Do You Have To File Form 8958 In Texas

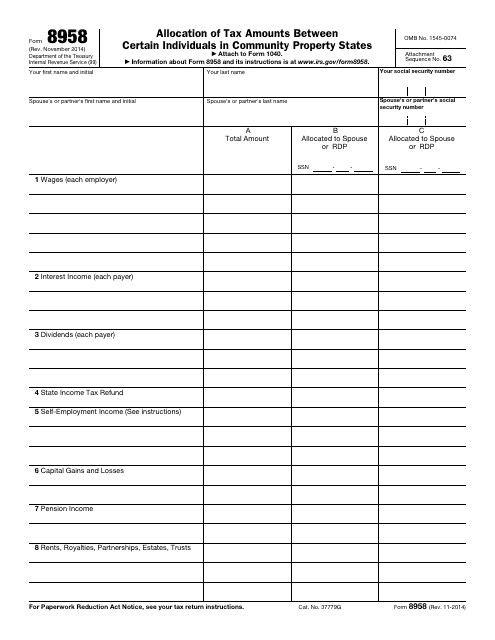

Do You Have To File Form 8958 In Texas - Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. Answered in 2 hours by: Community property laws affect how you figure your income on your federal income tax return if you are married, live in a. The states having community property are louisiana, arizona, california, texas, washington, idaho, nevada, new mexico, and wisconsin. Yes, loved it could be better no one. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Also what if the client doesnt have the spouses information? Web how to fill out form 8958, im in texas. Web how do i complete the married filing separate allocation form (8958)?

Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. This means that all income earned is divided equally ask your own. Web introduction community property laws generally. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Nelsonprotax form 8959, this means that you live in a community state. Web how do i complete the married filing separate allocation form (8958)? Yes, loved it could be better no one. Generally, the laws of the state in which you are. Community property laws affect how you figure your income on your federal income tax return if you are married, live in a.

Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Yes, loved it could be better no one. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. This means that all income earned is divided equally ask your own. Web tx tax professional: Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. The states having community property are louisiana, arizona, california, texas, washington, idaho, nevada, new mexico, and wisconsin. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal. Do i put the clients information and the spouse.

Fill Free fillable Allocation of Tax Amounts Between Certain

Web how do i complete the married filing separate allocation form (8958)? Web in arizona, california, nevada, new mexico, and washington, income from separate property is the separate income of the spouse who owns the property. Relating to the creation of a texas conditional driver's permit, provisional texas conditional driver's permit, and texas conditional learner permit;. The states having community.

3.11.3 Individual Tax Returns Internal Revenue Service

Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. Relating to the creation of a texas conditional driver's permit, provisional texas conditional driver's permit, and texas conditional learner permit;. Also what if the client doesnt have the spouses information? Web watch newsmax live for the latest.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Also what if the client doesnt have the spouses information? Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. Web tx tax professional: Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered.

Form 8958 instructions 2023 Fill online, Printable, Fillable Blank

Web how do i complete the married filing separate allocation form (8958)? Web tx tax professional: Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web how to fill out form 8958, im in texas. Generally, the laws of the state in which you are domi.

Teeth Veneer Testimonial Gilbert, Arizona YouTube

Yes, loved it could be better no one. Community property laws affect how you figure your income on your federal income tax return if you are married, live in a. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web tx tax professional: Web.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web tx tax professional: Answered in 2 hours by: Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use.

How do I organize ALL.THE.PAPER? Paper organization, Paper

Generally, the laws of the state in which you are domi. Web how do i complete the married filing separate allocation form (8958)? Web introduction community property laws generally. Answered in 2 hours by: Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use.

Do You Have To File A Will In Maryland letitbitlead

Answered in 2 hours by: Web tx tax professional: Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Generally, the laws of the state in which you are domi. Yes, loved it could be better no one.

What is Form 8958 Allocation of Tax Amounts Between Certain

Do i put the clients information and the spouse. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Answered in 2 hours by: Web tx tax professional: Web introduction community property laws generally.

Contact The Davis Saadian Group

Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. Web how do i complete the married filing separate allocation form (8958)? Yes, loved it could be better no one. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be.

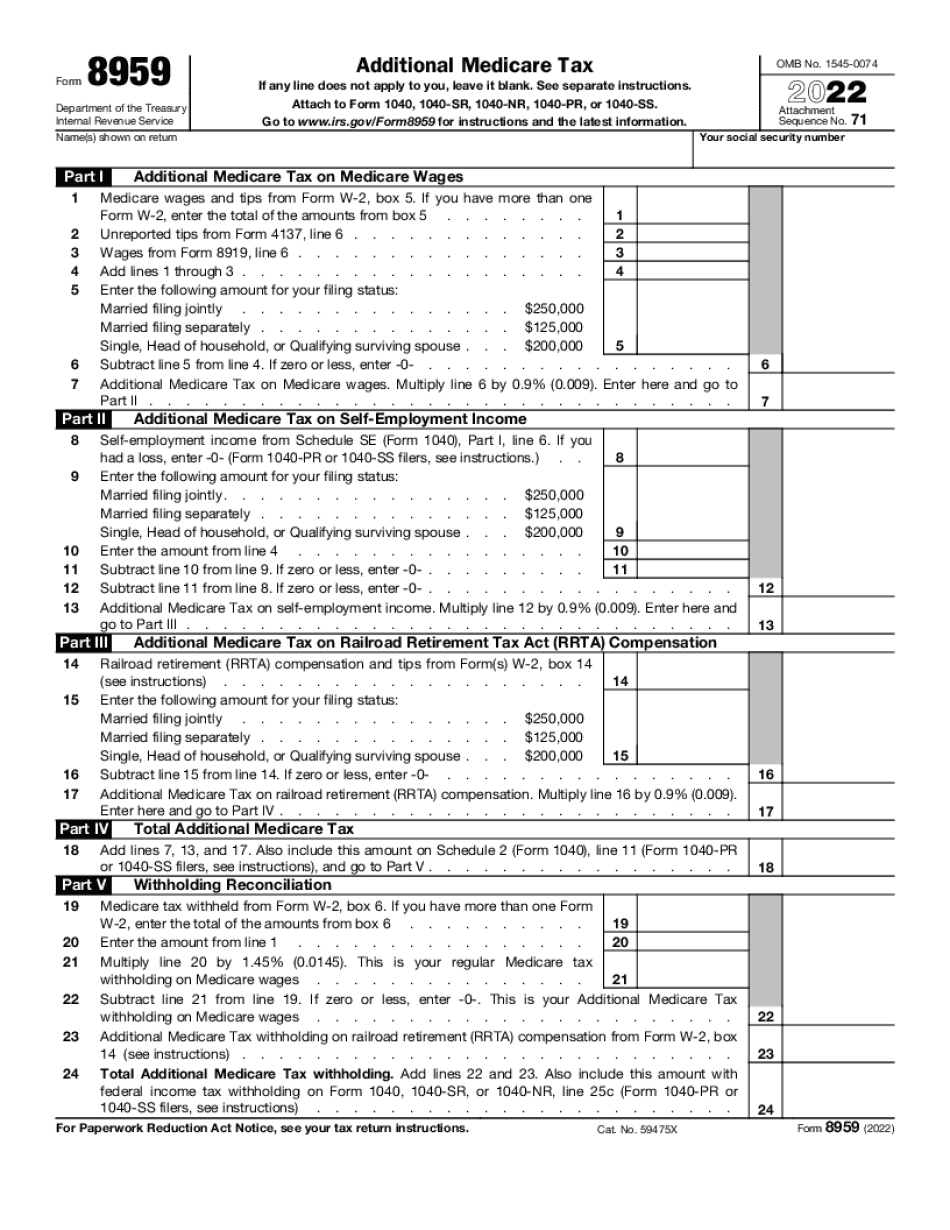

Nelsonprotax Form 8959, This Means That You Live In A Community State.

Do i put the clients information and the spouse. Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. Web you each must attach your form 8958 to your return showing how you figured the amount you are reporting on your return. Web how do i complete the married filing separate allocation form (8958)?

Web To Enter Form 8958 In The Taxact Program (This Allocation Worksheet Does Not Need To Be Completed If You Are Only Filing The State Returns Separately And Filing A Joint Federal.

Generally, the laws of the state in which you are domi. Also what if the client doesnt have the spouses information? Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. The states having community property are louisiana, arizona, california, texas, washington, idaho, nevada, new mexico, and wisconsin.

Web Introduction Community Property Laws Generally.

Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web tx tax professional: Web how to fill out form 8958, im in texas. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property.

Yes, Loved It Could Be Better No One.

Web in arizona, california, nevada, new mexico, and washington, income from separate property is the separate income of the spouse who owns the property. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. This means that all income earned is divided equally ask your own.