De9C Form Pdf

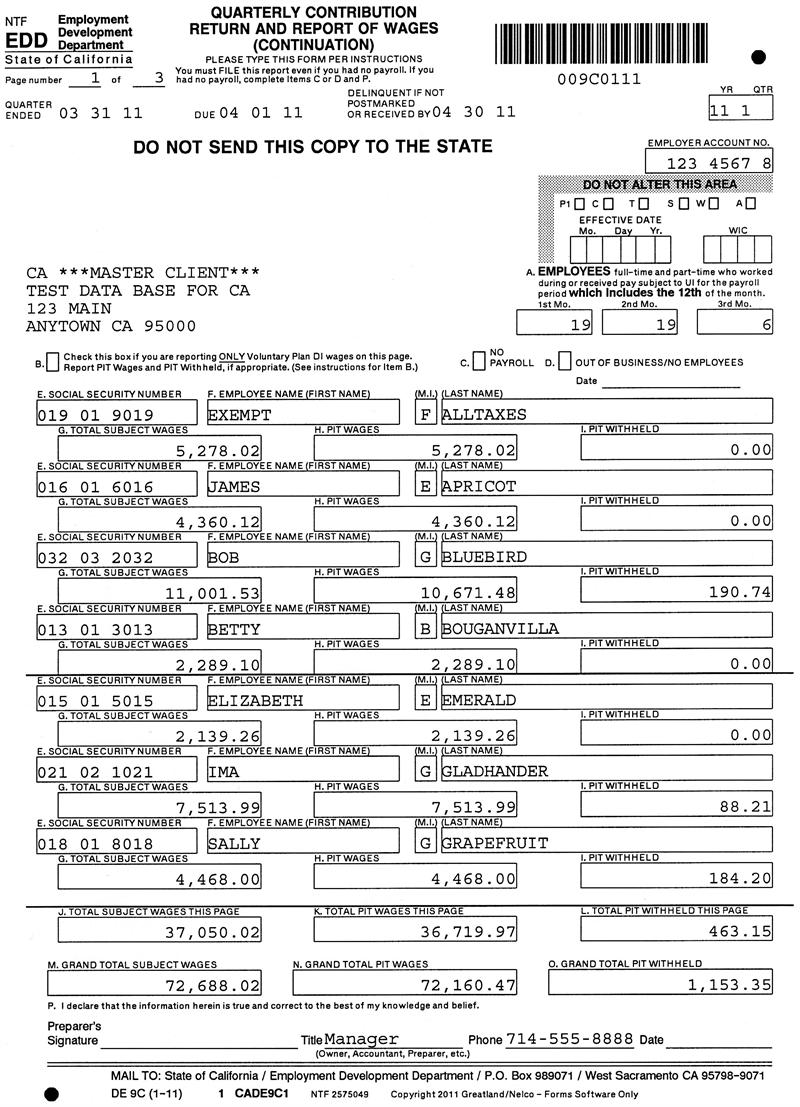

De9C Form Pdf - Web complete de9c online with us legal forms. Web this module contains california form de 9c, contribution return and report of wages (continuation). All three exemptions can be reported on one de 9c. The form is used to report wage and payroll tax withholding information for california employers. Web print and download pdf copies at anytime; The de 9c form is a form for submitting the necessary documentation to the irs when requesting a change in accounting method. The form is used to report wage and payroll tax withholding information for california employers. Click done to confirm the changes. 08/01/23)” to comply with their employment eligibility iii. Fill in the required fields that are.

Web the following tips will help you fill out ca de 9c quickly and easily: The de 9c form is a form for submitting the necessary documentation to the irs when requesting a change in accounting method. Web form de9c is the quarterly wage and withholding report for california employers. Web make sure everything is filled out properly, without any typos or lacking blocks. Web thequarterly contribution and wage adjustment form (de 9adj) is used to request corrections to information previously reported on a quarterly contribution return and. Save or instantly send your ready documents. Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously. Web print and download pdf copies at anytime; The form is used to report wage and payroll tax withholding information for california employers. Web complete de9c online with us legal forms.

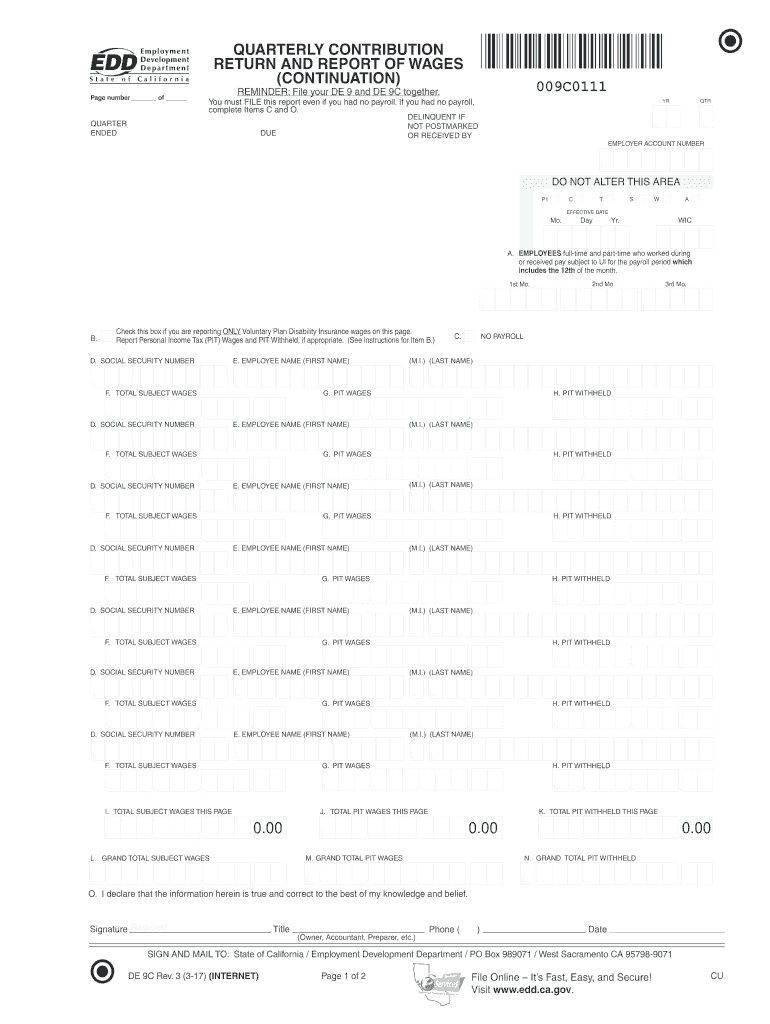

Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously. The state of california requires ca companies to file both a quarterly contribution return and report of wages. Fill in the required fields that are. Web prepare a de 9c to report the types of exemptions listed below. Click employees at the top menu bar. Write the exemption title(s) at the top of the form (e.g., sole. Web this module contains california form de 9c, contribution return and report of wages (continuation). Web i’d be happy to show you the de9 and de9c forms and federal 941 in quickbooks desktop. All three exemptions can be reported on one de 9c. Web form de9c is the quarterly wage and withholding report for california employers.

California DE 9 and DE 9C Fileable Reports

Easily fill out pdf blank, edit, and sign them. 08/01/23)” to comply with their employment eligibility iii. Save or instantly send your ready documents. Web this module contains california form de 9c, contribution return and report of wages (continuation). Web form de9c is the quarterly wage and withholding report for california employers.

Arbor CPA Payroll Accounting Employees vs Contractors, Wage

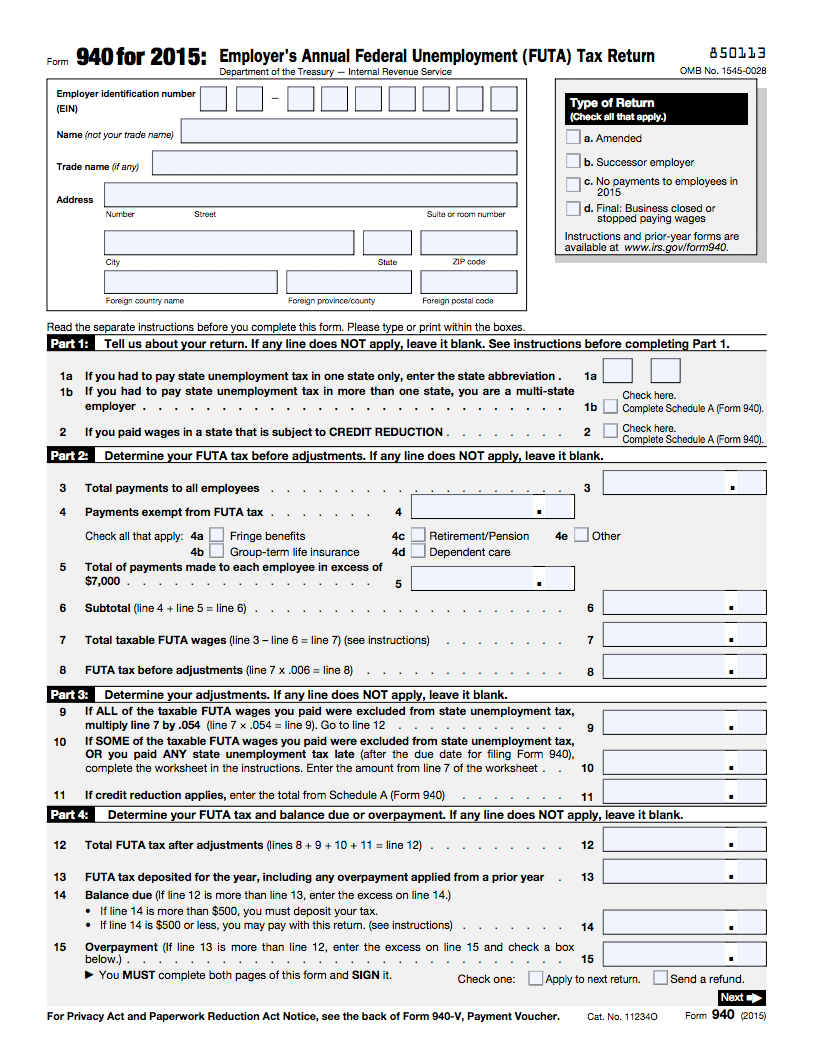

The state of california requires ca companies to file both a quarterly contribution return and report of wages. All three exemptions can be reported on one de 9c. 08/01/23)” to comply with their employment eligibility iii. Web print and download pdf copies at anytime; Web i’d be happy to show you the de9 and de9c forms and federal 941 in.

De9C Fill Out and Sign Printable PDF Template signNow

Web print and download pdf copies at anytime; Use your electronic signature to the pdf page. Web complete de9c online with us legal forms. Web california state form de 9c what is the de 9c? The form is used to report wage and payroll tax withholding information for california employers.

9q Form Free Download 9 Moments To Remember From 9q Form Free Download

Click done to confirm the changes. Web thequarterly contribution and wage adjustment form (de 9adj) is used to request corrections to information previously reported on a quarterly contribution return and. The form is used to report wage and payroll tax withholding information for california employers. Web quarterly contribution return and report of wages (de 9) and (continuation) (de 9c) payroll.

Arbor CPA Payroll Accounting Employees vs Contractors, Wage

Convenient access anywhere, anytime through a browser; Web the following tips will help you fill out ca de 9c quickly and easily: Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously. Use your electronic signature to the pdf page. Web prepare a de 9c to report the types of.

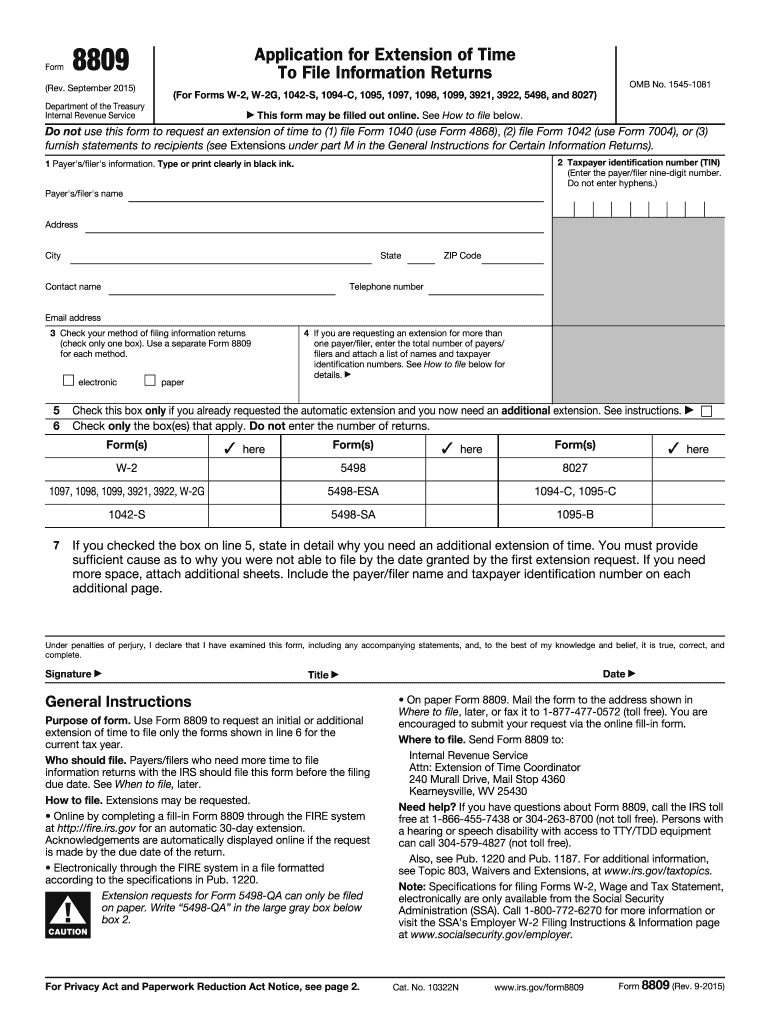

8809 Form Fill Out and Sign Printable PDF Template signNow

Web quarterly contribution return and report of wages (de 9) and (continuation) (de 9c) payroll tax deposit (de 88) how to report electronic filing paper filing submission. Web california state form de 9c what is the de 9c? The state of california requires ca companies to file both a quarterly contribution return and report of wages. Web complete de9c online.

DE9CA Mitchell Proffitt

Web california state form de 9c what is the de 9c? 08/01/23)” to comply with their employment eligibility iii. Web form de9c is the quarterly wage and withholding report for california employers. Web thequarterly contribution and wage adjustment form (de 9adj) is used to request corrections to information previously reported on a quarterly contribution return and. Web complete de9c online.

Arbor CPA Payroll Accounting

Web california state form de 9c what is the de 9c? Web print and download pdf copies at anytime; Web form de9c is the quarterly wage and withholding report for california employers. Save or instantly send your ready documents. Web the following tips will help you fill out ca de 9c quickly and easily:

Arbor CPA Payroll Accounting Employees vs Contractors, Wage

The form is used to report wage and payroll tax withholding information for california employers. Easily fill out pdf blank, edit, and sign them. Web make sure everything is filled out properly, without any typos or lacking blocks. Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously. The de.

De9c Sample Fill and Sign Printable Template Online US Legal Forms

08/01/23)” to comply with their employment eligibility iii. Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously. The de 9c form is a form for submitting the necessary documentation to the irs when requesting a change in accounting method. Use your electronic signature to the pdf page. Web thequarterly.

All Three Exemptions Can Be Reported On One De 9C.

08/01/23)” to comply with their employment eligibility iii. Click done to confirm the changes. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents.

Data May Be Imported From The 941 Payroll Data Previously.

The state of california requires ca companies to file both a quarterly contribution return and report of wages. Use your electronic signature to the pdf page. Web this module contains california form de 9c, contribution return and report of wages (continuation). Web make sure everything is filled out properly, without any typos or lacking blocks.

Web Form De9C Is The Quarterly Wage And Withholding Report For California Employers.

Web the quarterly contribution and wage adjustment form (de 9adj) (pdf) (edd.ca.gov/pdf_pub_ctr/de9adj.pdf) is used to request corrections to a previously. Convenient access anywhere, anytime through a browser; The form is used to report wage and payroll tax withholding information for california employers. Web prepare a de 9c to report the types of exemptions listed below.

Web Print And Download Pdf Copies At Anytime;

Web thequarterly contribution and wage adjustment form (de 9adj) is used to request corrections to information previously reported on a quarterly contribution return and. The de 9c form is a form for submitting the necessary documentation to the irs when requesting a change in accounting method. Web i’d be happy to show you the de9 and de9c forms and federal 941 in quickbooks desktop. Write the exemption title(s) at the top of the form (e.g., sole.