Eic Form 2021

Eic Form 2021 - Web how to file when to file where to file update my information popular get your economic impact payment status coronavirus tax relief get your tax record get an identity. Web more about the federal 1040 (schedule eic) tax credit. Web taking the time to check the earned income credit eligibility can pay off, as the tax benefit can be worth up to $6,935 (for 2022) depending on your: Web earned income tax credit worksheet for tax year 2021 for all taxpayers: We last updated federal 1040 (schedule eic) in december 2022 from the federal internal revenue service. Could you, or your spouse if filing. Ad with the right expertise, federal tax credits and incentives could benefit your business. The purpose of the eic is to reduce the tax burden and to. Web schedule eic (form 1040) 2023. To file a prior year tax.

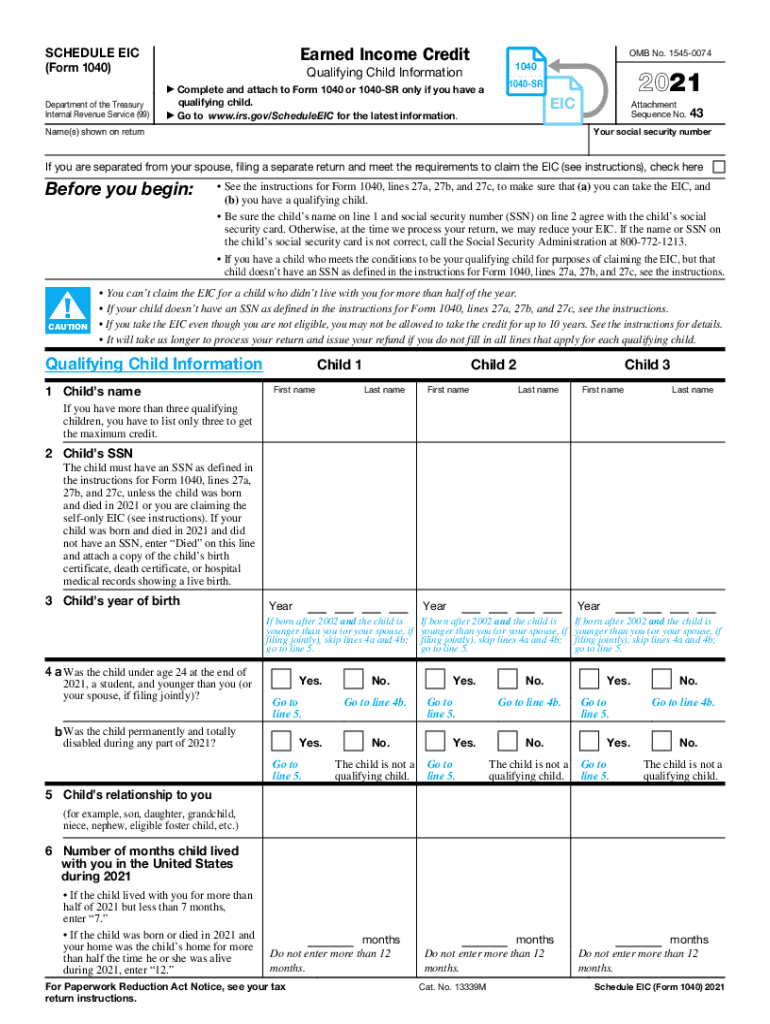

Web for 2021 if you file your tax return by april 18, 2025. The purpose of the eic is to reduce the tax burden and to. Web earned income tax credit worksheet for tax year 2021 for all taxpayers: For 2020 if you file your tax return by may 17, 2024. Web more about the federal 1040 (schedule eic) tax credit. Web schedule eic (form 1040) 2023. To file a prior year tax. Web earned income credit eic2021 notice to employees of federal earned income tax credit (eic) if you make $51,000* or less, your employer should notify you at the time of hiring. Page 2 purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your. Ad with the right expertise, federal tax credits and incentives could benefit your business.

Web schedule eic (form 1040) 2023. To file a prior year tax. Web up to $40 cash back earned income credit schedule eic form 1040 department of the treasury internal revenue service omb no. We last updated federal 1040 (schedule eic) in december 2022 from the federal internal revenue service. Web for 2021 if you file your tax return by april 18, 2025. Ad complete irs tax forms online or print government tax documents. The purpose of the eic is to reduce the tax burden and to. Web how to file when to file where to file update my information popular get your economic impact payment status coronavirus tax relief get your tax record get an identity. Page 2 purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your. For 2020 if you file your tax return by may 17, 2024.

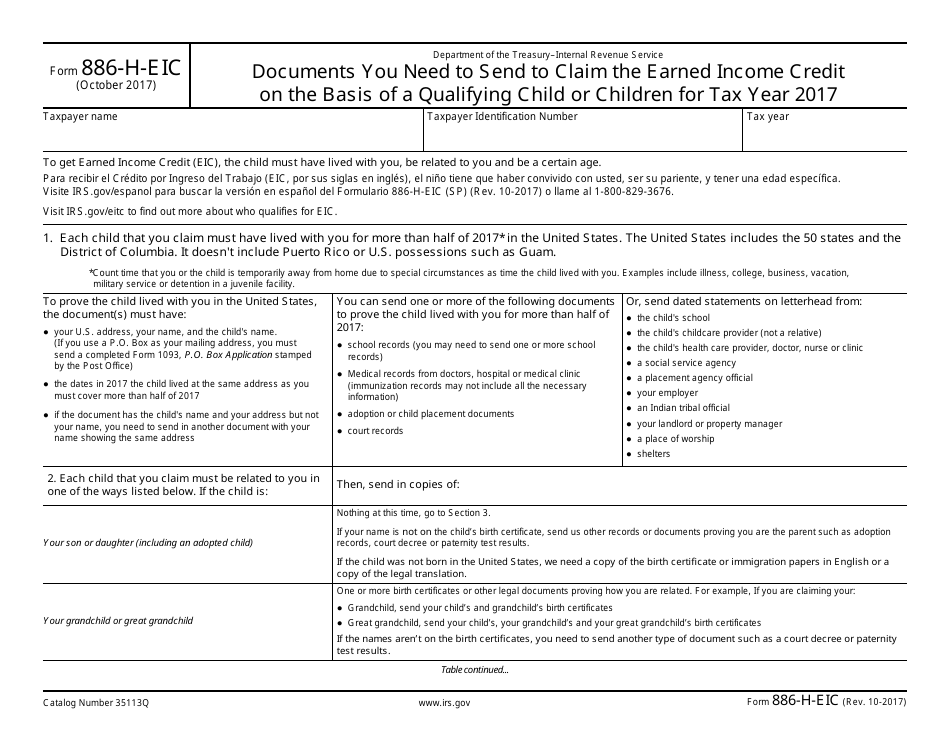

IRS Form 886HEIC Download Fillable PDF or Fill Online Documents You

Web also for 2021, a specified student can claim the credit starting at age 24 and qualifying former foster youths and qualified homeless youths can claim the credit at age. Complete, edit or print tax forms instantly. For 2020 if you file your tax return by may 17, 2024. Web more about the federal 1040 (schedule eic) tax credit. Were.

Form 1040 Schedule EIC Earned Credit 2021 Tax Forms 1040 Printable

Were you a nonresident alien for any part of the year? Web more about the federal 1040 (schedule eic) tax credit. Web up to $40 cash back earned income credit schedule eic form 1040 department of the treasury internal revenue service omb no. If you qualify, you can use the credit to reduce the taxes you. You are related to.

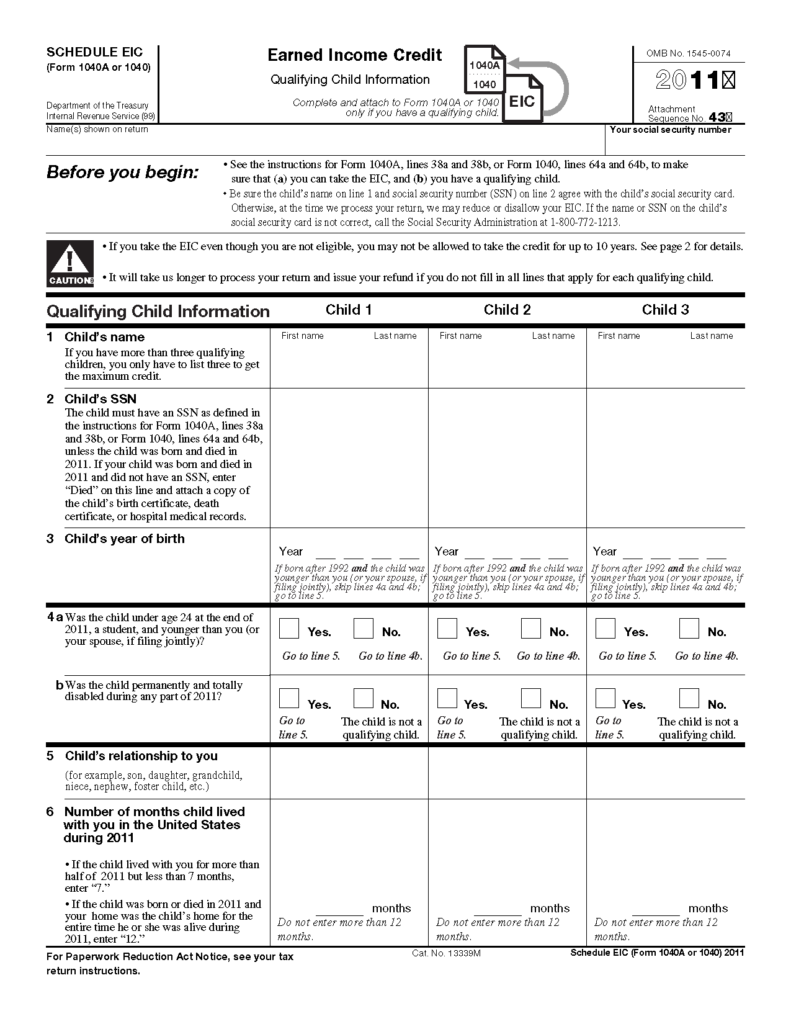

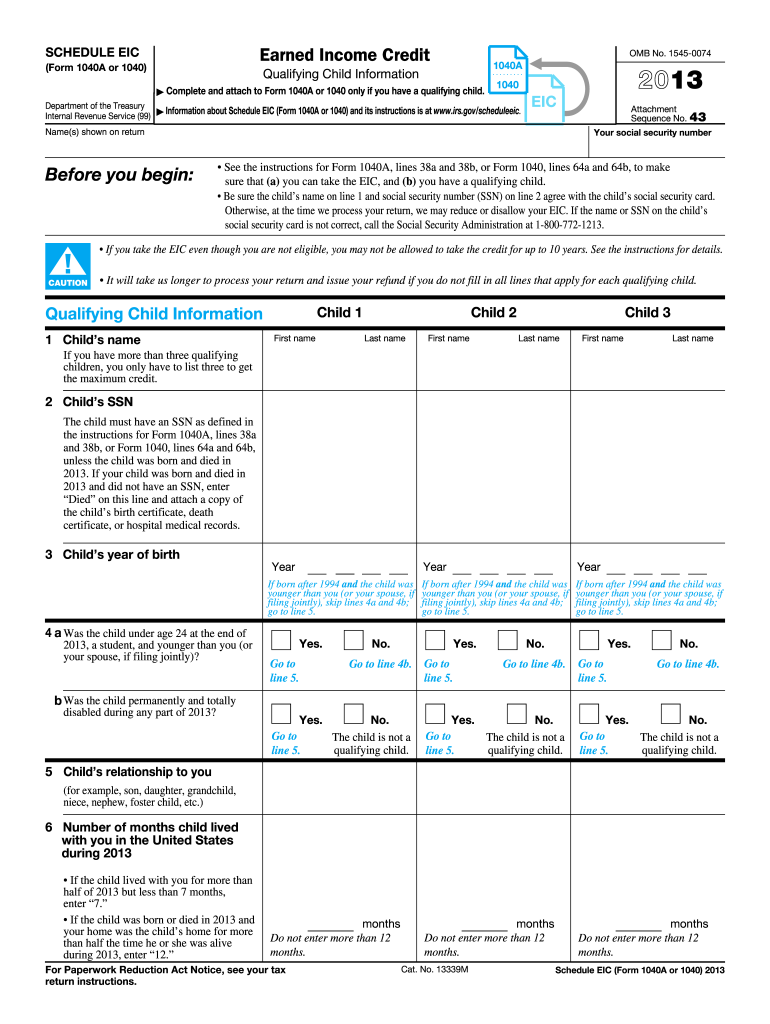

2013 Form IRS 1040 Schedule EIC Fill Online, Printable, Fillable

Web the maximum credit for single taxpayers with no qualifying child has increased for 2021: Web earned income credit eic2021 notice to employees of federal earned income tax credit (eic) if you make $51,000* or less, your employer should notify you at the time of hiring. For 2020 if you file your tax return by may 17, 2024. Web 3514.

Earned Credit Worksheet Fill Out and Sign Printable PDF

Page 2 purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your. You are related to the child, the child lived with you and the child's age. Web earned income credit eic2021 notice to employees of federal earned income tax credit (eic) if you make $51,000* or less,.

Irs Form 1040 Married Filing Jointly Form Resume Examples

Ad with the right expertise, federal tax credits and incentives could benefit your business. Web 3514 your ssn or itin before you begin: Web more about the federal 1040 (schedule eic) tax credit. Optimize your tax planning with a better understanding of federal credits and incentives. Web the maximum credit for single taxpayers with no qualifying child has increased for.

IRS releases drafts of 2021 Form 1040 and schedules Don't Mess With Taxes

Page 2 purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your. Web more about the federal 1040 (schedule eic) tax credit. For 2019 if you file your tax return by july 15, 2023. Web up to $40 cash back earned income credit schedule eic form 1040 department.

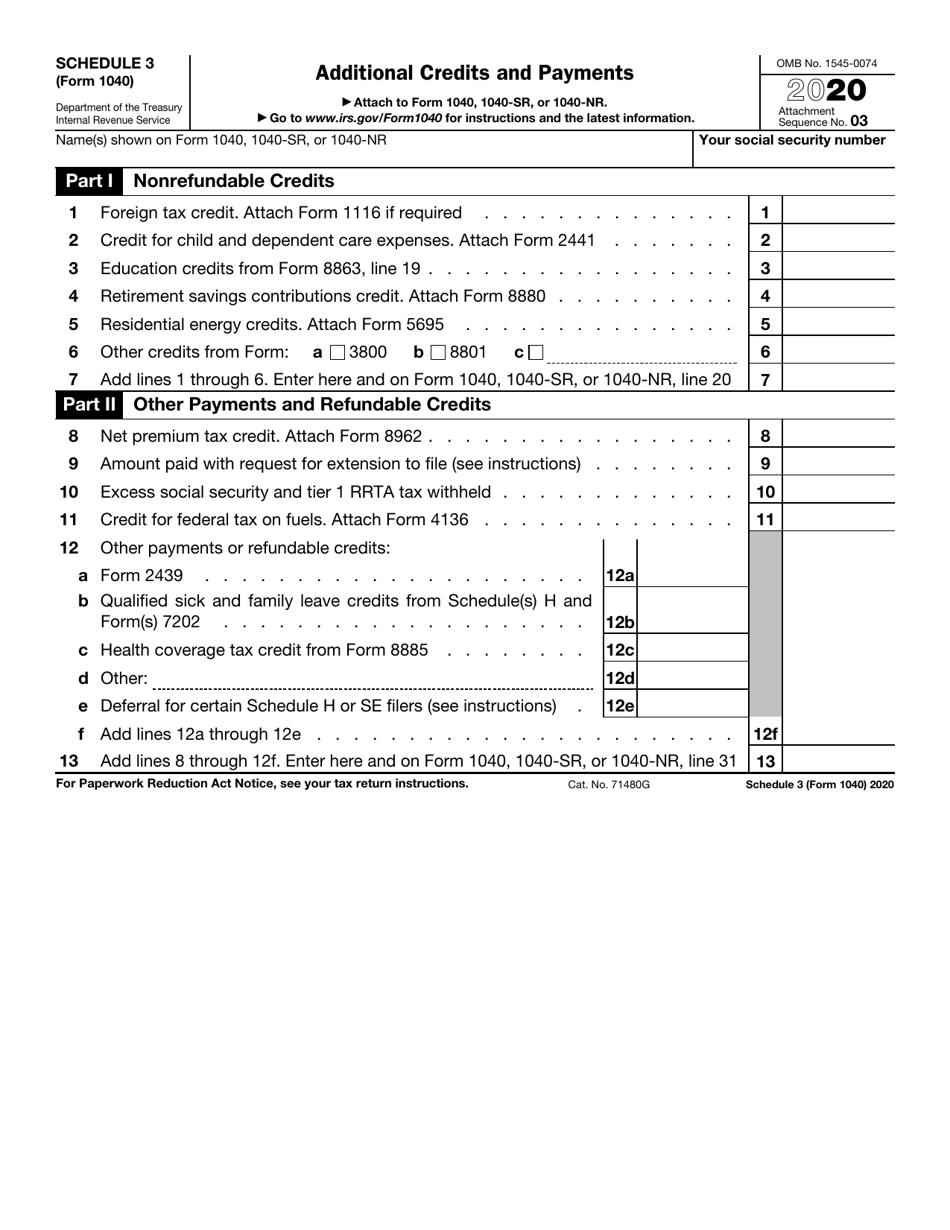

IRS Form 1040 Schedule 3 Download Fillable PDF or Fill Online

Page 2 purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. For 2020 if you file your tax return by may 17, 2024. Web 3514.

Earned Credit Table 2018 Chart Awesome Home

Were you a nonresident alien for any part of the year? Web also for 2021, a specified student can claim the credit starting at age 24 and qualifying former foster youths and qualified homeless youths can claim the credit at age. Page 2 purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give.

Launch of the EIC Work Programme 2021 Nanomedicine shall play a very

Web earned income credit eic2021 notice to employees of federal earned income tax credit (eic) if you make $51,000* or less, your employer should notify you at the time of hiring. Web the maximum credit for single taxpayers with no qualifying child has increased for 2021: You are related to the child, the child lived with you and the child's.

Child Tax Credit 2021 Monthly Payment Calculator / Storage Unit Size

Complete, edit or print tax forms instantly. Web schedule eic (form 1040) 2023. Web how to file when to file where to file update my information popular get your economic impact payment status coronavirus tax relief get your tax record get an identity. If you qualify, you can use the credit to reduce the taxes you. If you claim the.

Ad With The Right Expertise, Federal Tax Credits And Incentives Could Benefit Your Business.

For 2019 if you file your tax return by july 15, 2023. Ad complete irs tax forms online or print government tax documents. Web taking the time to check the earned income credit eligibility can pay off, as the tax benefit can be worth up to $6,935 (for 2022) depending on your: Web we last updated the earned income tax credit in december 2022, so this is the latest version of 1040 (schedule eic), fully updated for tax year 2022.

The Purpose Of The Eic Is To Reduce The Tax Burden And To.

You are related to the child, the child lived with you and the child's age. Complete, edit or print tax forms instantly. Web the earned income credit (eic) is a refundable tax credit for most people who work but do not earn high incomes. Page 2 purpose of schedule after you have figured your earned income credit (eic), use schedule eic to give the irs information about your.

Web The Maximum Credit For Single Taxpayers With No Qualifying Child Has Increased For 2021:

Web 3514 your ssn or itin before you begin: Web also for 2021, a specified student can claim the credit starting at age 24 and qualifying former foster youths and qualified homeless youths can claim the credit at age. To file a prior year tax. Were you a nonresident alien for any part of the year?

If You Claim The California Earned Income Tax Credit (Eitc) Even Though You Know You Are Not Eligible, You May Not Be Allowed To Take.

Web how to file when to file where to file update my information popular get your economic impact payment status coronavirus tax relief get your tax record get an identity. Web earned income credit eic2021 notice to employees of federal earned income tax credit (eic) if you make $51,000* or less, your employer should notify you at the time of hiring. Web schedule eic (form 1040) 2023. If you qualify, you can use the credit to reduce the taxes you.

:max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png)