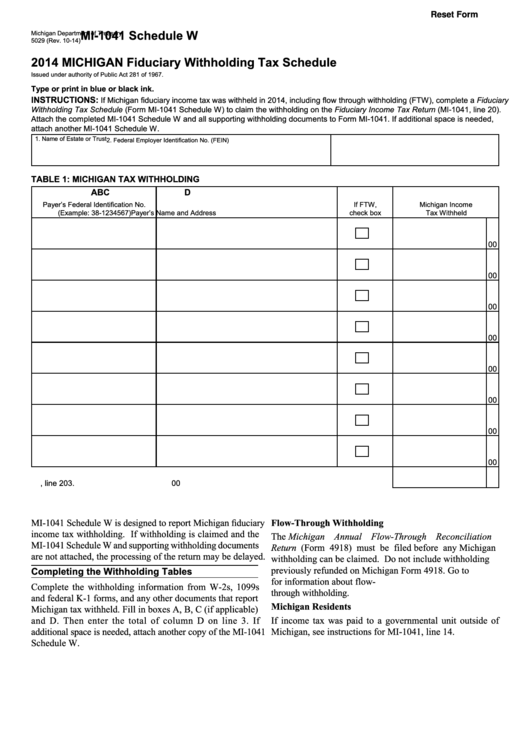

Fillable Form Mi1041 2014 Michigan Fiduciary Withholding Tax

Web fill online, printable, fillable, blank form 1041: Web (4.6 / 5) 107 votes get your form 1041 in 3 easy steps 01 fill and edit template 02 sign it online 03 export or print immediately what is irs form 1041? Ad checkpoint learning provides best in class tax, accounting, finance & more education. Then download the relevant pdf to.

1041 Fill Out and Sign Printable PDF Template signNow

Web irs form 1041 for 2022: You'll need turbotax business to file form. Web get federal tax forms. Ad access irs tax forms. Web the executor continues to file form 1041 during the election period even if the estate distributes all of its assets before the end of the election period.

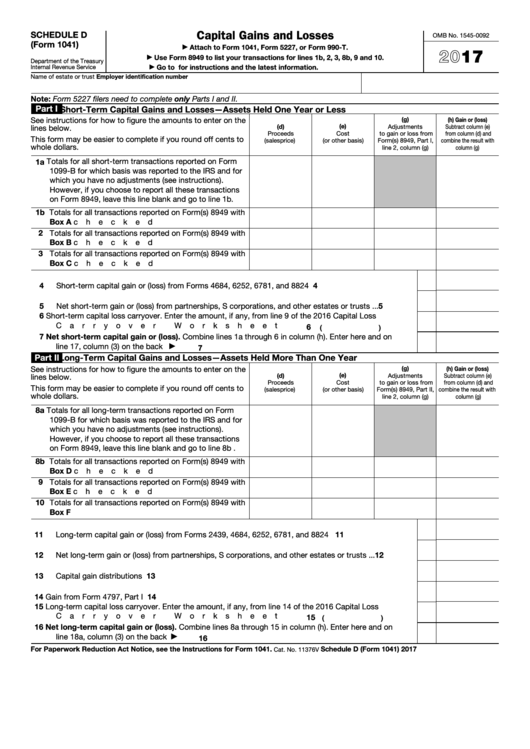

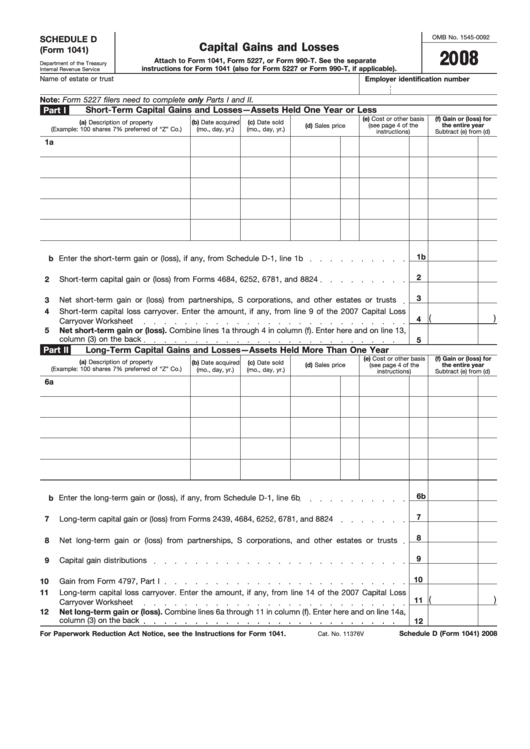

Fillable Schedule D (Form 1041) Capital Gains And Losses 2017

Complete, edit or print tax forms instantly. 2 schedule a charitable deduction. Web how to fill out form 1041 for the 2021 tax year. Web (4.6 / 5) 107 votes get your form 1041 in 3 easy steps 01 fill and edit template 02 sign it online 03 export or print immediately what is irs form 1041? Use fill to.

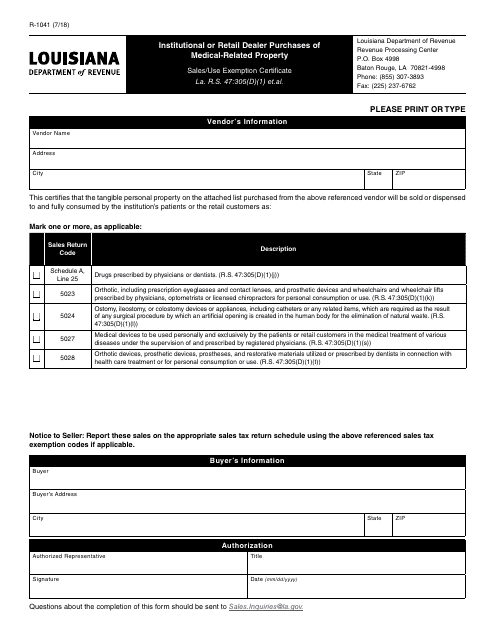

Form R1041 Download Fillable PDF or Fill Online Institutional or

Web (4.6 / 5) 107 votes get your form 1041 in 3 easy steps 01 fill and edit template 02 sign it online 03 export or print immediately what is irs form 1041? Get your cpe in one place with over 4,200 cpe credits offered. More help with filing a form 1041 for an. Form 5227 filers need to complete.

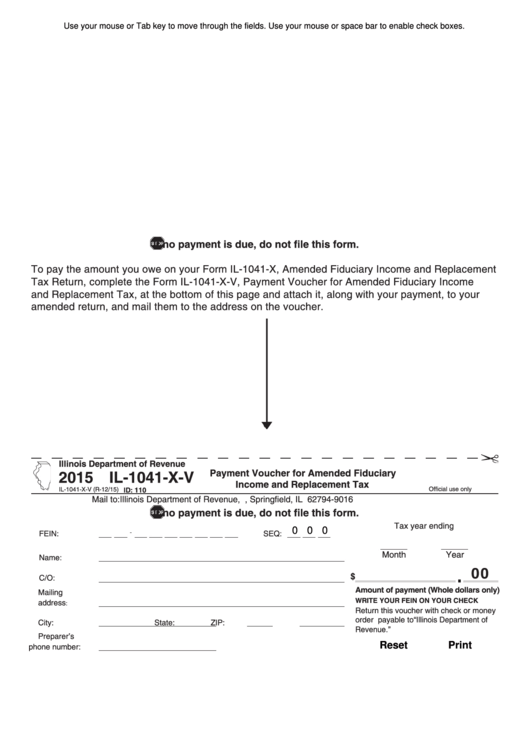

Fillable Form Il1041XV Illinois Payment Voucher For Amended

Solved•by turbotax•2428•updated january 13, 2023. Order by phone at 1. Obtain a sample of the 1041 estates tax return as a reference. More help with filing a form 1041 for an. Get the current filing year’s forms, instructions, and publications for free from the irs.

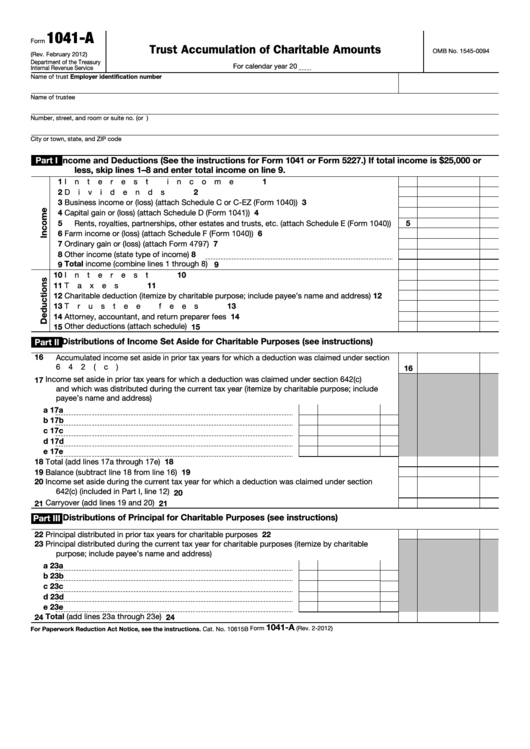

Fillable Form 1041A U.s. Information Return Trust Accumulation Of

Web how do i file form 1041 for an estate or trust? You'll need turbotax business to file form. Web irs form 1041 for 2022: Order by phone at 1. Then download the relevant pdf to print out or find a.

Fillable Form 1041 Schedule D Capital Gains And Losses 2008

Try it for free now! Steps to complete the blank copy. Web the executor continues to file form 1041 during the election period even if the estate distributes all of its assets before the end of the election period. Web fill online, printable, fillable, blank form 1041: 2 schedule a charitable deduction.

IRS Form 1041 Schedule D Download Fillable PDF or Fill Online Capital

Web get federal tax forms. Solved•by turbotax•2428•updated january 13, 2023. Irs 1041 is an official. Complete, edit or print tax forms instantly. Web correction to the instructions for form 941 (rev.

Get The Current Filing Year’s Forms, Instructions, And Publications For Free From The Irs.

Web (4.6 / 5) 107 votes get your form 1041 in 3 easy steps 01 fill and edit template 02 sign it online 03 export or print immediately what is irs form 1041? Order by phone at 1. Use fill to complete blank online irs pdf forms for free. For calendar year 2020 or fiscal year beginning , 2020, and ending.

Department Of The Treasury Internal Revenue Service See Back Of Form And Instructions.

For instructions and the latest information. Solved•by turbotax•2428•updated january 13, 2023. Complete, edit or print tax forms instantly. Web how do i file form 1041 for an estate or trust?

Web Correction To The Instructions For Form 941 (Rev.

Try it for free now! Web fill online, printable, fillable, blank form 1041: Pdf form solution • proven solutions to report the earnings (that is accumulated,. Web if “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss.

Don’t Complete For A Simple Trust Or A Pooled Income Fund.

Download, print or email irs 1041 tax form on pdffiller for free. Web the executor continues to file form 1041 during the election period even if the estate distributes all of its assets before the end of the election period. Steps to complete the blank copy. Form 5227 filers need to complete only parts i and ii.