Does Form 114 Need An Extension

Does Form 114 Need An Extension - Web additional information for form 114 is available on the united states department of the treasury, financial crimes enforcement network (fincen) website:. For calendar year 2022, the deadline for filing fincen form 114 is april 15, 2023. Web form 114 is the form used to report financial interests or signatory authority over foreign financial interests as required under the report of foreign bank and financial accounts. Web automatic extension to submit fbar: It is technically referred to as fincen form 114. Web do you need to file an extension for form 114? Web additionally, if you are unable to file the form by april 15, there is no need to file an extension, as you are allowed an automatic extension until october 15. If the combined value of your foreign financial assets surpasses $10,000 anytime throughout. Web for 2016, the form is now due april 18, 2017, but the financial crimes enforcement network (fincen) is providing an automatic extension for all filers of the. The fbar is not a complicated form to complete, but failing to file an.

Even though the fbar is not a tax form, since 2003 the internal revenue service has taken over enforcement of fincen form 114. Forms 114 are filed with fincen (not the internal revenue service. Web the deadline for the fbar is april 15th, but there is an automatic extension in place until october 15th. Web do you need to file an extension for form 114? Get the rundown on what you need to know about fbar filing and. Web what is the deadline for electronically filing fincen form 114 (fbar)? Do you need to file an extension for form 114? Taxpayers in certain disaster areas do not need to submit an extension. Fincen is the financial crimes. No action is required in ultratax cs to extend fincen form 114 (fbar) since specific requests for this extension are not required.

Web additionally, if you are unable to file the form by april 15, there is no need to file an extension, as you are allowed an automatic extension until october 15. Forms 114 are filed with fincen (not the internal revenue service. No action is required in ultratax cs to extend fincen form 114 (fbar) since specific requests for this extension are not required. Web at a glance what is an fbar? The fbar is the foreign bank account reporting form. If the combined value of your foreign financial assets surpasses $10,000 anytime throughout. Fincen is the financial crimes. Web additional information for form 114 is available on the united states department of the treasury, financial crimes enforcement network (fincen) website:. When (and how) do i report money in foreign bank accounts? Get the rundown on what you need to know about fbar filing and.

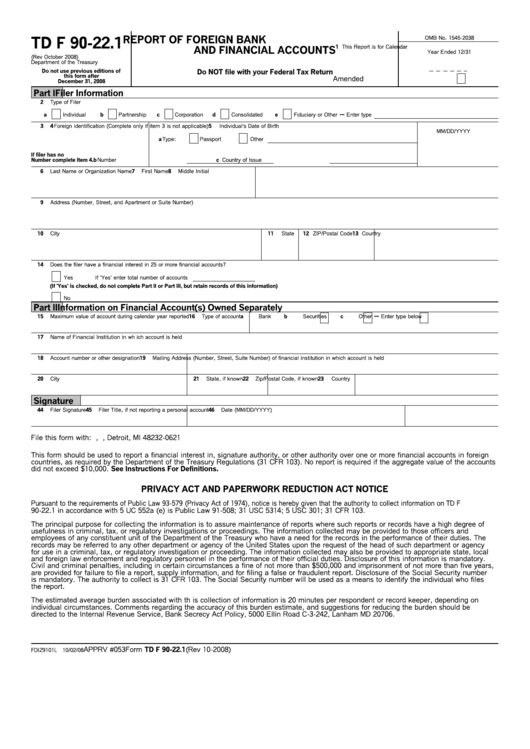

Does Report of Foreign Bank and Financial Accounts (FBAR) on FinCEN

Web form 114 is the form used to report financial interests or signatory authority over foreign financial interests as required under the report of foreign bank and financial accounts. Web before you know it, you have savings accounts, investments, and more. No action is required in ultratax cs to extend fincen form 114 (fbar) since specific requests for this extension.

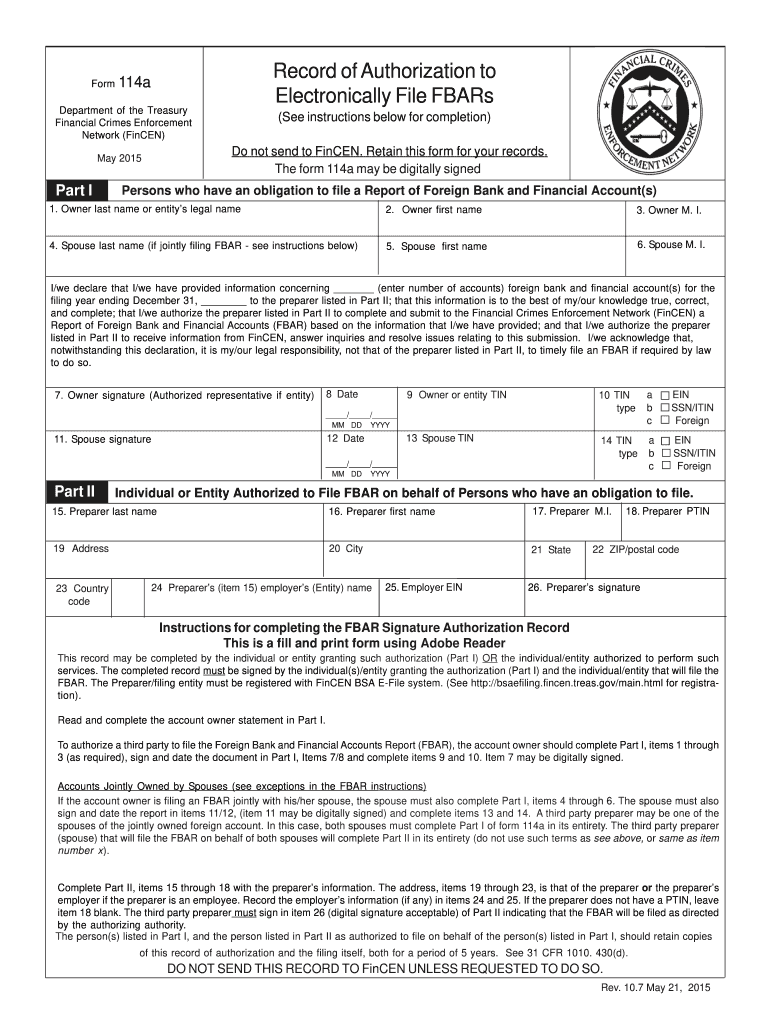

20152021 FinCen Form 114a Fill Online, Printable, Fillable, Blank

Get the rundown on what you need to know about fbar filing and. Web in many cases, us persons may have both financial interest and signature authority accounts to report. Web form 114 is the form used to report financial interests or signatory authority over foreign financial interests as required under the report of foreign bank and financial accounts. The.

Are you a Corporate or SCorp? Know your Extension Form Type in Form

Do you need to file an extension for form 114? Web you must file your extension request no later than the regular due date of your return. Web form 114 is the form used to report financial interests or signatory authority over foreign financial interests as required under the report of foreign bank and financial accounts. Web the deadline for.

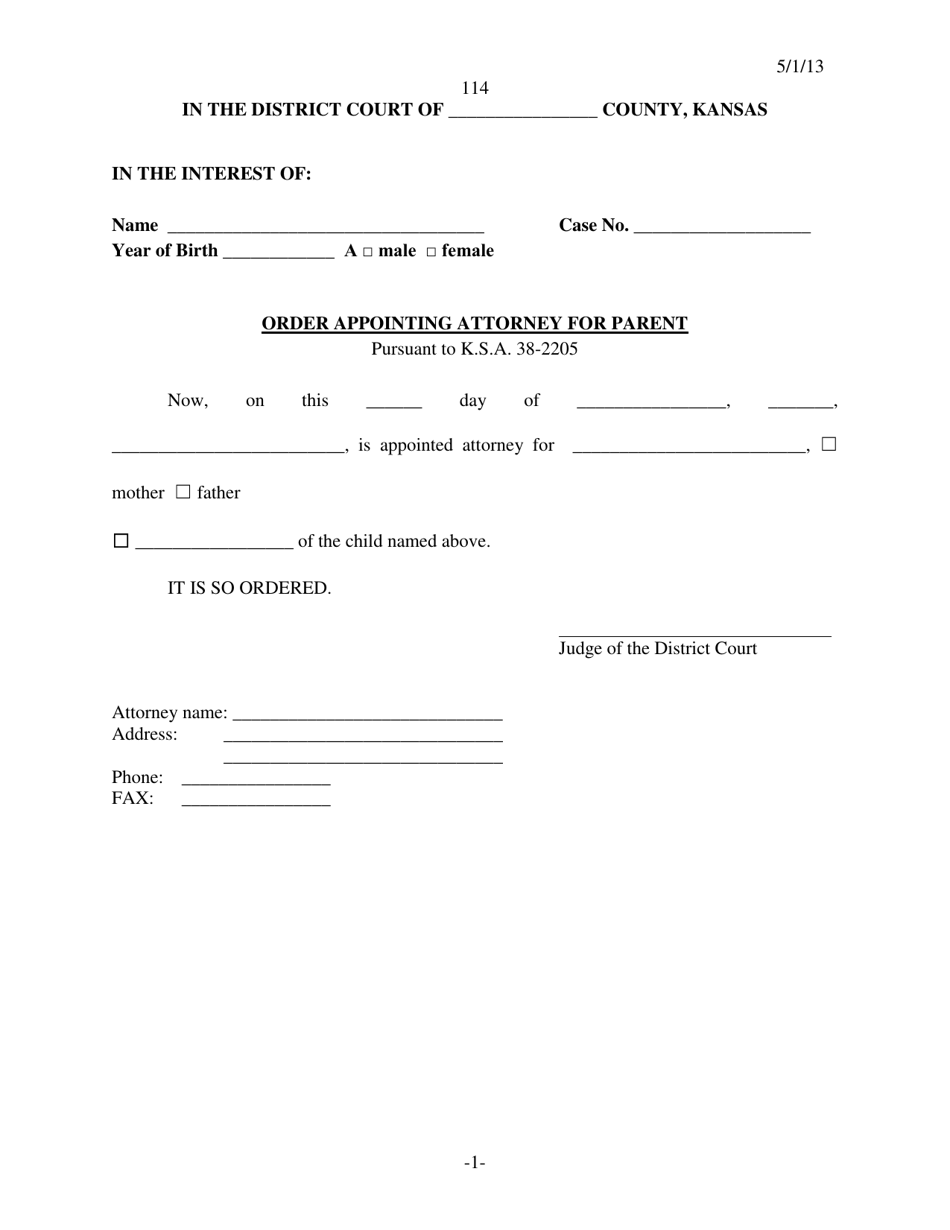

Form 114 Download Fillable PDF or Fill Online Order Appointing Attorney

Get the rundown on what you need to know about fbar filing and. Forms 114 are filed with fincen (not the internal revenue service. If the combined value of your foreign financial assets surpasses $10,000 anytime throughout. Web additional information for form 114 is available on the united states department of the treasury, financial crimes enforcement network (fincen) website:. Persons.

Form 114 Due Date

Web the extension of the federal income tax filing due date and other tax deadlines for individuals to may 17, 2021, does not affect the fbar requirement. Even though the fbar is not a tax form, since 2003 the internal revenue service has taken over enforcement of fincen form 114. Web additional information for form 114 is available on the.

Form 114 Due Date

It is technically referred to as fincen form 114. The fbar is not a complicated form to complete, but failing to file an. Web do you need to file an extension for form 114? Web the deadline for the fbar is april 15th, but there is an automatic extension in place until october 15th. Web you must file your extension.

USAFA Form 114 Fill Out, Sign Online and Download Fillable PDF

Web the deadline for the fbar is april 15th, but there is an automatic extension in place until october 15th. Web up to $40 cash back the deadline to file form 114, also known as the report of foreign bank and financial accounts (fbar), is typically april 15th of each year. Persons with an interest in or signature or other.

Does Report of Foreign Bank and Financial Accounts (FBAR) on FinCEN

Persons with an interest in or signature or other authority over foreign financial accounts where the total value exceeded $10,000 at any time during 2022 must. Web additionally, if you are unable to file the form by april 15, there is no need to file an extension, as you are allowed an automatic extension until october 15. It is technically.

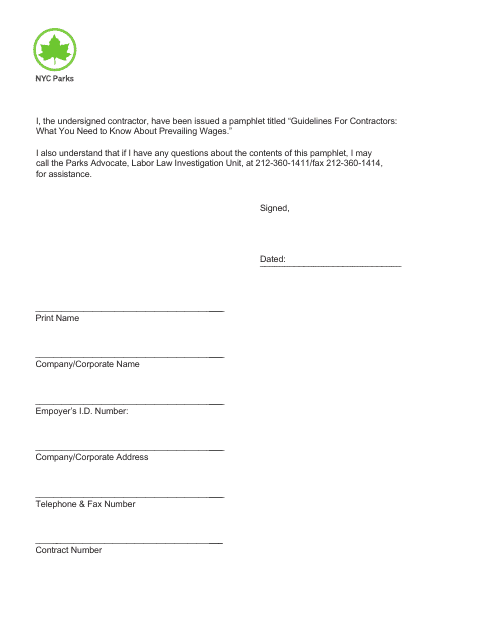

Form 114 Download Printable PDF or Fill Online Prevailing Wage

Do you need to file an extension for form 114? Even though the fbar is not a tax form, since 2003 the internal revenue service has taken over enforcement of fincen form 114. Forms 114 are filed with fincen (not the internal revenue service. Web in many cases, us persons may have both financial interest and signature authority accounts to.

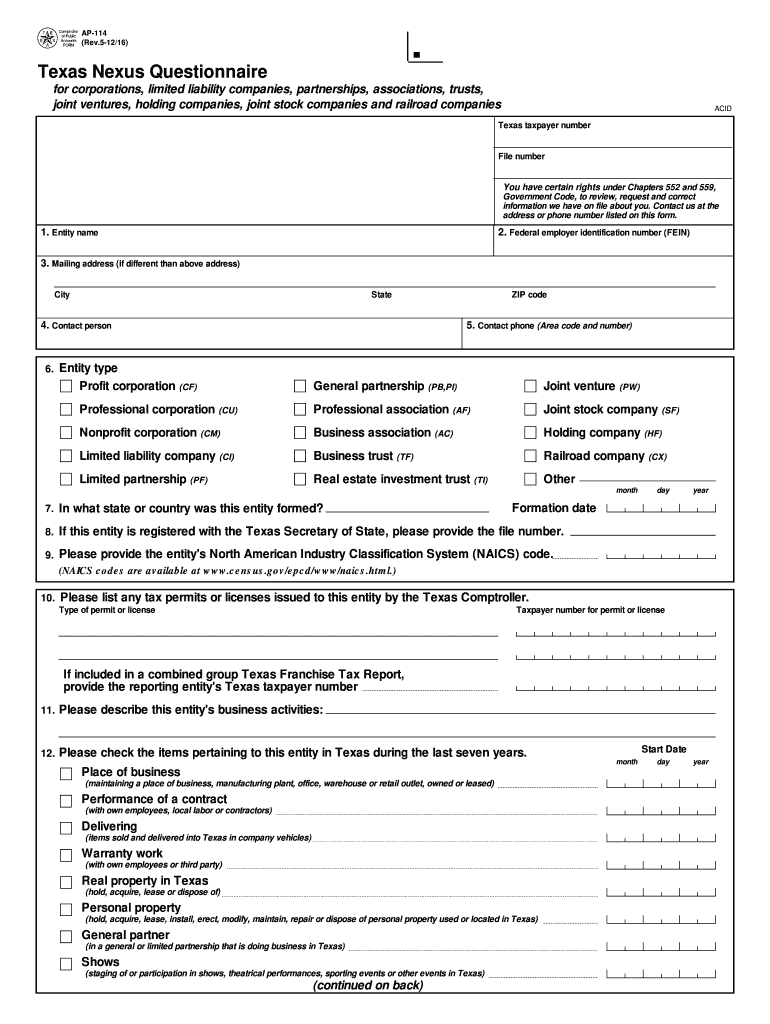

Ap 114 Form Fill Out and Sign Printable PDF Template signNow

Persons with an interest in or signature or other authority over foreign financial accounts where the total value exceeded $10,000 at any time during 2022 must. Web form 114 is the form used to report financial interests or signatory authority over foreign financial interests as required under the report of foreign bank and financial accounts. Web what is the deadline.

When (And How) Do I Report Money In Foreign Bank Accounts?

Forms 114 are filed with fincen (not the internal revenue service. For calendar year 2022, the deadline for filing fincen form 114 is april 15, 2023. Web automatic extension to submit fbar: Web you must file your extension request no later than the regular due date of your return.

Web At A Glance What Is An Fbar?

Web in many cases, us persons may have both financial interest and signature authority accounts to report. Web form 114 is the form used to report financial interests or signatory authority over foreign financial interests as required under the report of foreign bank and financial accounts. Web do you need to file an extension for form 114? Do you need to file an extension for form 114?

Persons With An Interest In Or Signature Or Other Authority Over Foreign Financial Accounts Where The Total Value Exceeded $10,000 At Any Time During 2022 Must.

The fbar is not a complicated form to complete, but failing to file an. Web the deadline for the fbar is april 15th, but there is an automatic extension in place until october 15th. Web before you know it, you have savings accounts, investments, and more. Even though the fbar is not a tax form, since 2003 the internal revenue service has taken over enforcement of fincen form 114.

No Action Is Required In Ultratax Cs To Extend Fincen Form 114 (Fbar) Since Specific Requests For This Extension Are Not Required.

Taxpayers in certain disaster areas do not need to submit an extension. Web up to $40 cash back the deadline to file form 114, also known as the report of foreign bank and financial accounts (fbar), is typically april 15th of each year. Fincen is the financial crimes. Get the rundown on what you need to know about fbar filing and.