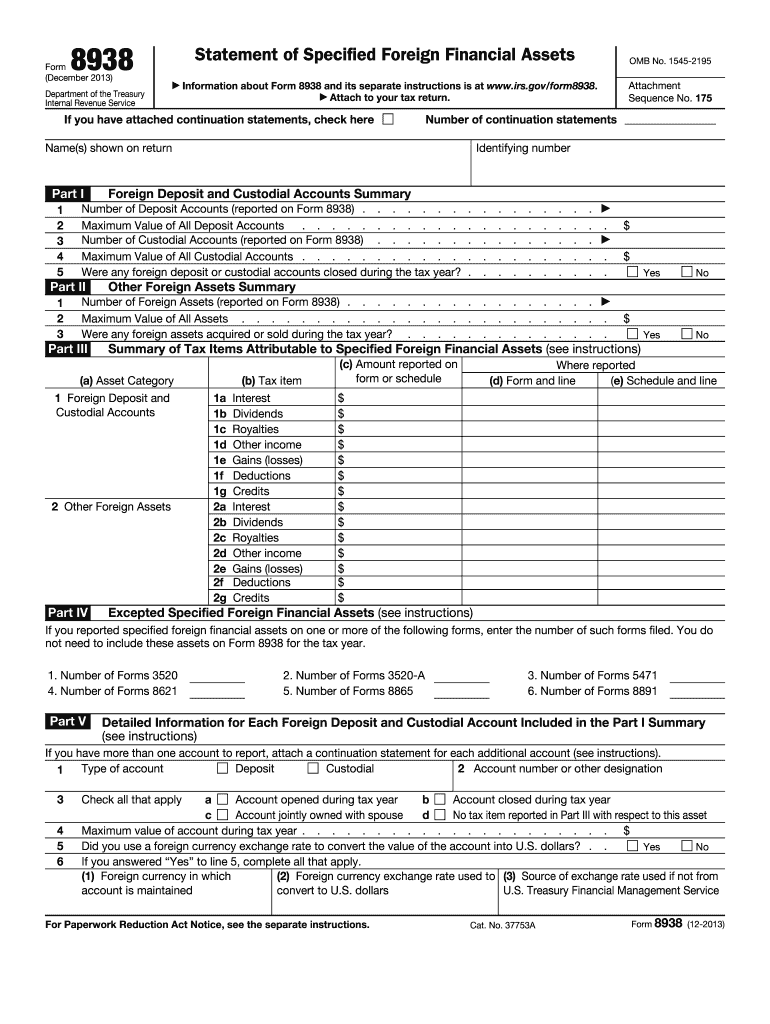

File Form 8938 Online

File Form 8938 Online - Web form 8938 is used to report your foreign financial assets if the total value exceeds a certain threshold based on your filing status and the types of assets. Click on the tab other tax situations next to deductions & credits; Solved • by intuit • 7 • updated july 13, 2022. Examples of financial accounts include:. Use form 8938 to report your. Web under prior law, the reporting of sffas on form 8938 solely applied to individuals, provided that the value of the reportable foreign assets exceeded the. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 8938 must be submitted to the irs by the tax deadline, or the extended deadline if you file a tax extension. If you’re one of the people who doesn’t need to file tax.

If you’re one of the people who doesn’t need to file tax. Select statement of foreign assets (8938) from the left panel. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web follow these steps to fill out form 8938: Ad get ready for tax season deadlines by completing any required tax forms today. Web the reporting requirements for form 8938 are also more complex. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web general information about form 8938, statement of specified foreign financial assets. Complete, edit or print tax forms instantly. Web to enter the information for form 8938 in the taxact program:

Select statement of foreign assets (8938) from the left panel. Ad get ready for tax season deadlines by completing any required tax forms today. Web if you are required to file form 8938, you must report your financial accounts maintained by a foreign financial institution. Web when you have a domestic trust and at least one specific beneficiary, you need to fill out form 8938. Unlike the fbar penalties, there has been no indication that the internal revenue service plans on seeking penalties. The irs issued regulations that require a domestic entity to file form 8938 if the entity is formed or used to hold specified foreign financial assets. Web in general, form 8938 penalties will be $10,000 per year. Failure to file by the deadline will result in a $10,000 penalty. Try it for free now! Web filing form 8938 is only available to those using turbotax deluxe or higher.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

Web form 8938 is used by certain u.s. Web under prior law, the reporting of sffas on form 8938 solely applied to individuals, provided that the value of the reportable foreign assets exceeded the. Web when you have a domestic trust and at least one specific beneficiary, you need to fill out form 8938. Click on the tab other tax.

Do YOU need to file Form 8938? “Statement of Specified Foreign

Solved • by intuit • 7 • updated july 13, 2022. All editing instruments are accessible online from your device. Web form 8938 is used to report your foreign financial assets if the total value exceeds a certain threshold based on your filing status and the types of assets. Web follow these steps to fill out form 8938: If you’re.

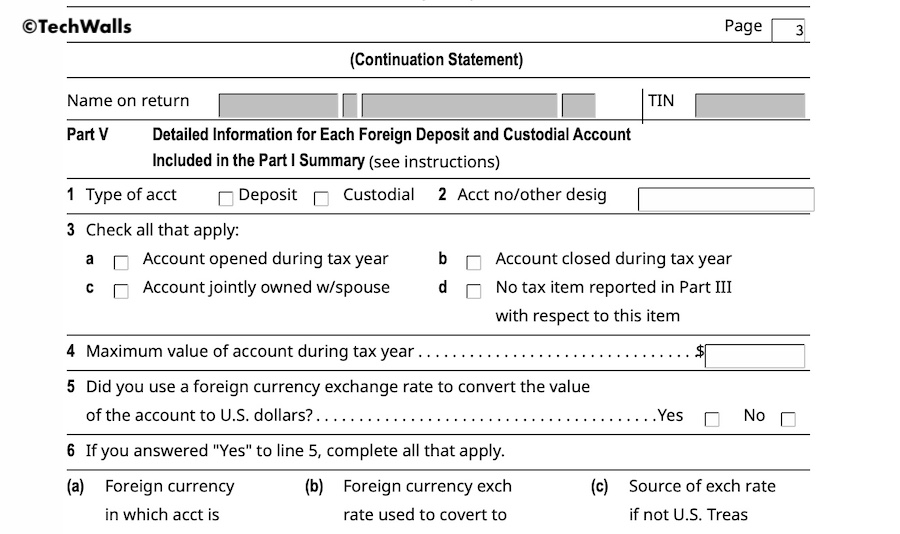

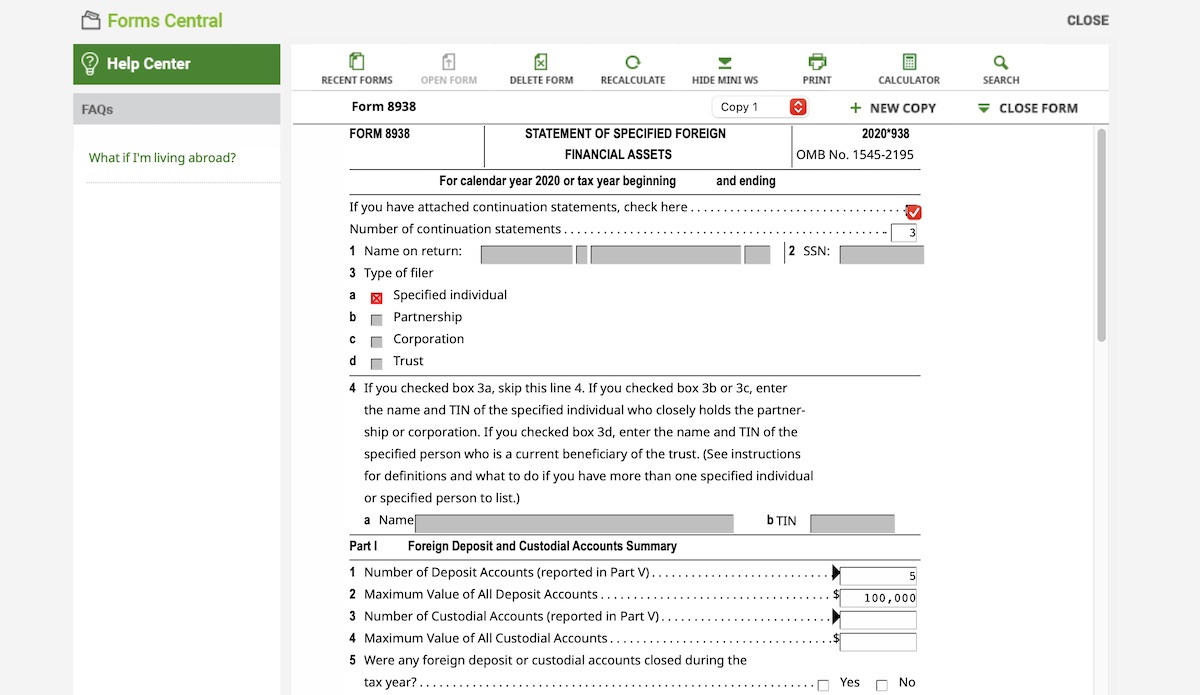

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Web form 8938 each year, the us government requires us taxpayers who own foreign assets, investments and accounts to disclose this information on internal revenue service form. Web application to domestic entities: Web form 8938 is used to report your foreign financial assets if the total value exceeds a certain threshold based on your filing status and the types of.

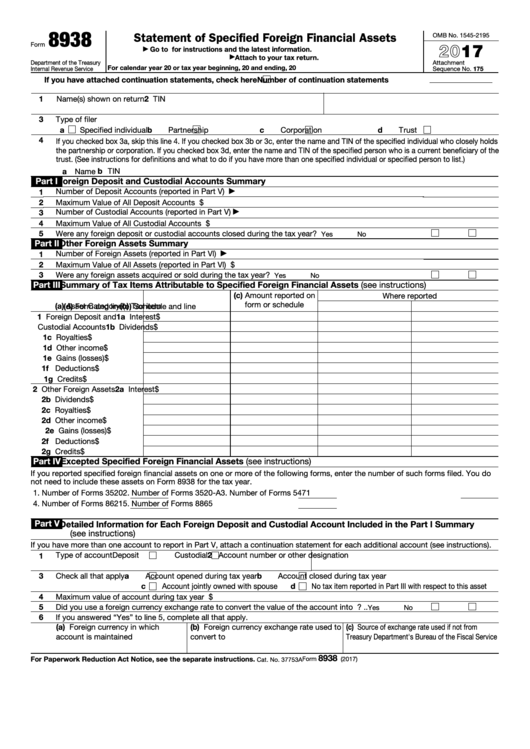

Fillable Form 8938 Statement Of Foreign Financial Assets 2017

Ad get ready for tax season deadlines by completing any required tax forms today. Unlike the fbar penalties, there has been no indication that the internal revenue service plans on seeking penalties. The irs issued regulations that require a domestic entity to file form 8938 if the entity is formed or used to hold specified foreign financial assets. Try it.

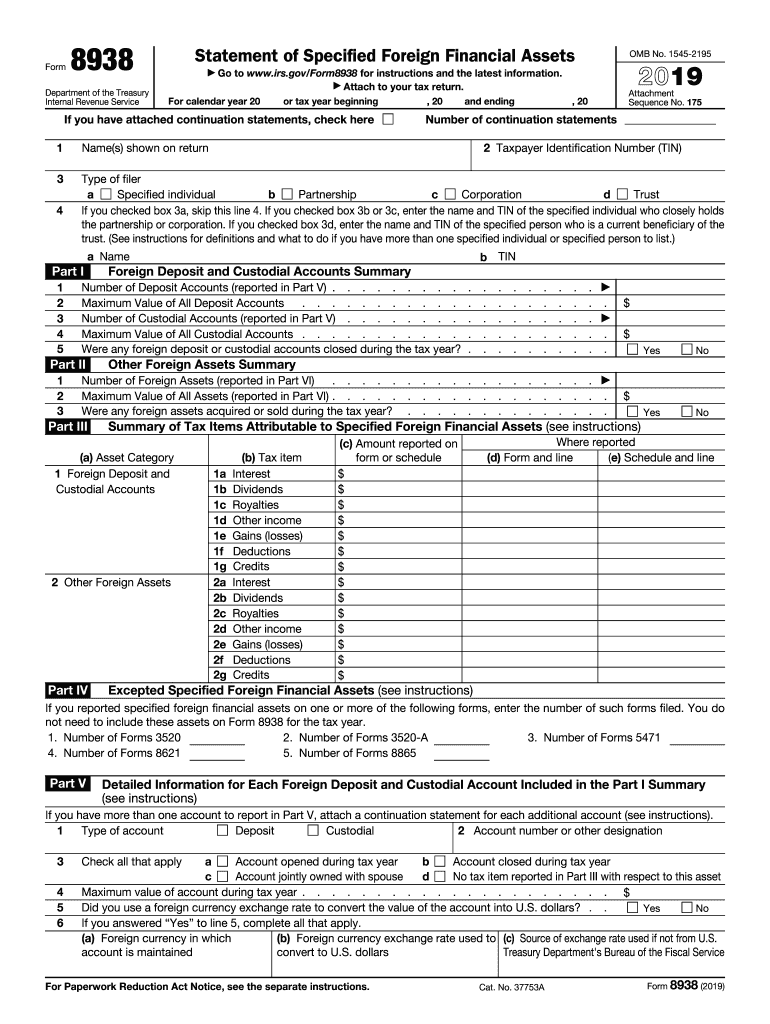

2019 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Web there are several ways to submit form 4868. Web the reporting requirements for form 8938 are also more complex. Web filing form 8938 is only available to those using turbotax deluxe or higher. Try it for free now! Web under prior law, the reporting of sffas on form 8938 solely applied to individuals, provided that the value of the.

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Failure to file by the deadline will result in a $10,000 penalty. Examples of financial accounts include:. Web to enter the information for form 8938 in the taxact program: Web form 8938 must be submitted to the irs by the tax deadline, or the extended deadline if you file a tax extension. Ad get ready for tax season deadlines by.

What’s the cheapest way to file tax return (federa... Fishbowl

Web follow these steps to fill out form 8938: Web 1 open up the form 8938 open up the form in the editor with out downloading/uploading the document. The irs issued regulations that require a domestic entity to file form 8938 if the entity is formed or used to hold specified foreign financial assets. Web if you are required to.

Form 8938 Who Has to Report Foreign Assets & How to File

While the fbar applies when any taxpayer has at least $10,000 stored in a foreign bank account, the reporting. Open or continue with your return; Solved • by intuit • 7 • updated july 13, 2022. Web general information about form 8938, statement of specified foreign financial assets. Web 1 open up the form 8938 open up the form in.

2011 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner. To enter the information for form 8938 in your taxact ® return:. Web in general, form 8938 penalties will be $10,000 per year. Try it for free now! Web see the irs instructions for form 8938 and basic questions and.

2013 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Ad get ready for tax season deadlines by completing any required tax forms today. Use form 8938 to report your. Web for tax years beginning after december 31, 2015, certain domestic corporations, partnerships, and trusts that are formed or availed of for the purpose of holding, directly. Web under prior law, the reporting of sffas on form 8938 solely applied.

While The Fbar Applies When Any Taxpayer Has At Least $10,000 Stored In A Foreign Bank Account, The Reporting.

Click on the tab other tax situations next to deductions & credits; Web form 8938 is used by certain u.s. The irs issued regulations that require a domestic entity to file form 8938 if the entity is formed or used to hold specified foreign financial assets. To get to the 8938 section in turbotax, refer to the following instructions:

Web General Information About Form 8938, Statement Of Specified Foreign Financial Assets.

Web under prior law, the reporting of sffas on form 8938 solely applied to individuals, provided that the value of the reportable foreign assets exceeded the. Web follow these steps to fill out form 8938: Select statement of foreign assets (8938) from the left panel. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file.

Web For Tax Years Beginning After December 31, 2015, Certain Domestic Corporations, Partnerships, And Trusts That Are Formed Or Availed Of For The Purpose Of Holding, Directly.

Web if you are required to file form 8938, you must report your financial accounts maintained by a foreign financial institution. Failure to file by the deadline will result in a $10,000 penalty. Web in general, form 8938 penalties will be $10,000 per year. Web application to domestic entities:

Web Form 8938 Is Used To Report Your Foreign Financial Assets If The Total Value Exceeds A Certain Threshold Based On Your Filing Status And The Types Of Assets.

Enter the description of asset. Web see the irs instructions for form 8938 and basic questions and answers on form 8938 for more information. Unlike the fbar penalties, there has been no indication that the internal revenue service plans on seeking penalties. If you’re one of the people who doesn’t need to file tax.