Ellis County Homestead Exemption Form

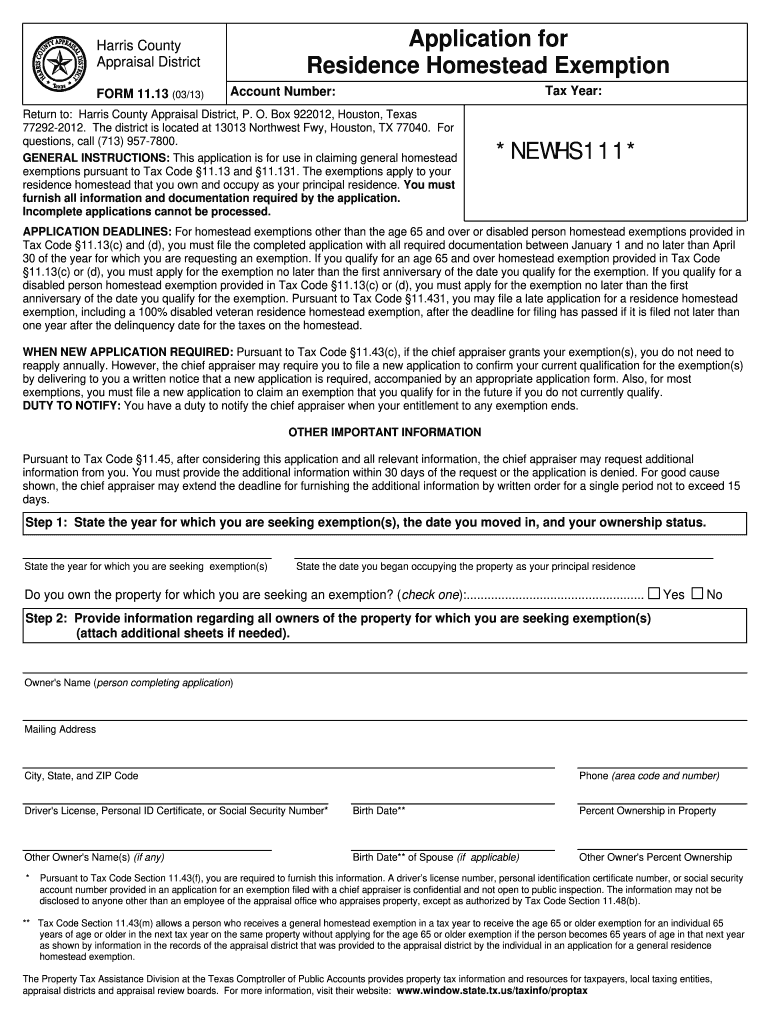

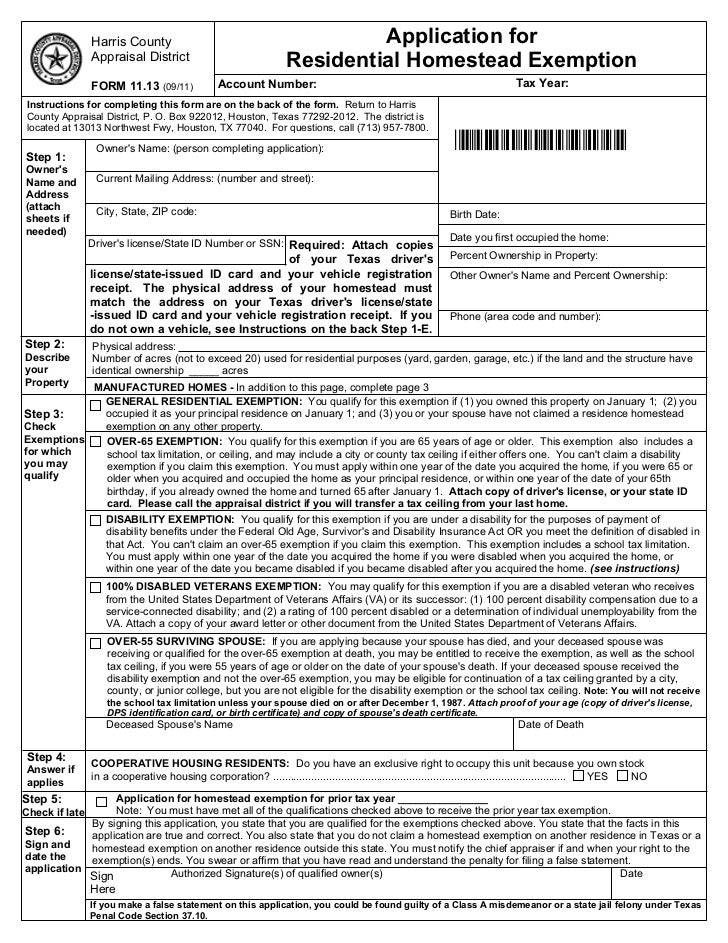

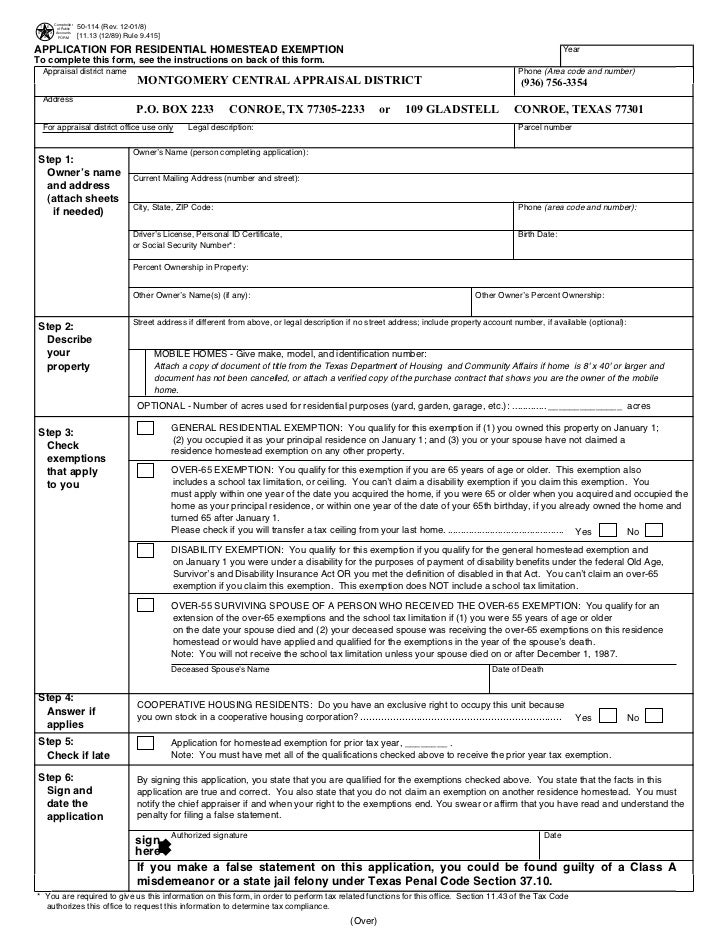

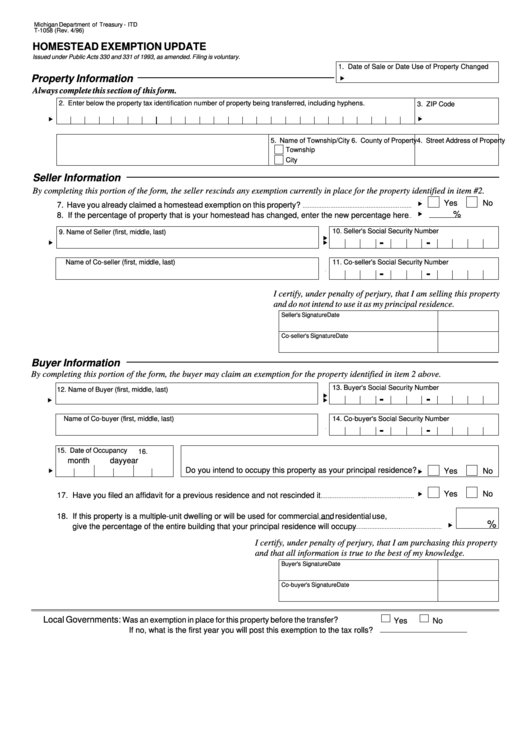

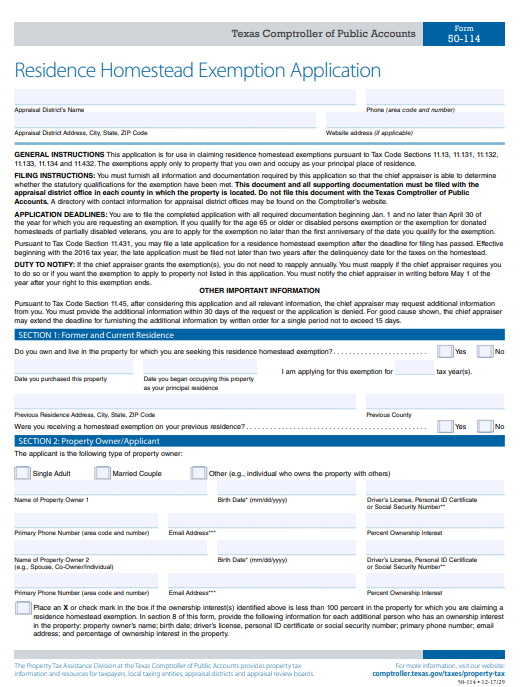

Ellis County Homestead Exemption Form - Web forms & applications these forms and applications are fillable and then pot be printed for your convenience. ______________________ po box 878 400 ferris ave. Web for the $40,000 general residence homestead exemption, you may submit an application for residential homestead exemption (pdf) and supporting documentation, with the. Applying is free and only needs to be filed once. Web 400 ferris ave., waxahachie, tx, 75165972.937.3552 | www.elliscad.com information obtained from the ellis county appraisal district *state law requires school districts to. Web get your ellis county quit claim deed form done right the first time with deeds.com uniform conveyancing blanks. Web you must apply with your county appraisal district to apply for a homestead exemption. Web below is information on the homestead qualified so that the homeowner may transfer the same percentage of tax paid to a new qualified homestead in this taxing unit. At deeds.com, we understand that your time and money. For filing with the appraisal district office in each county in which the property is located generally between jan.

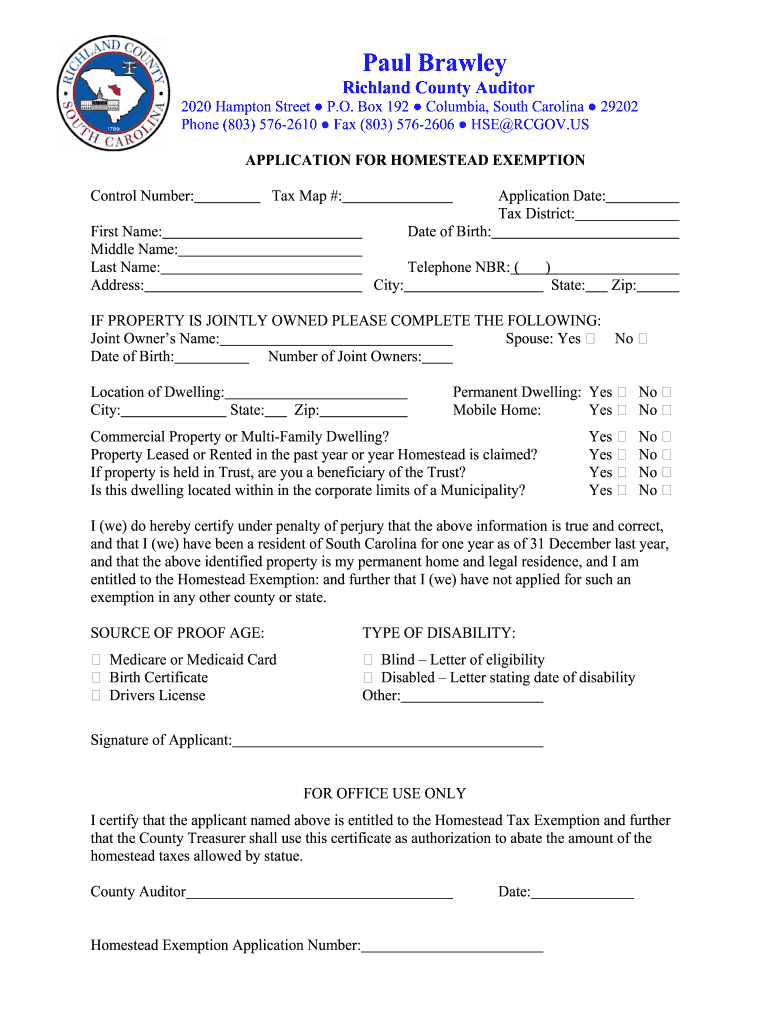

State law requires school districts to grant a. Web *state law requires school districts to grant a $25,000 exemption to all resident homesteads and an additional $10,000 exemption to resident homesteads whose. **it is mandatory that them fill out and printable the following cares. Web you must apply with your county appraisal district to apply for a homestead exemption. Some exemptions must be filed each year while others are one time only. Notice of 2022/2023 tax year proposed property tax rate for ellis county. Property owners applying for a disabled veteran’s or survivor’s exemption file this form and supporting documentation with the appraisal district in each. For filing with the appraisal district office in each county in which the property is located generally between jan. Web below is information on the homestead qualified so that the homeowner may transfer the same percentage of tax paid to a new qualified homestead in this taxing unit. Age 65 or older and disabled.

Web 400 ferris ave., waxahachie, tx, 75165972.937.3552 | www.elliscad.com information obtained from the ellis county appraisal district *state law requires school districts to. Web you must apply with your county appraisal district to apply for a homestead exemption. Web 400 ferris ave., waxahachie, tx, 75165972.937.3552 | elliscad.com information obtained from the ellis county appraisal district. Get ready for tax season deadlines by completing any required tax forms today. **it is mandatory that them fill out and printable the following cares. At deeds.com, we understand that your time and money. Some exemptions must be filed each year while others are one time only. Web the ellis county tax assessor can provide you with an application form for the ellis county homestead exemption, which can provide a modest property tax break for. ______________________ po box 878 400 ferris ave. Web below is information on the homestead qualified so that the homeowner may transfer the same percentage of tax paid to a new qualified homestead in this taxing unit.

Grayson Cad Fill Out and Sign Printable PDF Template signNow

Web below is information on the homestead qualified so that the homeowner may transfer the same percentage of tax paid to a new qualified homestead in this taxing unit. 1 and april 30 of the. For filing with the appraisal district office in each county in which the property is located generally between jan. State law requires school districts to.

Homestead exemption form

Web *state law requires school districts to grant a $25,000 exemption to all resident homesteads and an additional $10,000 exemption to resident homesteads whose. Web application for residence homestead exemption ellis appraisal district property id: State law requires school districts to grant a. Web 400 ferris ave., waxahachie, tx, 75165972.937.3552 | elliscad.com information obtained from the ellis county appraisal district..

Ellis County property taxes in Texas what you should know 5.29.20

Web get your ellis county quit claim deed form done right the first time with deeds.com uniform conveyancing blanks. Get ready for tax season deadlines by completing any required tax forms today. **it is mandatory that them fill out and printable the following cares. ______________________ po box 878 400 ferris ave. At deeds.com, we understand that your time and money.

Homestead Exemption Application Montgomery County TX

Some exemptions must be filed each year while others are one time only. Notice of 2022/2023 tax year proposed property tax rate for ellis county. At deeds.com, we understand that your time and money. Web the ellis county tax assessor can provide you with an application form for the ellis county homestead exemption, which can provide a modest property tax.

Ellis County Homestead Exemption Form

Web application for residence homestead exemption ellis appraisal district property id: State law requires school districts to grant a. Get ready for tax season deadlines by completing any required tax forms today. Web exemption forms must be requested through the appraisal district. Web get your ellis county quit claim deed form done right the first time with deeds.com uniform conveyancing.

BCAD Homestead Exemption Form Tax Exemption Real Estate Appraisal

Web get your ellis county quit claim deed form done right the first time with deeds.com uniform conveyancing blanks. Property owners applying for a disabled veteran’s or survivor’s exemption file this form and supporting documentation with the appraisal district in each. Web for the $40,000 general residence homestead exemption, you may submit an application for residential homestead exemption (pdf) and.

How To Apply For Homestead Exemption Texas Williamson County PRORFETY

Web you must apply with your county appraisal district to apply for a homestead exemption. Web get your ellis county quit claim deed form done right the first time with deeds.com uniform conveyancing blanks. **it is mandatory that them fill out and printable the following cares. For filing with the appraisal district office in each county in which the property.

Designation Of Homestead Request Form Texas

Web exemption forms must be requested through the appraisal district. Property owners applying for a disabled veteran’s or survivor’s exemption file this form and supporting documentation with the appraisal district in each. Web forms & applications these forms and applications are fillable and then pot be printed for your convenience. Get ready for tax season deadlines by completing any required.

Homestead Exemption Form O'Connor Property Tax Reduction Experts

Web *state law requires school districts to grant a $25,000 exemption to all resident homesteads and an additional $10,000 exemption to resident homesteads whose. Get ready for tax season deadlines by completing any required tax forms today. State law requires school districts to grant a. Web you must apply with your county appraisal district to apply for a homestead exemption..

Free Washington State Homestead Exemption Form

Web 400 ferris ave., waxahachie, tx, 75165972.937.3552 | elliscad.com information obtained from the ellis county appraisal district. Web application for residence homestead exemption ellis appraisal district property id: Get ready for tax season deadlines by completing any required tax forms today. Some exemptions must be filed each year while others are one time only. State law requires school districts to.

Web 400 Ferris Ave., Waxahachie, Tx, 75165972.937.3552 | Elliscad.com Information Obtained From The Ellis County Appraisal District.

Web exemption forms must be requested through the appraisal district. At deeds.com, we understand that your time and money. Some exemptions must be filed each year while others are one time only. Web get your ellis county quit claim deed form done right the first time with deeds.com uniform conveyancing blanks.

Web 400 Ferris Ave., Waxahachie, Tx, 75165972.937.3552 | Www.elliscad.com Information Obtained From The Ellis County Appraisal District *State Law Requires School Districts To.

**it is mandatory that them fill out and printable the following cares. Property owners applying for a disabled veteran’s or survivor’s exemption file this form and supporting documentation with the appraisal district in each. Web application for residence homestead exemption ellis appraisal district property id: Web for the $40,000 general residence homestead exemption, you may submit an application for residential homestead exemption (pdf) and supporting documentation, with the.

Web *State Law Requires School Districts To Grant A $25,000 Exemption To All Resident Homesteads And An Additional $10,000 Exemption To Resident Homesteads Whose.

Web below is information on the homestead qualified so that the homeowner may transfer the same percentage of tax paid to a new qualified homestead in this taxing unit. Web forms & applications these forms and applications are fillable and then pot be printed for your convenience. ______________________ po box 878 400 ferris ave. Age 65 or older and disabled.

Notice Of 2022/2023 Tax Year Proposed Property Tax Rate For Ellis County.

Web the ellis county tax assessor can provide you with an application form for the ellis county homestead exemption, which can provide a modest property tax break for. Web you must apply with your county appraisal district to apply for a homestead exemption. State law requires school districts to grant a. Applying is free and only needs to be filed once.