Debt Payment Plan Printable

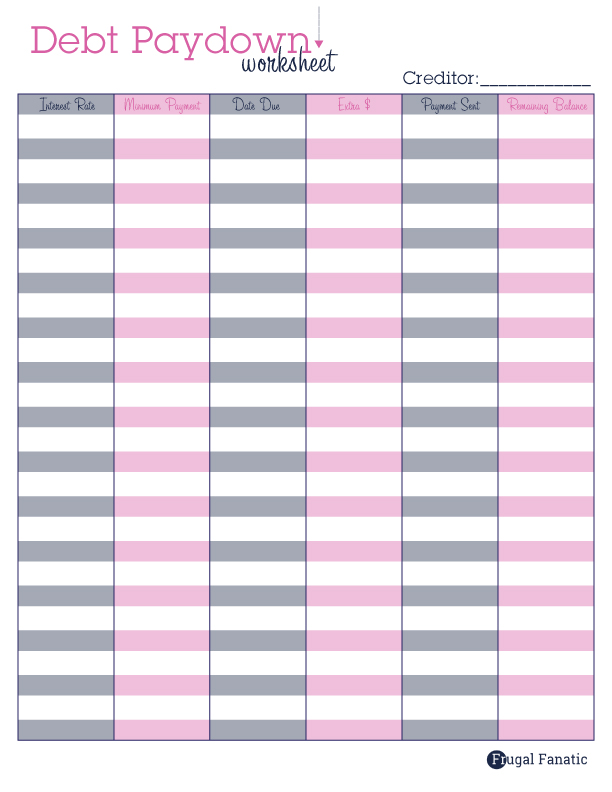

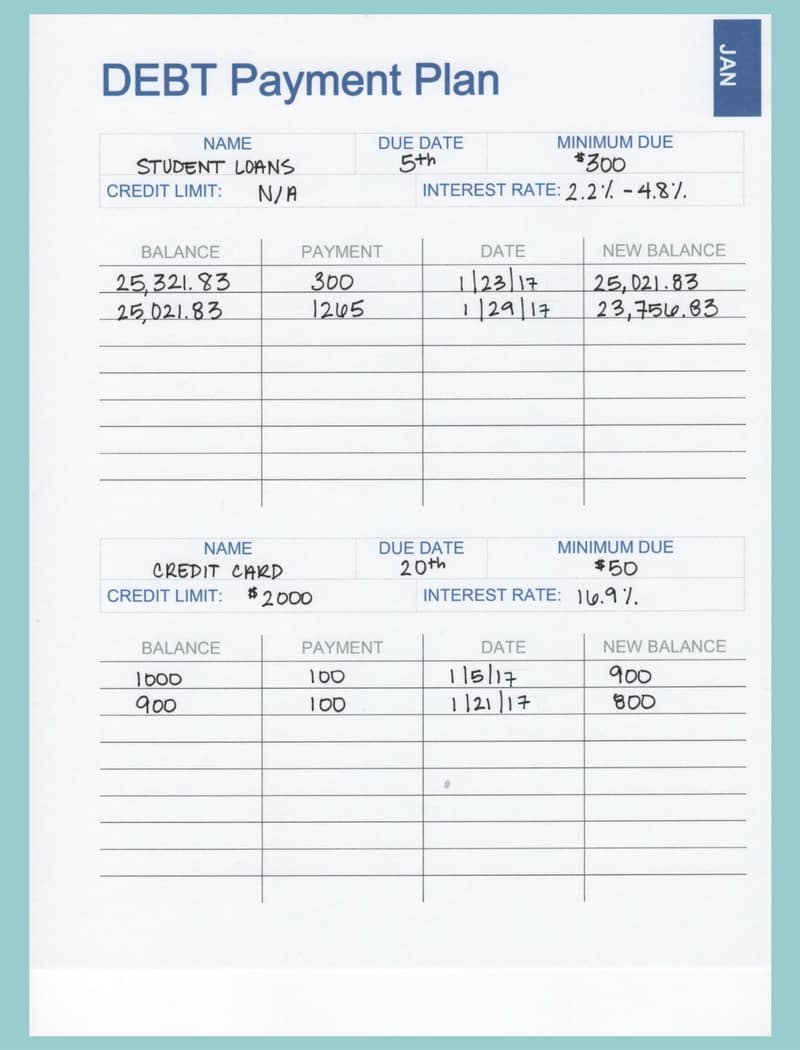

Debt Payment Plan Printable - Add up all your minimum monthly payments. Web 12 free payment templates try smartsheet for free by andy marker | july 17, 2017 payment templates offer a simple solution for managing both business and personal finances. A payment agreement (or repayment agreement) outlines an installment plan to repay an outstanding balance that is made over a specified time frame. Or, do you want to learn more about the debt snowball method? Web download pdf what is a payment agreement? Web this spreadsheet includes a printable payment schedule for easy reference. This can involve budgeting, setting clear goals around paying down the debt, and committing to making steady payments that are affordable and separate from regular expenses. Web follow these six easy steps to set up a debt repayment plan. Make a list of all your debts. Pick up our free printable debt payoff worksheet pdf and debt snowball guide.

A debt payment plan agreement is for any person or company that owes an amount of money that they cannot afford to pay immediately or under its current terms. Make a list of all your debts. You’ll get two sheets, one debt overview worksheet and one debt repayment plan tracking. In some instances, the creditor will allow the debtor to pay back a lesser amount or change the terms so that they will have a longer period to pay back the money. Web follow these six easy steps to set up a debt repayment plan. Web download pdf what is a payment agreement? Web updated april 14, 2023. List all your debts in the first column. Web 12 free payment templates try smartsheet for free by andy marker | july 17, 2017 payment templates offer a simple solution for managing both business and personal finances. Then, go over your monthly budget to determine how much money you have available for debt repayment.

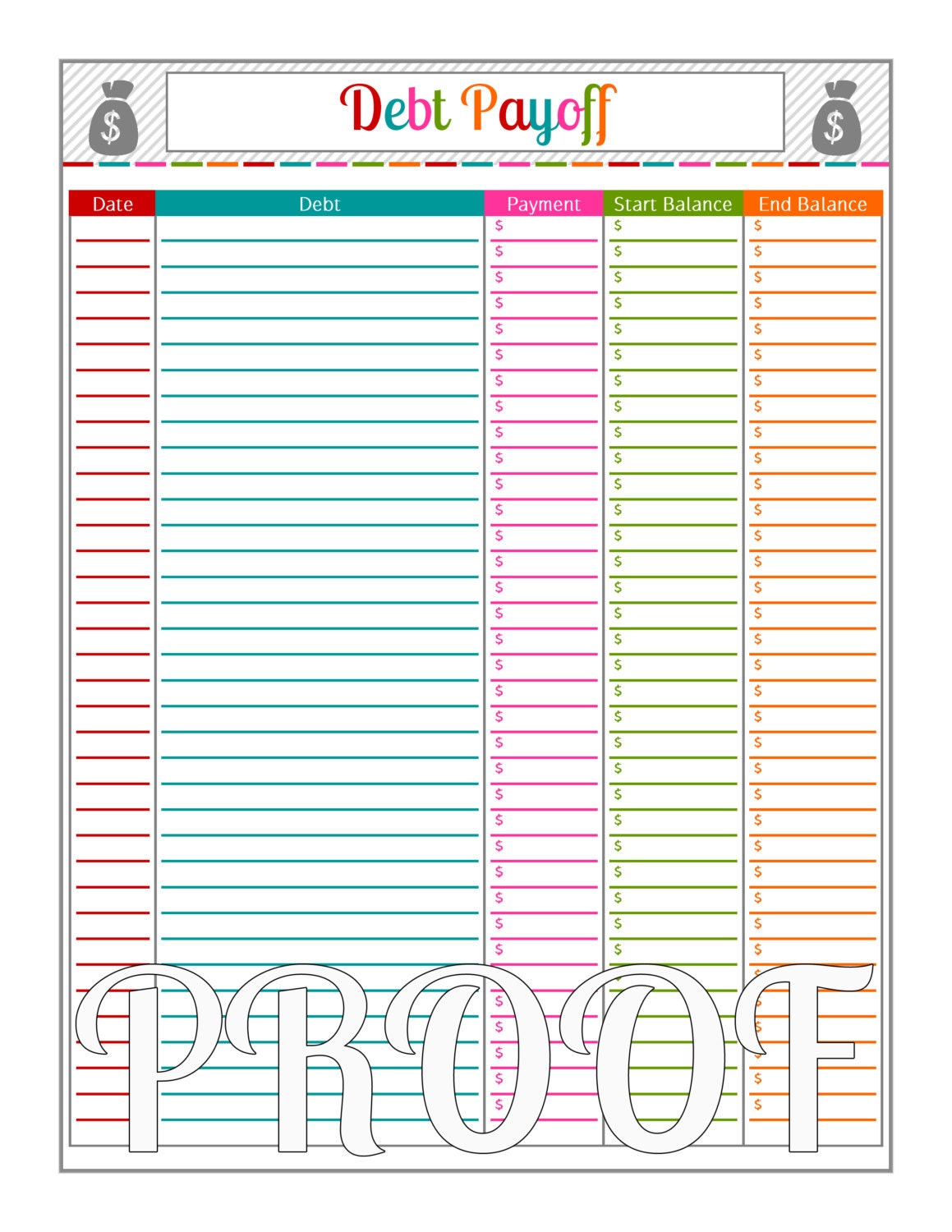

This can involve budgeting, setting clear goals around paying down the debt, and committing to making steady payments that are affordable and separate from regular expenses. Web follow these six easy steps to set up a debt repayment plan. How to write a payment plan agreement? Web a debts snowball payments sheet to record your debt payments, and a debt payoff visual that you can fill out as you progress through your journey. Add up all your minimum monthly payments. A debt payment plan agreement is for any person or company that owes an amount of money that they cannot afford to pay immediately or under its current terms. Also record the interest rate and minimum payment requirement for each debt. Debt repayment printables by simply stacy. What is a payment agreement used for? A payment agreement is a legal contractdetailing the terms of installment payments between the lender (the creditor) and the payer (the debtor).

Debt Payment Plan Template charlotte clergy coalition

Debt repayment printables by simply stacy. What is a payment agreement? Let’s look at a quick example to illustrate the nature of a. Web updated april 14, 2023. Need help repairing your credit?

How to Create A Budget Binder One Sweet Life

Web download pdf what is a payment agreement? You’ll get two sheets, one debt overview worksheet and one debt repayment plan tracking. Web this spreadsheet includes a printable payment schedule for easy reference. Web last updated on march 1st, 2023 at 02:48 pm are you using the debt snowball method to get out of debt? Web updated april 14, 2023.

Paying off Debt Worksheets

Usually, the interest on the mortgage is much less than other consumer debt or student loan debt. What is a payment agreement used for? This list should also include all of your debt, from. I usually don’t count the mortgage, but you certainly can. Web this spreadsheet includes a printable payment schedule for easy reference.

debt payment tracker printable. finances printables Finance

Make a list of all your debts. Usually, the interest on the mortgage is much less than other consumer debt or student loan debt. A payment agreement is a legal contractdetailing the terms of installment payments between the lender (the creditor) and the payer (the debtor). Also record the interest rate and minimum payment requirement for each debt. This can.

Debt Payoff Instant Download PDF by on Etsy

Need help repairing your credit? This is common when an amount is too much to pay for a debtor in a single payment. Add up all your minimum monthly payments. You’ll get two sheets, one debt overview worksheet and one debt repayment plan tracking. Or, do you want to learn more about the debt snowball method?

Debt Payments Printables By Design Money saving strategies, Debt

Web a debts snowball payments sheet to record your debt payments, and a debt payoff visual that you can fill out as you progress through your journey. Grab these debt repayment printable set by simply stacy. Web a debt payment schedule or plan is a strategy used by individuals or businesses to make consistent payments toward their debt in order.

The Ultimate Debt Payoff Planner That Will Help You Crush Your Debt

Before you can come up with a strategy, you need to be able to see all your debts in one place. Grab these debt repayment printable set by simply stacy. Web follow these six easy steps to set up a debt repayment plan. I usually don’t count the mortgage, but you certainly can. Web a debts snowball payments sheet to.

Budget Binder A Plan for Every Dollar The Budget Mom

This is common when an amount is too much to pay for a debtor in a single payment. Then, go over your monthly budget to determine how much money you have available for debt repayment. Web a debt payment schedule or plan is a strategy used by individuals or businesses to make consistent payments toward their debt in order to.

Items similar to Debt Payment Plan Printable on Etsy Credit card

Usually, the interest on the mortgage is much less than other consumer debt or student loan debt. Web a debts snowball payments sheet to record your debt payments, and a debt payoff visual that you can fill out as you progress through your journey. How to write a payment plan agreement? Pick up our free printable debt payoff worksheet pdf.

Debt Payment Plan Budget Printable Instant Download Etsy

You’ll get two sheets, one debt overview worksheet and one debt repayment plan tracking. Log into each account to get the actual balance (don’t just guestimate). Web updated april 14, 2023. Also record the interest rate and minimum payment requirement for each debt. Debt repayment printables by simply stacy.

Web Table Of Contents What Is A Payment Agreement?

A debt payment plan agreement is for any person or company that owes an amount of money that they cannot afford to pay immediately or under its current terms. Web a debts snowball payments sheet to record your debt payments, and a debt payoff visual that you can fill out as you progress through your journey. Web follow these six easy steps to set up a debt repayment plan. This is common when an amount is too much to pay for a debtor in a single payment.

Debt Repayment Printables By Simply Stacy.

Need help repairing your credit? Web this spreadsheet includes a printable payment schedule for easy reference. Add up all your minimum monthly payments. A payment agreement (or repayment agreement) outlines an installment plan to repay an outstanding balance that is made over a specified time frame.

Sample Payment Plan Agreement Template Why Make A Payment Plan Agreement?

Usually, the interest on the mortgage is much less than other consumer debt or student loan debt. A payment plan agreement is a legal document between a lender and a. Log into each account to get the actual balance (don’t just guestimate). A payment agreement is a legal contractdetailing the terms of installment payments between the lender (the creditor) and the payer (the debtor).

Then, Go Over Your Monthly Budget To Determine How Much Money You Have Available For Debt Repayment.

Make a list of all your debts. Your list should include the minimum payment amount, the interest rate, and how much you owe total. Web grab the free printable debt payoff worksheet below, fill it out, and start by getting your debts organized. This can involve budgeting, setting clear goals around paying down the debt, and committing to making steady payments that are affordable and separate from regular expenses.