Employer Change Form

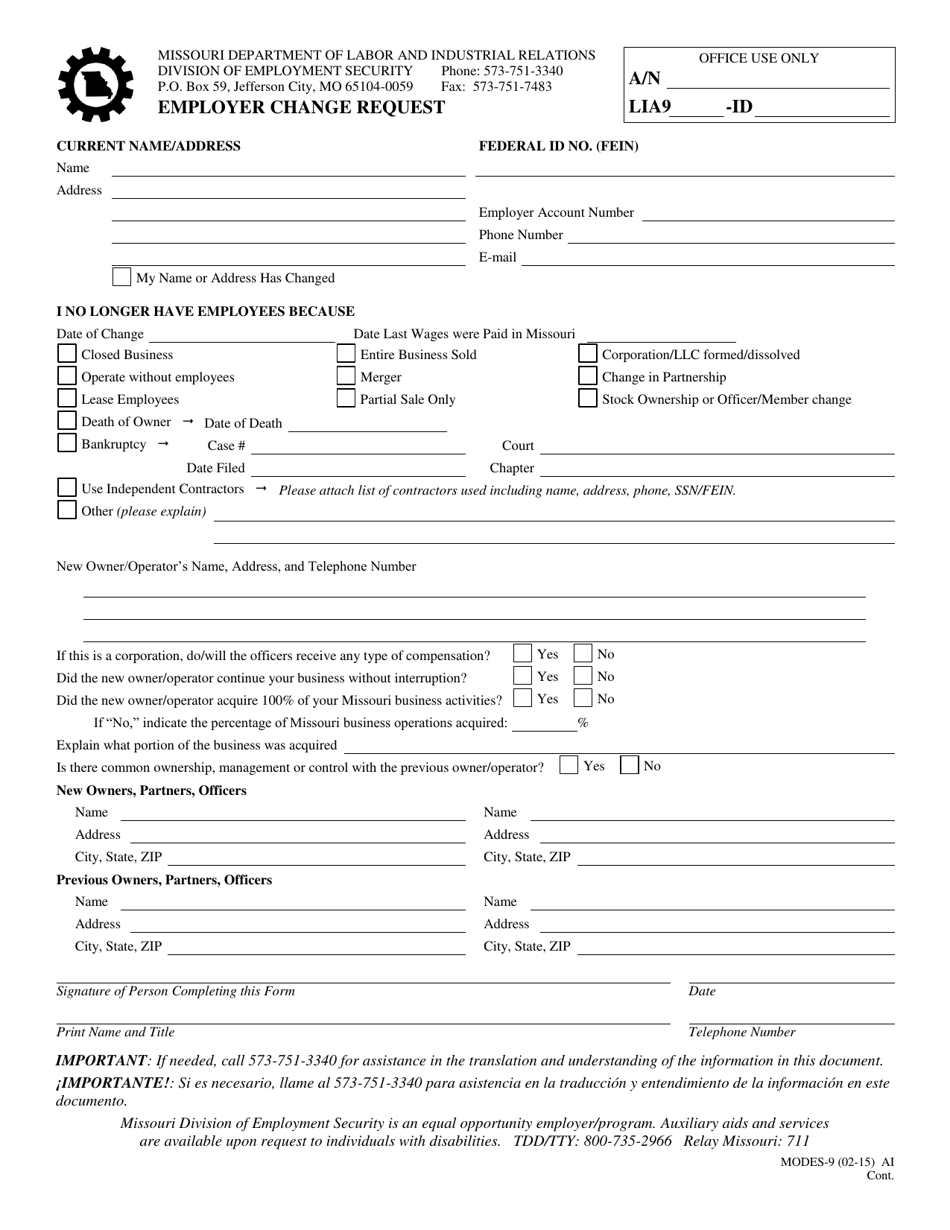

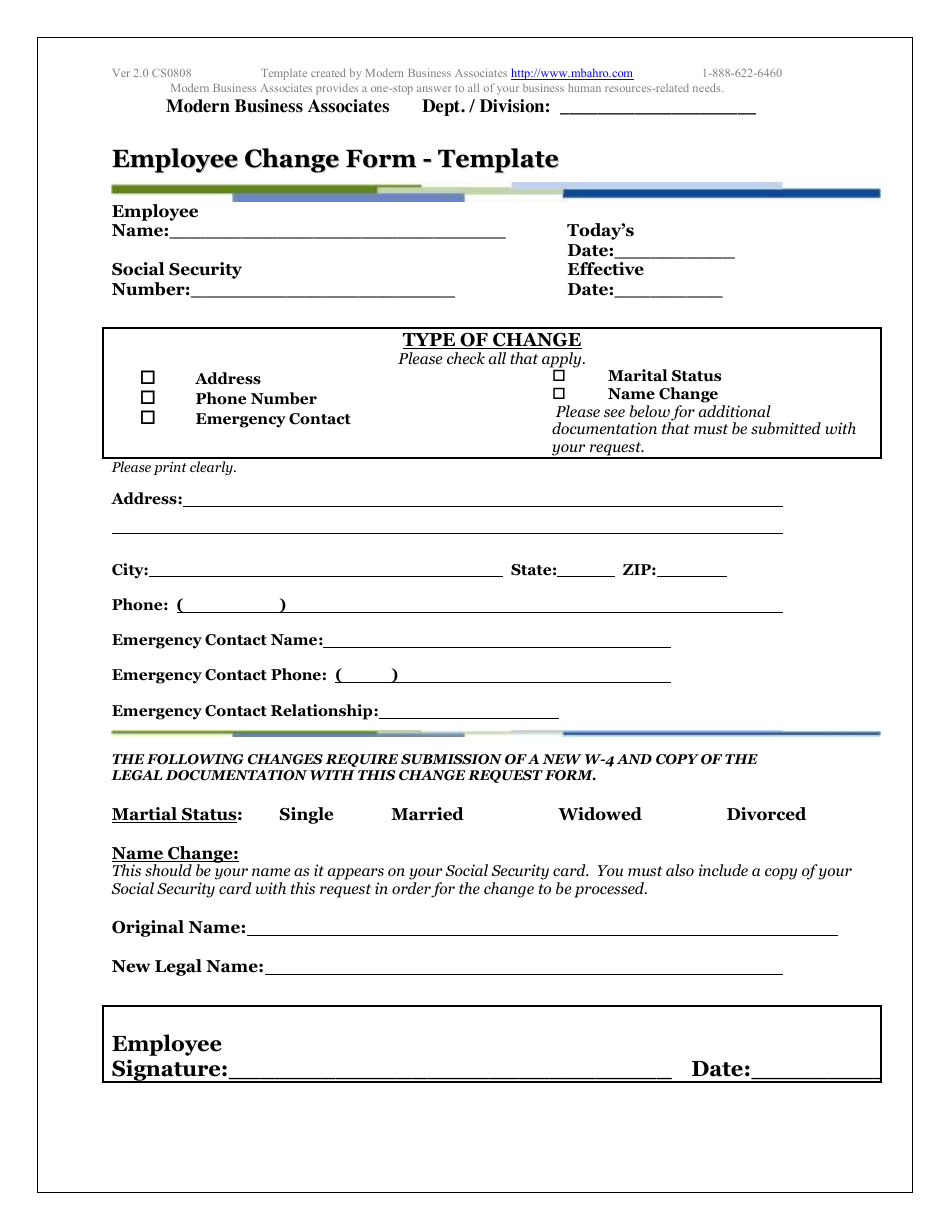

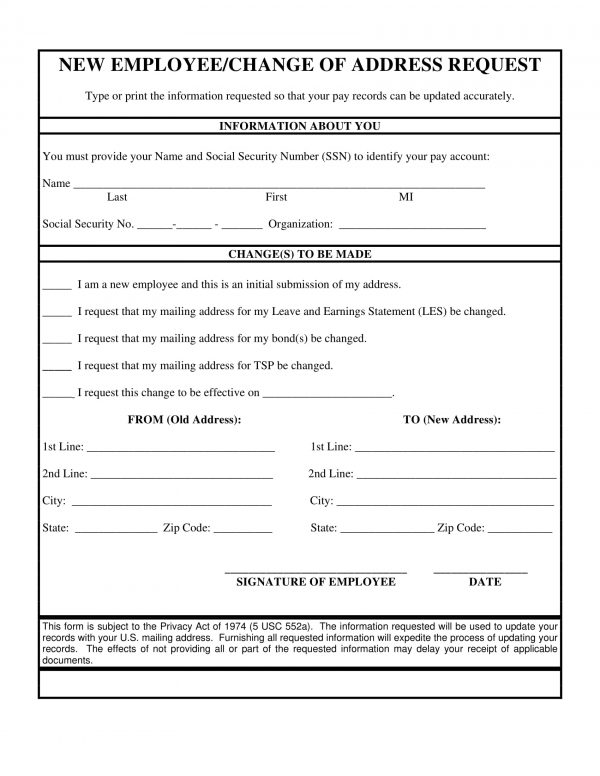

Employer Change Form - All information in part i must be completed. Multiply the number of qualifying children under age 17 by $2,000 $ multiply the number of other dependents by $500. Include the employee’s full name, job title, department, and employee identification number, if. Page 1, line e, box 3. If you have changed names, living address, status, contact number, number of children, or whatever it is that you need to change, you need to let your employer know about it. Web employer change request this form should be used when there is a change to business operations or the employer contact details. For employers who have not yet renewed for the 2023 plan year, please use the 2022 employer change form. I’m taking about employee change forms. Types of changes find different examples that may apply to your business. There are 30 codes from you can chose one and accept as change election.

Identity of your responsible party. Fill in the first box to record the employment change. The employer must write down the appropriate information and sign it accordingly. This form includes general information about an employer's workplace, such as the average number of employees and total number of hours worked by all employees during the calendar year. Web employer change forms use the employer change form to make changes in your group’s reference plan, metal tier levels, and contribution levels or to change the address or ownership of your small business. Web if you are filing a current year return, mark the appropriate name change box of the form 1120 type you are using: If you have changed names, living address, status, contact number, number of children, or whatever it is that you need to change, you need to let your employer know about it. Web to change your tax withholding you should: Allow ten (10) working days for the agency to process the request to make the account inactive. Page 1, line e, box 3.

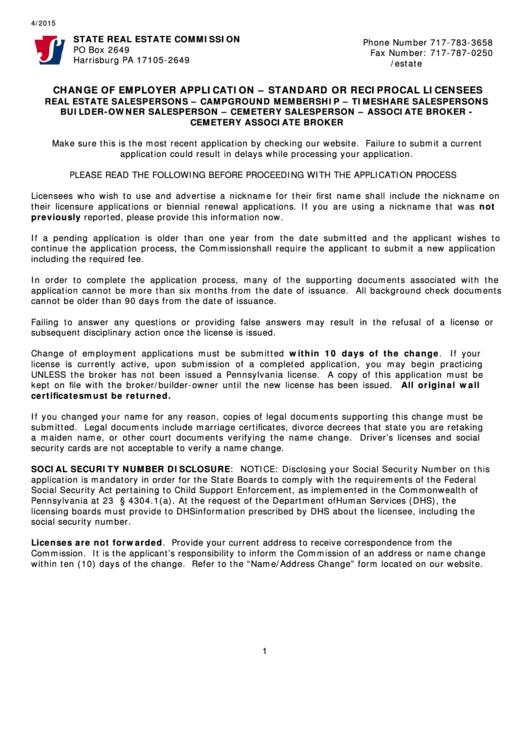

Use this form if you are changing employers. This revised form and condensed instructions streamline the materials and reduce the employer and employee burden associated with the form. The employee must search for the appropriate number and fill it in, in the right place. Fill in the first box to record the employment change. The employer must write down the appropriate information and sign it accordingly. Required documents and information to finish your application: Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): You may add to this the amount of any other credits. This form includes general information about an employer's workplace, such as the average number of employees and total number of hours worked by all employees during the calendar year. ___________________________________ have you sold your missouri business?

Form MODES9 Download Fillable PDF or Fill Online Employer Change

It does not contain information about individual employees. Web if your business is a corporation, llc or llp, you must make any legal name change with the department of state (dos). Web employer change forms use the employer change form to make changes in your group’s reference plan, metal tier levels, and contribution levels or to change the address or.

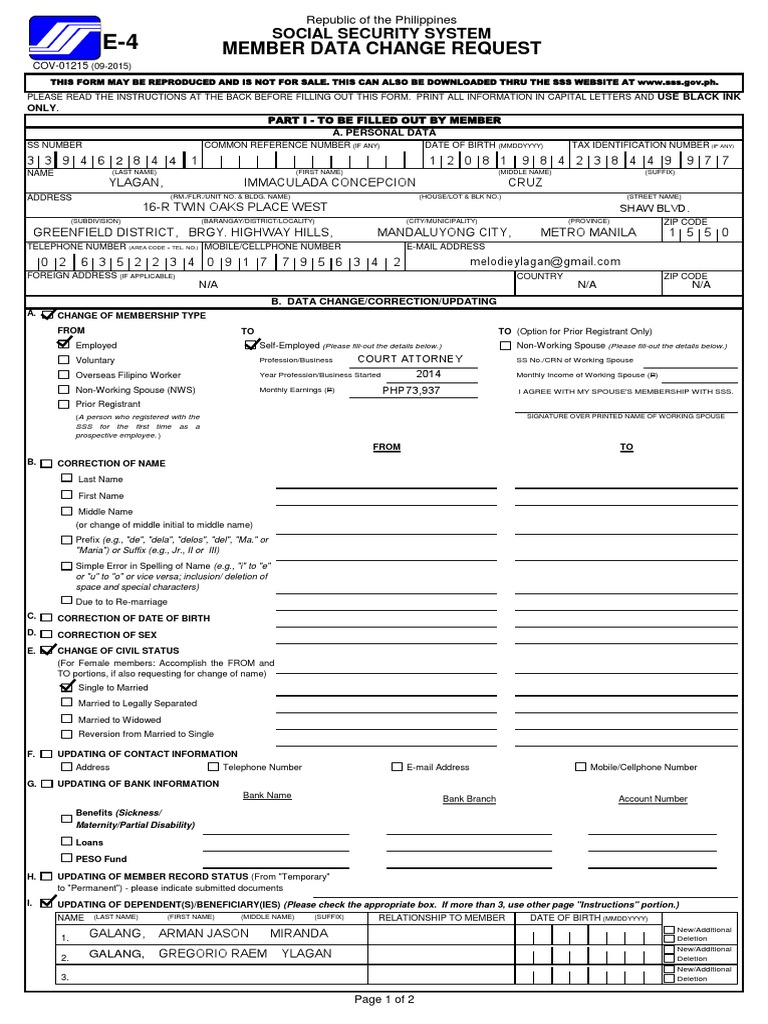

SSS Change Request Form Identity Document Annulment Prueba

Changes in responsible parties must be reported to the irs. Web generally, businesses need a new ein when their ownership or structure has changed. Identity of your responsible party. Instructions are on page 2. Required documents and information to finish your application:

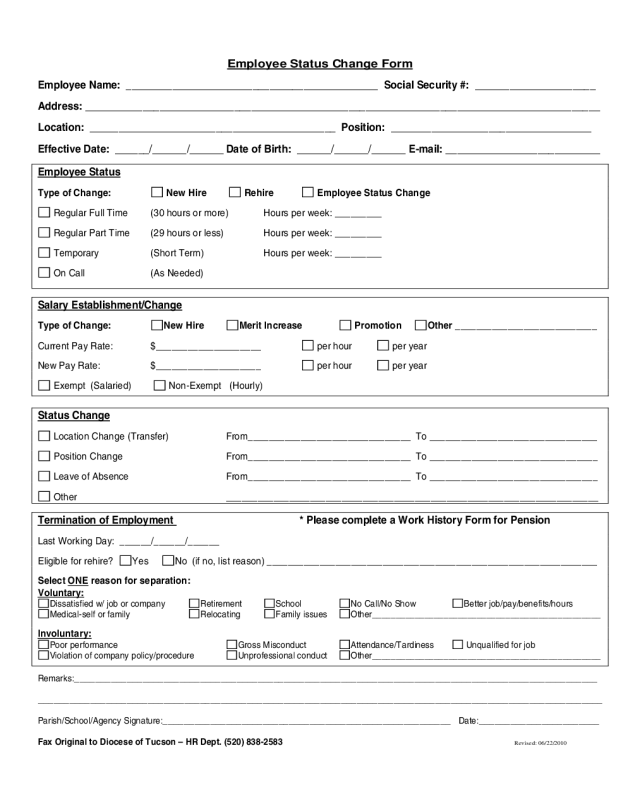

Employee Status Change Forms Word Excel Samples

This revised form and condensed instructions streamline the materials and reduce the employer and employee burden associated with the form. Required documents and information to finish your application: Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Allow ten (10) working days for the agency to process the request to make the.

2022 Employee Status Change Form Fillable, Printable PDF & Forms

For employers who have not yet renewed for the 2023 plan year, please use the 2022 employer change form. Provide your account number in the space to the right. $ add the amounts above for qualifying children and other dependents. Changes in responsible parties must be reported to the irs. All information in part i must be completed.

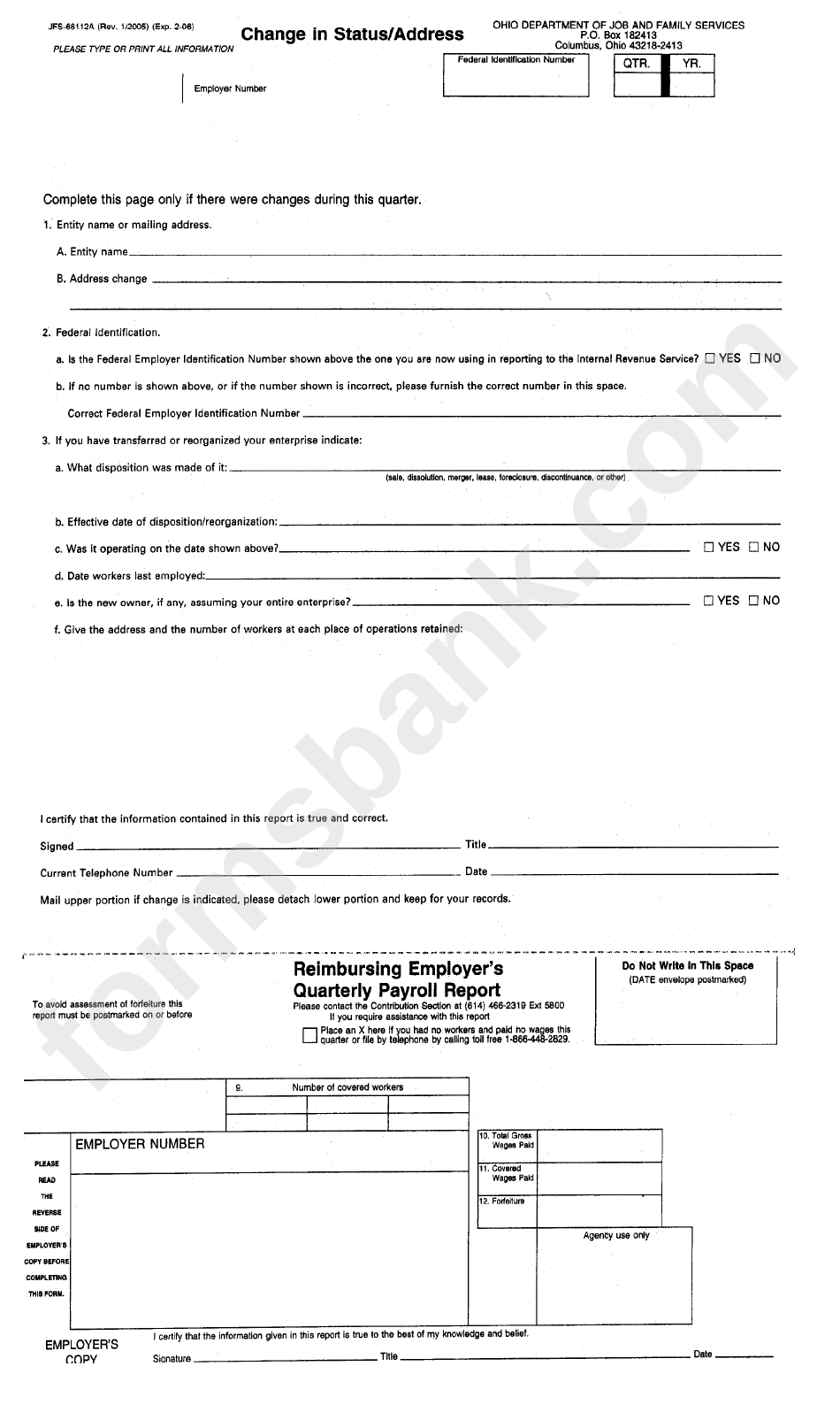

Form Jfs66112a Change In Status/address And Reimbursing Employer'S

Provide your account number in the space to the right. Provide details of the specific change, such as a promotion, transfer, salary change,. (optional) please note that the date of submission of this form to change employer will be the start date of your notice period with your current employer. Changes in responsible parties must be reported to the irs..

Employee Change Form Download Printable PDF Templateroller

Web how to fill an employee status change form? This revised form and condensed instructions streamline the materials and reduce the employer and employee burden associated with the form. It implies the type of status, type of change, and the. ﺐﻠﻄﻟا لﺎﻤﻜﺘﺳﻻ ﺔ ﻮﻠﻄﳌا تﺎﻘﻓﺮﻤﳌاو تاﺪﻨ. (optional) please note that the date of submission of this form to change employer.

employeestatuschangeformtemplate

Web this form has code numbers for various change requests. ﺐﻠﻄﻟا لﺎﻤﻜﺘﺳﻻ ﺔ ﻮﻠﻄﳌا تﺎﻘﻓﺮﻤﳌاو تاﺪﻨ. This form includes general information about an employer's workplace, such as the average number of employees and total number of hours worked by all employees during the calendar year. There are 30 codes from you can chose one and accept as change election. Allow.

FREE 11+ Change of Address Forms in PDF MS Word Excel

Web employer change forms use the employer change form to make changes in your group’s reference plan, metal tier levels, and contribution levels or to change the address or ownership of your small business. Page 1, line e, box 3. I’m taking about employee change forms. Web change of account information (inf 4) instructions all employer pull notice (epn) applicants.

Change Of Employer Application Form printable pdf download

The employee must search for the appropriate number and fill it in, in the right place. Page 1, line h, box 2. ﺐﻠﻄﻟا لﺎﻤﻜﺘﺳﻻ ﺔ ﻮﻠﻄﳌا تﺎﻘﻓﺮﻤﳌاو تاﺪﻨ. Web how to fill an employee status change form? Identity of your responsible party.

Employer Account Change Form Employee Change Form Template

Web if your business is a corporation, llc or llp, you must make any legal name change with the department of state (dos). Web employer change request this form should be used when there is a change to business operations or the employer contact details. $ add the amounts above for qualifying children and other dependents. Web unemployment insurance employer.

Yes No If Yes, Date Of Change________________________

There are 30 codes from you can chose one and accept as change election. The employee must search for the appropriate number and fill it in, in the right place. Fill in the first box to record the employment change. If you have already filed your return for the current year, write to us at the address where you filed your return to inform us of the name change.

Web An Employee Status Change Form Should Include The Following Information:

Web how to fill an employee status change form? Web if your total income will be $200,000 or less ($400,000 or less if married filing jointly): Changes in responsible parties must be reported to the irs. This revised form and condensed instructions streamline the materials and reduce the employer and employee burden associated with the form.

Web If You Are Filing A Current Year Return, Mark The Appropriate Name Change Box Of The Form 1120 Type You Are Using:

(optional) please note that the date of submission of this form to change employer will be the start date of your notice period with your current employer. In the first part of the form, the employer has to enter the contact information of the employee whose status is. Required documents and information to finish your application: Although changing the name of your business does not require you to obtain a new ein, you may wish to visit the business name change page to find out what actions are required if you change the name of your business.

The Information Below Provides Answers To.

For employers who have not yet renewed for the 2023 plan year, please use the 2022 employer change form. ﺐﻠﻄﻟا لﺎﻤﻜﺘﺳﻻ ﺔ ﻮﻠﻄﳌا تﺎﻘﻓﺮﻤﳌاو تاﺪﻨ. Web if your business is a corporation, llc or llp, you must make any legal name change with the department of state (dos). Types of changes find different examples that may apply to your business.