Federal Certified Payroll Form

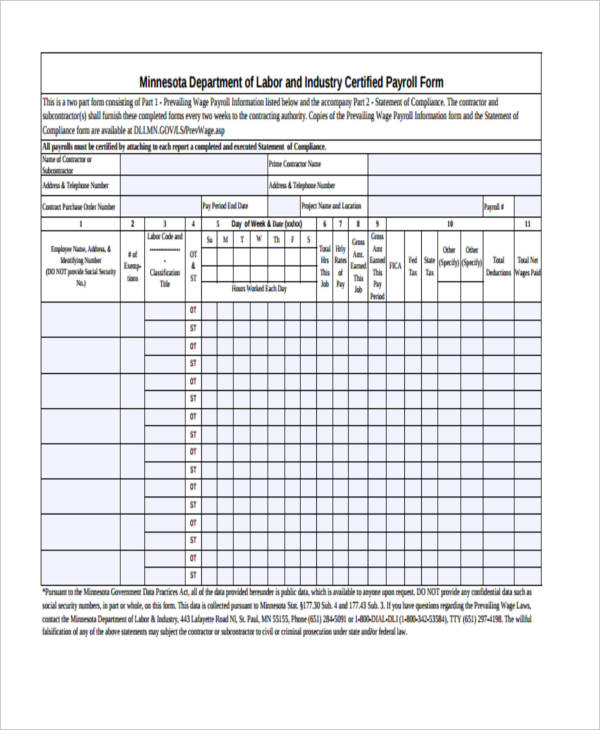

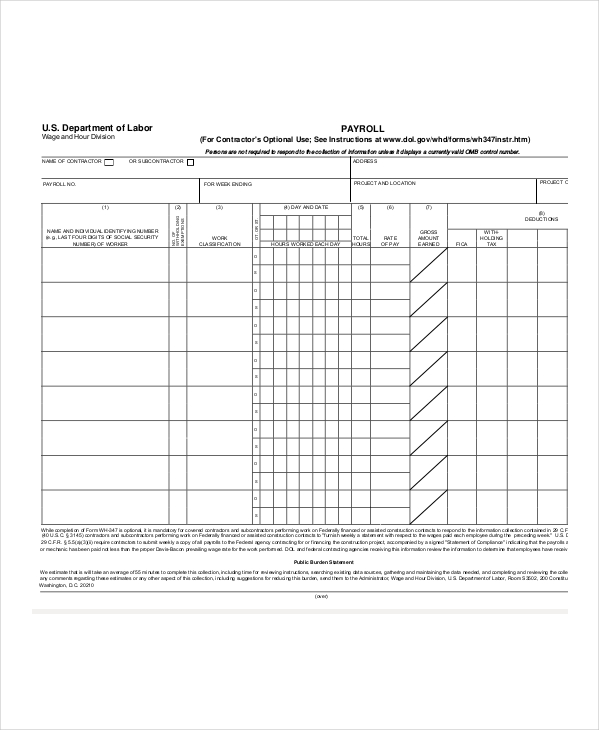

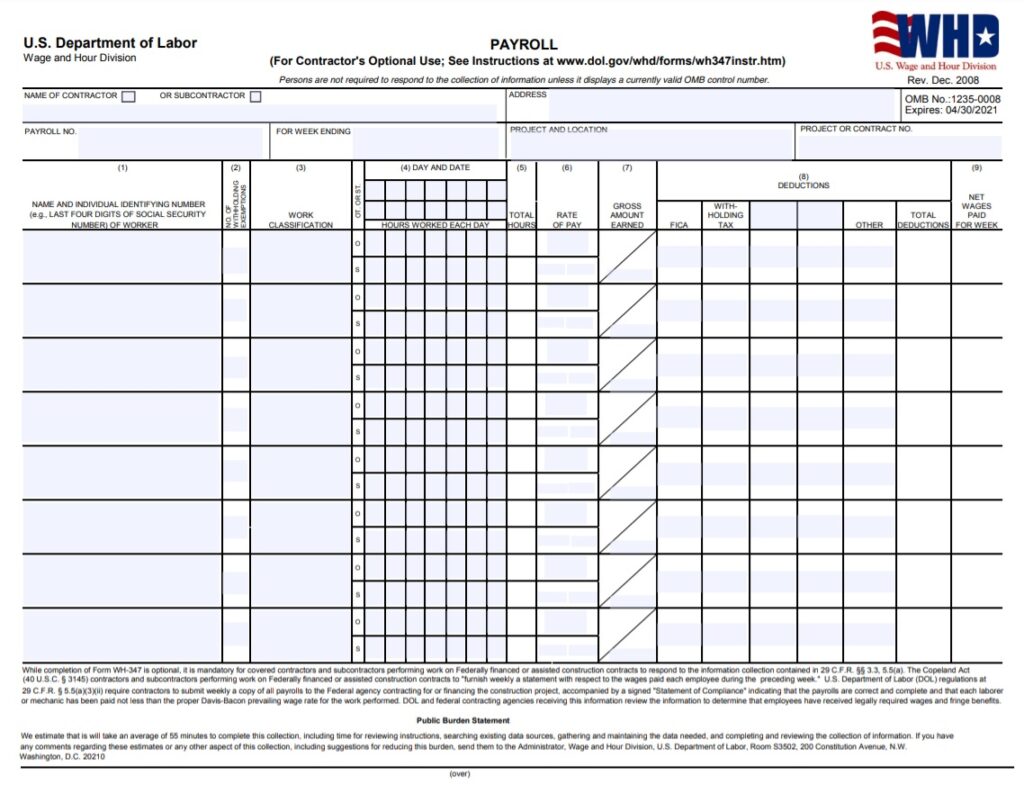

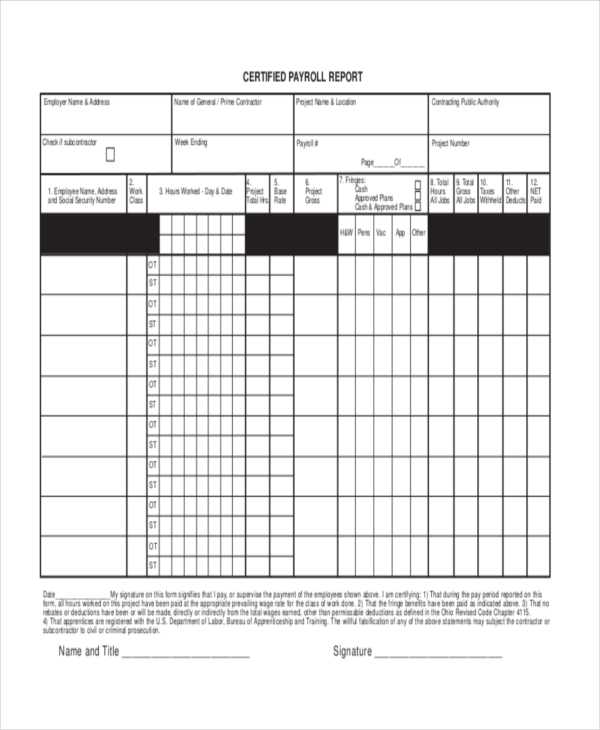

Federal Certified Payroll Form - Web employment tax forms: Your withholding is subject to review by the irs. The form is broken down into two files pdf and instructions. Web payroll wage and hour division (for contractor's optional use; Instructions for form 941 pdf Online section 14(c) certificate application; Web certified payroll is a special weekly payroll report used by contractors who are working on federally funded projects. • the payroll for the payroll period contains the information required to be provided • the appropriate information is being maintained • such information is correct and complete See instructions at www.dol.gov/whd/forms/wh347instr.htm) persons are not required to respond to the collection of information unless it displays a currently valid omb control number. Properly filled out, this form will satisfy the requirements of regulations, parts 3 and 5 (29 c.f.r., subtitle a), as to payrolls.

If you need a little help to with the. Web employer's quarterly federal tax return. To meet your certified payroll requirements, you’ll need to submit form wh. The form is broken down into two files pdf and instructions. Form 941, employer's quarterly federal tax return. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Application to employ workers with disabilities at special minimum wages. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. The form lists every employee, their wages, their benefits,. Web payroll wage and hour division (for contractor's optional use;

Form 941, employer's quarterly federal tax return. Web employer's quarterly federal tax return. Web employment tax forms: Web certification for weekly payrolls • the properly signed “statement of compliance” submitted or transmitted to the appropriate federal agency certifies that: • the payroll for the payroll period contains the information required to be provided • the appropriate information is being maintained • such information is correct and complete To meet your certified payroll requirements, you’ll need to submit form wh. Your withholding is subject to review by the irs. Web payroll wage and hour division (for contractor's optional use; Instructions for form 941 pdf Properly filled out, this form will satisfy the requirements of regulations, parts 3 and 5 (29 c.f.r., subtitle a), as to payrolls.

FREE 42+ Sample Payroll Forms in PDF Excel MS Word

Properly filled out, this form will satisfy the requirements of regulations, parts 3 and 5 (29 c.f.r., subtitle a), as to payrolls. The form is broken down into two files pdf and instructions. Form 941, employer's quarterly federal tax return. Your withholding is subject to review by the irs. Application to employ workers with disabilities at special minimum wages.

General Certified Payroll Form Payroll template, Project management

• the payroll for the payroll period contains the information required to be provided • the appropriate information is being maintained • such information is correct and complete Instructions for form 941 pdf Name of contractor or subcontractor. The form is broken down into two files pdf and instructions. Your withholding is subject to review by the irs.

Downloadable Certified Payroll Form Sample Templates

See instructions at www.dol.gov/whd/forms/wh347instr.htm) persons are not required to respond to the collection of information unless it displays a currently valid omb control number. Web payroll wage and hour division (for contractor's optional use; Your withholding is subject to review by the irs. Web employment tax forms: • the payroll for the payroll period contains the information required to be.

FREE 9+ Sample Certified Payroll Forms in PDF Excel Word

Your withholding is subject to review by the irs. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. The form is broken down into two files pdf and instructions. Instructions for form 941 pdf Web employer's quarterly federal tax return.

Payroll Certificate Templates 6+ Word, Excel & PDF Formats, Samples

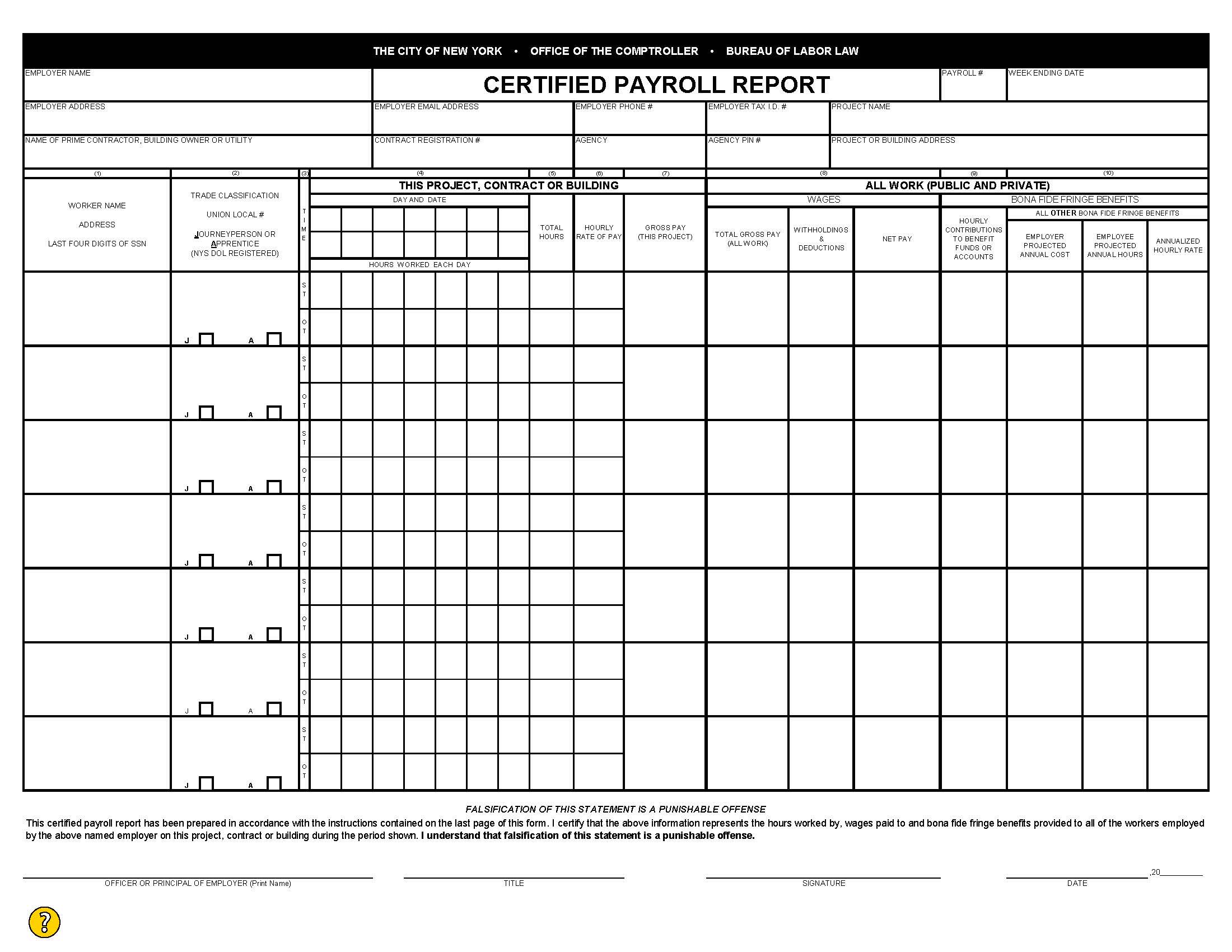

Web certification for weekly payrolls • the properly signed “statement of compliance” submitted or transmitted to the appropriate federal agency certifies that: The form lists every employee, their wages, their benefits,. Web certified payroll is a federal payroll report. Application to employ workers with disabilities at special minimum wages. To meet your certified payroll requirements, you’ll need to submit form.

Payroll Report Template For Your Needs

Form 940, employer's annual federal unemployment tax return. If you need a little help to with the. • the payroll for the payroll period contains the information required to be provided • the appropriate information is being maintained • such information is correct and complete Application to employ workers with disabilities at special minimum wages. Properly filled out, this form.

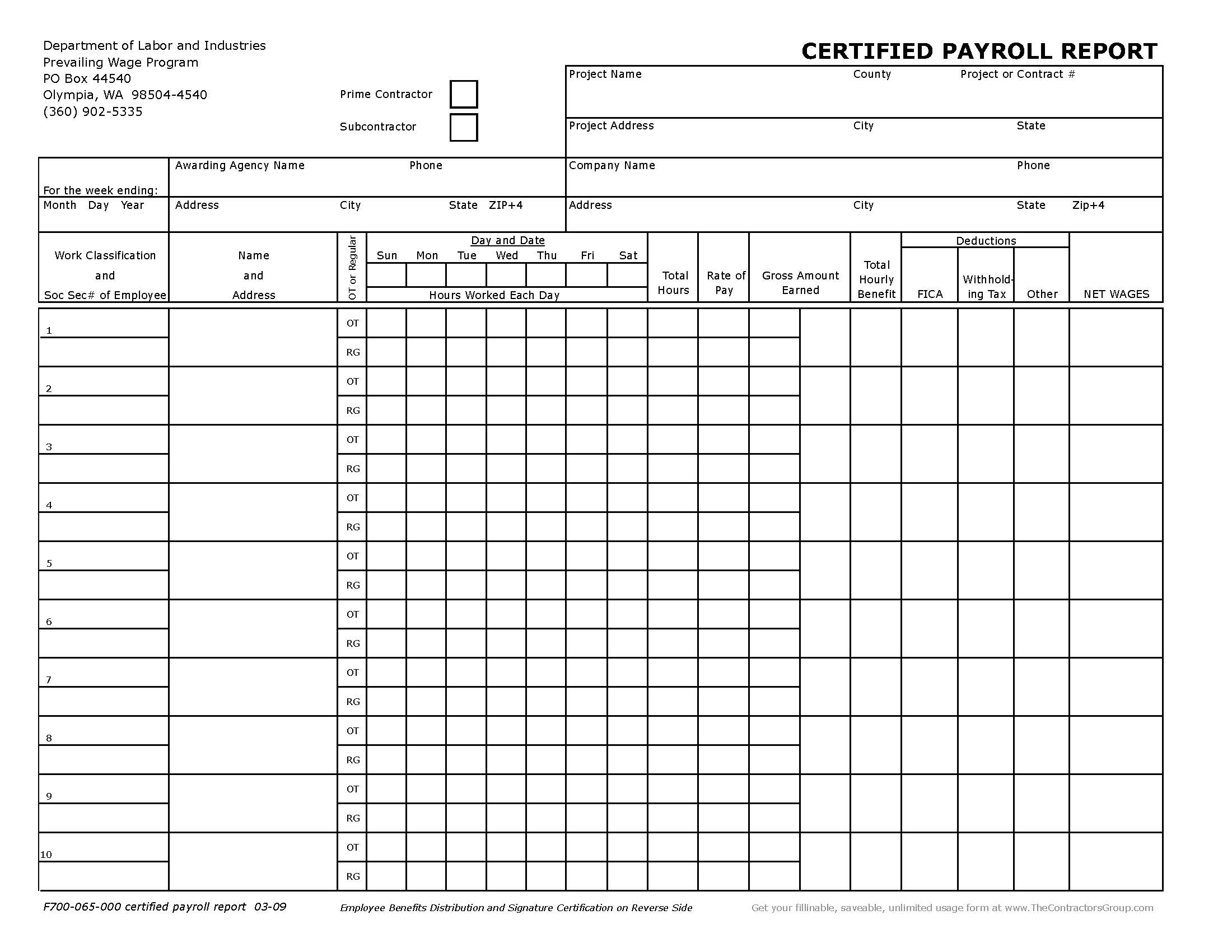

F700065000 Washington Certified Payroll Report Form

Web certified payroll is a special weekly payroll report used by contractors who are working on federally funded projects. Web payroll wage and hour division (for contractor's optional use; Online section 14(c) certificate application; Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare.

Prevailing Wage Certified Payroll Form Ny Form Resume Examples

Name of contractor or subcontractor. Properly filled out, this form will satisfy the requirements of regulations, parts 3 and 5 (29 c.f.r., subtitle a), as to payrolls. Web employment tax forms: Your withholding is subject to review by the irs. Form 940, employer's annual federal unemployment tax return.

FREE 9+ Sample Certified Payroll Forms in PDF Excel Word

Form 941, employer's quarterly federal tax return. The form is broken down into two files pdf and instructions. Properly filled out, this form will satisfy the requirements of regulations, parts 3 and 5 (29 c.f.r., subtitle a), as to payrolls. Web employer's quarterly federal tax return. Name of contractor or subcontractor.

Quickbooks Payrolls Certified Payroll Forms Maryland

Online section 14(c) certificate application; Application to employ workers with disabilities at special minimum wages. Properly filled out, this form will satisfy the requirements of regulations, parts 3 and 5 (29 c.f.r., subtitle a), as to payrolls. The form is broken down into two files pdf and instructions. Form 940, employer's annual federal unemployment tax return.

Web Certified Payroll Is A Federal Payroll Report.

Application to employ workers with disabilities at special minimum wages. The form lists every employee, their wages, their benefits,. Web payroll wage and hour division (for contractor's optional use; Online section 14(c) certificate application;

Instructions For Form 941 Pdf

See instructions at www.dol.gov/whd/forms/wh347instr.htm) persons are not required to respond to the collection of information unless it displays a currently valid omb control number. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Web employment tax forms:

To Meet Your Certified Payroll Requirements, You’ll Need To Submit Form Wh.

Your withholding is subject to review by the irs. Properly filled out, this form will satisfy the requirements of regulations, parts 3 and 5 (29 c.f.r., subtitle a), as to payrolls. • the payroll for the payroll period contains the information required to be provided • the appropriate information is being maintained • such information is correct and complete Name of contractor or subcontractor.

If You Need A Little Help To With The.

The form is broken down into two files pdf and instructions. Web certified payroll is a special weekly payroll report used by contractors who are working on federally funded projects. Web employer's quarterly federal tax return. Form 940, employer's annual federal unemployment tax return.