Federal Form 1310

Federal Form 1310 - Web form 1310 informs the internal revenue service (irs) that a taxpayer has died and that a refund is being claimed by their beneficiaries and/or estate. Statement of person claiming refund due a deceased taxpayer (form 1310) unless: Use form 1310 to claim a refund on behalf of a deceased taxpayer. You are not a surviving spouse filing an original or amended joint return with the decedent; More about the federal form 1310 You are the personal representative (executor) filing the return on behalf of the estate. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Green died on january 4 before filing his tax return. The form is filed as part of a complete. The irs doesn't need a copy of the death certificate or other proof of death.

Web form 1310 federal — statement of person claiming refund due a deceased taxpayer download this form print this form it appears you don't have a pdf plugin for this browser. Statement of person claiming refund due a deceased taxpayer (form 1310) unless: Use form 1310 to claim a refund on behalf of a deceased taxpayer. You are the surviving spouse filing a joint return, or. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web use form 1310 to claim a refund on behalf of a deceased taxpayer. More about the federal form 1310 You must have written proof to file as the personal representative. Web who should file irs form 1310? You are not a surviving spouse filing an original or amended joint return with the decedent;

More about the federal form 1310 Use form 1310 to claim a refund on behalf of a deceased taxpayer. Statement of person claiming refund due a deceased taxpayer (form 1310) unless: Anyone who expects to receive an income tax refund on behalf of a decedent should file irs form 1310 if he or she is: Web form 1310 informs the internal revenue service (irs) that a taxpayer has died and that a refund is being claimed by their beneficiaries and/or estate. Web form 1310 federal — statement of person claiming refund due a deceased taxpayer download this form print this form it appears you don't have a pdf plugin for this browser. On april 3 of the same year, you were appointed Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Green died on january 4 before filing his tax return. You are the surviving spouse filing a joint return, or.

Form 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer

Statement of person claiming refund due a deceased taxpayer (form 1310) unless: Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed personal representative. If you are claiming a.

Manage Documents Using Our Document Editor For IRS Form 1310

More about the federal form 1310 Web form 1310 federal — statement of person claiming refund due a deceased taxpayer download this form print this form it appears you don't have a pdf plugin for this browser. Web form 1310 informs the internal revenue service (irs) that a taxpayer has died and that a refund is being claimed by their.

Form 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer

Anyone who expects to receive an income tax refund on behalf of a decedent should file irs form 1310 if he or she is: The irs doesn't need a copy of the death certificate or other proof of death. The form is filed as part of a complete. You are the personal representative (executor) filing the return on behalf of.

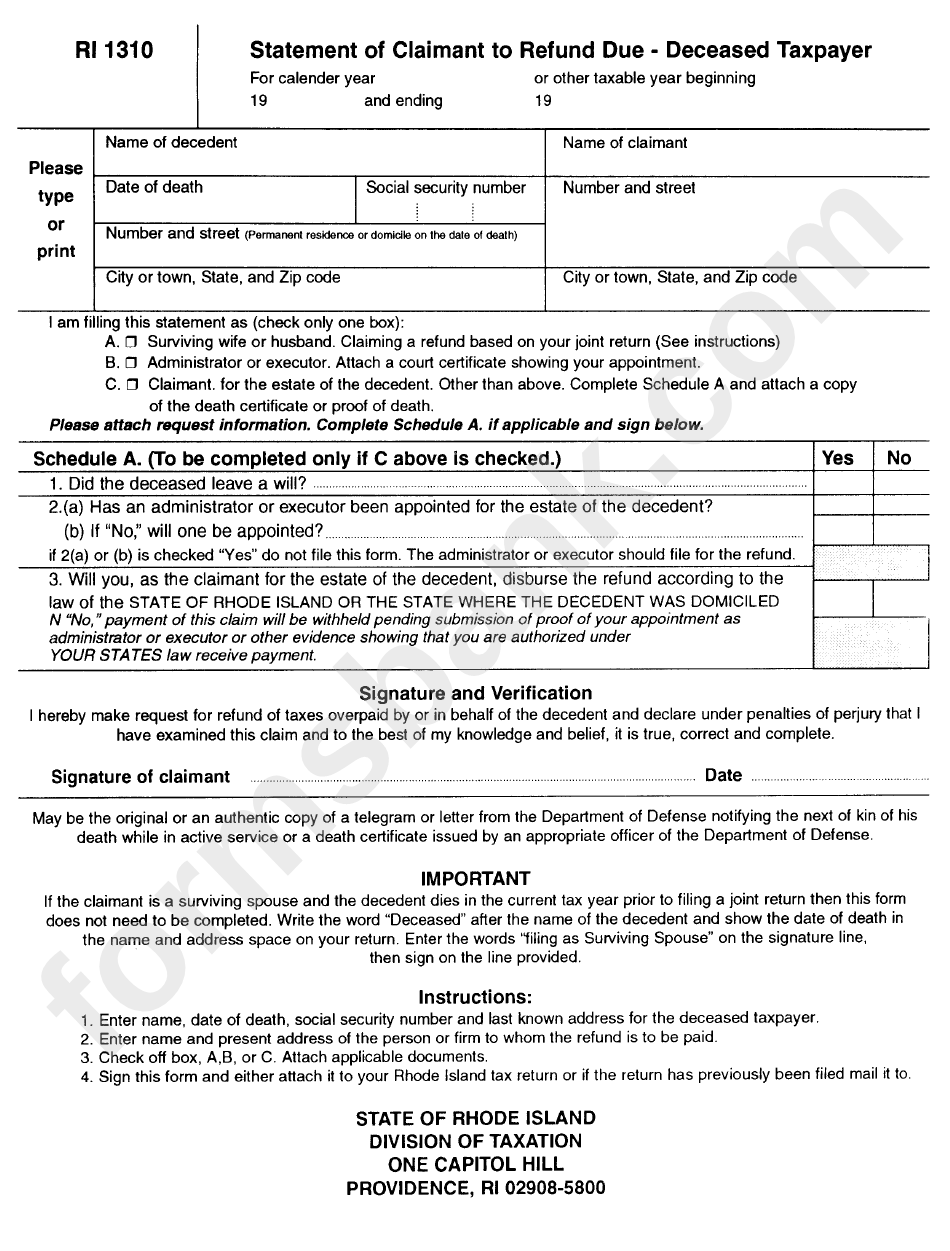

Fillable Form Ri 1310 Statement Of Claimant To Refund Due Deceased

You are not a surviving spouse filing an original or amended joint return with the decedent; More about the federal form 1310 Web use form 1310 to claim a refund on behalf of a deceased taxpayer. If money is owed, who is responsible for paying? You must have written proof to file as the personal representative.

Fill Free fillable Form 1310 Claiming Refund Due a Deceased Taxpayer

Use form 1310 to claim a refund on behalf of a deceased taxpayer. Anyone who expects to receive an income tax refund on behalf of a decedent should file irs form 1310 if he or she is: Web form 1310 federal — statement of person claiming refund due a deceased taxpayer download this form print this form it appears you.

Estimated Tax Payments 2022 Form Latest News Update

If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: You are the surviving spouse filing a joint return, or. Web who should file irs form 1310? Web form 1310 federal — statement of person claiming refund due a deceased taxpayer download this form print this form.

Fillable Form IRS 8888 Savings bonds, Irs, Financial institutions

Anyone who expects to receive an income tax refund on behalf of a decedent should file irs form 1310 if he or she is: Statement of person claiming refund due a deceased taxpayer (form 1310) unless: Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 if: Web form 1310.

2018 Form IL DoR IL1040X Fill Online, Printable, Fillable, Blank

Green died on january 4 before filing his tax return. If money is owed, who is responsible for paying? You are not a surviving spouse filing an original or amended joint return with the decedent; Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web form 1310 informs the internal revenue service (irs) that a.

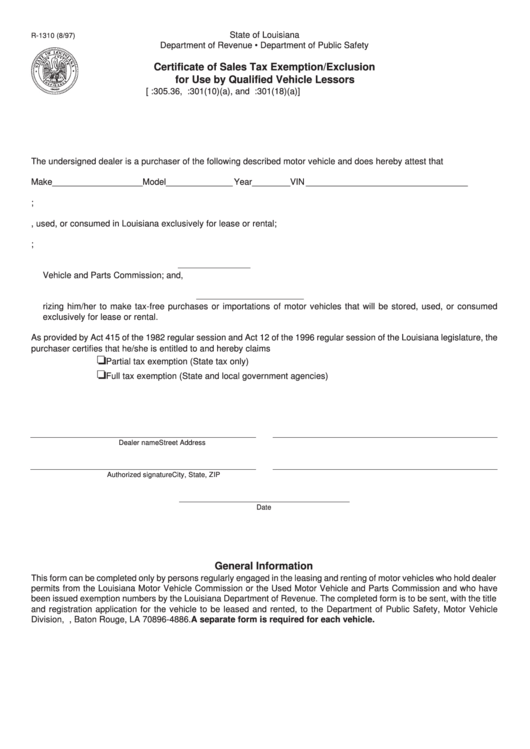

Fillable Form R1310 Certificate Of Sales Tax Exemption/exclusion For

If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 if: Statement of person claiming refund due a deceased taxpayer (form 1310) unless: You are not a.

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

You must have written proof to file as the personal representative. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. You are the surviving spouse filing a joint return, or. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. You are not a surviving spouse filing an original or amended.

Who Must File If You Are Claiming A Refund On Behalf Of A Deceased Taxpayer, You Must File Form 1310 If:

Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. You are the surviving spouse filing a joint return, or. You must have written proof to file as the personal representative. Web form 1310 federal — statement of person claiming refund due a deceased taxpayer download this form print this form it appears you don't have a pdf plugin for this browser.

You Are The Personal Representative (Executor) Filing The Return On Behalf Of The Estate.

Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web who should file irs form 1310? If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web use form 1310 to claim a refund on behalf of a deceased taxpayer.

The Form Is Filed As Part Of A Complete.

You are not a surviving spouse filing an original or amended joint return with the decedent; The irs doesn't need a copy of the death certificate or other proof of death. Anyone who expects to receive an income tax refund on behalf of a decedent should file irs form 1310 if he or she is: Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed personal representative.

Green Died On January 4 Before Filing His Tax Return.

Web form 1310 informs the internal revenue service (irs) that a taxpayer has died and that a refund is being claimed by their beneficiaries and/or estate. On april 3 of the same year, you were appointed More about the federal form 1310 Use form 1310 to claim a refund on behalf of a deceased taxpayer.