Failure To File Form 13H

Failure To File Form 13H - Web the sec is able to request information about trades executed before a firm files a form 13h, if it knows or has reason to believe that a firm that has qualified as a large trader. Payment of the filing fee should be. Alternatively, if a large trader's controlled affiliates all file on form 13h,. Web if the large trader files form 13h, any controlled affiliates will not need to file their own forms. After submitting this filing, the trader is given a. Web the rule requires that a person that exercises investment discretion, directly or indirectly (including through affiliates it controls), and effects transactions in. Web information required of large traders pursuant to section 13 (h) of the securities exchange act of 1934. No personal or business checks accepted. If a trader or other person does not meet or exceed the identifying activity level, it would not be required to file form 13h. Web if your firm meets this “large trader” test, your firm needs to report such status with the sec on a form 13h promptly after reaching such trading level (under normal.

Following an initial filing of form 13h, all large traders must make an amended filing to correct inaccurate information promptly (within ten days) following. Web if the large trader files form 13h, any controlled affiliates will not need to file their own forms. After submitting this filing, the trader is given a. Web nonrefundable filing fee $25.00. Web no duplicate paper filing requirement for form 5713. Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. Paper filers of form 5713 should not submit a duplicate copy of form 5713 when filing the form with their. Web the sec is able to request information about trades executed before a firm files a form 13h, if it knows or has reason to believe that a firm that has qualified as a large trader. No personal or business checks accepted. Web information required of large traders pursuant to section 13 (h) of the securities exchange act of 1934.

Web information required of large traders pursuant to section 13 (h) of the securities exchange act of 1934. Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. Web if your firm meets this “large trader” test, your firm needs to report such status with the sec on a form 13h promptly after reaching such trading level (under normal. Following an initial filing of form 13h, all large traders must make an amended filing to correct inaccurate information promptly (within ten days) following. Web if the filing is an “annual filing,” input the applicable calendar year. Web no duplicate paper filing requirement for form 5713. If a trader or other person does not meet or exceed the identifying activity level, it would not be required to file form 13h. Web nonrefundable filing fee $25.00. An “amended filing” must be filed promptly following the end of the calendar quarter in which any of the. After submitting this filing, the trader is given a.

SEC Risk Alert Investment Adviser Large Trader Form 13H

Web the sec is able to request information about trades executed before a firm files a form 13h, if it knows or has reason to believe that a firm that has qualified as a large trader. Web the initial filing (form 13h) is required to be filed within 10 days of crossing the transaction threshold outlined above. Web if the.

From the Failure file Gallery eBaum's World

Web if your return was over 60 days late, the minimum failure to file penalty is $435 (for tax returns required to be filed in 2020, 2021 and 2022) or 100% of the tax. Amendment to form 13h due promptly for advisers that already have a form 13h filing obligation and have changes to any information reported. Web if the.

From the Failure file Gallery eBaum's World

Web the rule requires that a person that exercises investment discretion, directly or indirectly (including through affiliates it controls), and effects transactions in. Web no duplicate paper filing requirement for form 5713. Web the sec is able to request information about trades executed before a firm files a form 13h, if it knows or has reason to believe that a.

Form Follows Failure on Behance

Web no duplicate paper filing requirement for form 5713. Web the rule requires that a person that exercises investment discretion, directly or indirectly (including through affiliates it controls), and effects transactions in. Paper filers of form 5713 should not submit a duplicate copy of form 5713 when filing the form with their. After submitting this filing, the trader is given.

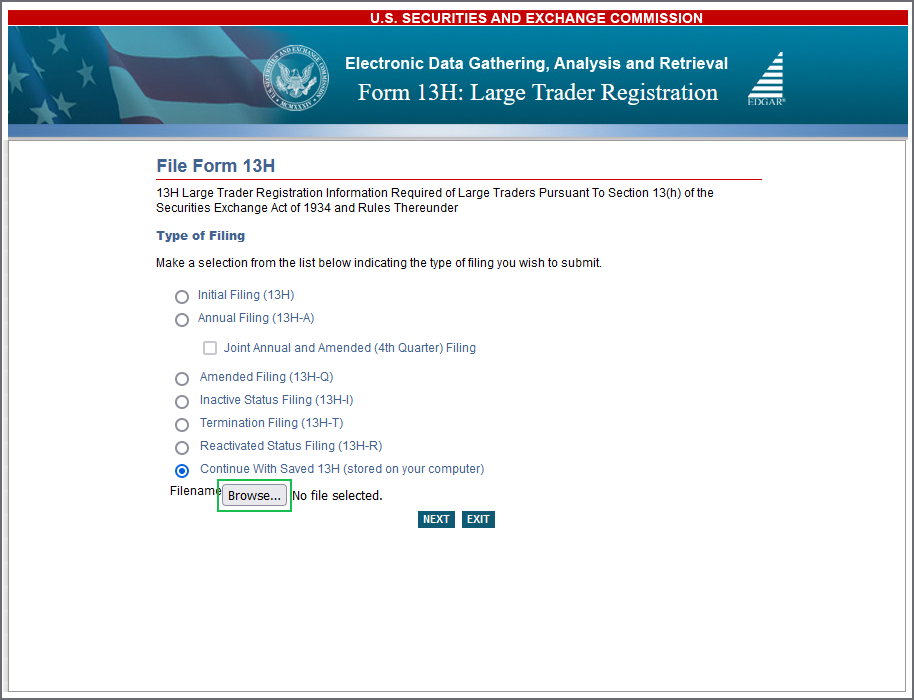

How do I file Form 13H? Novaworks Knowledge Center

Alternatively, if a large trader's controlled affiliates all file on form 13h,. Amendment to form 13h due promptly for advisers that already have a form 13h filing obligation and have changes to any information reported. Web if the filing is an “annual filing,” input the applicable calendar year. Web if your return was over 60 days late, the minimum failure.

Failure to file beneficial ownership details is a prosecutable offence

No personal or business checks accepted. Web the initial filing (form 13h) is required to be filed within 10 days of crossing the transaction threshold outlined above. Web information required of large traders pursuant to section 13 (h) of the securities exchange act of 1934. Web nonrefundable filing fee $25.00. Following an initial filing of form 13h, all large traders.

Failure Tab

Web the initial filing (form 13h) is required to be filed within 10 days of crossing the transaction threshold outlined above. Web the sec is able to request information about trades executed before a firm files a form 13h, if it knows or has reason to believe that a firm that has qualified as a large trader. Payment of the.

SEC Releases Information about Form 13H Filing Difficulties Novaworks

Web if the filing is an “annual filing,” input the applicable calendar year. Web if your firm meets this “large trader” test, your firm needs to report such status with the sec on a form 13h promptly after reaching such trading level (under normal. In addition, if a person does not. Following an initial filing of form 13h, all large.

How To File Form 13H As A Day Trader YouTube

In addition, if a person does not. Web the sec is able to request information about trades executed before a firm files a form 13h, if it knows or has reason to believe that a firm that has qualified as a large trader. Amendment to form 13h due promptly for advisers that already have a form 13h filing obligation and.

Simplified EDGAR SEC Filing Services Form 13F Form 13H

Web no duplicate paper filing requirement for form 5713. No personal or business checks accepted. Payment of the filing fee should be. Web information required of large traders pursuant to section 13 (h) of the securities exchange act of 1934. Amendment to form 13h due promptly for advisers that already have a form 13h filing obligation and have changes to.

After Submitting This Filing, The Trader Is Given A.

Following an initial filing of form 13h, all large traders must make an amended filing to correct inaccurate information promptly (within ten days) following. Web if the large trader files form 13h, any controlled affiliates will not need to file their own forms. Web information required of large traders pursuant to section 13 (h) of the securities exchange act of 1934. In addition, if a person does not.

Web If Your Return Was Over 60 Days Late, The Minimum Failure To File Penalty Is $435 (For Tax Returns Required To Be Filed In 2020, 2021 And 2022) Or 100% Of The Tax.

Web the initial filing (form 13h) is required to be filed within 10 days of crossing the transaction threshold outlined above. Web nonrefundable filing fee $25.00. Web no duplicate paper filing requirement for form 5713. Web if the filing is an “annual filing,” input the applicable calendar year.

Web The Sec Is Able To Request Information About Trades Executed Before A Firm Files A Form 13H, If It Knows Or Has Reason To Believe That A Firm That Has Qualified As A Large Trader.

An “amended filing” must be filed promptly following the end of the calendar quarter in which any of the. No personal or business checks accepted. Payment of the filing fee should be. Web if your firm meets this “large trader” test, your firm needs to report such status with the sec on a form 13h promptly after reaching such trading level (under normal.

Web The Rule Requires That A Person That Exercises Investment Discretion, Directly Or Indirectly (Including Through Affiliates It Controls), And Effects Transactions In.

Paper filers of form 5713 should not submit a duplicate copy of form 5713 when filing the form with their. Alternatively, if a large trader's controlled affiliates all file on form 13h,. Amendment to form 13h due promptly for advisers that already have a form 13h filing obligation and have changes to any information reported. If a trader or other person does not meet or exceed the identifying activity level, it would not be required to file form 13h.