E File Form 8868

E File Form 8868 - Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. File your nonprofit tax extension form 8868. You can file form 4868 and pay all or part of your estimated income tax due using the electronic federal tax payment system (eftps) or by using a credit or debit card. You can electronically file form 8868 if you need a 3. Web 8868 application for automatic extension of time to file an form exempt organization return (rev. Ad download or email irs 8868 & more fillable forms, register and subscribe now! Upload, modify or create forms. Web when and who needs to file form 8868? Complete, edit or print tax forms instantly. Web 1 enter your organization details 2 select the appropriate tax form to file an extension 3 review and transmit it to the irs ready to file your form 8868 electronically?

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Ad download or email irs 8868 & more fillable forms, register and subscribe now! Ad download or email irs 8868 & more fillable forms, register and subscribe now! *file from any device for an extension of up to 6 months. Web there are several ways to submit form 4868. Try it for free now! File your nonprofit tax extension form 8868. Upload, modify or create forms. You can electronically file form 8868 if you need a 3. Complete, edit or print tax forms instantly.

Web 8868 application for automatic extension of time to file an form exempt organization return (rev. Web go to www.irs.gov/form8868 for the latest information. Web there are several ways to submit form 4868. You can file form 4868 and pay all or part of your estimated income tax due using the electronic federal tax payment system (eftps) or by using a credit or debit card. You can complete your filing in a few simple steps: *file from any device for an extension of up to 6 months. You can electronically file form 8868 if you need a 3. Web when and who needs to file form 8868? Ad download or email irs 8868 & more fillable forms, register and subscribe now! Web form 8868 is due by 15th day of the 5th month after the tax year ends.

EFile Tax Extension Form 8868 by Span Enterprises LLC

Web form 8868 is due by 15th day of the 5th month after the tax year ends. Web 1 enter your organization details 2 select the appropriate tax form to file an extension 3 review and transmit it to the irs ready to file your form 8868 electronically? File your nonprofit tax extension form 8868. Ad download or email irs.

File Form 8868 Online Efile 990 Extension with the IRS

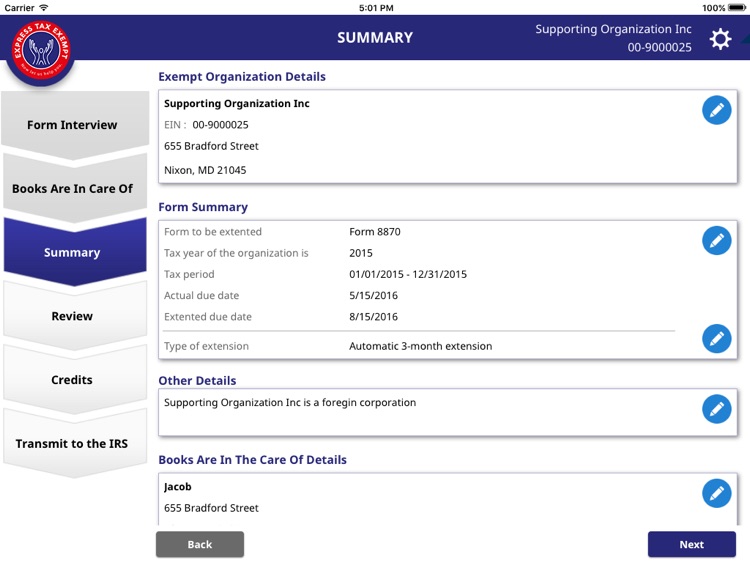

Web when and who needs to file form 8868? First step in filing this tax extension form is to enter the. *file from any device for an extension of up to 6 months. File your nonprofit tax extension form 8868. Upload, modify or create forms.

EFile Form 8868 990/990EZ, 990PF, & 990T Extension Online

Web when and who needs to file form 8868? Ad download or email irs 8868 & more fillable forms, register and subscribe now! Upload, modify or create forms. You can complete your filing in a few simple steps: Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.

EFile Tax Extension Form 8868 by Span Enterprises LLC

Web when and who needs to file form 8868? First step in filing this tax extension form is to enter the. Web 8868 application for automatic extension of time to file an form exempt organization return (rev. Web there are several ways to submit form 4868. You can file form 4868 and pay all or part of your estimated income.

File Form 8868 Online Efile 990 Extension with the IRS

Web when and who needs to file form 8868? You can complete your filing in a few simple steps: *file from any device for an extension of up to 6 months. You can electronically file form 8868 if you need a 3. First step in filing this tax extension form is to enter the.

Form 8868 Edit, Fill, Sign Online Handypdf

Web the following links provide information on the companies that have passed the irs assurance testing system (ats) requirements for software developers of. File your nonprofit tax extension form 8868. Web there are several ways to submit form 4868. Upload, modify or create forms. Web go to www.irs.gov/form8868 for the latest information.

Efile Form 8868 Online Nonprofit Tax Extension 990 Extension

File your nonprofit tax extension form 8868. Web when and who needs to file form 8868? Upload, modify or create forms. You can file form 4868 and pay all or part of your estimated income tax due using the electronic federal tax payment system (eftps) or by using a credit or debit card. Web 1 enter your organization details 2.

Extend Your Form 990 Deadline with IRS Form 8868!

You can complete your filing in a few simple steps: Web when and who needs to file form 8868? You can file form 4868 and pay all or part of your estimated income tax due using the electronic federal tax payment system (eftps) or by using a credit or debit card. Ad download or email irs 8868 & more fillable.

EFile Tax Extension Form 8868 by Span Enterprises LLC

File your nonprofit tax extension form 8868. Ad download or email irs 8868 & more fillable forms, register and subscribe now! Web 1 enter your organization details 2 select the appropriate tax form to file an extension 3 review and transmit it to the irs ready to file your form 8868 electronically? Web the following links provide information on the.

EFile Tax Extension Form 8868 by Span Enterprises LLC

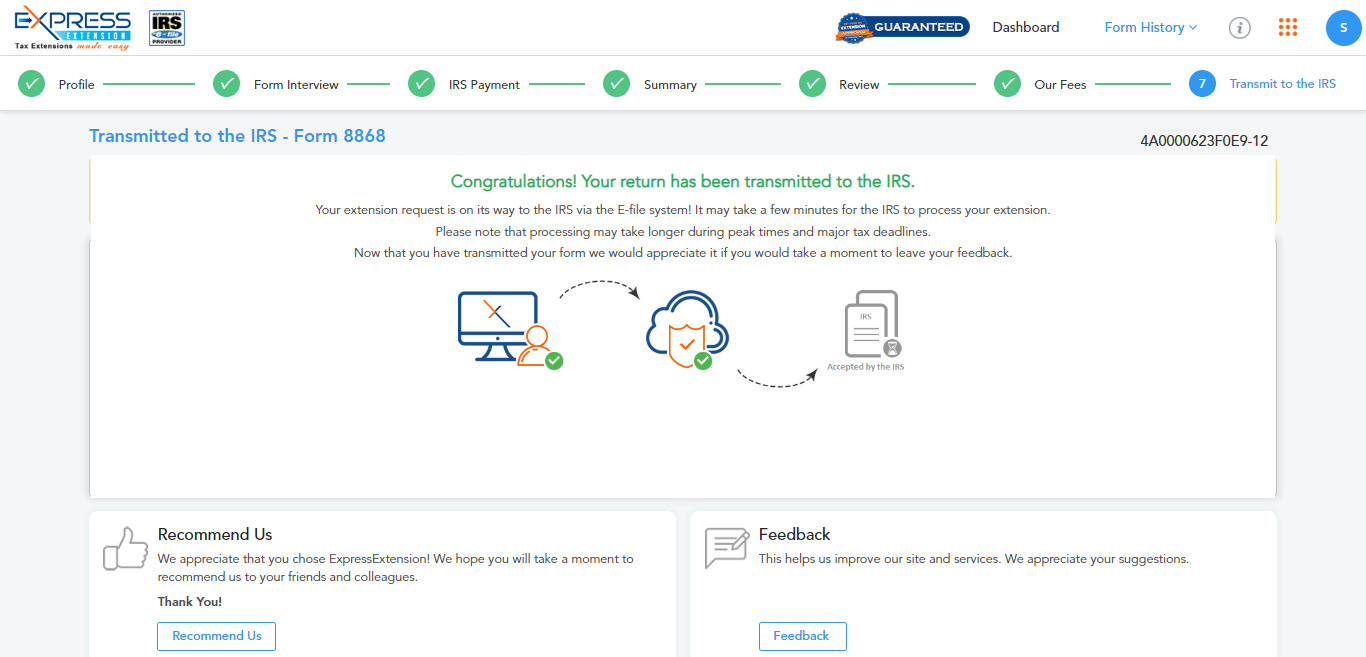

Web 1 enter your organization details 2 select the appropriate tax form to file an extension 3 review and transmit it to the irs ready to file your form 8868 electronically? Complete, edit or print tax forms instantly. *file from any device for an extension of up to 6 months. Taxpayers can file form 4868 by mail, but remember to.

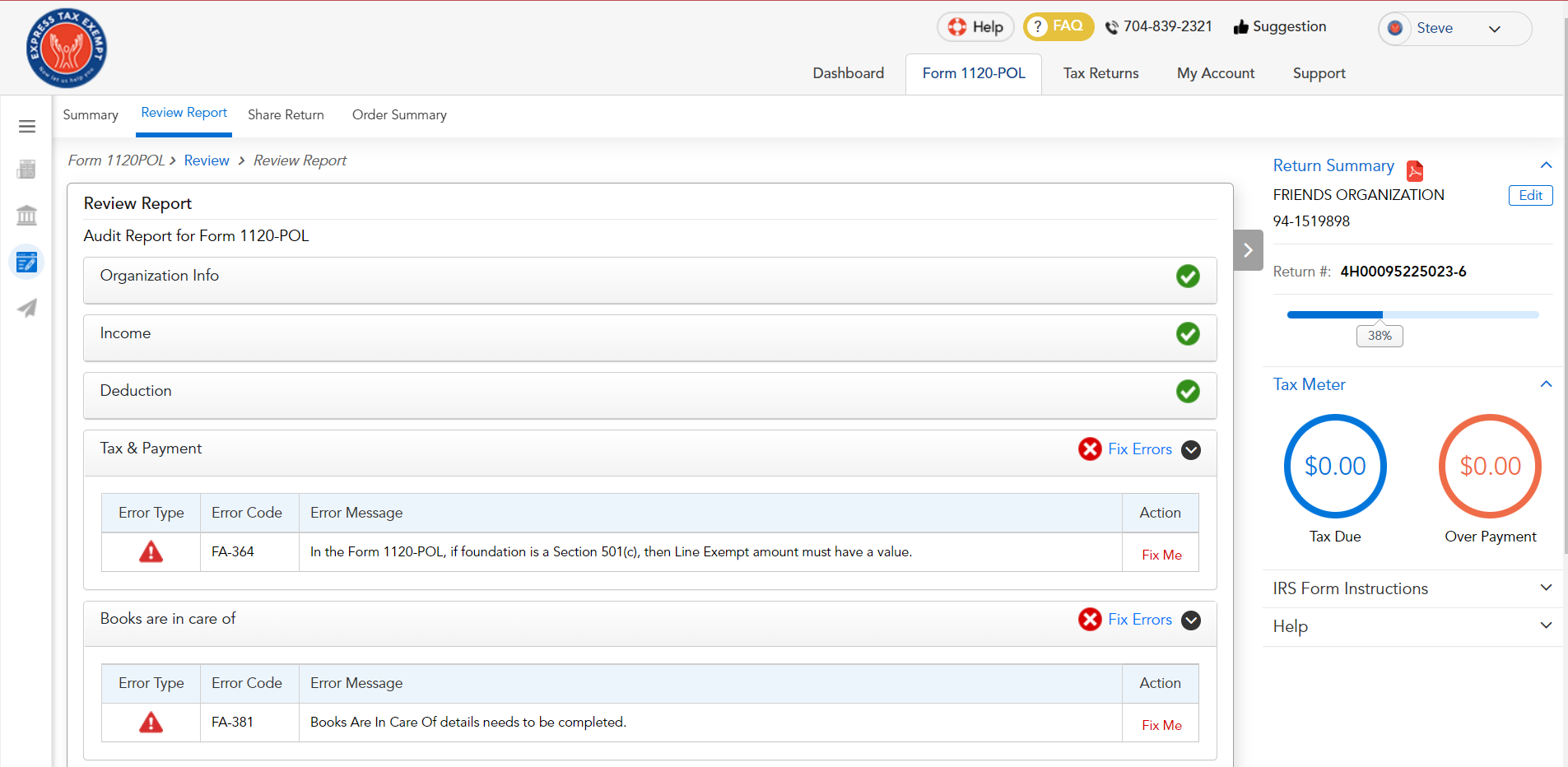

Web 1 Enter Your Organization Details 2 Select The Appropriate Tax Form To File An Extension 3 Review And Transmit It To The Irs Ready To File Your Form 8868 Electronically?

Try it for free now! Web when and who needs to file form 8868? You can electronically file form 8868 if you need a 3. File your nonprofit tax extension form 8868.

Web Form 8868 Is Due By 15Th Day Of The 5Th Month After The Tax Year Ends.

First step in filing this tax extension form is to enter the. Complete, edit or print tax forms instantly. You can file form 4868 and pay all or part of your estimated income tax due using the electronic federal tax payment system (eftps) or by using a credit or debit card. Upload, modify or create forms.

Web There Are Several Ways To Submit Form 4868.

Complete, edit or print tax forms instantly. Web go to www.irs.gov/form8868 for the latest information. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Ad download or email irs 8868 & more fillable forms, register and subscribe now!

You Can Complete Your Filing In A Few Simple Steps:

Ad download or email irs 8868 & more fillable forms, register and subscribe now! Web the following links provide information on the companies that have passed the irs assurance testing system (ats) requirements for software developers of. Web 8868 application for automatic extension of time to file an form exempt organization return (rev. *file from any device for an extension of up to 6 months.