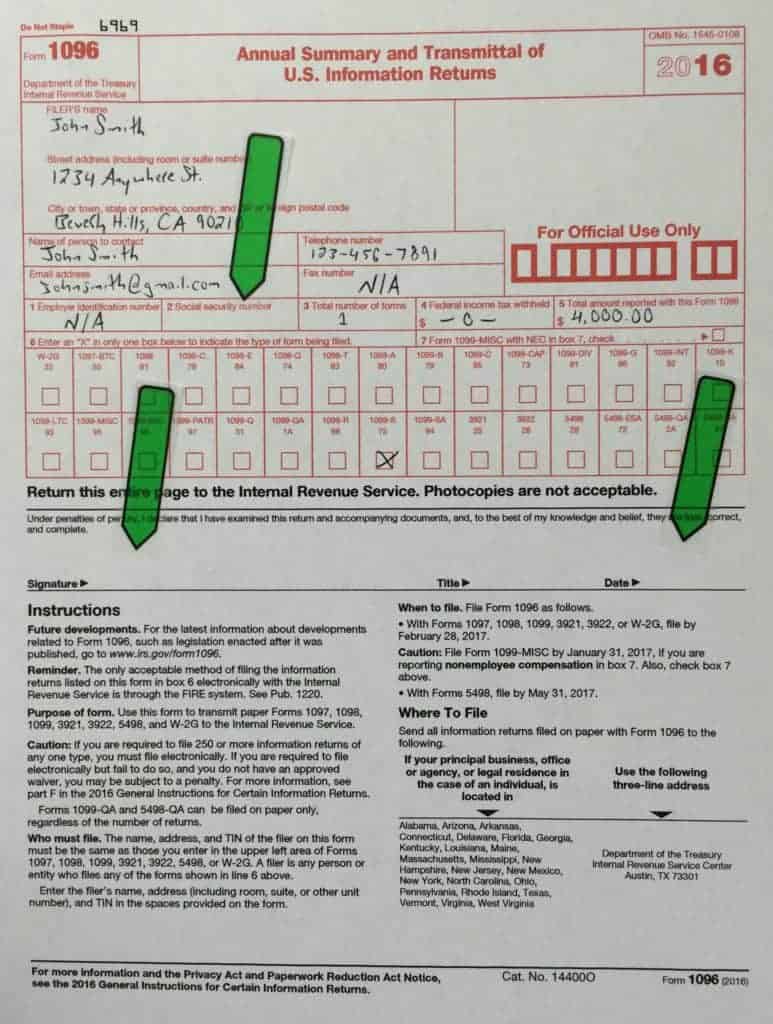

Corrected Form 1096

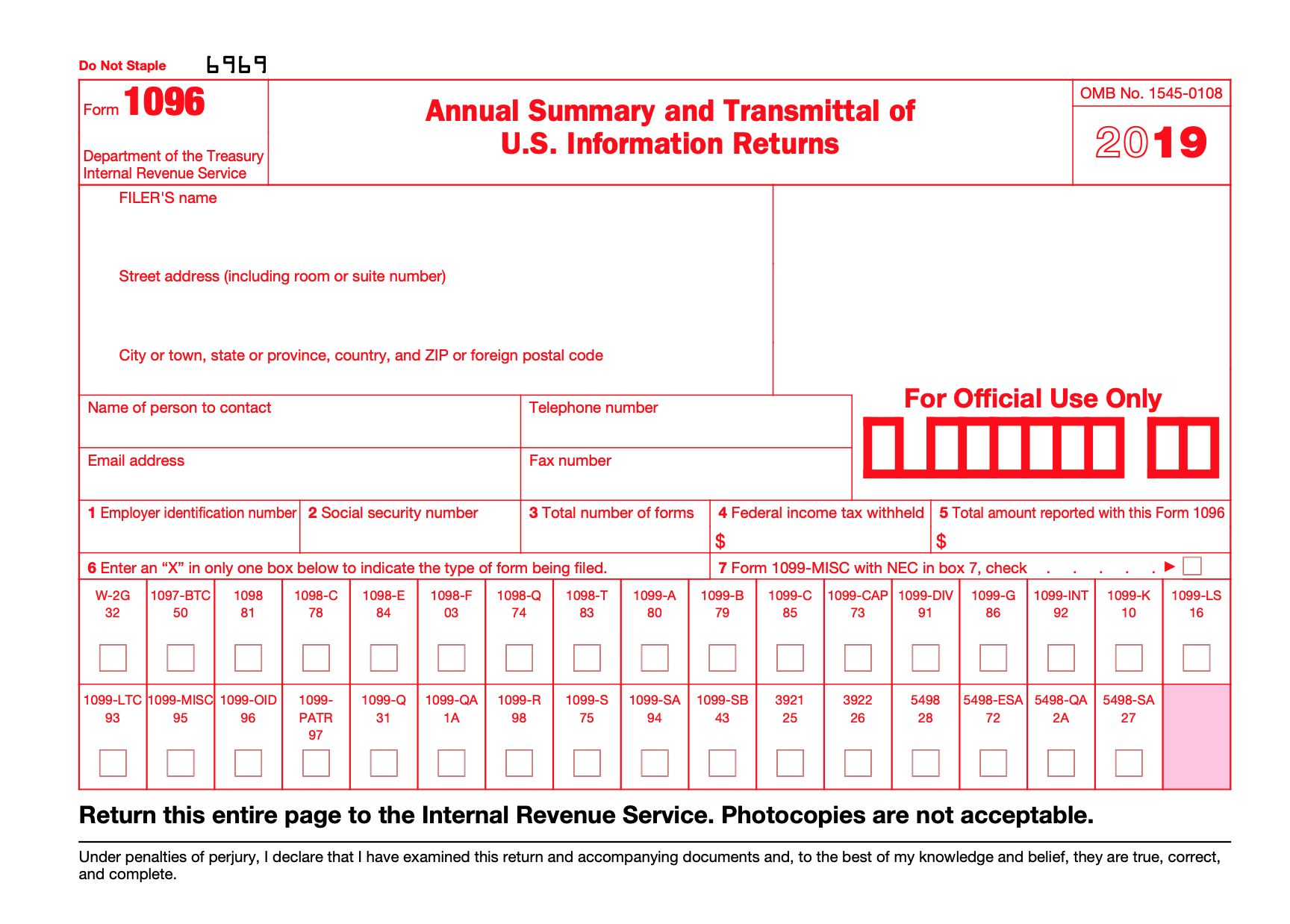

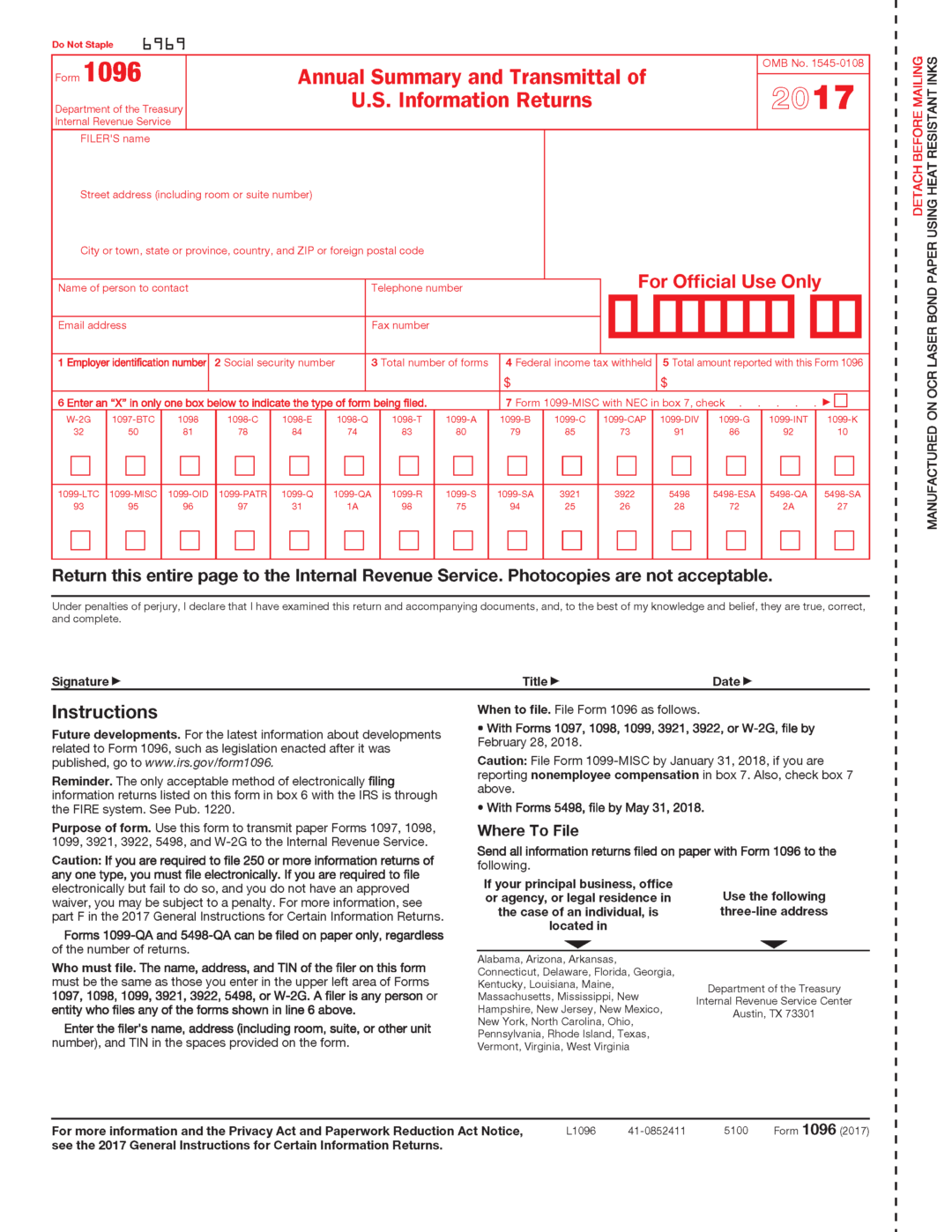

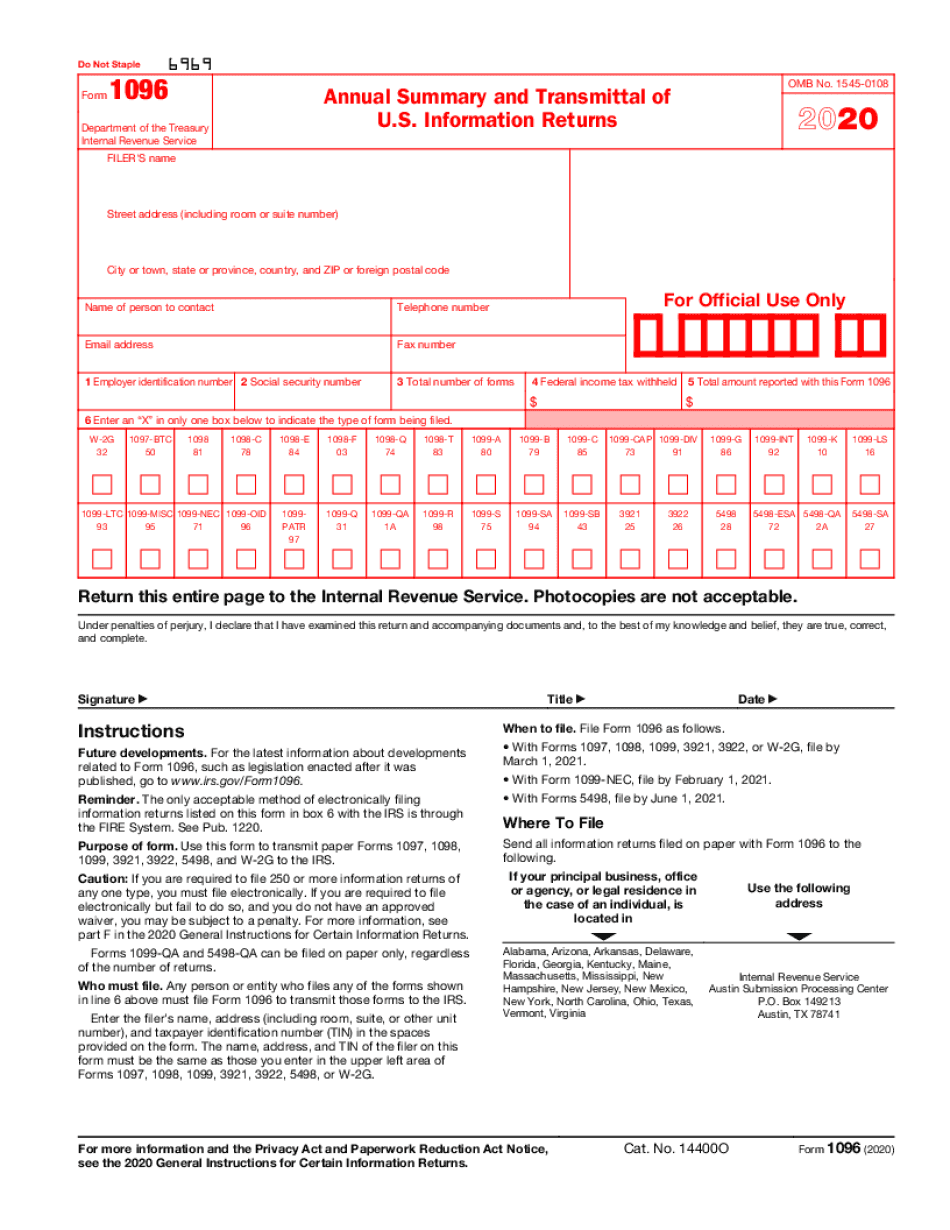

Corrected Form 1096 - Click on employer and information returns, and. Web what if i need to make corrections to form 1096? Since irs form 1096 has a very basic format, mistakes are rare, but still possible. January 2021) department of the treasury internal revenue service annual summary and transmittal of u.s. Complete, edit or print tax forms instantly. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Also, ensure you start with. Make sure to prepare the red copy a to be filed with the irs. According to the irs, “an information. Information returns issued by the united states internal revenue service (irs).

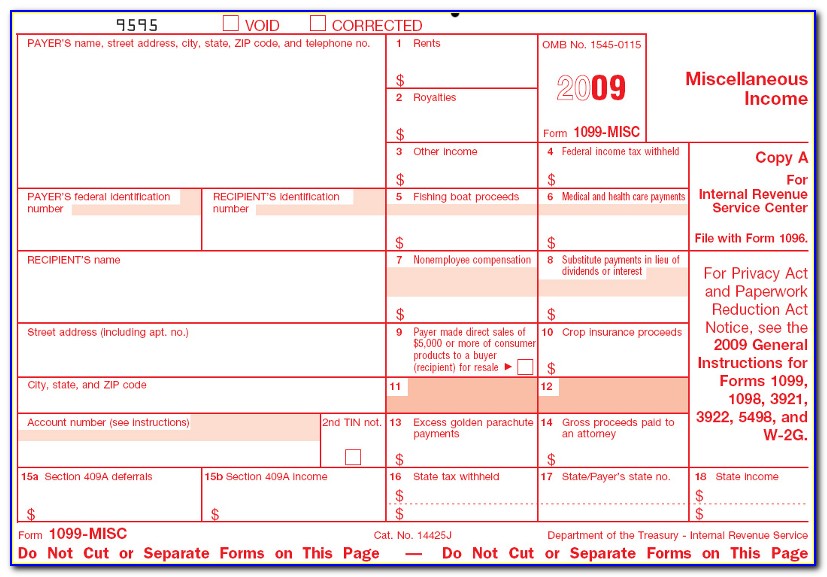

For the same type of return, you may use one form 1096 for both originals and corrections. Information returns issued by the united states internal revenue service (irs). Make sure to prepare the red copy a to be filed with the irs. Use a separate form 1096 for each type of return you are correcting. Web what if i need to make corrections to form 1096? Web to order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. Web a corrected 1099 form showing how the form was originally submitted, but with the money amount boxes blank. Web use form 1096 to send paper forms to the irs. Web in many cases, you can simply fill out a new form with the correct information, checking the box at the top of the form to indicate that it is a corrected form. Web form 1096 is the annual summary and transmittal of u.s.

Web use form 1096 to send paper forms to the irs. Information returns [1]) is an internal revenue service (irs) tax form used in the united states. Web a form 1096 summarizes the totals from your contractor payments, and the irs uses form 1096 to track every physical 1099 you’re filing for the year. Make sure to prepare the red copy a to be filed with the irs. Download and prepare one form 1096. Form 1096 (officially the annual summary and transmittal of u.s. Fill out and include form 1096 to indicate how many of which type of form you’re correcting. According to the irs, “an information. *for the majority of information returns, form 1096 is due february 28 of the year immediately following the tax year. For the same type of return, you may use one form 1096 for both originals and corrections.

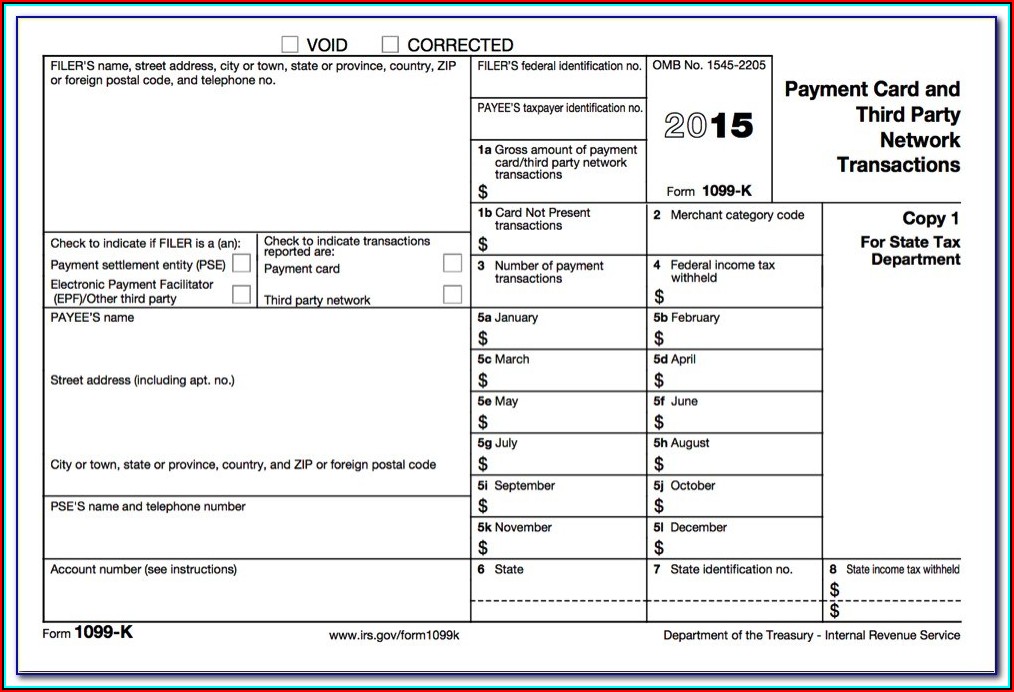

What the Heck is "IRS Form 1099S" and Why Does it Matter? REtipster

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Form 1096 (officially the annual summary and transmittal of u.s. Since irs form 1096 has a very basic format, mistakes are rare, but still possible. Complete, edit or print tax forms instantly. Web a form 1096 summarizes the totals from your contractor payments, and the irs.

Downloadable Irs Form 1096 Form Resume Examples N8VZj7DVwe

Web form 1096 is the annual summary and transmittal of u.s. Information returns issued by the united states internal revenue service (irs). *for the majority of information returns, form 1096 is due february 28 of the year immediately following the tax year. A 1099 form showing what should have been submitted, including. Since irs form 1096 has a very basic.

Form 1096 A Simple Guide Bench Accounting

Also, ensure you start with. Web cheer join the conversation 9 comments ashley h quickbooks team february 18, 2020 12:48 pm thanks for reaching out to the community, @entnadmin18. Complete, edit or print tax forms instantly. Information returns issued by the united states internal revenue service (irs). Complete, edit or print tax forms instantly.

1096 Annual Summary Transmittal Forms & Fulfillment

Since irs form 1096 has a very basic format, mistakes are rare, but still possible. January 2021) department of the treasury internal revenue service annual summary and transmittal of u.s. Web check the box at the top of the form to indicate the filing is a corrected form. Information returns [1]) is an internal revenue service (irs) tax form used.

What the Heck is "IRS Form 1099S" and Why Does it Matter? REtipster

Web check the box at the top of the form to indicate the filing is a corrected form. Also, ensure you start with. If paper filing, be sure to use the correct year of the form. Web use form 1096 to send paper forms to the irs. Complete, edit or print tax forms instantly.

1099 Tax Software Blog » 1099 Software How can I print Form 1096?

Fill out and include form 1096 to indicate how many of which type of form you’re correcting. Uslegalforms allows users to edit, sign, fill & share all type of documents online. January 2021) department of the treasury internal revenue service annual summary and transmittal of u.s. Edit, sign and save irs 1096 form. Use a separate form 1096 for each.

Printable Form 1096 1096 Tax Form Due Date Universal Network What

Information returns issued by the united states internal revenue service (irs). Uslegalforms allows users to edit, sign, fill & share all type of documents online. Complete, edit or print tax forms instantly. Download and prepare one form 1096. Web cheer join the conversation 9 comments ashley h quickbooks team february 18, 2020 12:48 pm thanks for reaching out to the.

Corrected Form 1099 And 1096 Form Resume Examples QBD3pXw5Xn

Information returns issued by the united states internal revenue service (irs). For the same type of return, you may use one form 1096 for both originals and corrections. Form 1096 (officially the annual summary and transmittal of u.s. Web to order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. Fill out.

Printable Form 1096 / 1096 Tax Form Due Date Universal Network

Web a form 1096 summarizes the totals from your contractor payments, and the irs uses form 1096 to track every physical 1099 you’re filing for the year. Information returns issued by the united states internal revenue service (irs). Since irs form 1096 has a very basic format, mistakes are rare, but still possible. According to the irs, “an information. Download.

can i fold form 1096 Fill Online, Printable, Fillable Blank 1096

Fill out and include form 1096 to indicate how many of which type of form you’re correcting. A 1099 form showing what should have been submitted, including. Download and prepare one form 1096. Make sure to prepare the red copy a to be filed with the irs. According to the irs, “an information.

Web Check The Box At The Top Of The Form To Indicate The Filing Is A Corrected Form.

Also, ensure you start with. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Complete, edit or print tax forms instantly. Web a form 1096 summarizes the totals from your contractor payments, and the irs uses form 1096 to track every physical 1099 you’re filing for the year.

Fill Out And Include Form 1096 To Indicate How Many Of Which Type Of Form You’re Correcting.

Web in many cases, you can simply fill out a new form with the correct information, checking the box at the top of the form to indicate that it is a corrected form. For the same type of return, you may use one form 1096 for both originals and corrections. Edit, sign and save irs 1096 form. Information returns issued by the united states internal revenue service (irs).

A 1099 Form Showing What Should Have Been Submitted, Including.

Complete, edit or print tax forms instantly. Make sure to prepare the red copy a to be filed with the irs. January 2021) department of the treasury internal revenue service annual summary and transmittal of u.s. Form 1096 (officially the annual summary and transmittal of u.s.

Use A Separate Form 1096 For Each Type Of Return You Are Correcting.

Download and prepare one form 1096. Information returns [1]) is an internal revenue service (irs) tax form used in the united states. *for the majority of information returns, form 1096 is due february 28 of the year immediately following the tax year. Web to order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms.