File Form 7004 Online

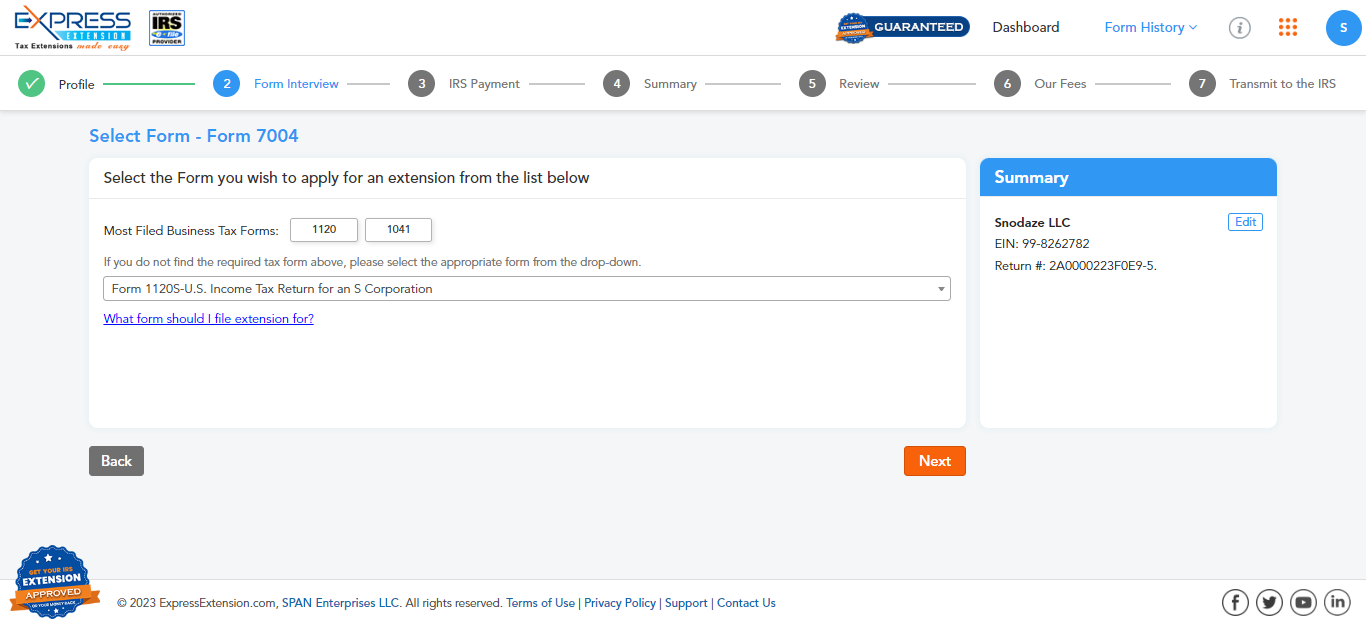

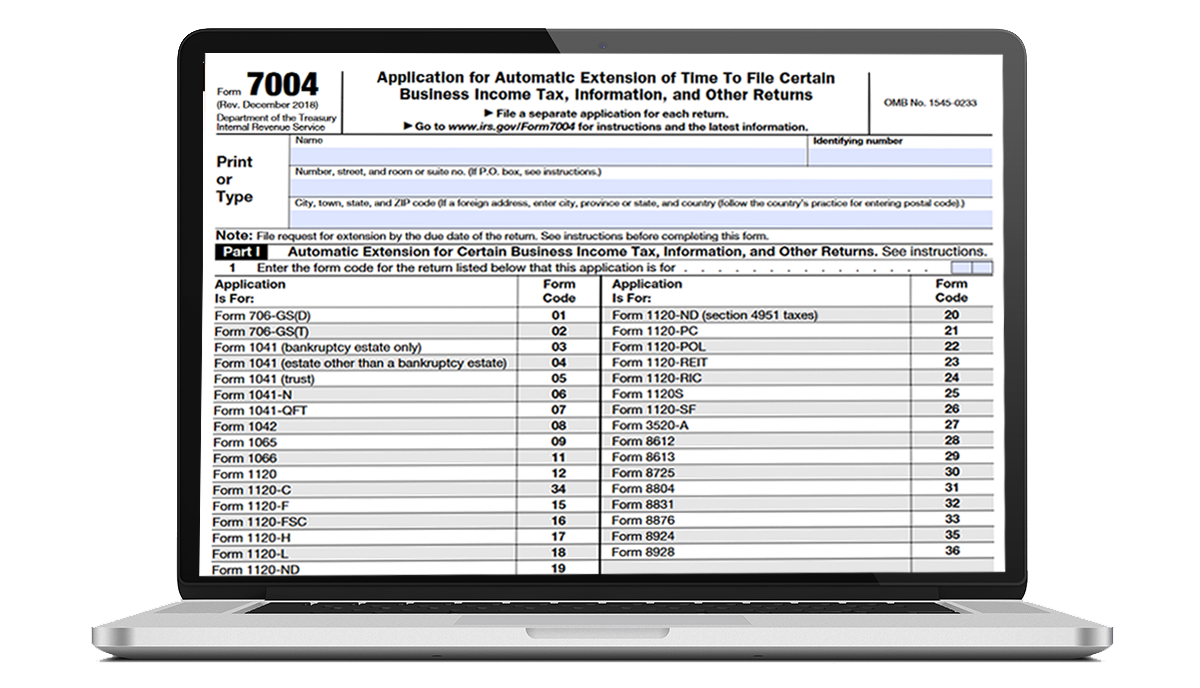

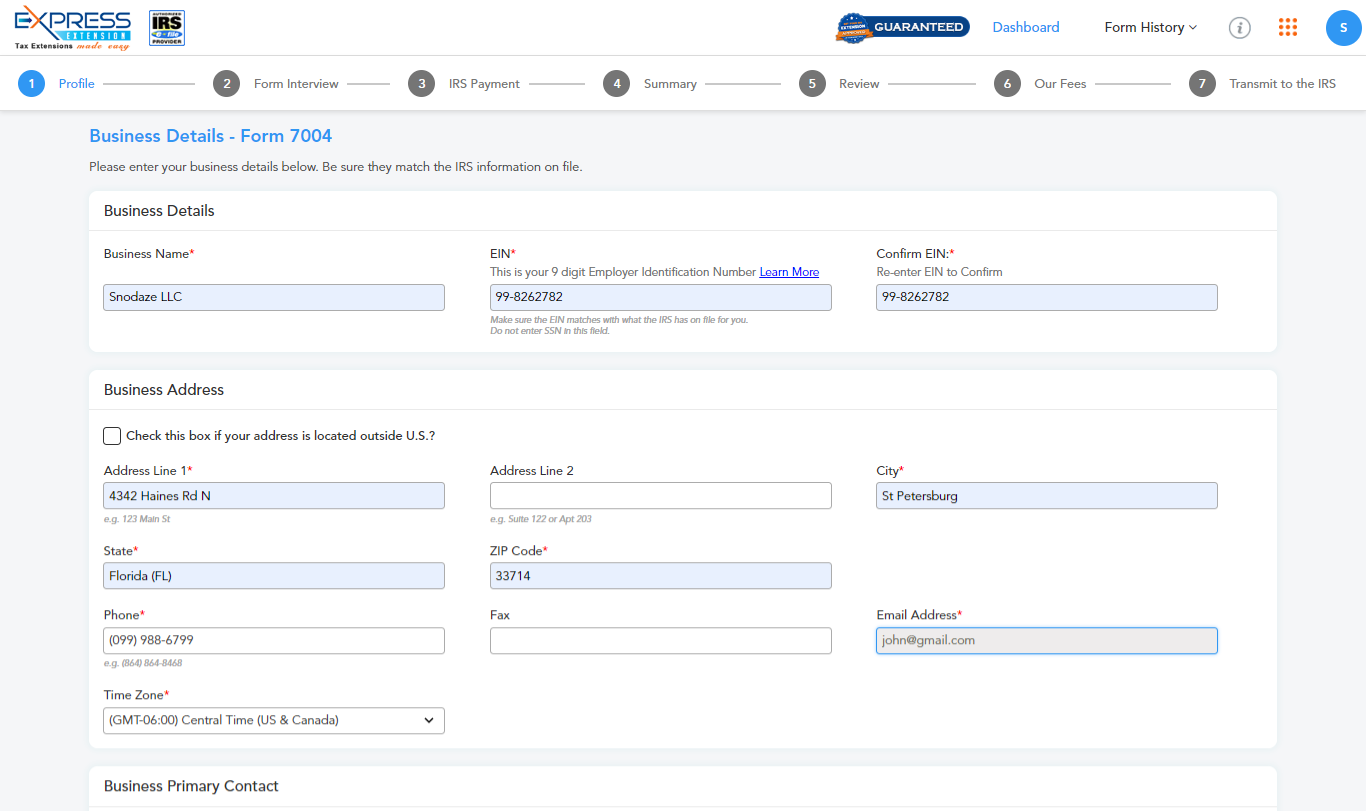

File Form 7004 Online - Here are some of the reasons why you should choose expressextension to file your tax extension forms. All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due date of the return. This can be particularly beneficial for those who need more time to gather financial records and. Form 7004 is used to request an automatic extension to file the certain returns. Web use the chart to determine where to file form 7004 based on the tax form you complete. Enter business details step 2: Select extension of time to file (form 7004) and continue; Web follow these steps to print a 7004 in turbotax business: Select business entity & form step 3: Enter tax payment details step 5:

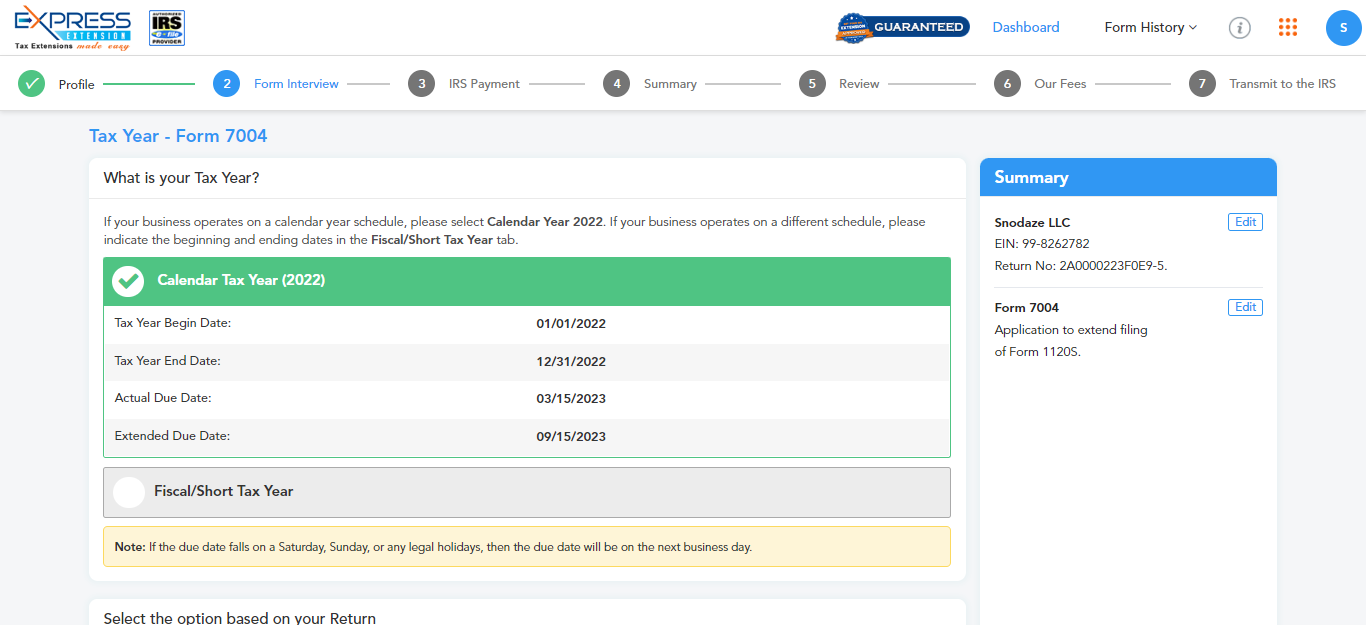

With your return open, select search and enter extend; Select the tax year step 4: Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Enter tax payment details step 5: Business information (name, ein, address) type of business (exp. Form 7004 is used to request an automatic extension to file the certain returns. Web to file form 7004 extension online, the taxpayers must gather all documents such as: Here are some of the reasons why you should choose expressextension to file your tax extension forms. Select extension of time to file (form 7004) and continue; Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns

Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns Select business entity & form step 3: Business information (name, ein, address) type of business (exp. Select the tax year step 4: Web to file form 7004 extension online, the taxpayers must gather all documents such as: All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due date of the return. Corporation, partnership) type of tax form that the business is requesting an extension an estimate of the amount of the tax owed to the irs (if. Form 7004 is used to request an automatic extension to file the certain returns. Web follow these steps to print a 7004 in turbotax business: It’s simple and easy to file your extension forms with the irs using expressextension.

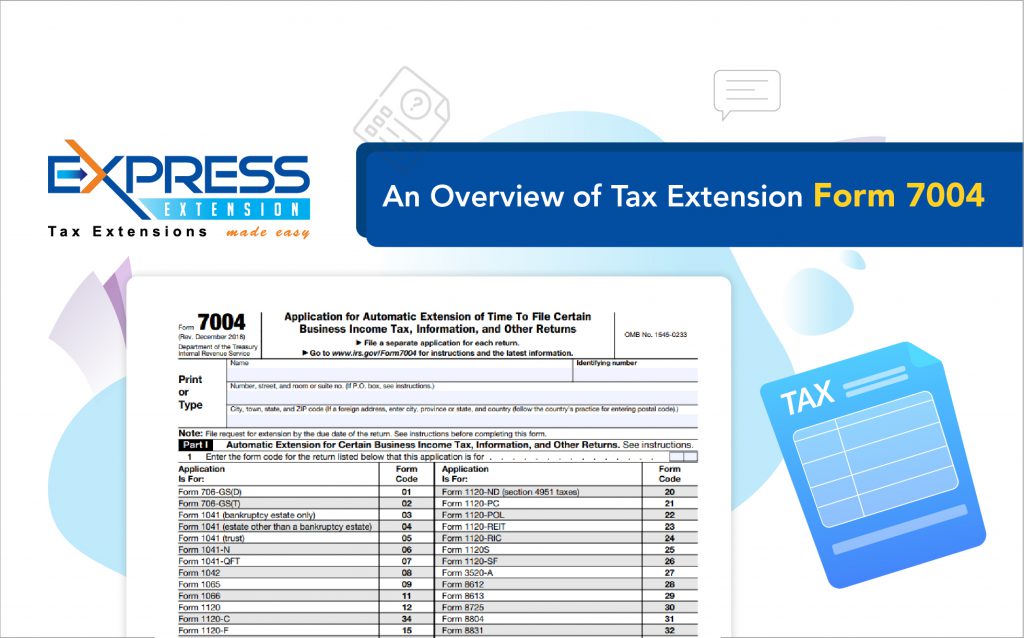

An Overview of Tax Extension Form 7004 Blog ExpressExtension

Select extension of time to file (form 7004) and continue; Web file irs tax extension form 7004 online. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. This can be particularly beneficial for those who need more.

File IRS Tax Extension Form 7004 Online TaxBandits Fill Online

Form 7004 is used to request an automatic extension to file the certain returns. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns Select business entity & form step 3: With your return open, select search and.

EFile IRS Form 7004 How to file 7004 Extension Online

Web to file form 7004 extension online, the taxpayers must gather all documents such as: Select business entity & form step 3: Business information (name, ein, address) type of business (exp. Web use the chart to determine where to file form 7004 based on the tax form you complete. Web information about form 7004, application for automatic extension of time.

EFile 7004 Online 2022 File Business Tax extension Form

Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Select business entity & form step 3: Business information (name, ein, address) type of business (exp. Web file irs tax extension form 7004 online. Follow the instructions to.

File Form 7004 Online 2023 Business Tax Extension Form

Form 7004 is used to request an automatic extension to file the certain returns. Web file irs tax extension form 7004 online. Select the tax year step 4: Enter tax payment details step 5: Web filing the irs form 7004 for 2022 provides businesses and certain individuals with the opportunity to request an extension on their tax return deadlines.

E File Form 7004 Online Universal Network

With your return open, select search and enter extend; This can be particularly beneficial for those who need more time to gather financial records and. Here are some of the reasons why you should choose expressextension to file your tax extension forms. We'll provide the mailing address and any payment instructions Business information (name, ein, address) type of business (exp.

File Form 7004 Online 2021 Business Tax Extension Form

This can be particularly beneficial for those who need more time to gather financial records and. Web use the chart to determine where to file form 7004 based on the tax form you complete. Business information (name, ein, address) type of business (exp. Enter business details step 2: Follow the instructions to prepare and print your 7004 form.

EFile IRS Form 7004 How to file 7004 Extension Online

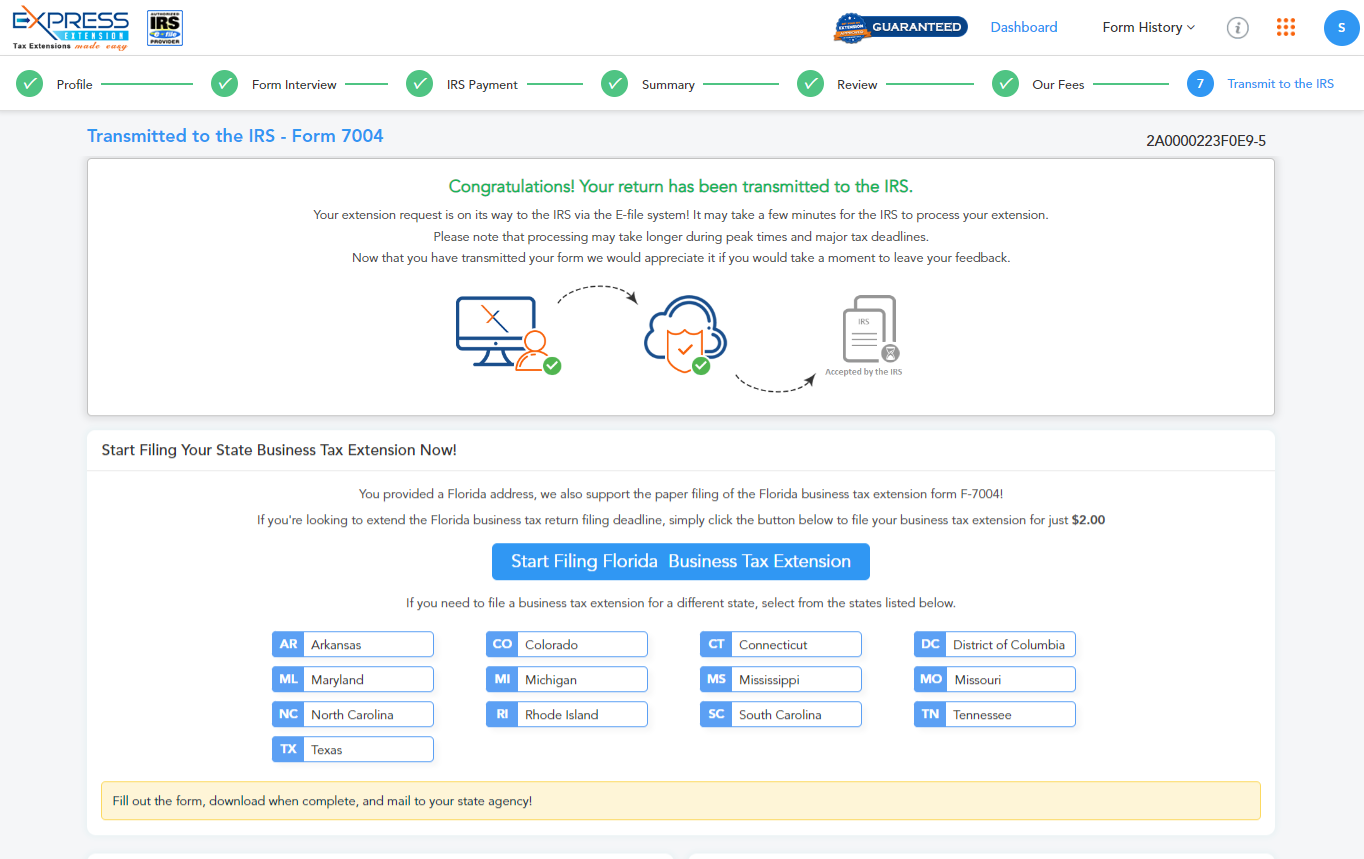

Transmit your form to the irs Corporation, partnership) type of tax form that the business is requesting an extension an estimate of the amount of the tax owed to the irs (if. It’s simple and easy to file your extension forms with the irs using expressextension. Web use the chart to determine where to file form 7004 based on the.

EFile IRS Form 7004 How to file 7004 Extension Online

Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related forms, and instructions on how to file. Here are some of the reasons why you should choose expressextension to file your tax extension forms. Select the tax year step 4: All the returns shown on.

EFile IRS Form 7004 How to file 7004 Extension Online

All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due date of the return. Select the tax year step 4: Transmit your form to the irs Follow the instructions to prepare and print your 7004 form. This can be particularly beneficial for those who need more time to gather financial.

Business Information (Name, Ein, Address) Type Of Business (Exp.

Follow the instructions to prepare and print your 7004 form. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns This can be particularly beneficial for those who need more time to gather financial records and. Select business entity & form step 3:

Web Filing The Irs Form 7004 For 2022 Provides Businesses And Certain Individuals With The Opportunity To Request An Extension On Their Tax Return Deadlines.

Transmit your form to the irs All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due date of the return. We'll provide the mailing address and any payment instructions Select extension of time to file (form 7004) and continue;

Web File Irs Tax Extension Form 7004 Online.

With your return open, select search and enter extend; Form 7004 is used to request an automatic extension to file the certain returns. Enter tax payment details step 5: Enter business details step 2:

Select The Tax Year Step 4:

Web to file form 7004 extension online, the taxpayers must gather all documents such as: Web use the chart to determine where to file form 7004 based on the tax form you complete. Corporation, partnership) type of tax form that the business is requesting an extension an estimate of the amount of the tax owed to the irs (if. It’s simple and easy to file your extension forms with the irs using expressextension.